CFOs are navigating an increasingly complex business landscape shaped by economic uncertainty, technological disruption, and evolving responsibilities.

Their role is no longer limited to financial oversight—they’re now strategic leaders driving digital transformation, managing risk, and guiding sustainability efforts. From changing succession patterns and recession forecasts to AI adoption and data confidence, this report breaks down the trends reshaping the office of the CFO.

Whether you’re a finance leader or work closely with one, these insights highlight the critical shifts happening across industries and how today’s CFOs are preparing for tomorrow.

Top 10 CFO Statistics for 2025

- CFO turnover hit 15.1% globally in 2024, with average tenure dropping to 5.8 years, the lowest in six years.

- 54% of outgoing CFOs retired or moved to board roles, signaling a widespread leadership transition.

- 75% of CFOs are pessimistic about the economy, and 60% expect a recession in the second half of 2025.

- 66% of CFOs plan to redirect capital toward new business investments, despite conservative earnings forecasts.

- 40% of CFOs report a growing risk appetite, up from 29% in the previous quarter.

- 73% of CFOs say technology like AI and blockchain will redefine their roles, marking the rise of the CFO 2.0 era.

- 59% of CFOs use predictive analytics, with a 33% boost in forecast accuracy.

- 68% of CFOs are leading sustainability strategies, yet over half of industrial and tech CFOs resist ESG responsibilities.

- Only 2% of CFOs fully trust their organization’s cash flow visibility, revealing major gaps in data confidence.

- 28% of Fortune 500 CFOs are women, with 54% of newly appointed female CFOs promoted internally, highlighting diversity progress.

CFO Turnover, Tenure, and Succession Planning Statistics

- Global CFO turnover reached 15.1% in 2024, just below the 2023 record of 16.2%.

- S&P CFO turnover hit a six-year high, matching the previous peak from 2021.

- Average retirement age dropped to 56.6 years, the lowest in six years.

- 40% of new CFO appointments were experienced CFOs, the highest percentage in six years.

- 275 CFOs were appointed in 2024, with 70 of them being women — the highest in recent years.

- 54% of the women CFOs were promoted internally.

- Tech and financial services sectors led diversity, with 36% and 39% of incoming CFOs being women — double the rates from 2023.

Economic Outlook and Risk Management Statistics

- 60% of CFOs expect a recession in the second half of 2025.

- Of those expecting a recession, 50% anticipate it will be moderate, while 40% say it will be mild.

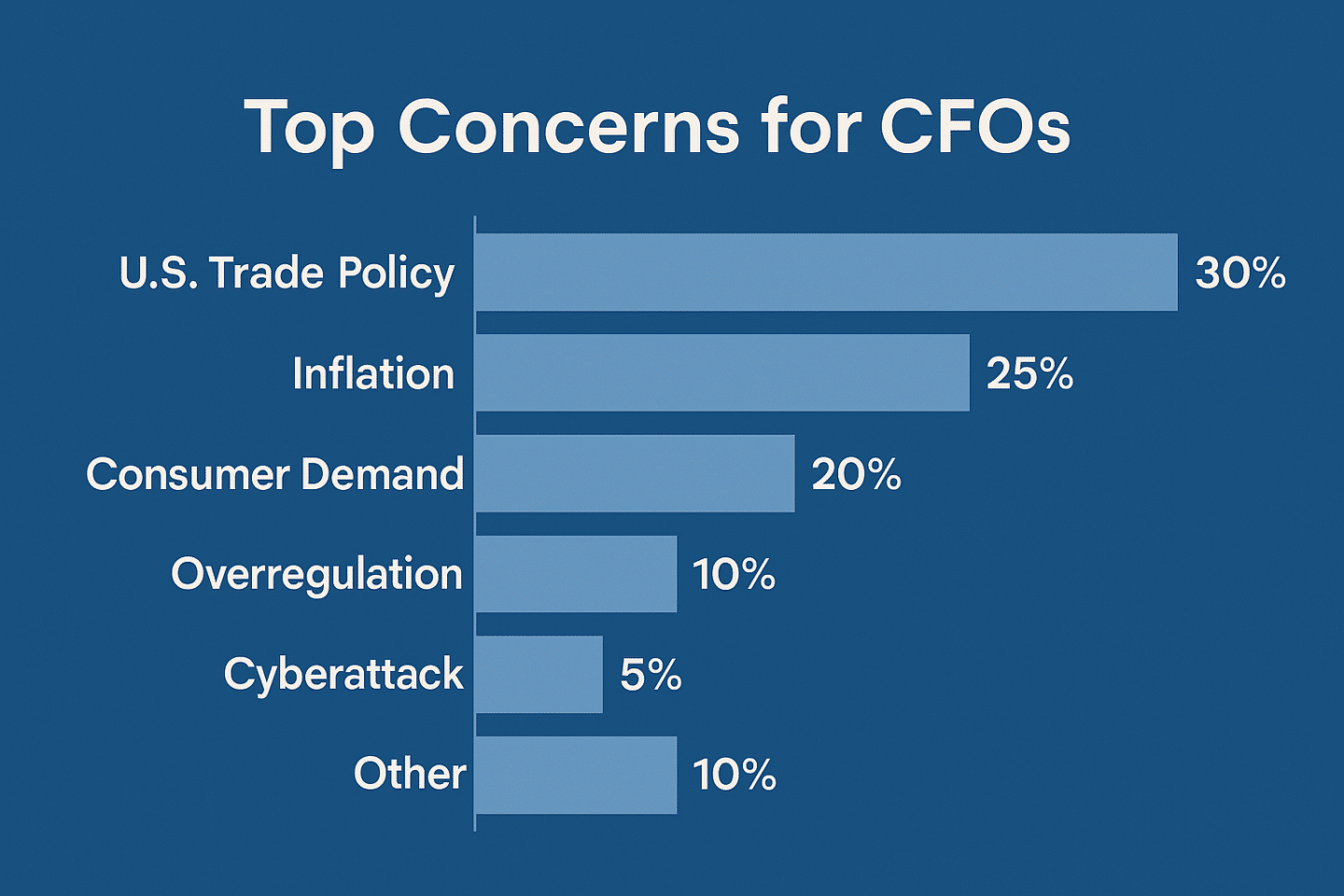

- U.S. trade policy is the top-ranked concern for CFOs (30%), followed by:

- Inflation (25%)

- Consumer demand (20%)

- Overregulation (10%)

- Cyberattack (5%)

- Other (10%)

- 40% of CFOs said they don’t know which sector will see the most growth in the next six months.

- Only 10% expect growth in technology and 10% in healthcare, while 20% chose energy.

- 55% of CFOs are uncertain about which tariffs will remain in place.

- 25% believe tariffs will not help the economy, while 20% believe they will help.

- 95% of CFOs say current policies from the Trump administration affect business decision-making.

- 15% of CFOs rate the Fed’s handling of inflation as excellent, 45% say good, 35% say fair, and 5% say poor.

- 66% believe the Fed won’t reach the 2% inflation target before 2027, and 25% are unsure if it will ever be reached.

CFO Strategic Priorities and Growth Expectations

- Revenue growth expectations dropped to 4.2% (from 6.2%) and earnings to 2.9% (from 6.4%), showing a more cautious outlook.

- Updated forecasts show revenue growth at 4.4%, earnings at 5.4%, capital investment at 5.7%, and domestic hiring at 2.3%.

- 58% of CFOs are focused on global market expansion, which has led to a 25% increase in global revenue streams.

- 52% of CFOs prioritize cost management, especially by reducing vendor and consulting costs.

- 78% of CFOs have implemented strategic cost reduction initiatives, with 58% reporting long-term efficiency gains.

Digital Transformation and Technology Adoption

- 55% of CFOs are integrating machine learning into financial systems, leading to a 30% efficiency increase.

- 79% of CFOs report a strong focus on digital transformation and automation to improve operations and insights.

- 72% of CFOs have accelerated cloud adoption, with 65% citing enhanced data security as a direct benefit.

- 80% of CFOs have increased cybersecurity investment, which led to a 50% reduction in cyber incidents.

- 63% of CFOs collaborate with CIOs to co-manage IT budgets, resulting in a 35% improvement in strategic technology spending.

- 62% of CFOs report a digital skills gap in their teams, and 40% are increasing budgets for tech training to close it.

ESG, Sustainability, and Compliance Reporting

- 62% of industrial CFOs, 57% in tech/communications, and 52% in consumer sectors believe ESG shouldn’t be their responsibility.

- ESG and compliance are now considered part of the CFO’s expanded role, with 55% reporting new ESG responsibilities in the past five years.

- 66% of CFOs are working to improve financial transparency, which has led to a 30% increase in investor confidence.

Talent Management and Workforce Trends

- 74% of CFOs expect rising talent and labor costs in the upcoming year.

- 43% of CFOs report frequent poaching attempts, with 21% in services and 49% in pharma approached at least monthly.

- 65% of CFOs have increased investment in employee well-being, linking it to higher productivity and financial performance.

- 75% of CFOs fund financial literacy programs, which have led to a 40% improvement in financial decision-making within teams.

- 62% of CFOs cite a digital skills gap in finance teams, and 40% are boosting training budgets to address it.

- Financial services CFOs are less reliant on CAOs (36%), while North American CFOs rely heavily on them (67%).

Data Confidence and Financial Accuracy

- Nearly 40% of CFOs do not completely trust their organization’s financial data.

- 64% say manual day-to-day tasks limit time for financial planning and analysis.

- 68% report that manual processes increase vulnerability to errors.

- 31% of CFOs cite fragmented data sources, while 27% blame spreadsheet dependency.

- 98% of finance leaders lack complete confidence in cash flow visibility for the second year in a row.

- CFOs are embracing cloud computing (80%), generative AI (78%), and emerging AI (76%) to improve accuracy.

CFO Compensation, Background, and Demographics

- The average CFO tenure dropped to 5.8 years in 2024.

- Female representation among newly appointed CFOs reached 70 out of 275 appointments.

- 54% of newly appointed women CFOs were internal promotions.

- In tech, 36% of new CFOs were women; in financial services, 39% — both double 2023 figures.

The Expanding Role of CFOs in the C-Suite

- 82% of CFOs report increased responsibilities over the past five years.

- Key areas of expansion include ESG (55%), M&A (44%), corporate strategy (38%), and risk management (36%).

- CFOs are more involved in cybersecurity (27%), IT (24%), procurement (23%), legal (22%), and supply chain (12%).

- 35% of CFOs now share co-leadership responsibilities with their CEOs.

- The most valuable team members are the head of FP&A (57%) and controller/CAO (49%).

- 67% of North American CFOs rely heavily on their CAOs.

Source

- Global CFO Turnover Index

- CFO News

- 50 CFO Interesting Facts & Statistics

- Blackline – Financial Release

- PWC Report