Bookkeeping involves accountants carefully recording and managing money for companies, businesses, and individuals. It can be a long and detailed task. Using automated bookkeeping can simplify this process and make it less time-consuming.

Automation has many benefits, including increasing efficiency and revenue. It speeds up processes and reduces errors, leading to more accurate and faster results.

Key Takeaways:

- Automated bookkeeping uses technology to handle tasks traditionally done manually, increasing efficiency, reducing errors, and speeding up financial processes.

- Benefits include time savings, audit-ready financial records, high accuracy rates, instant financial overview, and support in making informed decisions.

- Key automation methods include importing bank transactions into accounting software, categorizing transactions, converting PDF bank statements, managing invoices, and automating payroll.

What is Automated Bookkeeping

Automated bookkeeping refers to using technology to handle bookkeeping tasks that were traditionally done by hand.

This spans across pre-accounting tasks like gathering and categorizing financial data and post-accounting processes, such as generating reports and analyzing financial trends.

This means that repetitive, manual work is replaced by software that can operate independently or with minimal oversight.

Getting automation means accessing top-notch software. This software can either be OCR bank statement converters or IDP. It gathers data, analyzes information, and helps make good financial choices.

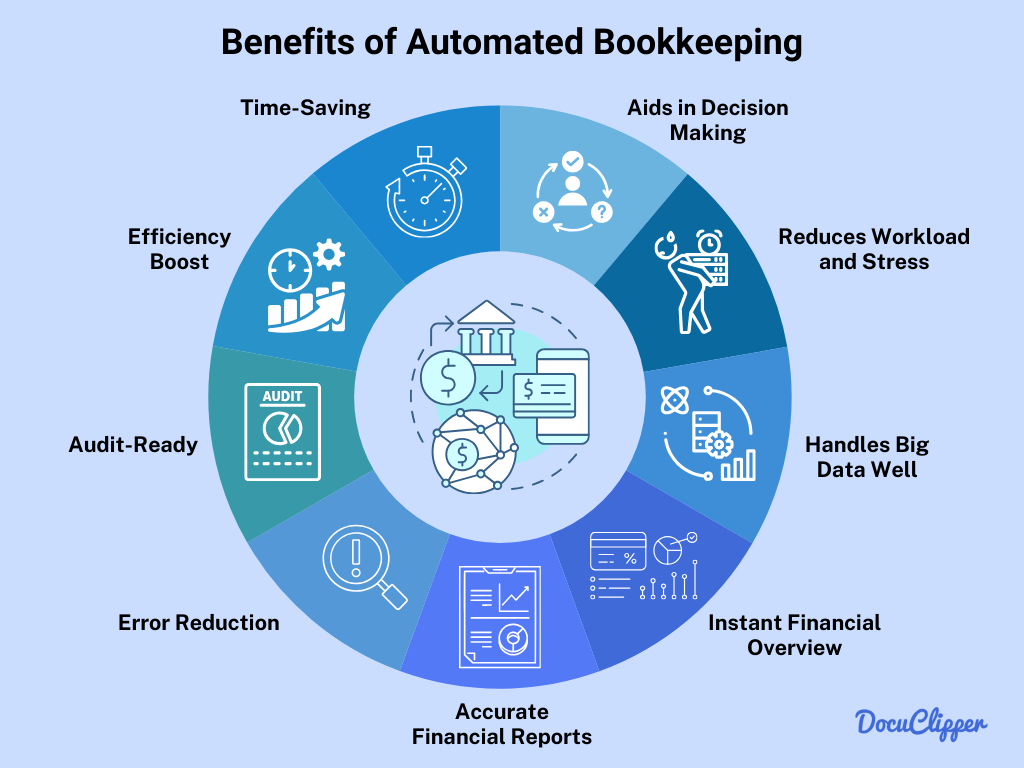

Benefits of Automated Bookkeeping

Starting to use automated bookkeeping can feel scary at first. You might be worried about the cost, if it’s accurate, or if you can depend on it.

But there are lots of good reasons to try it:

- Time-Saving: OCR software rapidly processes bank statements and invoices, transforming days of work into just minutes.

- Efficiency Boost: It processes documents quickly, allowing you to complete more tasks in less time.

- Audit-Ready: It organizes financial records in an ideal format for audits and financial reporting.

- Error Reduction: OCR bank statement tools have a high accuracy rate, about 99% correct in reading bank statements.

- Accurate Financial Reports: Automatic sorting and matching of transactions ensure financial reports are over 99.5% accurate, even with formatted data.

- Instant Financial Overview: Offers real-time views of your financial status at any moment.

- Handles Big Data Well: Efficiently and quickly manages large volumes of data.

- Reduces Workload and Stress: 21% of small to medium business owners admit not knowing enough about bookkeeping. Automating it helps owners to focus on more urgent things.

- Aids in Decision Making: Provides quick, accurate data for informed financial decisions. Moreover, automated bookkeeping plays a pivotal role in evaluating incremental cash flow, a crucial metric for assessing the financial viability of new investments or changes.

10 Best Ways to Automate Bookkeeping

Automating bookkeeping data entry requires tech initiatives and manual input. Human personnel remain involved in achieving this and here are some ways to automate it.

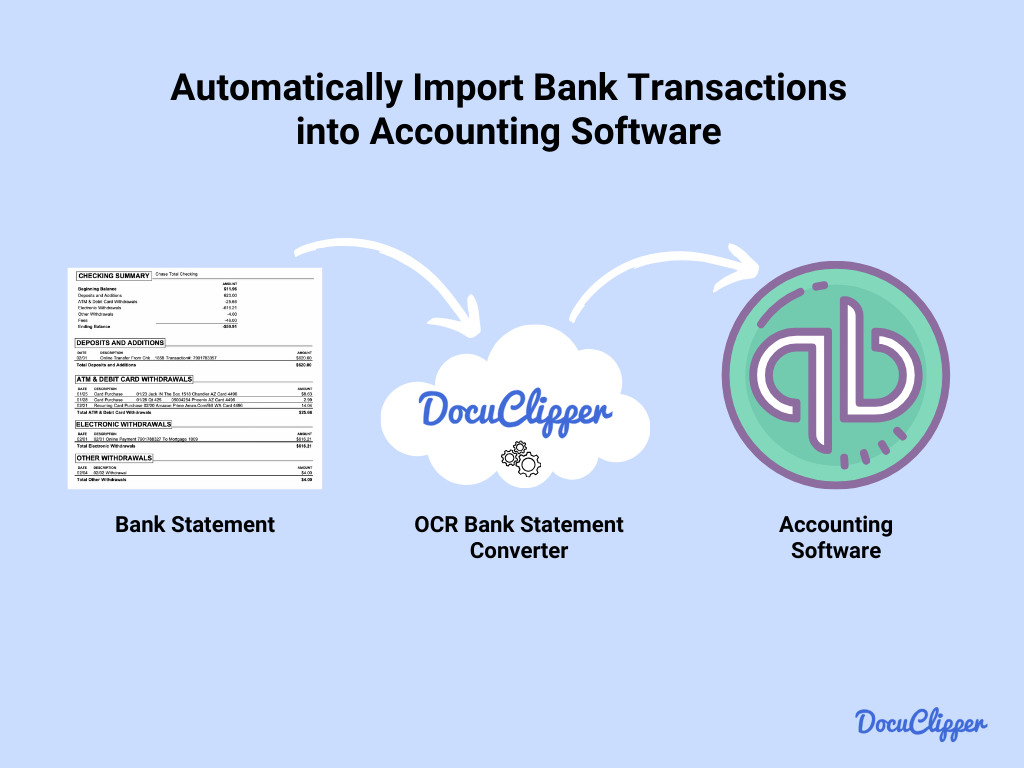

1. Automatically Import Bank Transactions into Accounting Software

Manually importing bank transactions offers more chances of human error that affect the smallest details. Using tech tools that automatically import information to accounting software improves efficiency.

Connect your accounting software to your bank account to automatically import transactions. This saves time on manual entry, reduces errors, and keeps your books up-to-date.

Most modern accounting platforms offer this feature, making it easier to track income and expenses without manual input. Importing bank transactions into QuickBooks using OCR data capture software is an example.

And when comparing manual vs automated data entry this is one of the best ways to save time.

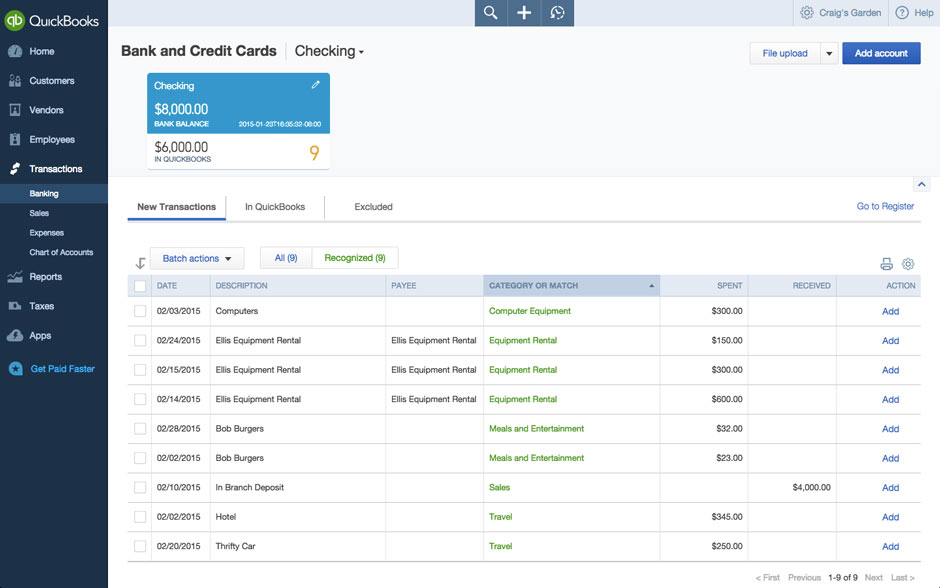

2. Categorize Transactions

QuickBooks, a popular accounting software, automatically categorizes bank transactions. This feature streamlines organizing expenses, managing income, and preparing for tax season.

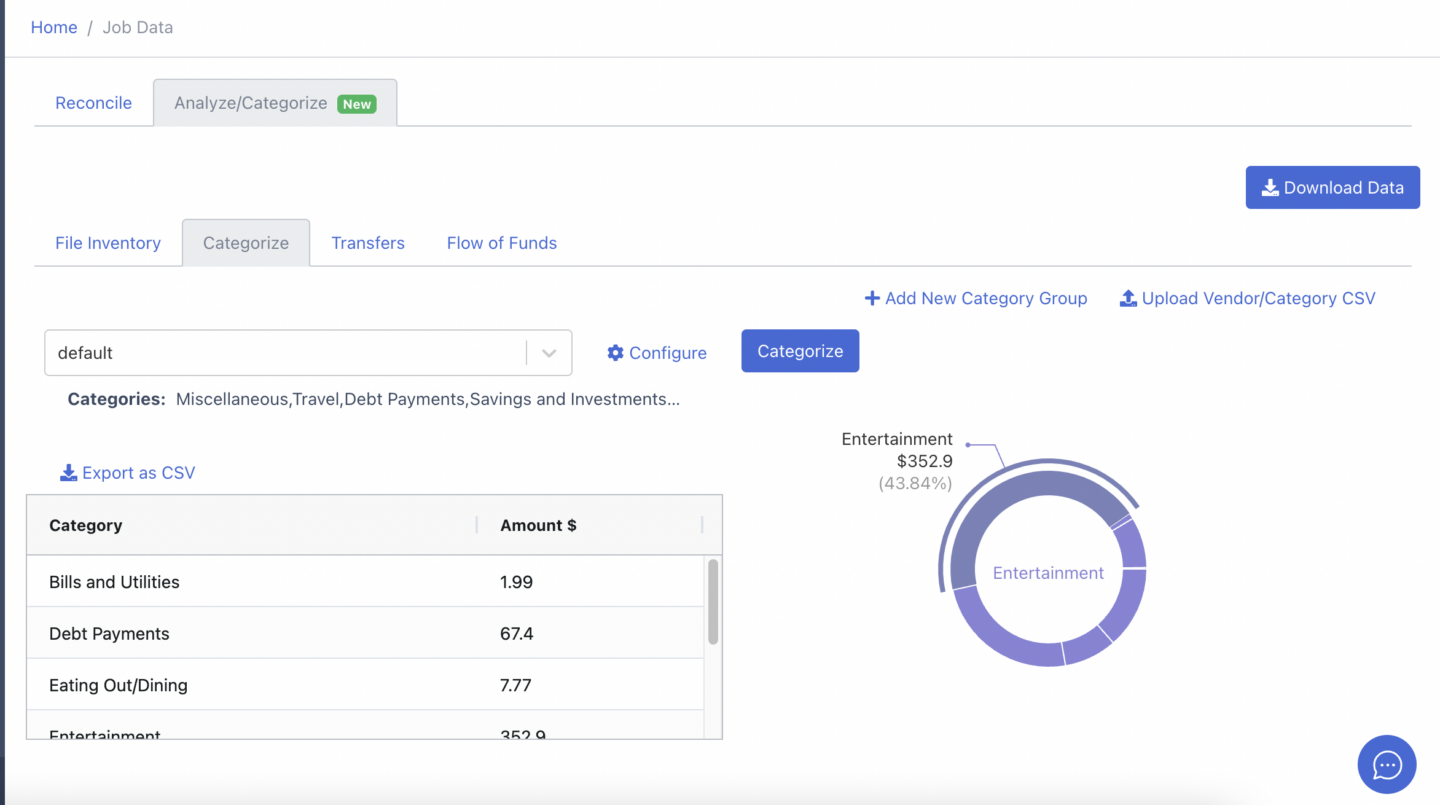

Some accounting software, such as Quickbooks, can be complex for everyday users and small businesses. Alternatives like DocuClipper provide a simpler solution.

DocuClipper specializes in transaction categorization from PDF bank statements, ideal for small businesses or sole proprietors who need to track expenses and prepare for taxes without the complexity of full-fledged accounting software.

Or for more basic needs, you can use Excel to categorize your bank transactions.

We have a transaction categorization and expense spreadsheet here that you can download.

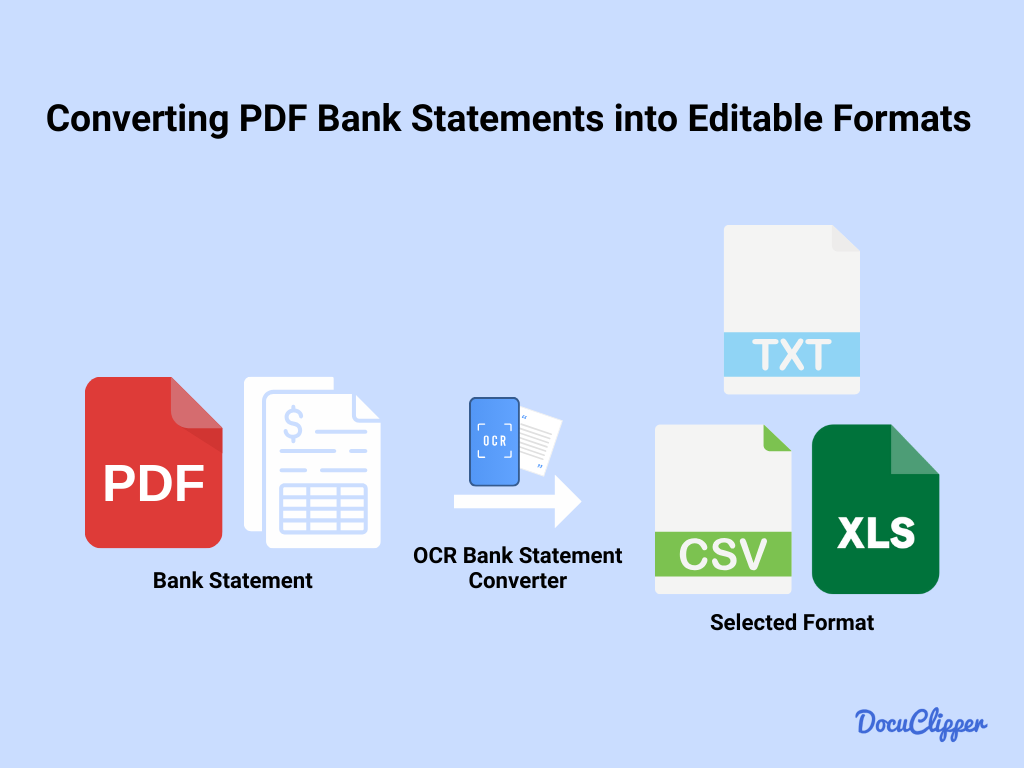

3. Convert PDF Bank Statements

Extracting bank statements from PDF to a format compatible with your accounting software simplifies data entry. This process involves extracting transaction data from PDFs and importing it directly into your bookkeeping system.

Tools like DocuClipper convert bank statements into formatted bank extract data in the form of XLSX, CSV, and QBO. These are easily imported into numerous accounting software like Sage, Xero, and Quickbooks.

With DocuClipper you can convert PDF to QBO or PDF to CSV for Xero accurately and in seconds, greatly eliminating manual data entry and errors.

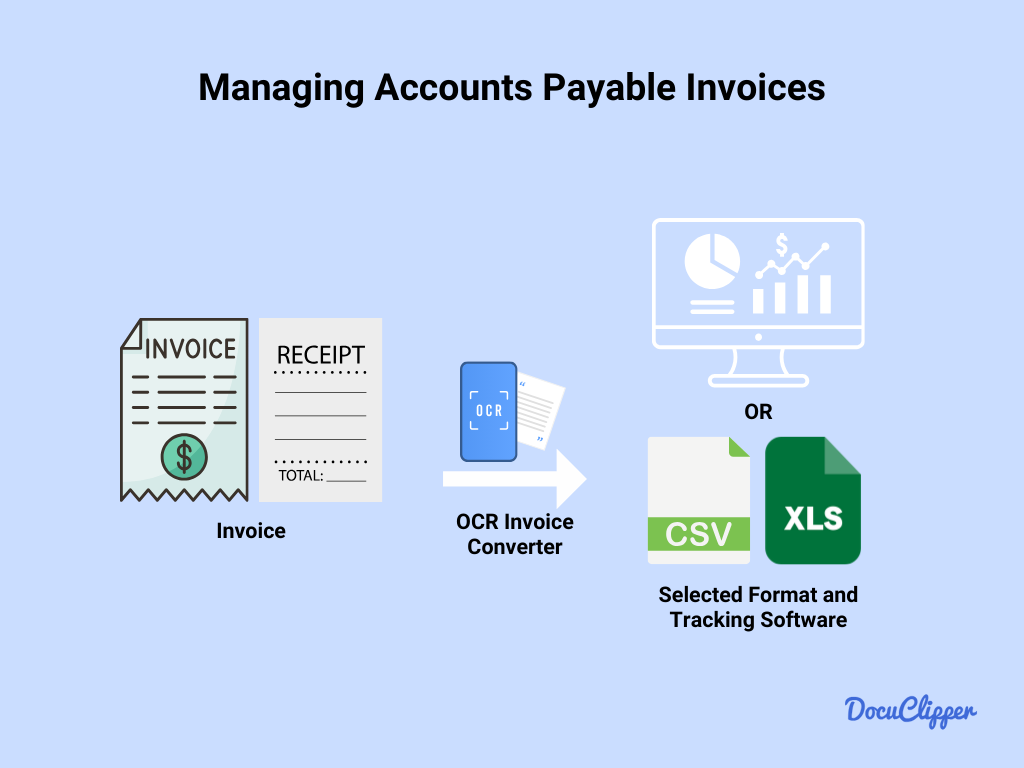

4. Managing Accounts Payable Invoices

Accounts payables are often overlooked and can sometimes cost businesses penalties because dues affect trust from partners, clients, and suppliers.

Automating your accounts payable can be highly efficient, especially when dealing with large volumes of invoices and complex numerical data. OCR invoice converters scan invoices and upload them immediately in a dashboard to put things on track.

Use software that quickly processes, tracks, and pays invoices. This type of software often includes features like displaying results and sending reminders about due dates and deadlines.

5. Filling Receipts & Business Expenses

Managing receipts and expenses can be overwhelming for employees. Using software that accurately tracks and compiles them saves time and reduces manual errors.

Digital tools that scan, file, and organize receipts and categorize business expenses as well as keep track of business expenses are helpful.

They usually integrate with accounting software, enabling automatic tracking and categorization of expenses. This integration is crucial for precise budgeting and financial reporting. (Learn more about important business expense categories.)

6. Payroll Automation

Payroll automation software simplifies the process of calculating employee wages, withholding taxes, and distributing paychecks. These systems are designed to track work hours, manage employee benefits, and ensure compliance with tax regulations.

Automated payroll not only saves time but also reduces the likelihood of errors in salary calculations and tax withholdings, ensuring a smooth payroll process.

7. Payment Processing & Integration

Integrating your payment processing system with accounting software automates the reconciliation of sales and revenue data. This integration ensures that financial records accurately reflect customer payments, simplifying cash flow management.

It’s particularly beneficial for businesses with a high volume of transactions, as it provides an efficient and error-free method of tracking sales and customer payments.

8. Business Bank Accounts & Integration

Linking business bank accounts with accounting software automates the flow of financial data. This integration eliminates the need for manual data entry and provides a comprehensive overview of the business’s financial status.

It’s especially useful for small to medium-sized businesses looking to streamline their financial operations and maintain accurate records with minimal effort.

9. Financial Statements Generation

Automated accounting software can generate essential financial statements like profit and loss, balance sheets, and cash flow statements. Manually typing and filling each can cost a lot of time and require many people.

Using tools that easily fill up information helps. This feature not only saves significant time but also offers critical insights into the financial health of a business, aiding in strategic decision-making.

10. Tax Record Management

Organizing tax documents and information through automation simplifies the tax filing process. This includes tracking expenses eligible for deductions, managing essential tax documents, and ensuring compliance with tax laws.

Automated tax record management reduces the complexity and stress associated with tax preparation, making it easier for businesses to meet their tax obligations accurately and on time.

Conclusion

Automated bookkeeping is revolutionizing the way businesses handle their finances. By using technology, businesses can streamline their bookkeeping processes, reduce errors, and focus more on analysis and strategic decision-making.

Automation in bookkeeping saves time and offers deeper insights into financial health, enabling better business decisions.

As the role of traditional bookkeeping evolves, embracing automation becomes essential for efficiency and competitiveness in the modern business landscape.

Of course, if you don’t want to use accounting software then Excel can also help you to automate some of your accounting tasks.

For example you can categorize expenses in Excel, create dashboards to track cash flow, or simply prepare your financials for tax filing.

How DocuClipper Can Help

DocuClipper specifically aids in simplifying the bookkeeping process for those who might find comprehensive accounting software overwhelming.

It’s particularly effective in extracting and categorizing transactions from PDF bank statements. This feature is great for small businesses or individuals who need a straightforward method for tracking expenses and preparing taxes.

DocuClipper automates these often tedious tasks, ensuring accuracy, saving time, and allowing users to focus on the more crucial aspects of their business. It’s an excellent tool for those seeking to streamline their financial management without the complexities of full-scale accounting software.

FAQs about Automated Bookkeeping

As automated bookkeeping reshapes the financial world, these FAQs explore its impact and the role of AI in this evolving field.

Is there a way to automate bookkeeping?

Yes, bookkeeping can be automated using various software solutions. These tools can handle tasks like transaction categorization, invoice processing, payroll, and generating financial reports, significantly reducing manual effort.

Is bookkeeping going to be automated?

Automation is increasingly becoming a standard part of bookkeeping. While not all aspects can be automated, many routine tasks are now handled by software, leading to more efficient and accurate bookkeeping practices.

Can AI do bookkeeping?

AI (Artificial Intelligence) plays a significant role in modern bookkeeping. AI can categorize transactions, predict future trends, and even offer insights for financial decision-making. However, it still requires human oversight for complex decision-making and strategic planning.

Will AI replace bookkeepers?

AI is unlikely to completely replace bookkeepers. While it can handle many routine tasks, the expertise and judgment of human bookkeepers are crucial, especially for complex financial decisions and a nuanced understanding of a business’s finances.

Will AI eliminate bookkeeping?

AI won’t eliminate bookkeeping but will transform it. The role of bookkeepers will evolve, focusing more on analysis and decision-making rather than routine data entry tasks.

Why are bookkeepers declining?

The decline in traditional bookkeeping roles is due to the rise of automation and AI technologies. These technologies make many traditional bookkeeping tasks faster and more efficient, shifting the bookkeeper’s role from data entry to more analytical and advisory functions.