In divorce proceedings, few tasks are as critical—or as complex—as the financial discovery process. Lawyers must sift through pages of financial documentation to uncover the truth behind a couple’s finances, often under intense scrutiny and tight deadlines. One of the most vital aspects of this process is bank statement analysis for divorce. From identifying undisclosed accounts to detecting spending patterns that could indicate hidden assets, the work demands both precision and speed.

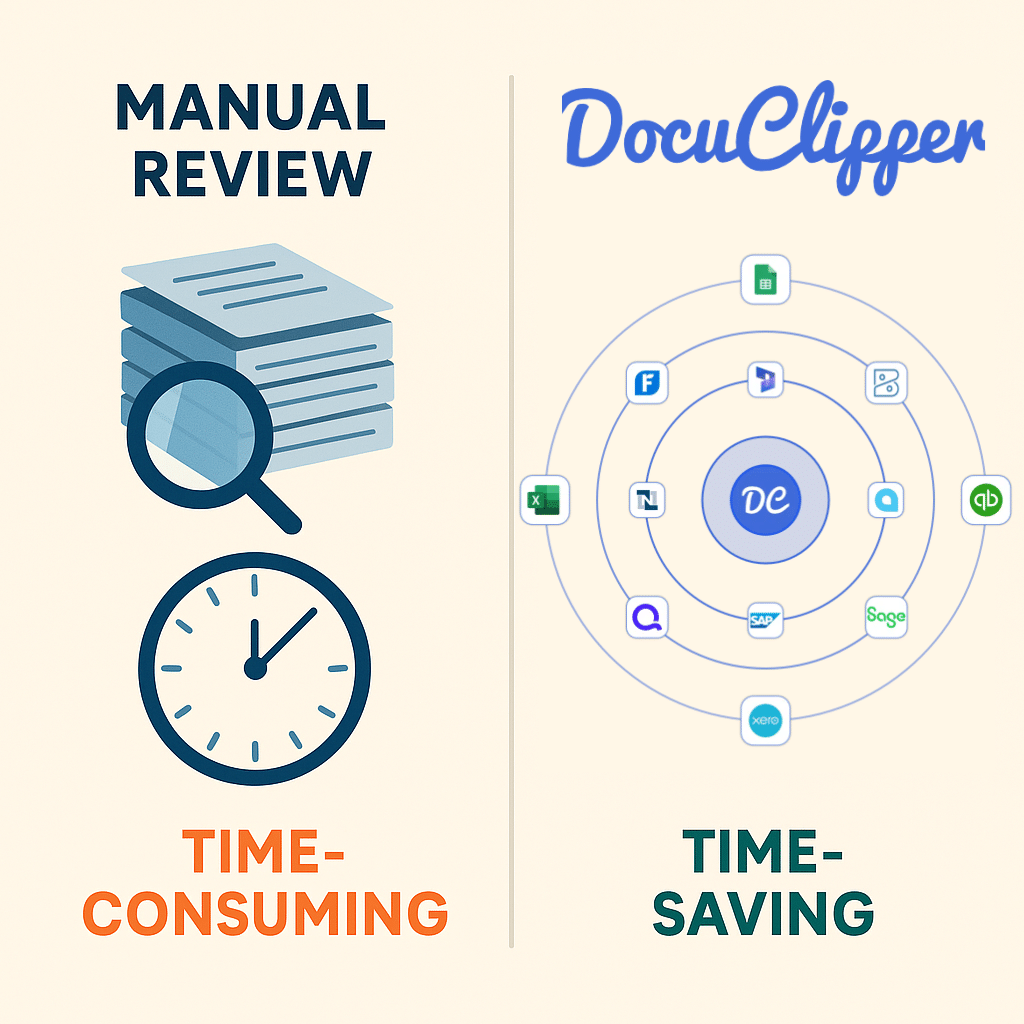

But with the right tools, this daunting task becomes significantly more manageable. That’s where DocuClipper comes in.

DocuClipper empowers family law professionals by automating the review of bank statements, streamlining financial discovery, and surfacing financial red flags with clarity and confidence. In this blog, we’ll explore how to effectively analyze bank statements for divorce cases and how DocuClipper’s OCR software and financial document automation can help uncover vital evidence and save time.

Why Bank Statement Analysis Is Crucial in Divorce Proceedings

Divorce is as much a financial negotiation as it is a legal separation. Assets, debts, and spending behaviors are central to the outcome of a divorce settlement. Lawyers must be prepared to:

- Trace financial transactions in divorce proceedings

- Identify undisclosed accounts or hidden income

- Analyze lifestyle and spending patterns

- Support or refute claims regarding financial misconduct

- Provide court-admissible financial records to support their client’s position

Yet, these objectives are often obstructed by manual data entry, incomplete records, and inconsistencies across statements. Each of these issues adds time, introduces risk, and potentially jeopardizes the outcome.

Common Financial Red Flags in Divorce Bank Statements

When reviewing divorce financial documentation, it’s important to know what to look for. Certain indicators often signal that one party may be attempting to conceal assets or manipulate financial records. Common red flags include:

- Frequent large cash withdrawals or transfers to unfamiliar accounts

- Recurring ATM transactions near unknown locations

- Unexplained wire transfers

- Increased spending shortly before separation

- Checks made out to cash

- New account activity not previously disclosed

- Inconsistencies between income and expenditures

These red flags can influence how assets are divided, whether spousal support is awarded, and can even affect child custody decisions if financial irresponsibility is demonstrated.

How OCR and Automation Help Legal Teams Save Time

Manual reviews of bank statements are time-consuming and error-prone. Each month of statements must be scanned, read, categorized, and compared. This often results in missed transactions or delayed discoveries.

Optical Character Recognition (OCR) technology transforms scanned bank statements into machine-readable data. But not all OCR tools are created equal—accuracy, formatting compatibility, and legal-grade reliability are key for attorneys.

That’s why many family law firms turn to DocuClipper, a solution built specifically to digitize bank statements for family law and related financial litigation.

Key Ways DocuClipper Supports Divorce Financial Investigations

DocuClipper is purpose-built to streamline and enhance financial discovery in divorce. Its capabilities empower legal teams to spend less time on manual tasks and more time interpreting and acting on key financial insights. Here’s how:

1. Extract and Reconcile Data Instantly

Upload scanned or digital PDFs and let DocuClipper automatically extract transaction data from bank statements. No manual entry, no human error.

- Parses thousands of pages in minutes

- Reconciles balances across statements

- Captures dates, descriptions, vendors, and amounts

2. Identify Hidden Accounts and Unreported Assets

DocuClipper’s intelligent review engine helps attorneys uncover hidden accounts and trace financial transactions across multiple bank accounts and time periods. This is critical for spotting:

- Patterns in income concealment

- Transfers to third-party accounts

- Unreported income streams

3. Detect Spending Patterns in Marriage

Understanding spending habits before and after separation can help demonstrate lifestyle inflation, marital waste, or sudden shifts that indicate asset concealment.

DocuClipper visualizes spending categories over time, helping build compelling, data-driven legal arguments.

4. Create Court-Admissible Financial Reports

With just a few clicks, generate standardized court-admissible financial records that can be attached to filings or presented during mediation or litigation.

These reports are formatted for legal review, ensuring credibility and consistency.

Case Study: Accelerating Discovery in a High-Asset Divorce

A family law attorney handling a high-net-worth divorce recently used DocuClipper to review 36 months of bank statements across four financial institutions. Manual review would have taken 40+ hours. Using DocuClipper:

- Data extraction was completed in under an hour

- The attorney discovered an undisclosed brokerage account through recurring transfers

- Spending patterns revealed frequent gifts and luxury expenses that contradicted sworn affidavits

- The findings resulted in a favorable settlement and strengthened the attorney’s case in mediation

DocuClipper vs Manual Review and Basic OCR Tools

While basic OCR tools can scan a bank statement, they often lack:

- Categorization by transaction type

- Cross-account reconciliation

- Flagging of suspicious transactions

- Formatting tailored for legal review

DocuClipper provides these advanced features with an intuitive interface designed for lawyers and paralegals. It integrates seamlessly into existing legal workflows and is frequently used in tandem with forensic accountants or financial investigators.

Why Family Law Professionals Choose DocuClipper

Family lawyers need solutions they can depend on. DocuClipper delivers:

- Accuracy you can trust – with near-perfect extraction rates and reconciled balances

- Speed that saves billable hours – process months of financial data in minutes

- Clarity for your client’s case – turn complex statements into clear evidence

- Compliance and court-readiness – with exportable, standardized documentation

Whether you’re working with cooperative spouses or handling high-conflict litigation, DocuClipper gives you the tools to stay ahead in financial discovery.

Start Your Free Trial of DocuClipper Today

Every divorce case tells a financial story. Make sure yours is backed by data, speed, and clarity.

DocuClipper helps you uncover the truth—quickly, accurately, and with confidence.

✅ Automate your document review

✅ Detect hidden assets and income

✅ Build stronger, data-driven legal arguments