Do you want to prepare for debt fluctuations with the current state of inflation? Do you want to prepare for interest rates and see an opportunity?

Here are important credit card debt statistics you should know in 2025.

Top Credit Card Statistics in 2025

- Average Interest Rate: The average credit card interest rate stands at a staggering 28.15%.

- Average credit card debt is at $6,365

- Average credit utilization rate is at 22.16%

- APR scores: Superprime (740+) has 16%-18%, Prime (670-739) is 20%-22%, Subprime (580-669) is 22%-24%, and Deep Subprime (below 579) faces 24% and above.

Credit Card Debt Statistics in the U.S.

- As the Federal Reserve raises interest rates, lenders are expanding consumers’ access to credit, leading to a record $89 billion in new credit card accounts in the first quarter.

- In August, Americans’ collective credit card bill exceeded $1 trillion for the first time.

- Discover, Synchrony Financial, and Capital One are among the lenders planning to promote credit line increases and credit card offers in Quarter 3.

- U.S. consumer credit increased by $10.4 billion.

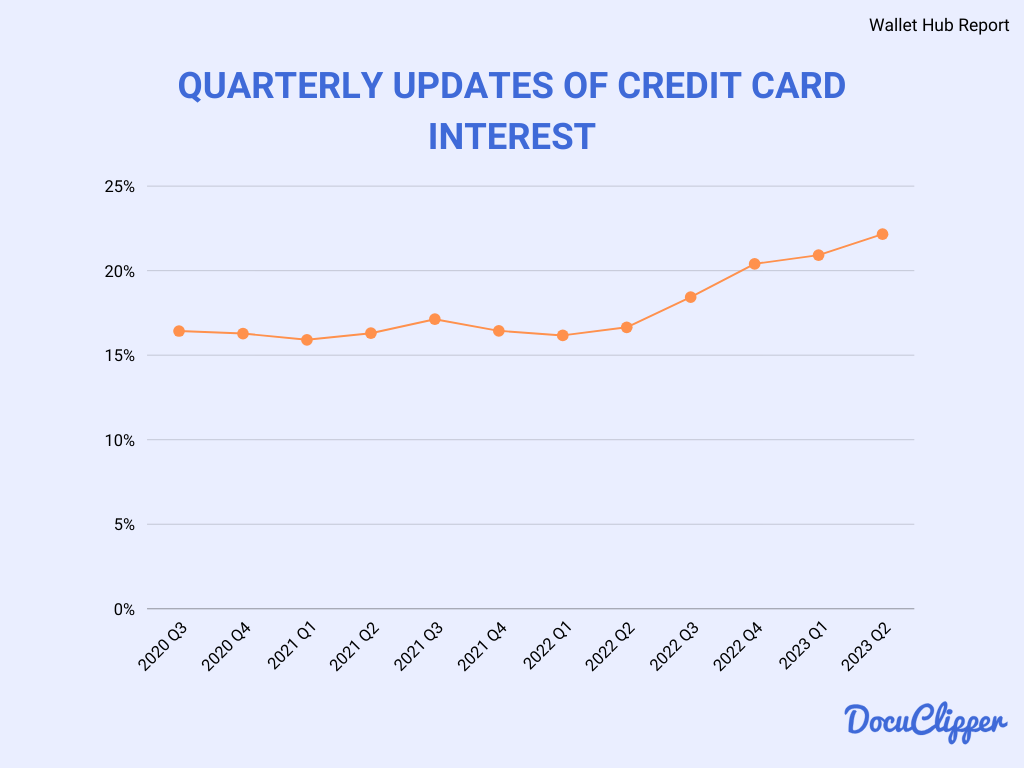

Quarterly Updates of Credit Card Debt

- WalletHub reports that U.S. consumers took on an additional $43 billion in credit card debt during Q2 2025, more than triple the average amount since the Great Recession.

- The effects of higher interest rates are evident, with credit card interest rates exceeding 20%, the highest in more than two decades.

Credit Card Transactions Statistics in the US

- Credit cards remain a popular payment method, with the number of credit card payments in the U.S. increasing by nearly 26 billion.

- Credit cards accounted for 77% of non-cash payments, with 157 billion credit card payments made in the U.S.

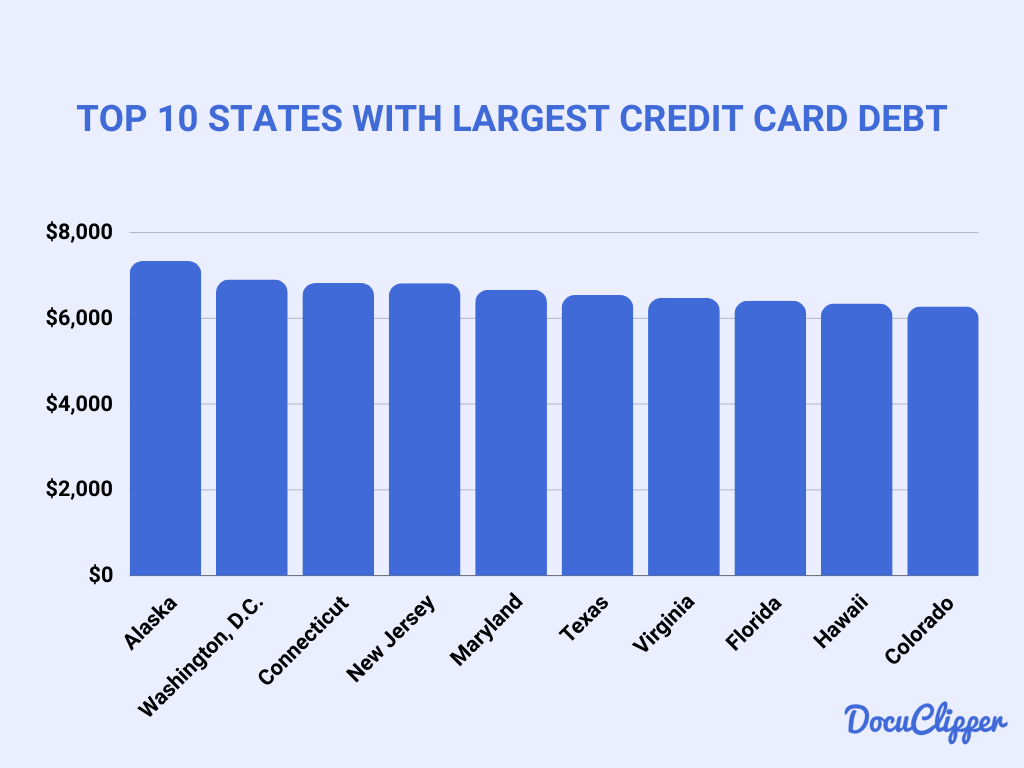

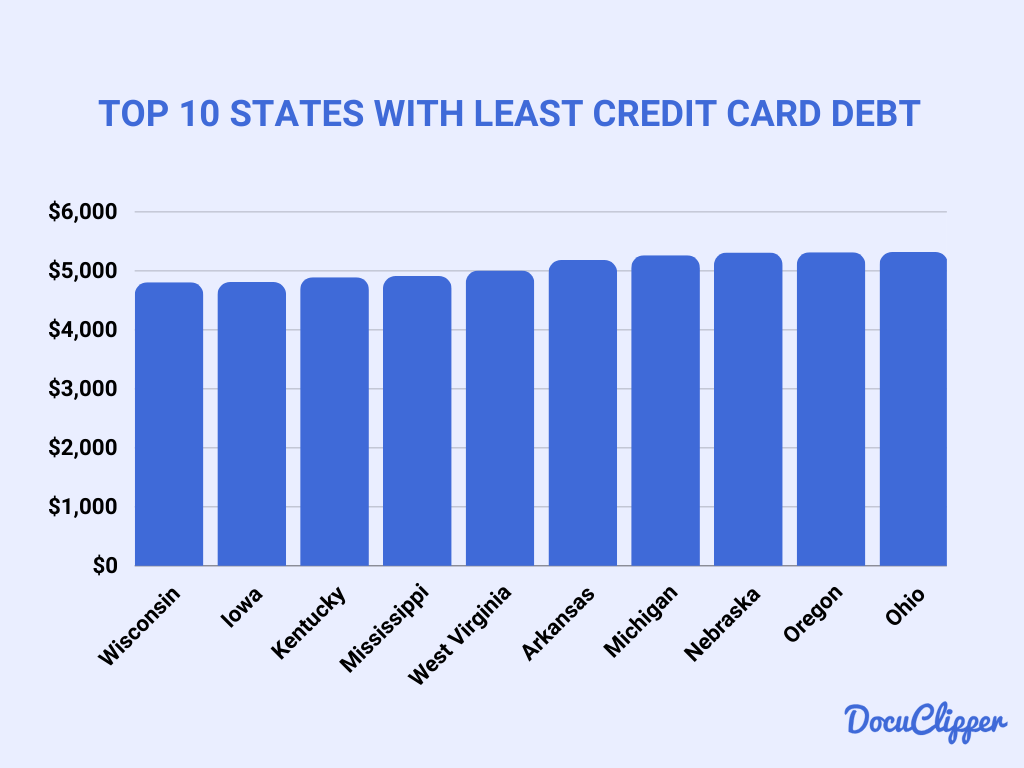

Average Credit Card Debt by State

- Alaska holds the highest average credit card debt among U.S. states, with an amount of $7,338.

- Wisconsin and Iowa boast the smallest average balances at $4,808 and $4,811, respectively.

Credit Card Debt by Demographic

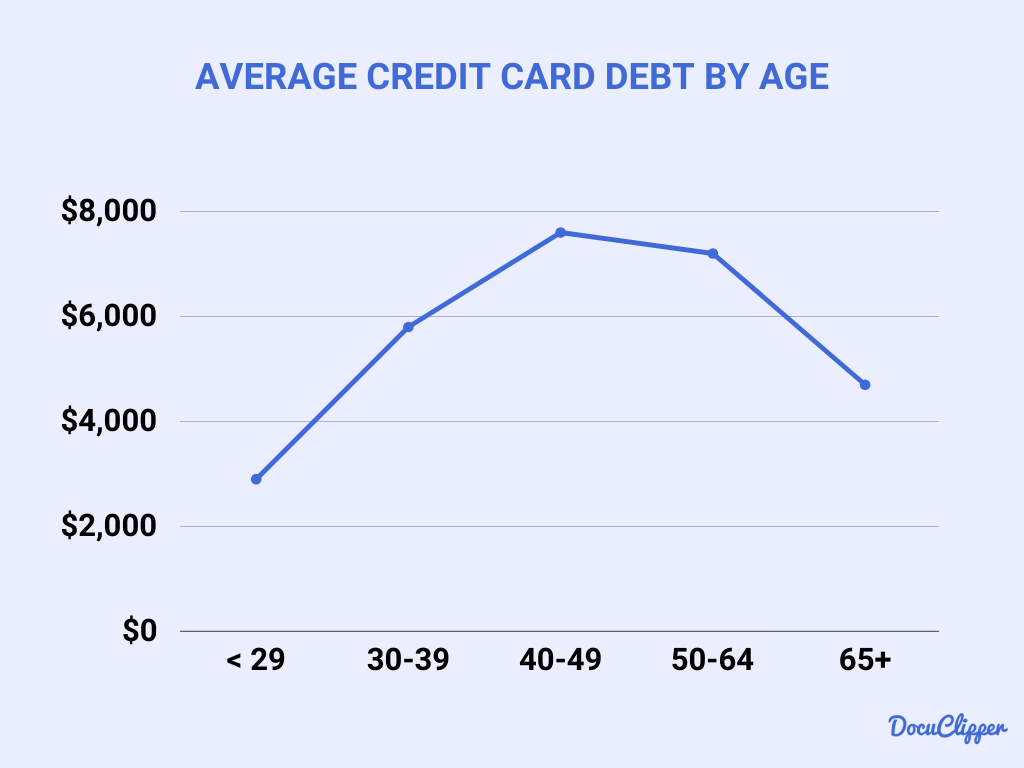

- Consumer age influences credit card debt, with those aged 40-49 carrying the highest average balance of $7,600.

- Credit card debt tends to rise from the 30s.

- The ages 29 below and 65 both have the least amount of debt.

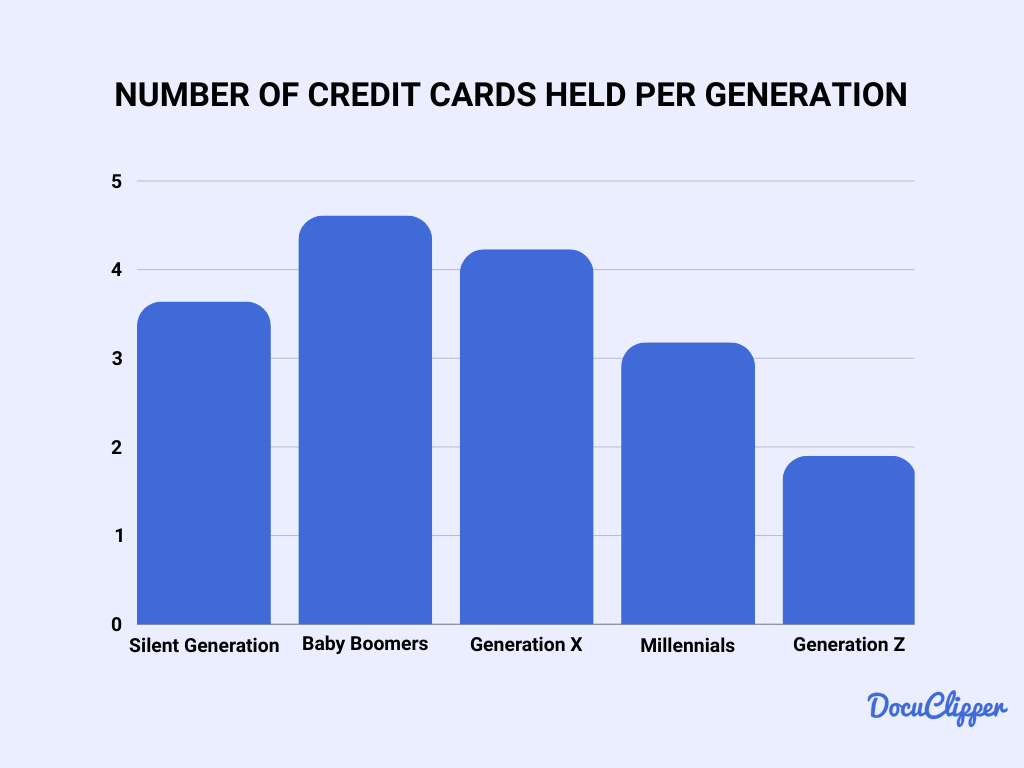

- Baby Boomers and Gen Xers also have more credit cards on average compared to other consumers.

US Credit Card Debt Statistics Due to Economic Changes

- Bank of America’s recent participant pulse report showed that the number of 401(k) plan participants taking hardship withdrawals was up 13% from the second quarter

- There is a notable 27% rise, and the average withdrawal amount stands slightly above $5,000.

Personal Credit Card Debt Statistics

- A staggering 48% of Americans rely on credit cards to cover essential living expenses.

- Missed Payments: 43% of Americans have missed at least one credit card payment in the past five years.

- 61% of Americans carry an average credit card debt of $5,875, while 23% increase their debt monthly, and 14% missed a payment in 2023

- The average American now spends $1,506 on their credit card each month, with millennials surpassing $2,410.

- Maxed Out Credit Cards: Over half of Americans (53%) have reached their credit card limit, and 29% max out their credit cards every month.

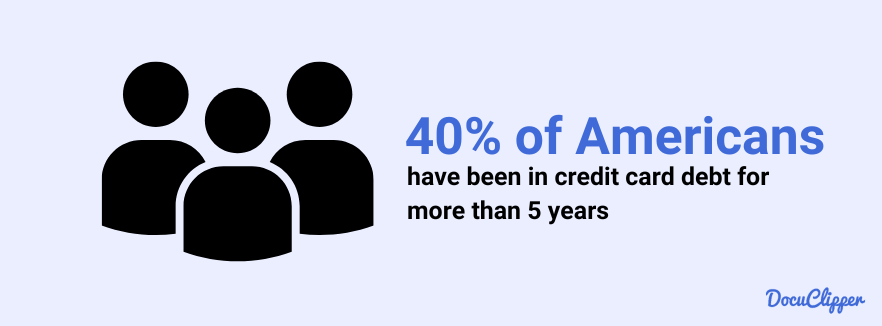

- Long-Term Debt: 40% of Americans have been in credit card debt for over 5 years.

Small Businesses Credit Card Debt Statistics

- Small businesses often rely on personal credit cards for financing, with 61% of owners using personal credit cards for business expenses.

- 20% of small business owners have a separate credit card for company usage.

- $7,000 is the median revolving balance for businesses that didn’t pay off their credit card bill in full each month according to JPMorgan Chase.

Related Articles

Looking for more statistics? Check out these resources:

- Data Entry Statistics 2025

- Accounting & Bookkeeping Statistics 2025

- Accounts Payable Statistics 2025

- 7 Human Error Statistics 2025

- Accounts Receivable Statistics 2025

Or use these resources to learn more about accounting and bookkeeping processes: