Tax audits and bookkeeping are inconvenient from a business point of view. It disrupts efficiency and requires professional employment. That’s why some businesses outsource bookkeeping to others

In this blog, we’ll talk about why businesses outsource bookkeeping and what are its potential benefits.

What do Bookkeepers do?

They handle the day-to-day recording of financial activities, like tracking sales and expenses, and make sure every transaction is accurately entered into the company’s accounting system.

Their job also includes preparing simple financial reports and making sure the bank records match the company’s records. Bookkeepers often take care of payroll, ensuring employees are paid correctly.

What is Outsource Bookkeeping?

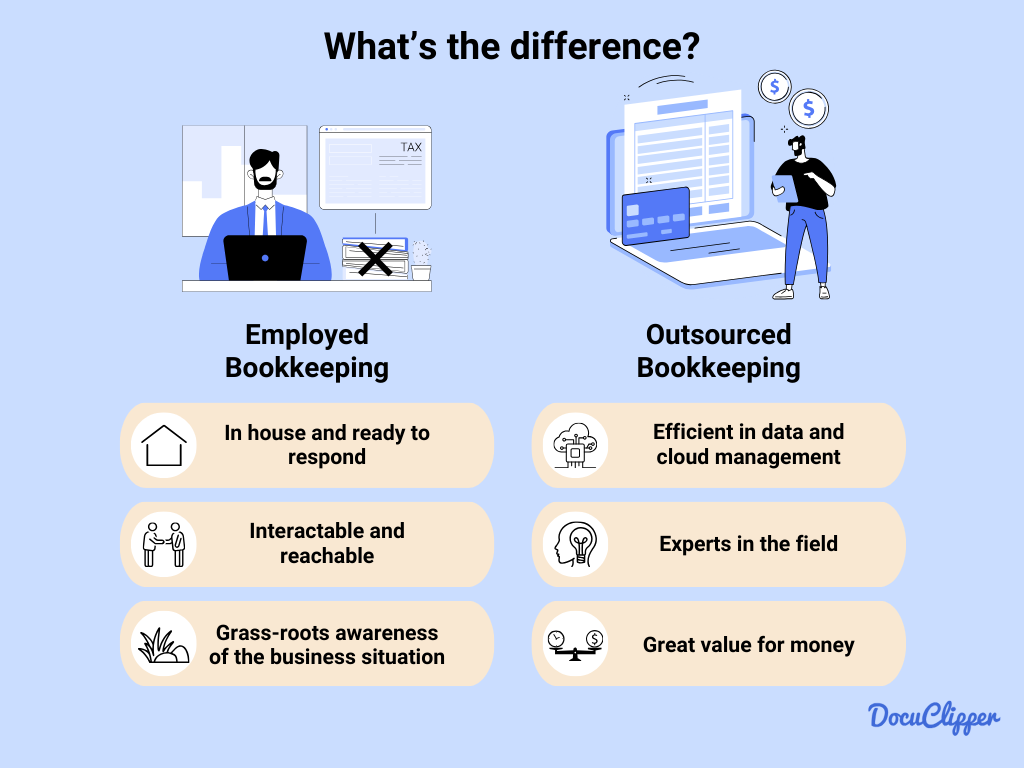

Outsourcing bookkeeping means hiring outside people or companies to handle a business’s financial records, from pre-accounting organization to post-accounting analysis. This can be more convenient than having full-time employees do it.

Businesses hire outside bookkeepers and pay them depending on the size of the business and how long they need help. This is a good option for smaller businesses that need help with their financial records but don’t have the staff or money for a full-time bookkeeper.

Why Outsource Bookkeeping?

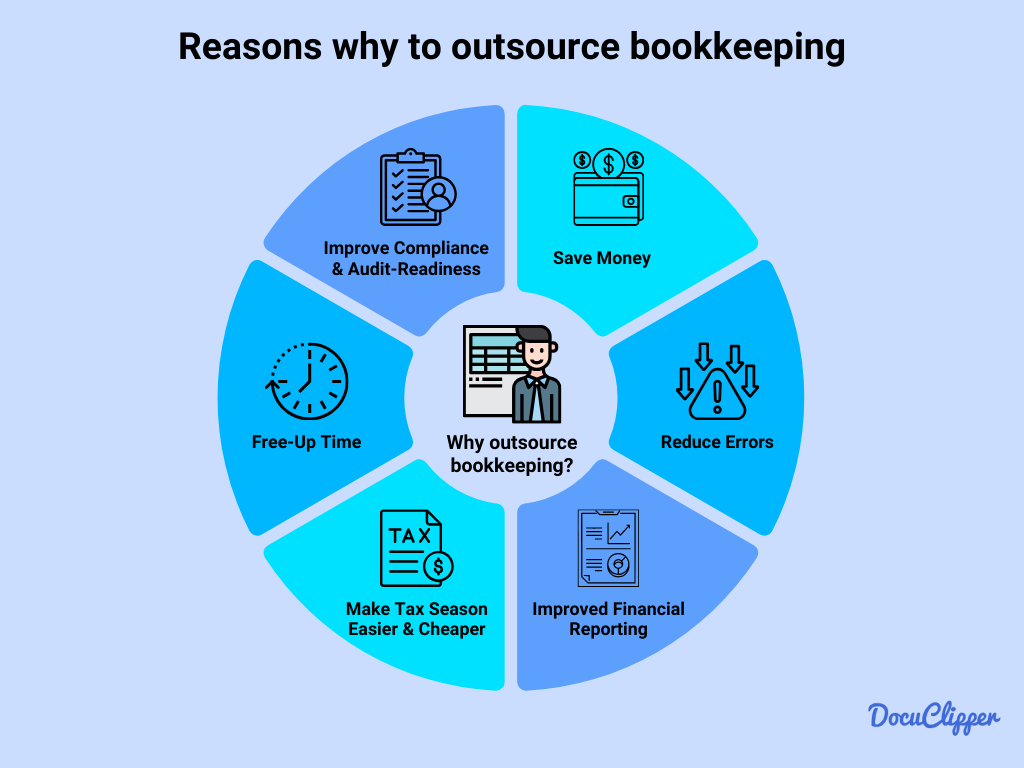

Outsourcing bookkeeping services always has advantages. Here are some reasons why businesses choose to outsource:

Improve Compliance & Audit-Readiness

Bookkeeping service providers are highly skilled professionals who specialize in managing financial records. Because bookkeeping is their main focus, they are very good at what they do, ensuring high-quality work.

They are also careful about important financial details, like tax returns and audits, making sure to comply with all the rules and regulations. This expertise makes them a reliable choice for businesses looking for top-notch financial management.

Free-Up Time

Outsourcing bookkeeping can be a great time-saver for businesses.

It frees up other employees to concentrate on their primary roles, rather than spending time on financial management or bookkeeping tasks.

It can also help you to outsource data entry which takes significant time.

This is especially helpful for business owners who often take on bookkeeping themselves.

It not only improves efficiency but also reduces the pressure on the business owner, allowing for better focus on growth and strategy.

Save Money

Outsourcing bookkeeping is often a better choice financially for many businesses, especially smaller ones. When you outsource, you pay only for the services you need, which can be less expensive than a full-time bookkeeper’s salary and benefits.

There’s also no need to spend money on training or equipment. Plus, you get access to expert bookkeepers who specialize in this work, which can be more effective than training someone in-house.

Reduce Errors

Outsourcing bookkeeping to professionals can greatly reduce errors. These experts, with their high level of skill and established systems, make fewer mistakes than training a new employee. This leads to more accurate and reliable financial records, ensuring better overall financial management.

Improved Financial Reporting

Professional bookkeepers are well-versed in the latest legal requirements and financial trends, resulting in improved financial reporting.

Their expertise allows for more precise and insightful financial statements, important for informed decision-making and strategy development.

Outsourcing bookkeeping can also lead to better management of incremental cash flow, as it enables businesses to more accurately forecast and manage their financial growth and investment opportunities

Make Tax Season Easier & Cheaper

During tax season, many bookkeeping service providers offer special deals and packages, which can be more cost-effective than handling them in-house. Their expertise in tax matters not only simplifies the process but also ensures compliance and accuracy, potentially leading to cost savings and a smoother tax filing experience.

When to Outsource Bookkeeping?

Deciding when to outsource bookkeeping can vary for each business, but certain signs indicate it might be the right time:

- Inaccuracy in Financial Records: If you’re noticing frequent errors or inconsistencies in your financial records, it’s a sign that professional help might be needed.

- Time Constraints and Management Focus: If managing bookkeeping is taking up too much time that could be better spent focusing on core business activities, outsourcing can free up valuable time for management.

- Budget Constraints for Full-Time Staff: When the cost of hiring a full-time bookkeeper is too high, outsourcing becomes a cost-effective alternative.

- Lack of In-House Expertise: If your current team lacks the necessary bookkeeping expertise, outsourcing to professionals ensures accuracy and compliance.

- Rapid Business Growth: As a business grows, its financial needs become more complex. Outsourcing can provide the necessary expertise to handle this increased complexity.

- Difficulty in Managing Cash Flow: Professional bookkeepers can help improve cash flow management, a crucial aspect of business sustainability.

- Preparing for Audit or Investment: If your business is preparing for an audit or seeking investment, accurate and professional financial records are essential. Outsourcing bookkeeping can help ensure your financial data is audit-ready and attractive to potential investors.

How Does Outsource Bookkeeping Work?

Outsourced bookkeeping works by delegating your business’s financial management tasks to external professionals or firms specializing in bookkeeping and accounting services.

Here’s how the process typically works:

- Selection of a Service Provider: The first step is to choose a bookkeeping service provider. This could be an independent bookkeeper, a freelancing professional, or an accounting firm. Businesses often select based on factors like expertise, cost, and the specific services offered.

- Assessment and Onboarding: The service provider assesses your business’s specific bookkeeping needs. This includes understanding your current financial processes, software used, and any specific requirements your business has. During onboarding, they will set up any necessary systems and ensure a smooth transition.

- Transfer of Financial Information: You’ll need to provide the bookkeeper with access to all necessary financial documents and records. This could include bank statements, invoices, receipts, payroll data, and any other relevant financial information.

- Regular Bookkeeping Tasks: The bookkeeper then takes over the regular tasks of recording transactions, managing accounts payable and receivable, reconciling bank statements, and preparing financial reports. These tasks are typically performed using accounting software.

- Communication and Reporting: Good communication is key. The bookkeeper will regularly update you on your financial status and provide reports as needed. This might be monthly, quarterly, or annually, depending on your arrangement.

- Tax and Compliance Support: Many bookkeeping services also assist with tax preparation and ensure that your business complies with all relevant financial regulations and reporting requirements.

How Much Does It Cost to Outsource Bookkeeping?

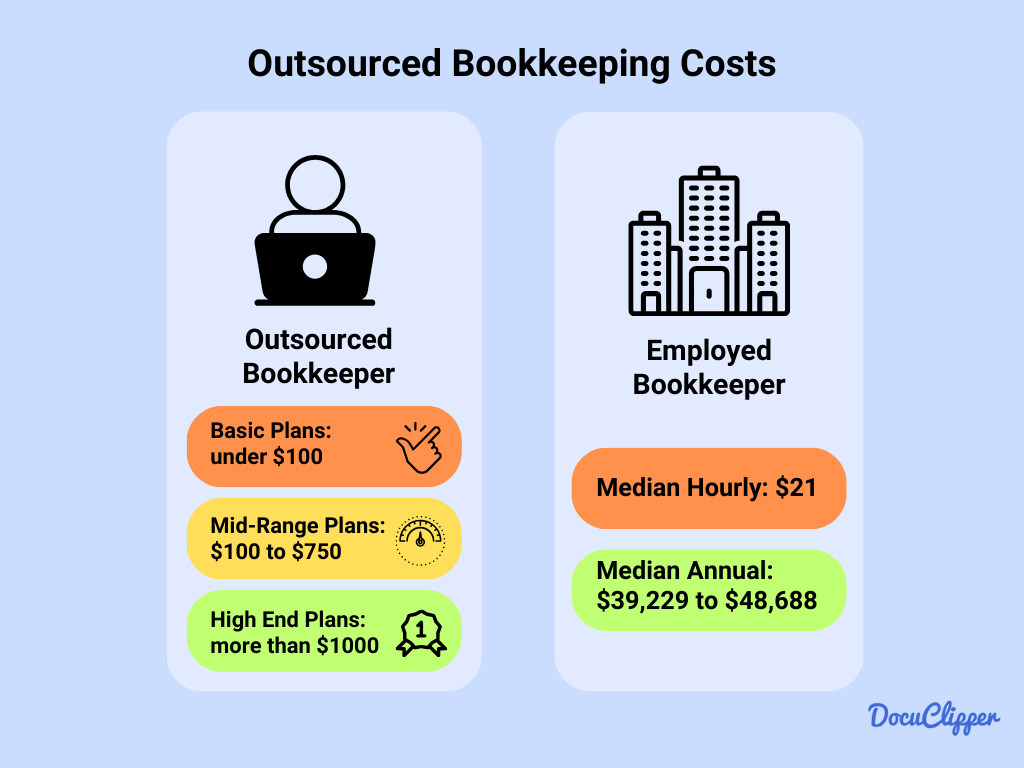

The cost of outsourcing bookkeeping varies significantly depending on several factors, including whether you choose a freelancer or a firm, the pricing structure (hourly or per project), and the location of the service provider.

The median hourly rate of an employed bookkeeper is $21 with a potential annual salary within the range of $39,229 and $48,688

Outsourcing bookkeeping services means you have to pay less than these numbers. And accounting firms offer straightforward prices.

When looking for outsourced accounting services, businesses have many price options. Affordable plans start at under $100 per month, perfect for small businesses or startups that need basic bookkeeping and financial reporting.

For more detailed services like financial analysis and payroll, mid-range plans are around $100 to $750. These are great for businesses with regular accounting needs.

For larger businesses or those with complex finances, high-end plans cost more than $1000. These offer full accounting management and detailed financial services.

For offshore bookkeeping like in countries from India and the Philippines. Costs can start at 3$ per hour up to $8. While projects tend to vary and remain negotiable.

How to Outsource Bookkeeping

Outsourcing bookkeeping is a strategic process that involves several key steps to ensure that you find the right service that fits your business needs and budget. Here’s how to approach it:

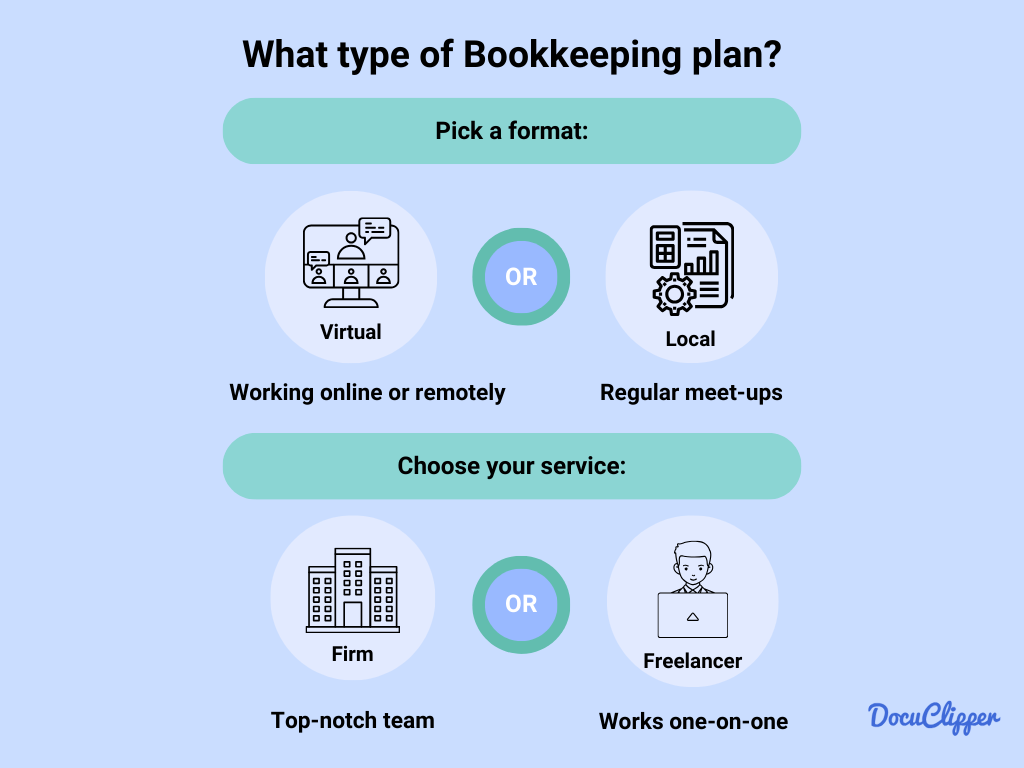

Step 1: Choose the Service Format – Local or Virtual

Companies can choose whether to choose local or virtual. They have different advantages and businesses tend to have preferences on one over the other.

- Local Services: Opting for a local bookkeeper or firm means you have the opportunity for face-to-face interactions. This can be beneficial if you prefer a more personal approach or if your bookkeeping needs require frequent physical document exchanges. Local providers might be more familiar with regional accounting standards and tax laws.

- Virtual Services: Choosing an online bookkeeping service offers greater flexibility and often a wider selection of providers. they can be more cost-effective and can use advanced cloud-based accounting technologies. They are ideal for businesses comfortable with remote communication and digital data management.

Step 2: Decide on the Type of Provider – Freelancer or Firm

Providers can vary from independent contractors to huge and established firms. While they have varying degrees of capacities, costs are still a thing to think about.

- Freelancer: Hiring a freelance bookkeeper is often suitable for smaller businesses or those with straightforward bookkeeping needs. Freelancers can offer more personalized services and may have more flexible pricing options. However, they might have limitations in terms of capacity and range of services.

- Firm: Engaging a bookkeeping firm is generally advisable for businesses with more complex bookkeeping requirements or those seeking a broader range of services. Firms can provide a team of experts and access to more resources, but they may come with higher costs.

Step 3: Establish Your Budget

Quality does not always equal price. Find a fixed budget and do not avail a service that is too much for your business’s scale.

- Assess Your Financial Capacity: Determine how much you can realistically allocate for bookkeeping services. Remember that effective bookkeeping can save you money in the long run by ensuring financial accuracy and compliance.

- Consider the Complexity of Your Needs: Your budget should reflect the complexity of your bookkeeping tasks. More complex operations requiring specialized expertise will generally cost more.

- Explore Pricing Models: Understand the different pricing models offered by freelancers and firms, such as hourly rates, fixed monthly fees, or per-project charges. Match these with your budget and bookkeeping needs.

- Allocate for Scalability: If your business is growing, consider that your bookkeeping needs might evolve. Your budget should accommodate potential future requirements, so look for a service provider who can scale with your business.

Not Ready to Outsource Your Bookkeeping?

Are you not ready to let others do your bookkeeping? Do not worry DocuClipper is here to help you with managing your finances.

DocuClipper is an OCR bank statement converter that converts PDF bank statements into XLSX, CSV, and QBO. It is compatible with multiple accounting software, in case you have them, like QuickBooks, Sage, and Xero.

Conclusion

Outsourcing bookkeeping is a smart choice for many businesses. It helps in managing finances efficiently, ensuring compliance, and allowing businesses to focus on core activities as well as ensuring you have the right expertise to manage your business finances.

Whether you choose a freelancer or a firm, outsourcing provides flexibility and expertise that can adapt to your business’s evolving needs.

FAQs about Outsources Bookkeeping

Here are some frequently asked questions by business owners when they think about outsourcing bookkeeping:

What does an outsourced bookkeeper do?

They handle daily financial record-keeping, prepare reports, and ensure accurate transaction entries.

How much does it cost to outsource bookkeeping?

Costs vary, starting under $100 per month for basic services to over $1000 for comprehensive plans. Offshore rates can be as low as $3 to $8 per hour.

Should you outsource your bookkeeping?

Consider outsourcing if you need to save time, reduce errors, and focus on your business growth.

What is outsourced accounting?

It’s hiring external services for managing your business’s accounting and financial tasks.

Is freelance bookkeeping profitable?

Yes, especially for small businesses needing flexible and personalized services.

Why hire a freelance bookkeeper?

For their personalized service, flexibility, and often more affordable rates.

Why hire a virtual bookkeeper?

They offer remote, flexible services often at a lower cost, using cloud-based technologies.

Why hire a remote bookkeeper?

Remote bookkeepers provide convenient, efficient services without the need for physical office space.