DocuClipper vs DataSnipper: The Best DataSnipper Alternative. Automates More, Extracts Better, Works Faster

DocuClipper is the best DataSnipper alternative for converting and analyzing financial documents like bank statements and invoices. Unlike DataSnipper, which is focused on manual auditing inside Excel, DocuClipper automates data extraction, reconciliation, and fraud detection—all with greater speed, accuracy, and scalability.

- More Features: DocuClipper automatically extracts data from bank statements, invoices, and receipts, and runs reconciliation and fraud analysis out of the box. DataSnipper is focused on manual evidence documentation in Excel and doesn't support true data extraction or analysis automation

- The Most Accurate Converter:DocuClipper delivers 99%+ accuracy on scanned PDFs and low-quality documents, while DataSnipper users frequently report OCR issues, errors with foreign currencies, and missing data

- Automatic Reconciliation: DocuClipper automatically compares opening and closing balances with transactions to ensure reconciliation. With DataSnipper, users must reconcile manually using Excel formulas or visual inspection

- Advanced Analysis & Fraud Detection: DocuClipper flags suspicious patterns such as round numbers, high-risk transfers, and cash flow anomalies. DataSnipper offers no built-in analytics.

- No Excel Lag or Crashes: DocuClipper is a standalone, high-performance platform that scales to thousands of documents. DataSnipper users frequently report Excel crashing or slowing down when working with larger files

- More Affordable DocuClipper has transparent pricing, no license fees, unlimited users, and all features included. DataSnipper charges per named user and reviewers may count toward licensing

- Very Easy to Use: DocuClipper has a modern, intuitive web interface with minimal setup. No plugins or IT help required. DataSnipper requires Excel plugin installation and training for most features.

- Excellent Support: Get fast, expert help from our team via live chat and email. No wait times or generic responses.

Trusted by 10,000+ Businesses Around the World

DocuClipper vs DataSnipper at Glance

Accurately process all your bank statements, invoices, and receipts without breaking your bank account with DocuClipper.

Features

Convert Bank Statements

- All banks supported

- Supported via manual snipping only.

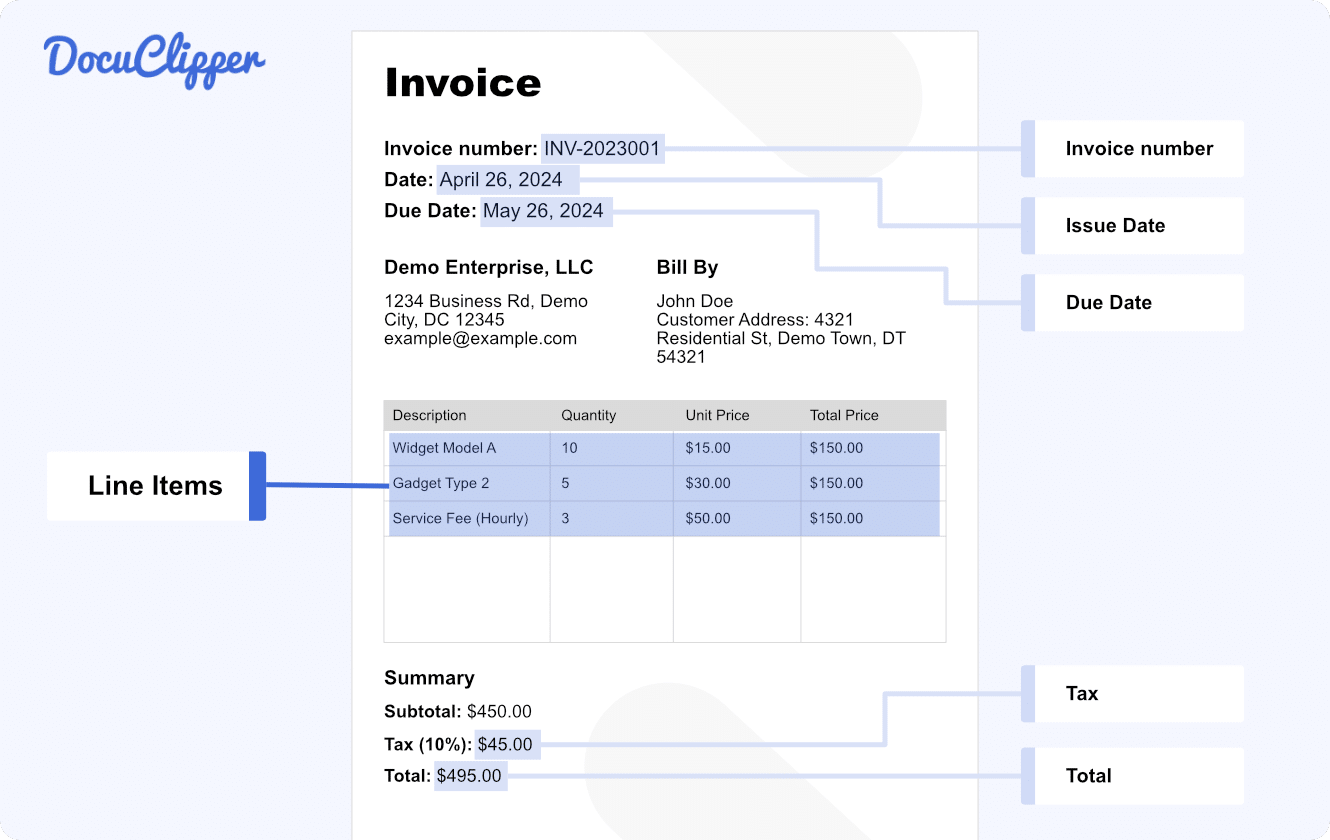

Extract data from invoices

- All invoices supported

- Not Supported

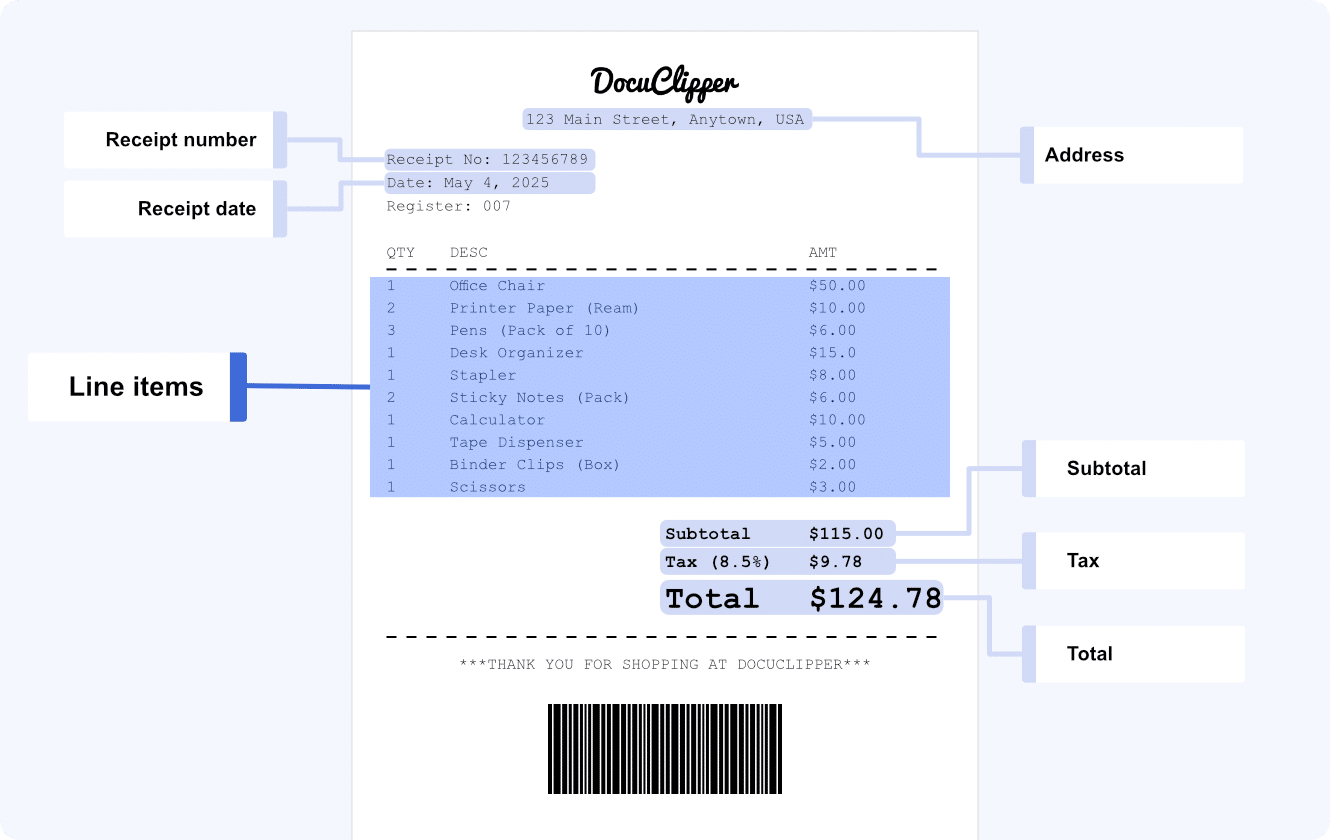

Extract data from receipts

- All receipts supported

- Not Supported

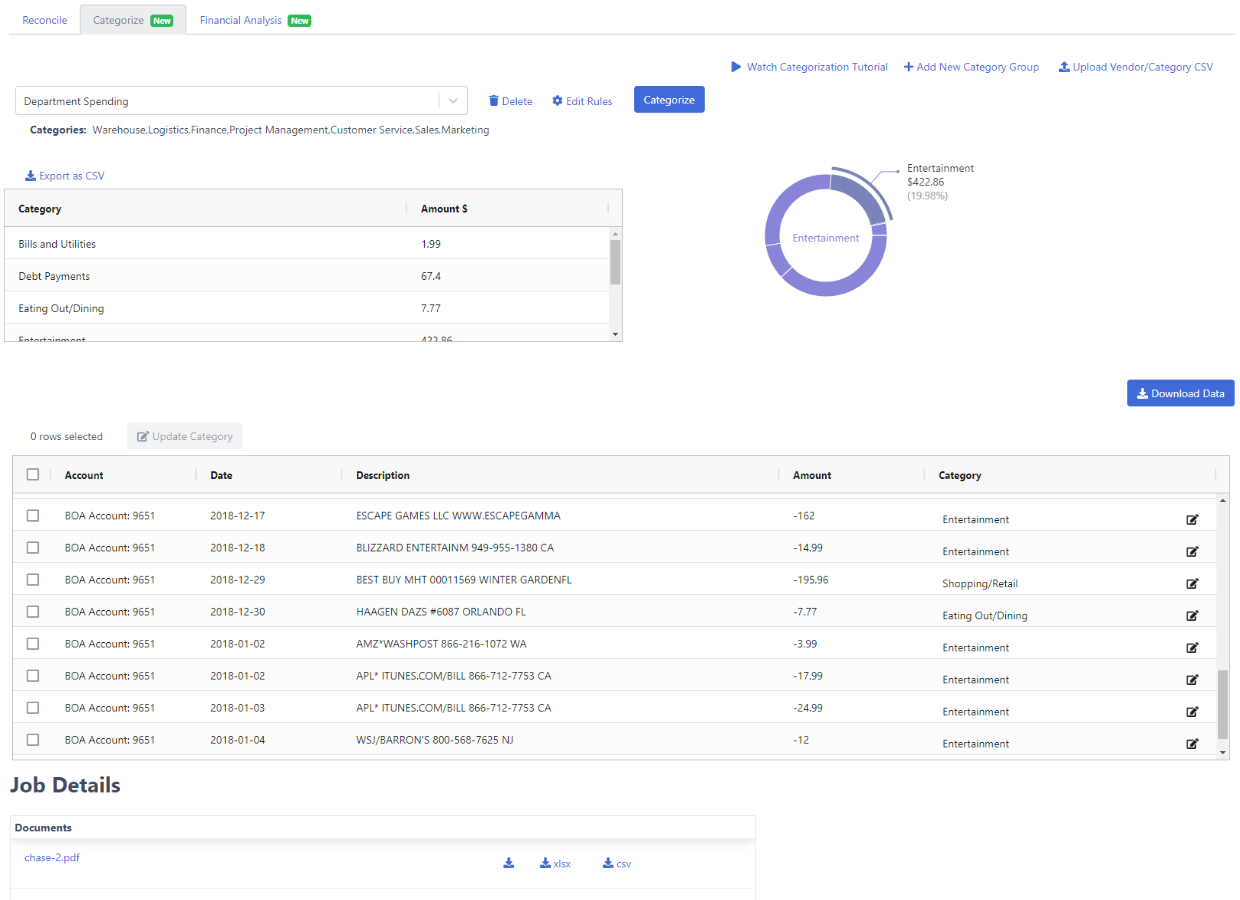

Transaction Categorization

- Supported

- Not Supported

Accuracy

- Highest in the Industry

- Hit-or-miss OCR accuracy reported

Security

- Industry-leading

- High

Bank Statement Reconciliation

- Supported

- Manual

Batch Conversion

- Supported

- Manual

Transfer Detection

- Supported

- Supported

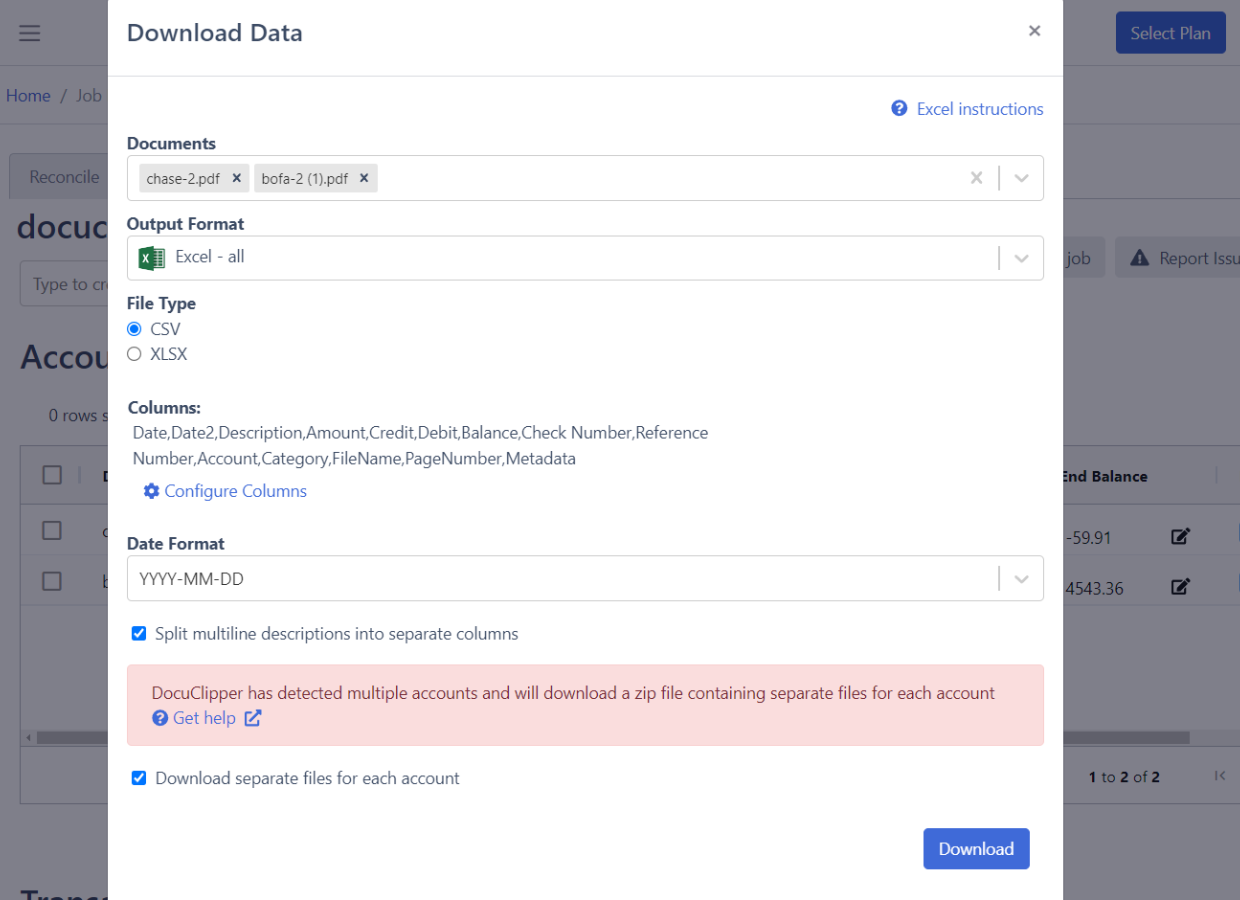

Customizable Output

- Supported

- Not Supported

Multi-Account Recognition

- Included, no extra fee.

- Not Supported

Custom Templates

- Supported

- Not Supported

File Inventory

- Supported

- Not Supported

Flow of Funds

- Supported

- Not Supported

Pricing

- $0.05 / page

- Transparent Pricing

- Per user pricing, limited seats, Excel only

- Hidden Pricing

Customer Rating

- Ease of Use

-

9.7/10

Industry Average: 8.8

- Not provided

- Quality of Support

-

9.8/10

Industry Average: 9.0

- Not provided

- Ease of Setup

-

10/10

Industry Average: 8.6

- Not provided

Let's Get You Started!

DocuClipper vs DataSnipper in Summary

The biggest differences between DocuClipper and DataSnipper are that DocuClipper is built for automation, while DataSnipper is built for manual audit documentation. DocuClipper processes bank statements, invoices, and receipts automatically, reconciles balances, flags risks, and exports to accounting tools—all at a fraction of the cost. DataSnipper, meanwhile, is limited to Excel snipping and lacks automation, scalability, and integration options.

If you’re looking to speed up your workflows, reduce manual work, and increase accuracy—DocuClipper is the clear winner.

See Why Finance Professionals Love DocuClipper

DocuClipper Top Features Loved by Our Users

DocuClipper’s advanced features enable accountants, bookkeepers, financial investigators, lenders, business owners, and insurers to streamline their financial workflows.

Works with Any Bank Statement

Our specialized Bank Statement OCR is able to handle any PDF bank and credit card statements, unlike our competitors.

- Convert PDF statements from any bank or credit card worldwide.

- Quickly onboard clients with efficient document processing capabilities.

- Reduce errors with our specialized OCR, ensuring accurate data capture.

- Enhance client satisfaction with fast, reliable statement conversion.

- Broaden your service reach to include international financial institutions.

Highest Conversion Accuracy for Invoices & Receipts

DocuClipper can process any type of invoices or receipts with high accuracy and speed.

Convert All Documents to Your Preferred File Type

Our OCR converter not only accurately converts all the bank, invoice, and receipts formats but also allows you to export them into the right format so you can import the bank transactions where you need them.

- Export to Excel, CSV, QBO, JSON, OFX, QFX, QIF for easy integration.

- Tailor output formats to fit your or your client's needs.

- Speed up financial reviews with ready-to-analyze data.

- Ensure high accuracy in financial records, minimizing corrections.

- Save time, focusing on strategic business or client needs.

Automatically Categorize Your Bank Transactions

Easily categorize your converted bank transactions for easy and quick financial analysis, tax filling, investigation, underwriting, or simply tracking your expenses.

- Quickly sort transactions into categories for faster insights.

- Organize expenses and income for hassle-free tax filing.

- Categorize transactions for clear, detailed financial investigations.

- Use categorized data for precise risk assessment and decision-making.

- Automatically sort spending for easy monitoring and budgeting.

Eliminate manual data extraction with a specialized OCR software for financial documents.

Try it for Free

Get a 14-day free trial to convert your financial documents.

Frequently Asked Questions about DataSnipper Alternative

DocuClipper is purpose-built to automate data extraction, reconciliation, and financial analysis—not just document annotation. While DataSnipper is primarily an Excel-based audit tool, DocuClipper offers full automation for bank statements, invoices, and receipts, dramatically reducing manual work and processing time.

For teams looking to go beyond Excel-based snipping, DocuClipper is the top alternative. It offers advanced OCR, automatic reconciliation, categorization, and seamless exports to tools like QuickBooks and Xero. Unlike DataSnipper, it’s designed for high-volume, automated financial document processing.

DocuClipper automates tasks that DataSnipper users still do manually. That includes extracting transactions from bank statements and invoices, reconciling balances, categorizing expenses, detecting fraud, and exporting clean data—all in seconds. DataSnipper lacks these capabilities and is limited to Excel plugins with manual workflows.

DocuClipper is more affordable than DataSnipper. You pay per page, not per user—with unlimited users and no licensing complexity. DataSnipper charges per user (including reviewers in some cases), which can make it costly for teams and clients.

Automatic data extraction from bank statements, invoices, and receipts

Built-in reconciliation and fraud detection

No Excel plugin required

4x cheaper per document

Unlimited users at no extra cost

Export to accounting systems and ERPs

These features make DocuClipper far more scalable and automation-ready compared to DataSnipper.

DocuClipper offers:

Automatic bank statement reconciliation

Multi-account recognition and flow-of-funds analysis

Invoice and receipt extraction

Transaction categorization and export-ready formats

Fraud flagging tools

Simple web-based interface—no plugins or installs

These features don’t exist in DataSnipper and are essential for firms handling large volumes of documents or looking to automate and scale their financial workflows.