Businesses make huge investments to grow their revenue and have the ability to be stronger and expand. That’s where checking your incremental cash flow becomes important.

However, it is not as simple as throwing money into a project and expecting amazing things like returning double or triple or 10x the initial investment.

Luckily, in this blog, we’ll talk about how to see your incremental cash flow and how it helps you make better decisions for your business.

What is Incremental Cash Flow

Incremental cash flow is the extra money a business makes after investing in something new. It’s a key number that helps businesses figure out if their investment is worth it.

By looking at the difference in cash flow before and after the investment, companies can tell if the new project or purchase is making them money. This helps them make smart choices about where to put their money to grow and make more profit.

Understanding incremental cash flow is essential for making sure investments pay off and help the business succeed.

Why Is Incremental Cash Flow Important?

There are many reasons why checking incremental cash flow is important for businesses to be knowledgeable about their financial status: Here are some reasons why:

- Decision Making: Incremental cash flow tells you how much extra money a project can make. This helps businesses pick the best projects that match their growth goals.

- ROI Assessment: It shows the return you get from an investment. Knowing this helps businesses focus on projects that make the most money.

- Risk Assessment: Projects with good incremental cash flow are usually safer. This helps companies avoid risky investments and pick better chances of success.

- Capital Allocation: It helps decide where to put money for the best outcome. This way, businesses invest in projects that help them grow and succeed.

- Performance Measurement: This measures how well a project does financially. Checking this regularly helps businesses know if they’re on the right track and make smart choices for the future.

How to Calculate Incremental Cash Flow

Calculating incremental cash flow is straightforward yet vital for making informed financial decisions.

Begin by identifying the initial investment costs, including any upfront payments for assets or technology.

Next, estimate the additional revenue the project will generate, but also account for any increase in operating expenses.

Subtract these expenses from your revenue to find your net income. Don’t forget to consider changes in working capital and tax implications, as these affect your cash flow.

Finally, calculate the net cash flow by adding non-cash expenses like depreciation back into your net income.

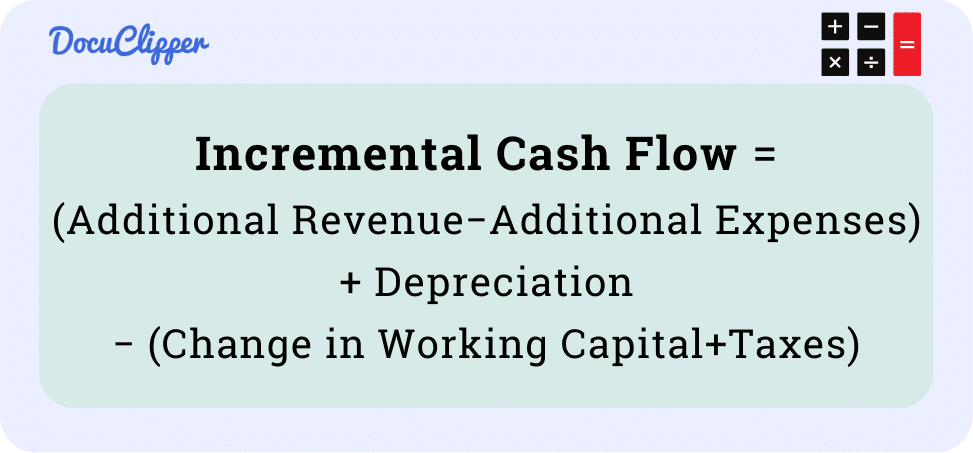

The formula looks like this:

Incremental Cash Flow = (Additional Revenue – Additional Expenses) + Depreciation – (Change in Working Capital + Taxes)

Examples of Incremental Cash Flow

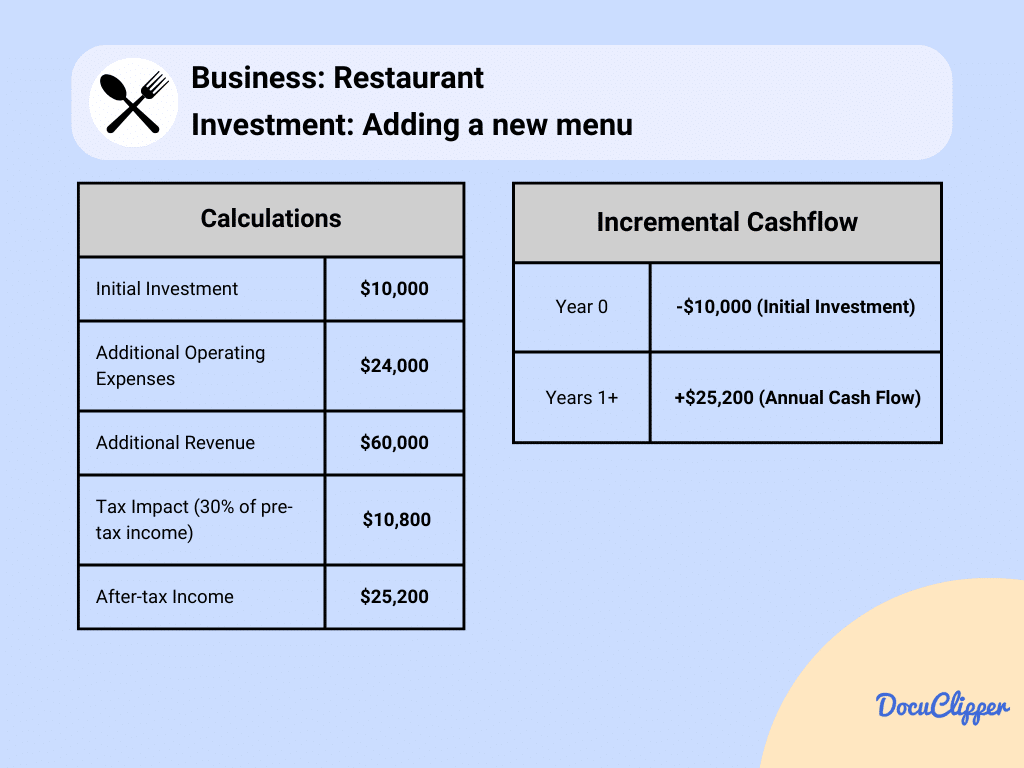

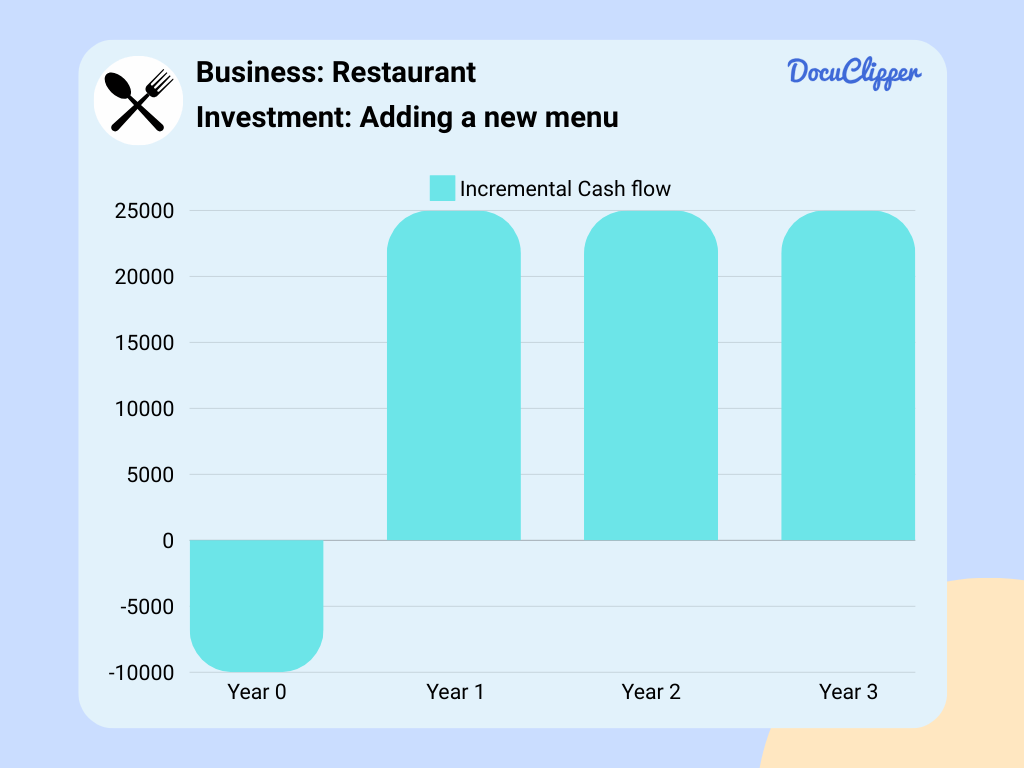

Restaurant: Launching a New Menu Item

Restaurants often add new dishes to keep things exciting and attract more customers. Here, we look at what happens financially when a restaurant introduces a new menu item, considering the costs to create and promote it, and the money it might bring in.

Scenario:

Initial Investment: Development and marketing of the new menu item cost $10,000.

Projected Additional Annual Revenue: Expected to increase by $60,000 due to the new item.

Additional Annual Operating Expenses: Ingredients and extra staff hours add $24,000 to expenses.

Working Capital: No significant change is needed for this initiative.

Tax Rate: The restaurant operates with a 30% tax rate.

Depreciation: Minimal, as the investment is mainly in perishable goods and marketing.

Salvage Value: Not applicable.

Calculation:

Initial Investment: -$10,000.

Annual Incremental Cash Flows:

Additional Revenue: $60,000

Less: Additional Operating Expenses: -$24,000

Pre-tax Income: $36,000

Tax Impact (30% of pre-tax income): -$10,800

After-tax Income: $25,200

Total Incremental Cash Flows:

Year 0: -$10,000 (Initial Investment)

Years 1+: +$25,200 (Annual Cash Flow)

Conclusion:

The new menu item is projected to generate an annual incremental cash flow of $25,200 after covering the initial costs. This makes the project financially attractive, suggesting a strong case for its launch.

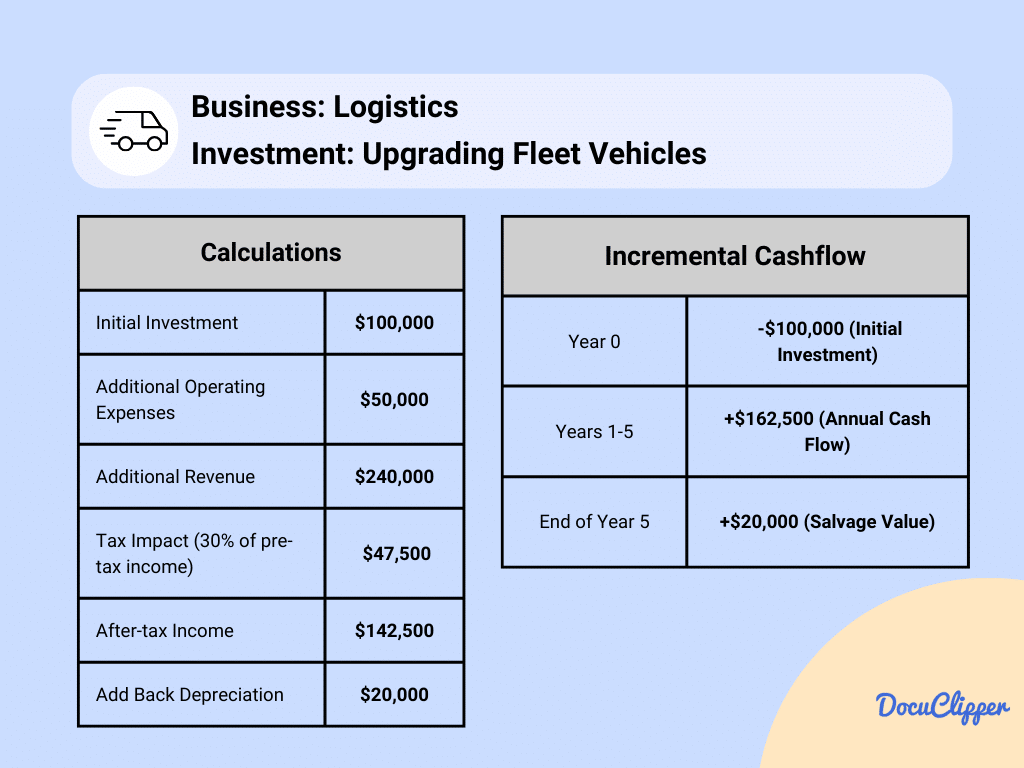

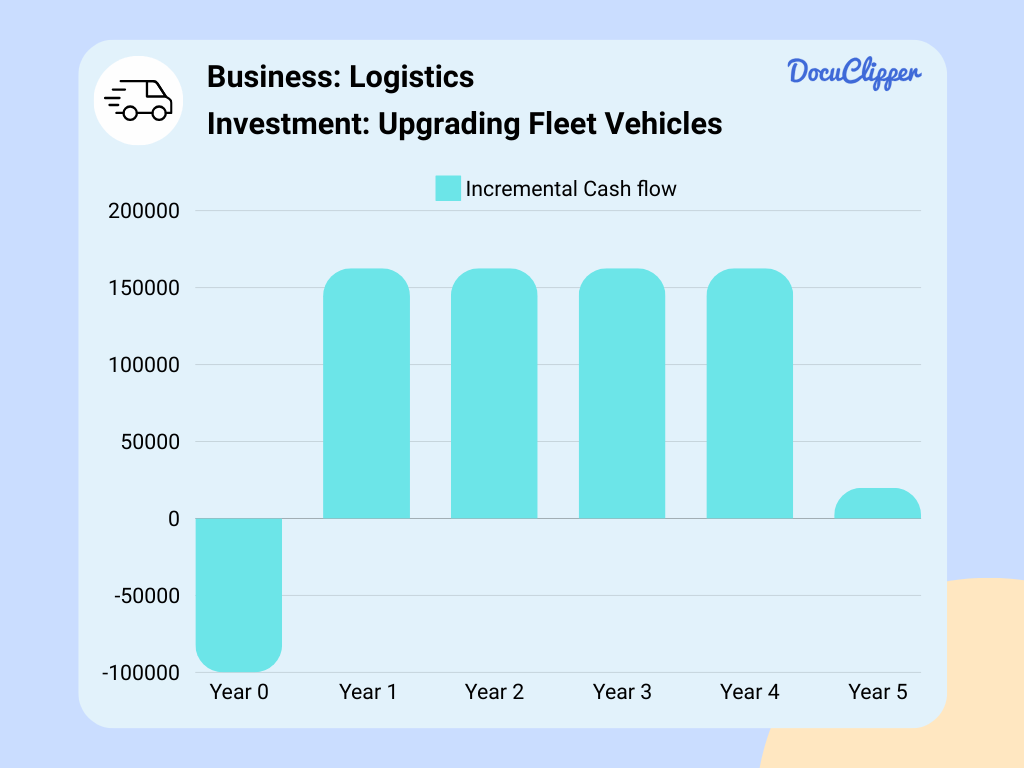

Logistics: Upgrading Fleet Vehicles

In logistics, having efficient trucks is crucial for making more money and serving customers better. This example digs into the costs and benefits of buying new trucks, showing how this move can impact a company’s bottom line.

Scenario:

Initial Investment: The purchase of new, efficient trucks requires $100,000.

Projected Additional Annual Revenue: Increased efficiency and capacity lead to an extra $240,000 in revenue.

Additional Annual Operating Expenses: Operating costs, including fuel and maintenance, increase by $50,000.

Working Capital: Not significantly affected.

Tax Rate: 25%.

Depreciation: The trucks depreciate by $20,000 annually.

Salvage Value: Estimated at $20,000 after 5 years.

Calculation:

Initial Investment: -$100,000.

Annual Incremental Cash Flows:

Additional Revenue: $240,000

Less: Additional Operating Expenses: -$50,000

Pre-tax Income: $190,000

Tax Impact (25%): -$47,500

After-tax Income: $142,500

Add Back Depreciation: +$20,000

Total Incremental Cash Flows:

Year 0: -$100,000 (Initial Investment)

Years 1-5: +$162,500 (Annual Cash Flow)

End of Year 5: +$20,000 (Salvage Value)

Conclusion:

Upgrading the fleet results in significant annual incremental cash flows of $162,500, with a salvage value adding to the final year’s benefit. The substantial increase in revenue and efficiency presents a compelling case for the investment.

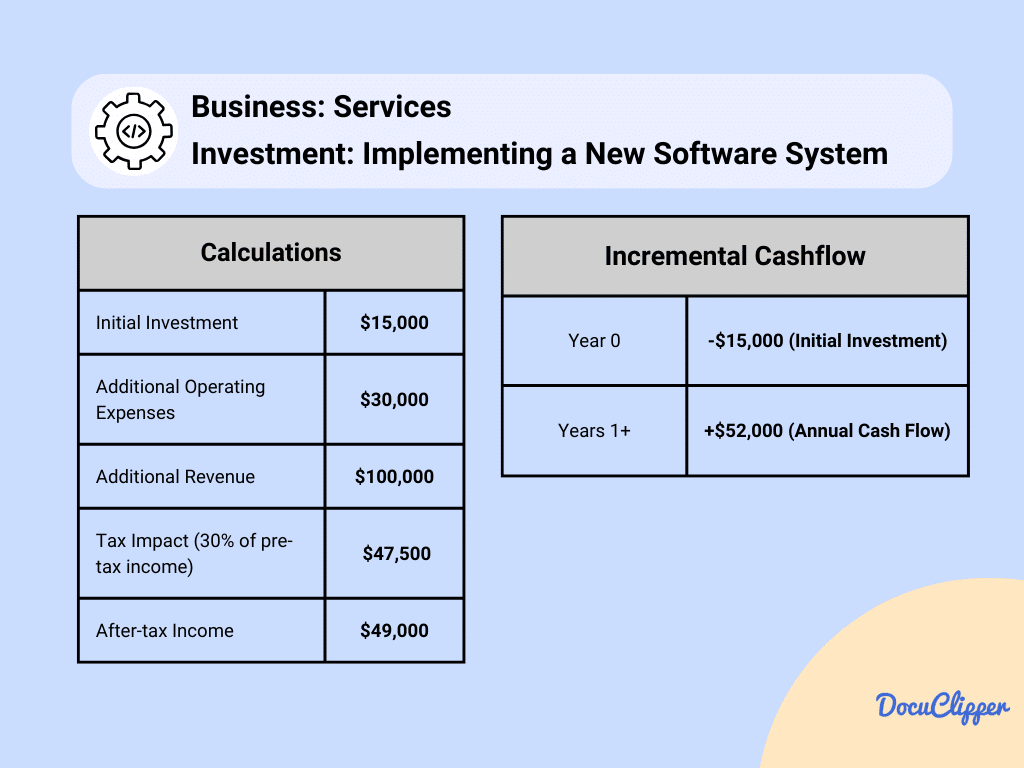

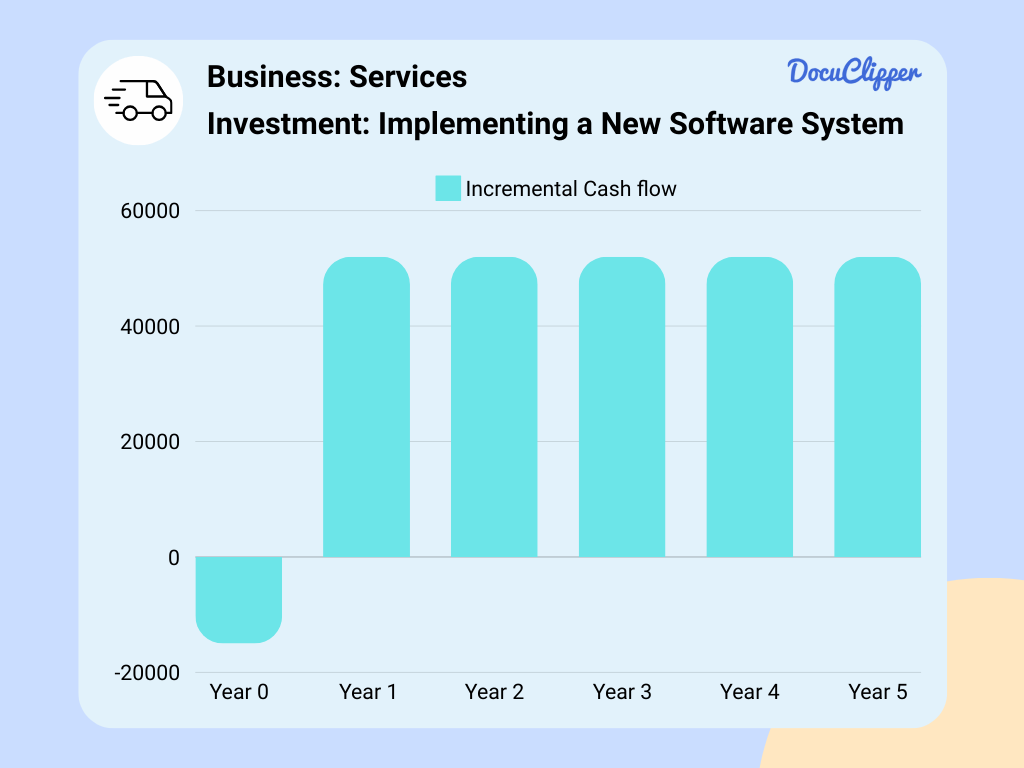

Services: Implementing a New Software System

Service businesses are always looking for ways to work smarter and please customers more. This scenario examines the investment in new software, breaking down the costs, potential extra income, and how it could make the business run smoother and more profitably.

Scenario:

Initial Investment: Software purchase and implementation cost $15,000.

Projected Additional Annual Revenue: Improved service efficiency boosts revenue by $100,000.

Additional Annual Operating Expenses: Maintenance and additional staffing costs total $30,000.

Working Capital: A slight increase of $5,000 is needed.

Tax Rate: 30%.

Depreciation: Software depreciates by $3,000 annually.

Salvage Value: Minimal to none.

Calculation:

Initial Investment: -$15,000.

Annual Incremental Cash Flows:

Additional Revenue: $100,000

Less: Additional Operating Expenses: -$30,000

Pre-tax Income: $70,000

Tax Impact (30%): -$21,000

After-tax Income: $49,000

Add Back Depreciation: +$3,000

Total Incremental Cash Flows:

Year 0: -$15,000 (Initial Investment)

Years 1+: +$52,000 (Annual Cash Flow)

Conclusion:

The software system enhances the company’s profitability with a yearly incremental cash flow of $52,000, justifying the initial outlay. This increase in efficiency and revenue significantly supports the decision to implement the new system.

Limitations of Incremental Cash Flow

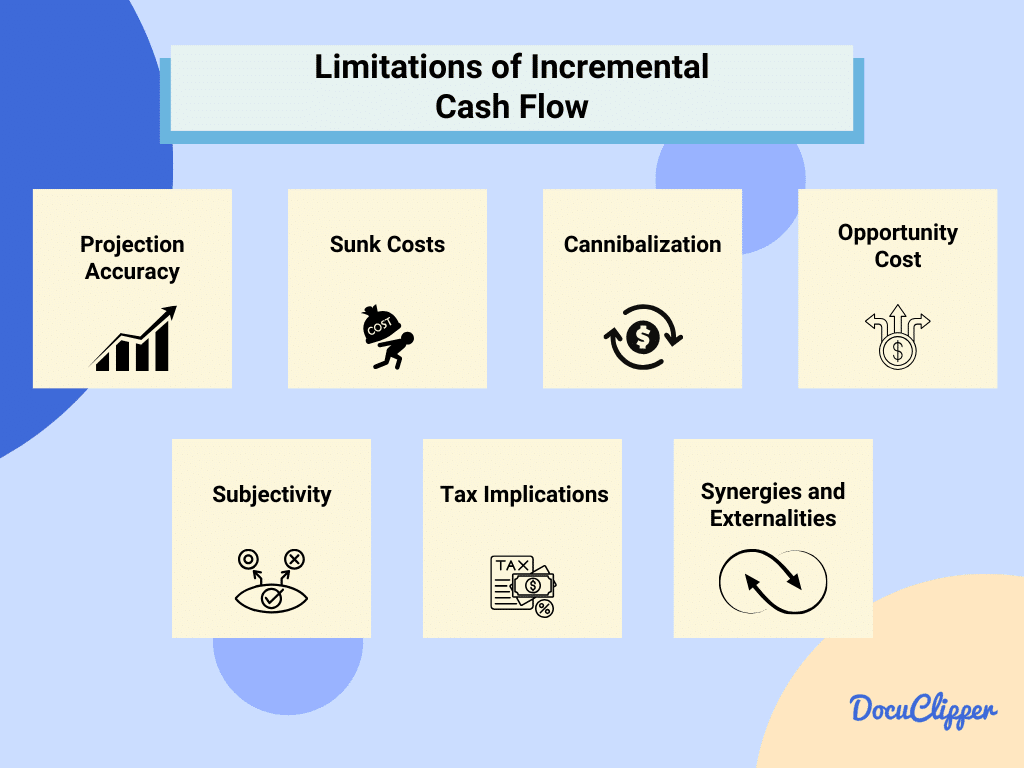

Understanding incremental cash flow is vital for assessing investment opportunities. However, this method has limitations that businesses must consider to make well-informed decisions.

- Projection Accuracy: Estimating future cash flows involves uncertainty. Assumptions about revenue growth and cost savings can be optimistic, leading to skewed financial projections. Real-world variables, such as market demand and economic conditions, often shift unpredictably, affecting the accuracy of these forecasts.

- Sunk Costs: It’s crucial to remember that sunk costs, expenses already incurred and irreversible, should not influence incremental cash flow analysis. However, their emotional weight might sway decision-making, leading to biased financial evaluations.

- Cannibalization: Introducing new products or services can sometimes reduce the sales of existing offerings. This internal competition, or cannibalization, must be factored into incremental cash flow analysis to avoid overstating the financial benefits of the new venture.

- Opportunity Cost: Choosing one investment over another carries the inherent cost of forgoing potential returns from alternative options. Incremental cash flow analysis might not always capture the full scope of opportunity costs, limiting its effectiveness in comparative analysis.

- Subjectivity: Assumptions about discount rates, growth projections, and lifespan can vary significantly among analysts. This subjectivity introduces variability in the calculated incremental cash flows, potentially affecting investment decisions.

- Tax Implications: Tax policies can influence incremental cash flows, with changes in tax rates or regulations potentially altering the financial attractiveness of a project.

- Synergies and Externalities: Incremental cash flow analysis may overlook synergies that enhance value across multiple projects or negative externalities, like environmental impact, that could impose additional costs.

Incremental Cost vs Total Cash Flow

The incremental cost is about the extra money spent on starting something new, like a project. It helps businesses see what specific steps will cost them right away.

Total cash flow, however, looks at all the money coming in and going out over time. This gives a full picture of a company’s money situation.

While incremental cost shows the cost of specific choices, total cash flow tells you how financially healthy the whole company is. Understanding both helps businesses make smart plans and choices.

Conclusion

Incremental Cash Flow Analysis is crucial for evaluating new investments, aiding businesses in decision-making and growth in 2025.

It helps assess the profitability of ventures by comparing pre and post-investment cash flows. Practical examples across sectors show its utility in guiding investment choices.

Despite its benefits, businesses must be aware of its limitations, including projection accuracy and potential biases.

This analysis is a vital tool for companies aiming to make informed financial decisions and drive success.

FAQs about Incremental Cash Flow Analysis

Here are some frequently asked questions about cash flow analysis and incremental cash flow:

How do you calculate the NPV of incremental cash flow?

To calculate the Net Present Value (NPV) of incremental cash flow, discount the future incremental cash flows to their present value using the company’s cost of capital, and subtract the initial investment.

What is the incremental cash flow method in brand valuation?

The incremental cash flow method in brand valuation estimates the additional cash flow a brand generates over what would have been generated without the brand, helping in determining the brand’s financial value.

Why do we use incremental cash flow?

We use incremental cash flow to assess the financial viability of investment decisions by estimating the additional cash inflows and outflows resulting from those decisions.

Is incremental cash flow the same as operating cash flow?

No, incremental cash flow is not the same as operating cash flow. Incremental cash flow focuses on the additional cash flows from a specific investment or decision while operating cash flow refers to the cash flows from the company’s regular business operations.

How do you calculate IRR from incremental cash flows?

To calculate the Internal Rate of Return (IRR) from incremental cash flows, use a financial calculator or spreadsheet software to find the discount rate that sets the NPV of the incremental cash flows to zero.