Santander allows you to download transactions as CSV, but only for 12 months. Beyond this window, you’re left with PDF statements, requiring you to enter each transaction manually.

This means you must manually enter the transactions into a spreadsheet or your accounting software, which can take hours or even days, potentially leading to multiple errors and requiring even more time to clean up.

Fortunately, a scalable solution makes it easier for you to apply to your accounting practice.

In this article, we’ll walk through the simple steps to convert Santander bank statements to Excel and explore how a bank statement converter can save time, enhance accuracy, and improve efficiency for your accounting needs.

Step 1: Upload Santander Bank Statement to DocuClipper

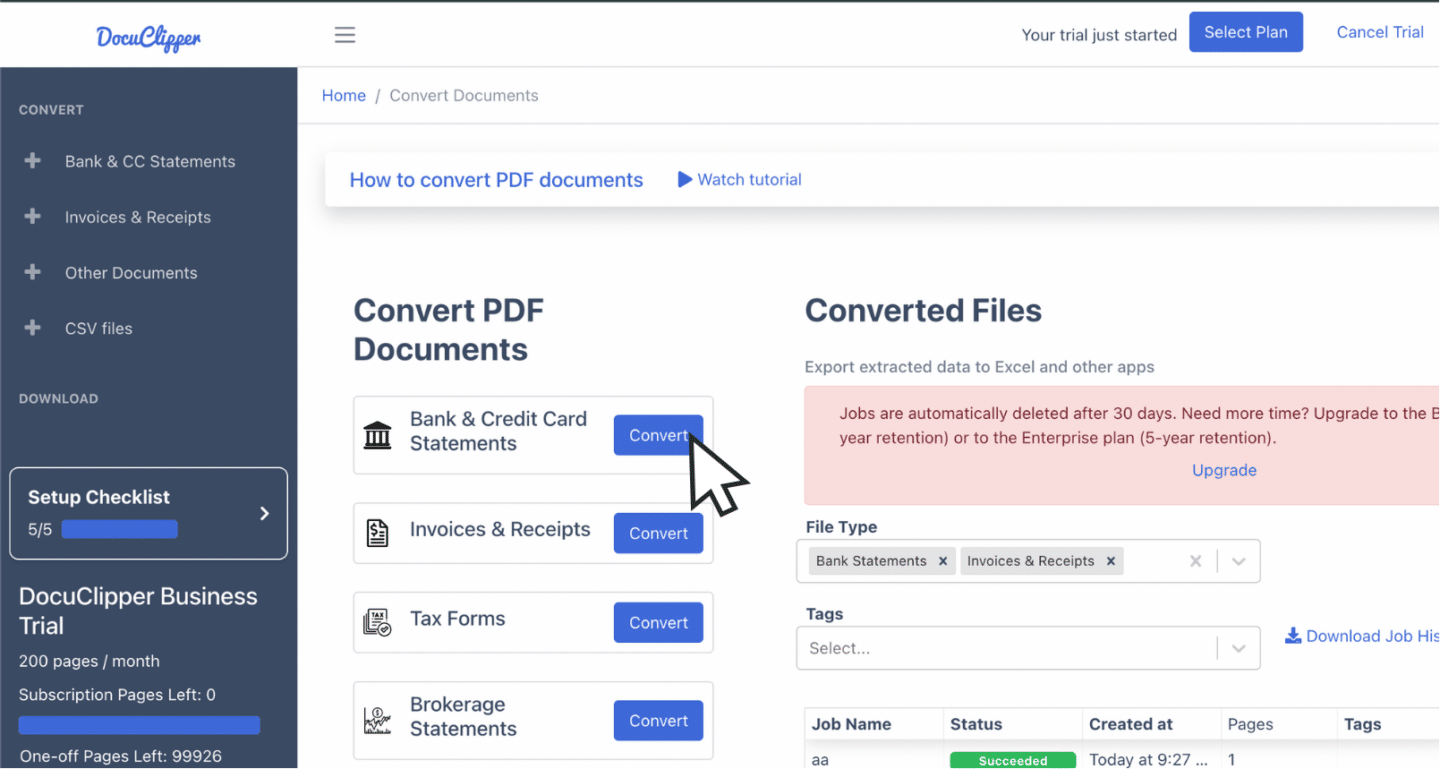

Log into your DocuClipper account—new users can try it with a free trial. Once inside, navigate to the “Convert” section specifically for bank and credit card statements.

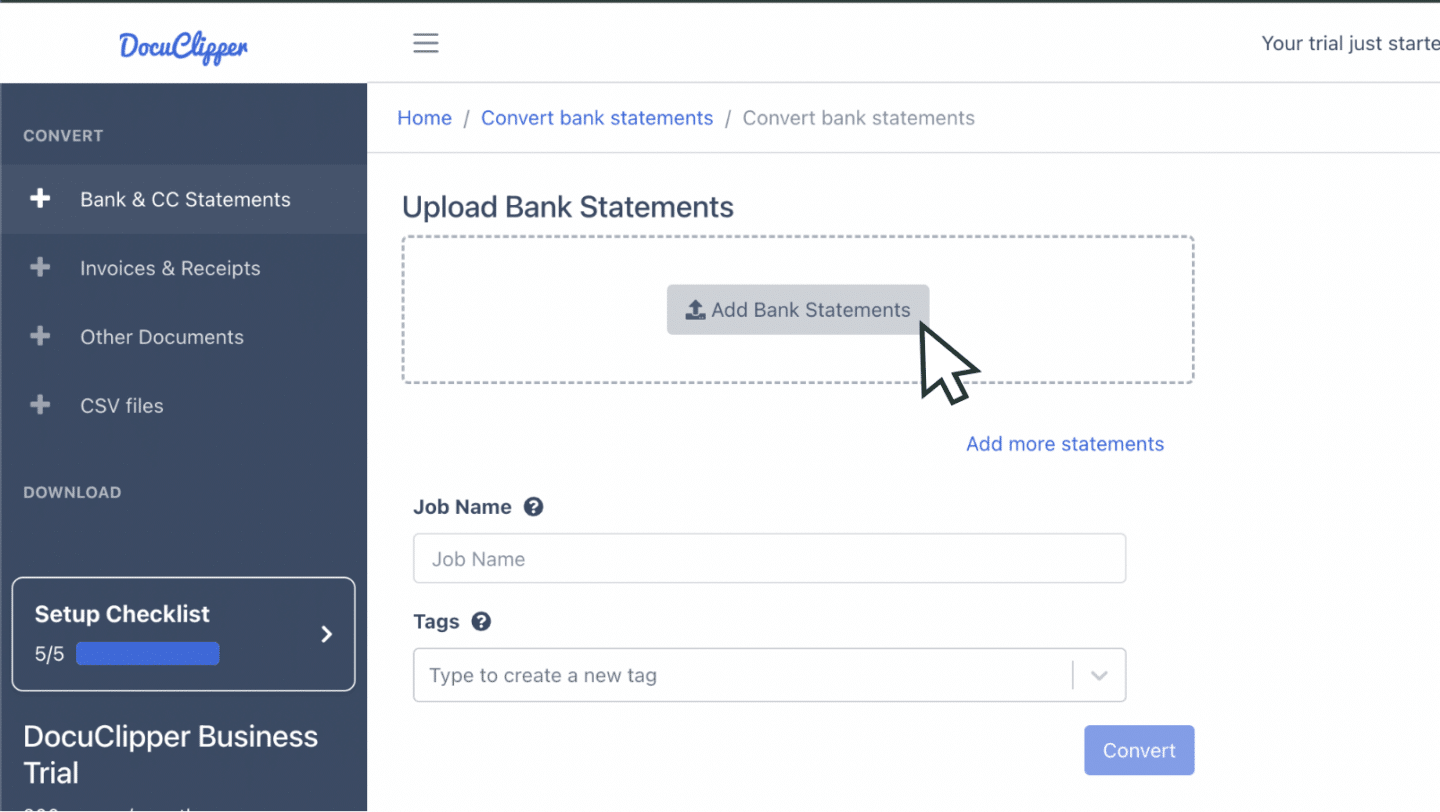

Here, you can easily upload your Santander Bank PDF statements by dragging and dropping them, with the flexibility to add multiple files simultaneously. To keep files organized, use tags or custom names.

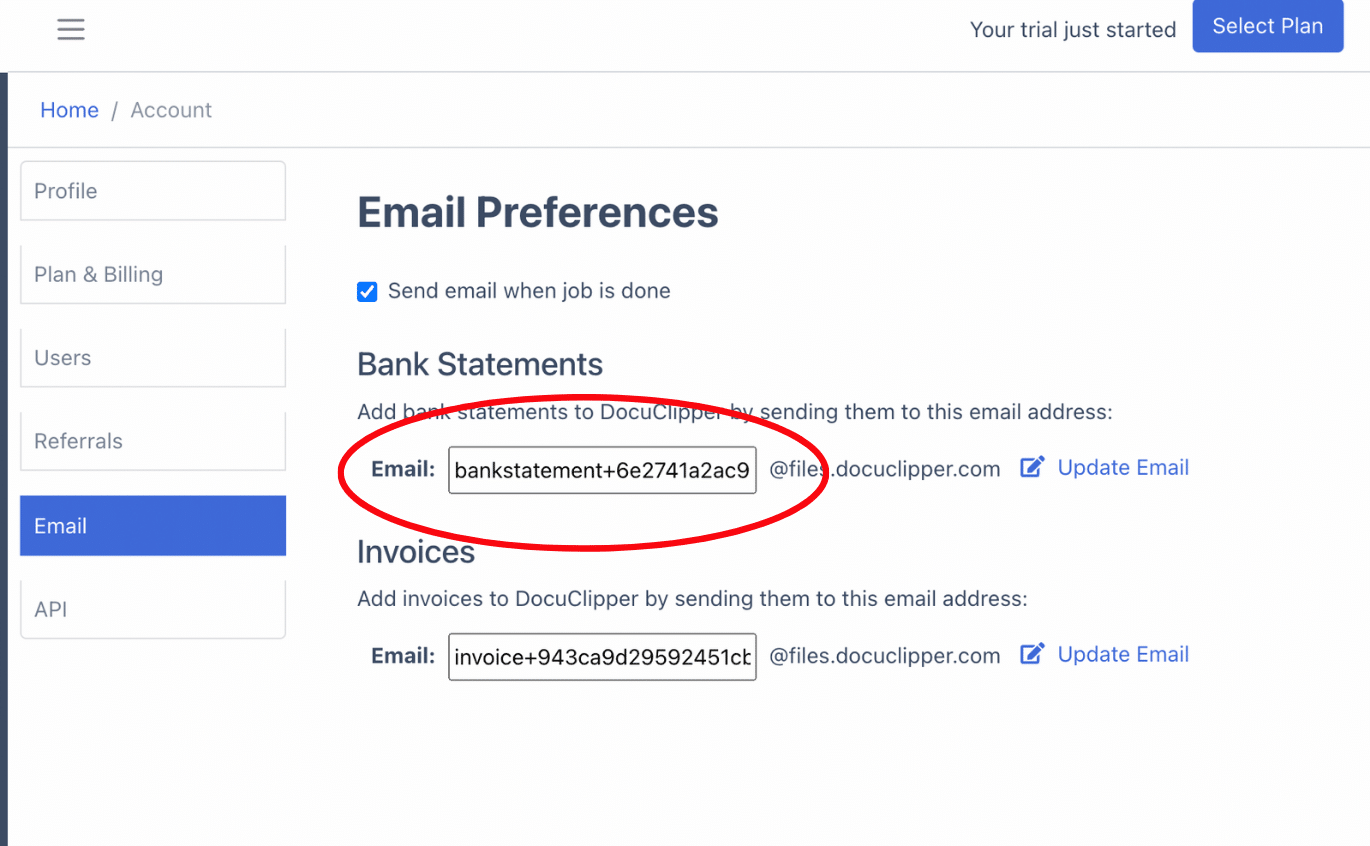

Another way is you can email your statements directly to a unique address in your account settings. Once uploaded, locate them in “Converted Files” on the left menu, ready to convert bank statements to Excel.

Step 2: Analyze Santander Bank Statement

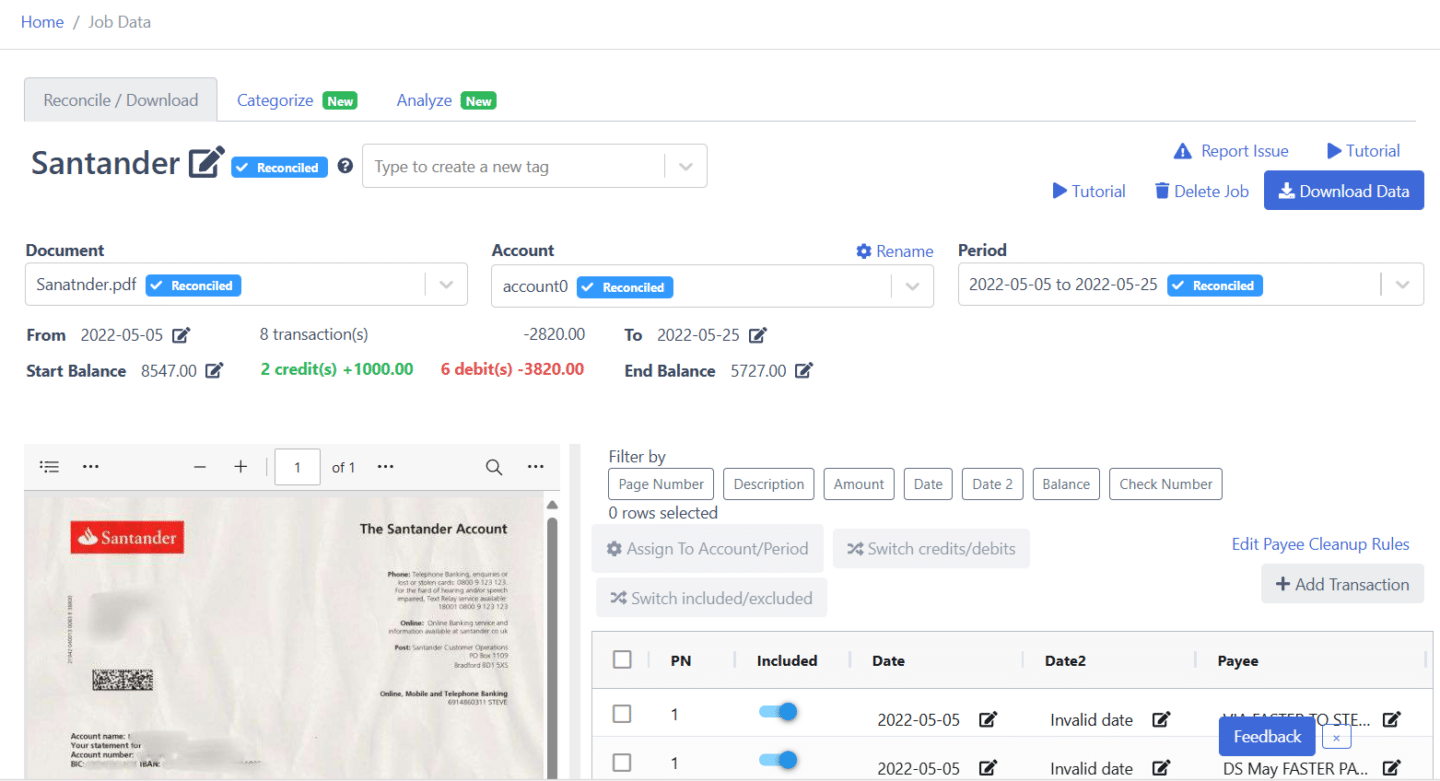

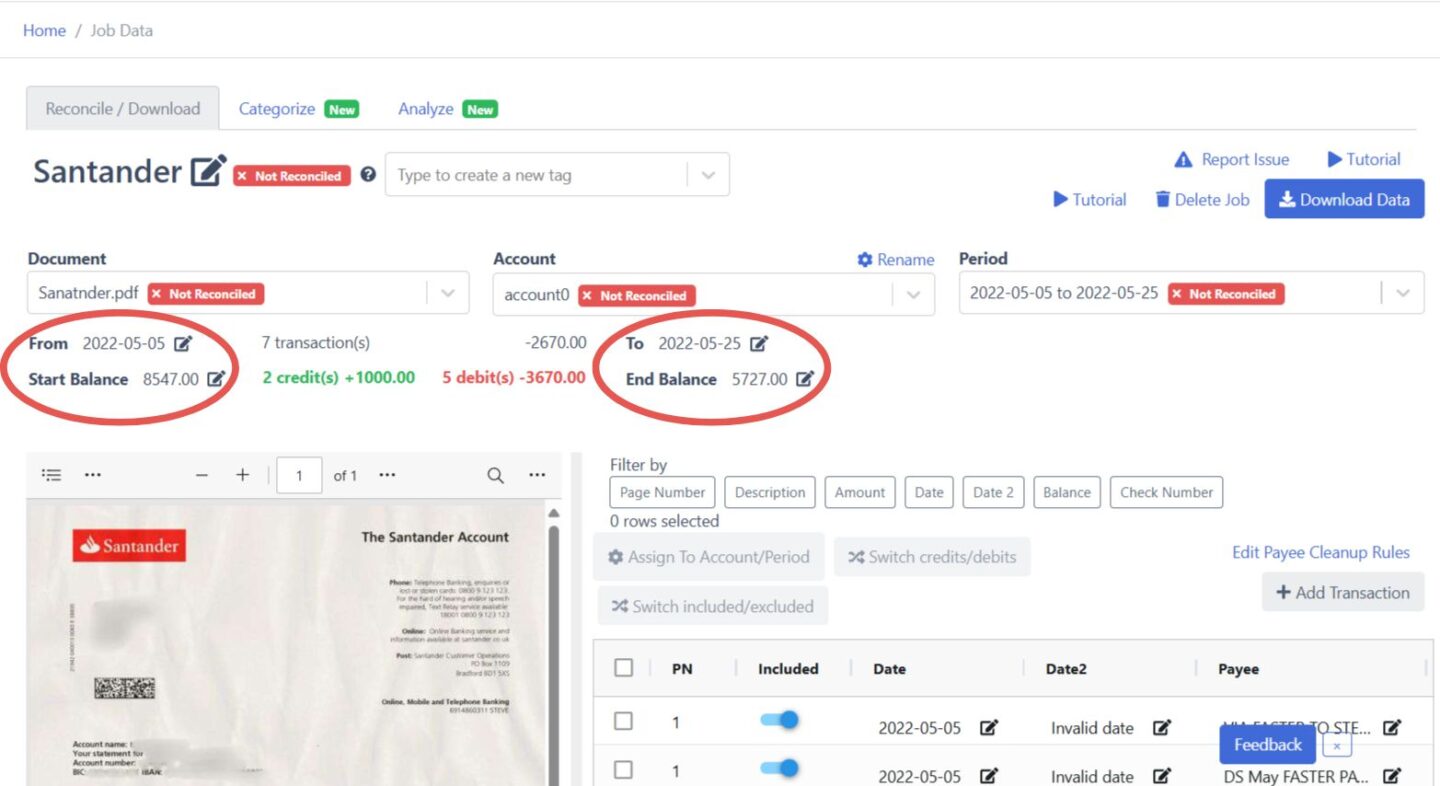

After uploading, DocuClipper presents a side-by-side view of your original statement alongside the extracted data in a spreadsheet format, with a dashboard for easy navigation.

This allows you to review each bank transaction and spot any discrepancies in amounts, dates, or totals that could stem from bank errors. For scanned paper statements, take extra time and attention to check for any scanning projection errors, as these can impact data accuracy.

Step 3: Reconcile Santander Bank Statements

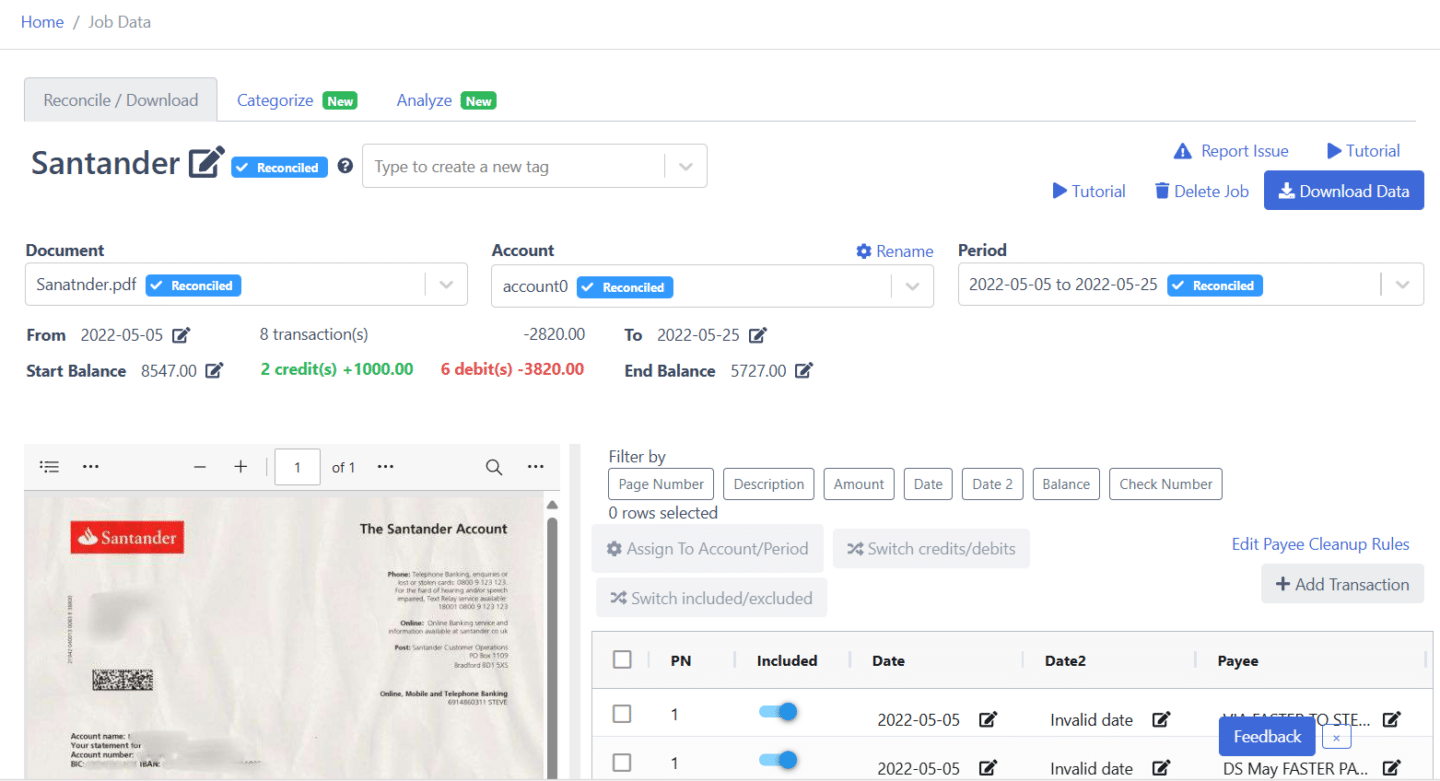

After reviewing the data, DocuClipper will automatically reconcile your bank statement. If any discrepancies are detected, the reconciliation of the bank statement will show an incomplete status.

To resolve this, adjust specific transaction details—such as amounts, dates, or descriptions—by clicking the arrow next to each relevant entry.

If additional transactions are needed, simply click “Add Transaction,” enter the details, and ensure all credits and debits are accurately categorized.

Once all adjustments are complete, your Santander Bank statement will be fully reconciled and ready for export.

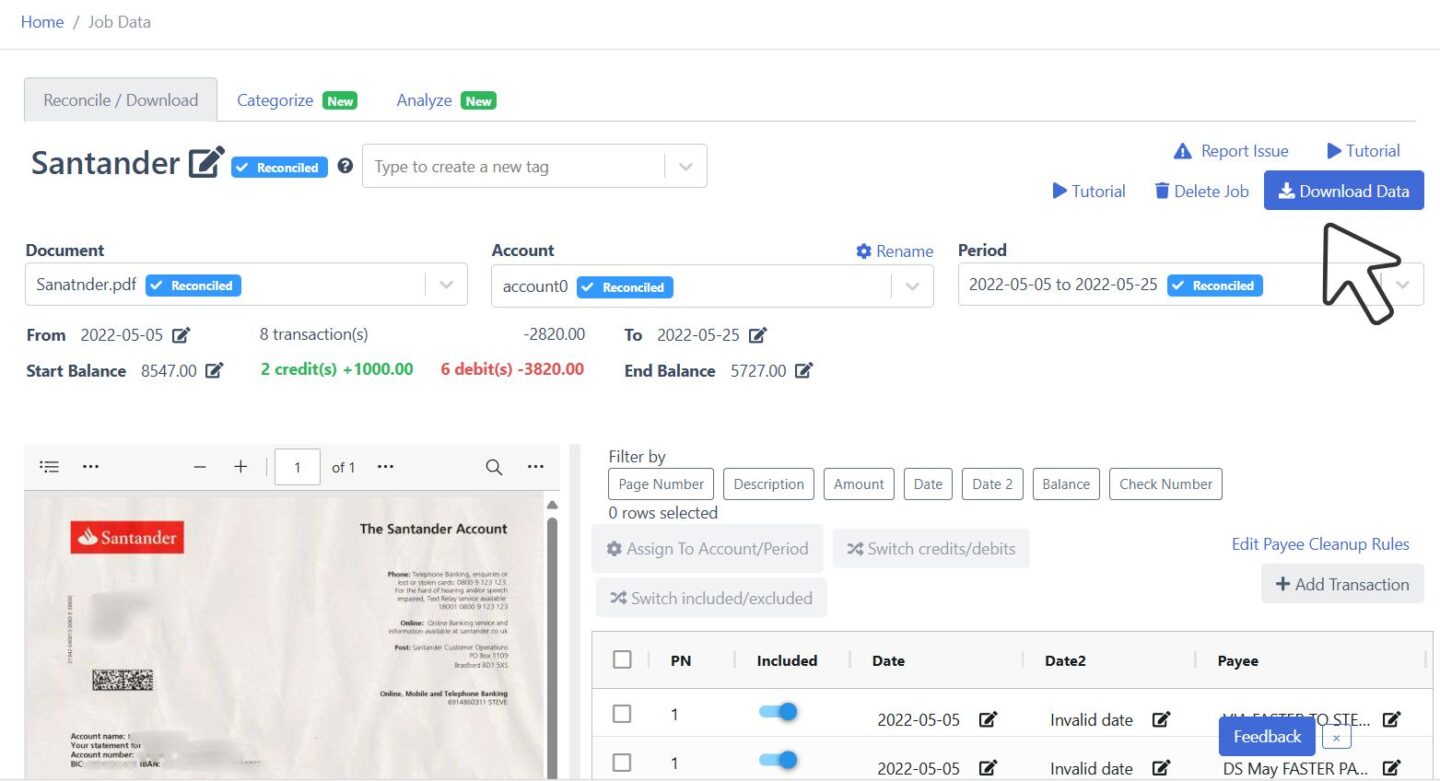

Step 4 Export Santander Bank Statement to Excel, CSV, QBO

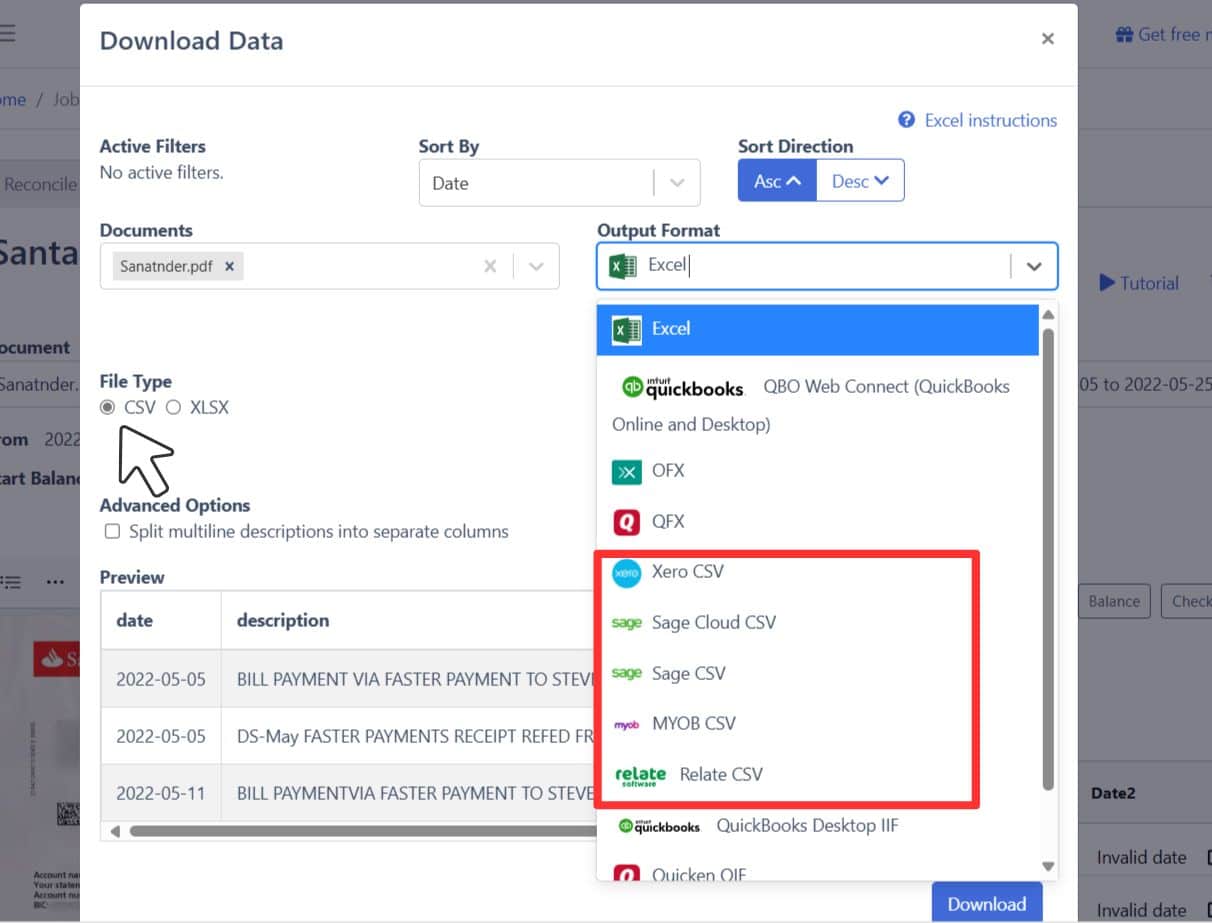

With your Santander Bank statement fully reconciled, you can export it to Excel, CSV, or QBO formats. Click “Download” to initiate the export and select your desired format.

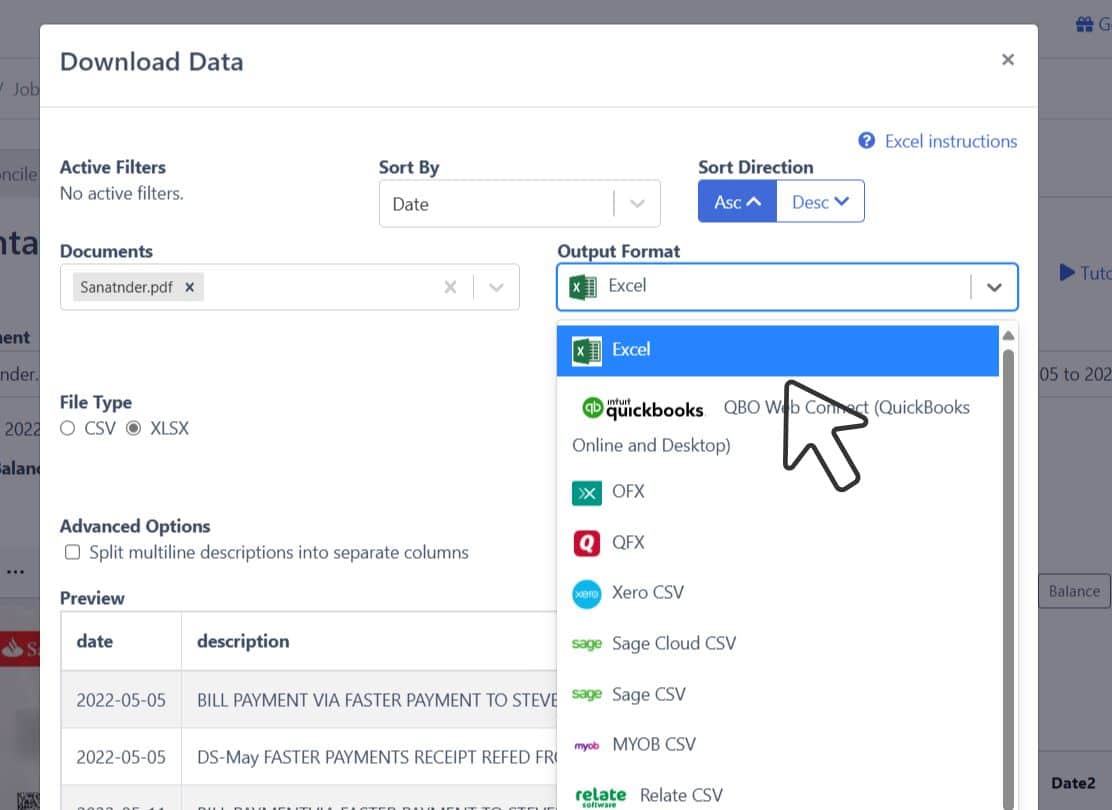

Export Santander Bank Statement to Excel

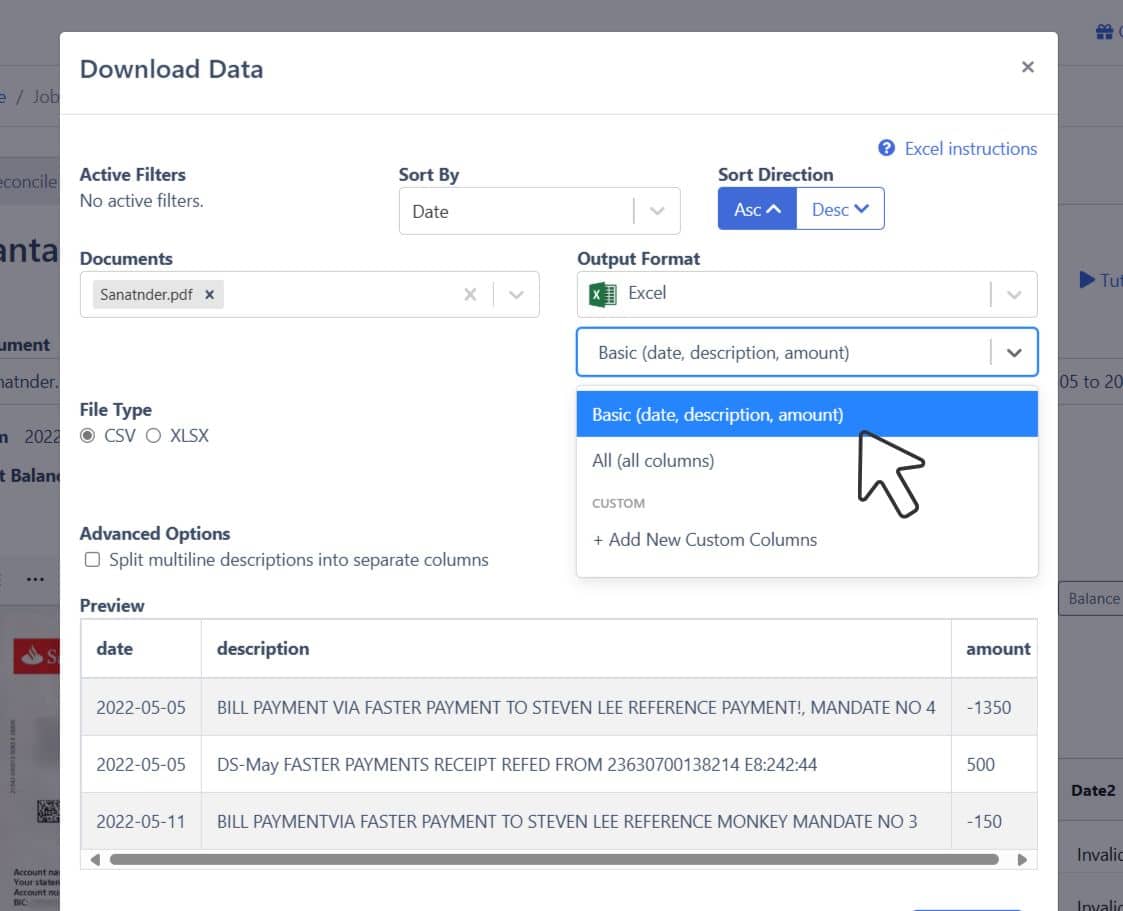

To export your Santander Bank statement as an Excel file, go to the export menu and select “Excel.” Choose the “XLSX” format to ensure compatibility with most spreadsheet programs.

Once selected, click “Download,” and the file will save to your Downloads folder, ready for seamless use in your accounting tasks.

Export Santander Bank Statement to CSV

You may need to export statements in CSV format to ensure compatibility with popular accounting platforms like Quicken, Xero, Sage, MYOB, Relate, and NetSuite.

To do this, open the export menu, select “Excel,” and then choose “CSV” from the dropdown options.

Additionally, DocuClipper provides ready-made formats optimized for specific software, making it even easier to integrate with your accounting tools.

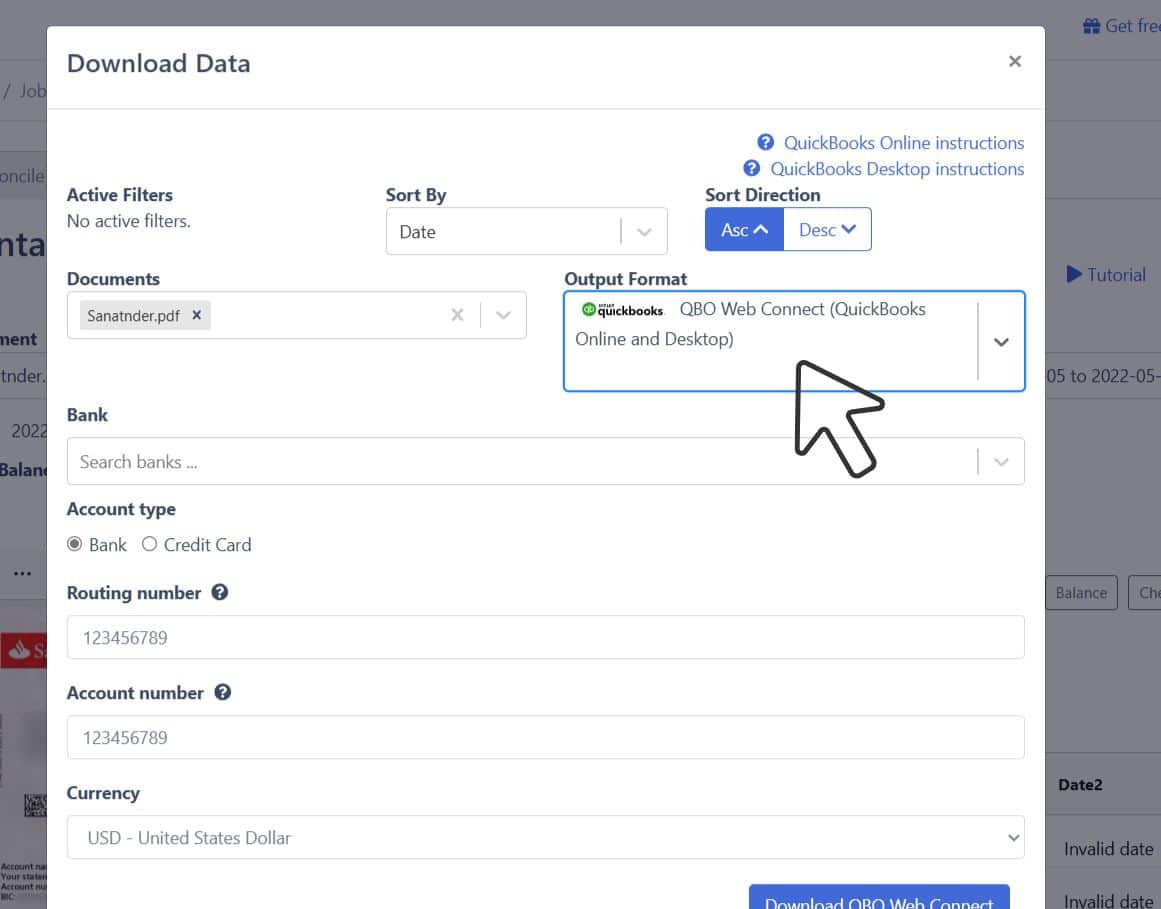

Export Santander Bank Statement to QBO

If you’re using QuickBooks, exporting your statement in QBO format allows for easy upload into the software.

To do this, open the export menu, choose the QBO option, and complete any required fields, such as bank account numbers, names, and classifications. Once configured, click “Download” to save the file, which is ready for a seamless import into QuickBooks for streamlined accounting.

Also, we have more guides on how to import bank statements into different software:

- Import bank statements into QuickBooks

- Import bank statements into Sage

- Import bank statements into Xero

- Import bank statements into NetSuite

Step 5: Configure the Output Format

Before downloading your data, review the spreadsheet’s output format to ensure it aligns with your requirements. You can adjust various settings, such as date formats or column order, to suit your preferences.

DocuClipper provides a default layout that you can modify by selecting “Customization,” allowing you to create a fully personalized setup tailored to your accounting needs.

How to Download Santander Bank Statements

Downloading your Santander Bank statements can typically be done through online banking (website) or the mobile app.

Via mobile application it can be done as follows:

- Open the App: Log in to the Santander mobile banking app.

- Find Statements: Go to the account you want, and look for an option like Statements & Documents.

- Choose the Period: Select the statement period or the specific month.

- Download or Share: Download the statement as a PDF or email it to yourself directly from the app.

Via online banking (website) it can be done as follows:

- Log In: Visit the Santander website for your region (e.g., Personal | Santander UK or Online Bank Account | Personal Banking | Santander Bank – Santander) and log in to your account.

- Access Statements: Navigate to the section labelled Statements or E-Statements. This is usually found in the “Accounts” or “Documents” menu.

- Select an Account: Choose the account for which you need the statement.

- Choose a Date Range: Select the period you want the statement for (e.g., last month, last 3 months, etc.).

- Download: Click on the download option, often labeled PDF Download or Save Statement. Save it securely to your device.

Final Advice

Most banks offer statements in limited formats, like bank feeds or CSV, leaving accountants frequently handling PDF files. As these PDFs pile up, managing and processing bank statements can become overwhelming.

DocuClipper simplify this task by converting PDFs into easily usable formats like Excel, CSV, or QBO, saving you time, minimizing errors, and increasing productivity.

Automating this conversion frees up time for more critical accounting tasks, leading to greater efficiency and reduced operational costs.

Why Use DocuClipper to Convert Santander Bank Statements

DocuClipper is a web-based tool that efficiently converts PDF bank statements into formats like XLS, CSV, and QBO.

Using advanced OCR technology, it accurately extracts data fields from bank statements, minimizing manual entry errors.

Seamless integration with popular accounting software such as QuickBooks, Sage, and Xero ensures smooth data transfer and management. Additionally, DocuClipper’s transaction categorization feature organizes transactions into groups, streamlining financial analysis.

Beyond bank statements, DocuClipper also processes credit card statements, brokerage statements, receipts, and invoices, making it a versatile solution for comprehensive financial document management.

FAQs about Santander Bank Statement to Excel

Here are some frequently asked questions about converting Santander Bank Statement to Excel.

Can I export my Santander bank statement to Excel?

Yes, using a tool like DocuClipper, you can convert your Santander Bank statement to Excel. Santander typically provides statements in PDF or CSV formats, and a converter transforms these into organized Excel files, making data management and analysis easier for your accounting tasks.

How do I download a Santander bank statement to a CSV file?

To download a Santander Bank statement as a CSV file, log in to your Santander online banking account, navigate to the account transactions section, and select the option to export or download your statement in CSV format. Make sure to choose the desired date range before exporting.

How do I export a Santander bank statement to Excel?

To export a Santander Bank statement to Excel, download the statement as a PDF from Santander Online Banking. Then, use a tool like DocuClipper to convert the PDF to an Excel format, enabling easy data management and organization for accounting tasks.

Learn More

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert Citizens Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert Citibank Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert Chime Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

Or use these resources to learn more about accounting: