Checking your bank statements is key to understanding your financial health. They provide precise and current records, giving you a clear picture of your money situation.

However, going through bank statements can be tough without the right techniques, tools, and paperwork.

This blog is here to simplify the process of managing your bank statements. We’ll guide you on how to make it easier and manageable, right from the comfort of your home, so you can better handle your finances.

What is Bank Statement Processing?

Bank statement processing involves organizing, extracting, and managing financial details to help preserve, monitor, and use your money more effectively.

This process is widely used in various financial areas, including accounting, lending, tax preparation, auditing, and many others.

To save time and reduce the hassle, many modern financial institutions and businesses now use Optical Character Recognition (OCR) to automate this often time-consuming and tedious task.

Benefits of Automated Bank Statement Processing

Optical Character Recognition (OCR) is a key technology in automating the process of bank statement processing. It extracts information from diverse bank statement formats efficiently.

Many businesses and organizations are adopting automated bank statement processing using OCR software, benefiting from its numerous advantages.

- Scale Operations: As businesses grow, they often have to handle more information across numerous bank statements. Automating this process can significantly simplify the workload for their accounting teams.

- Save Time & Money: Automating bank statement processing saves time in handling each statement and reduces costs associated with personnel needed. Using OCR technology can cut down time spent on physical paperwork by 75%, as per Levvel LLC.

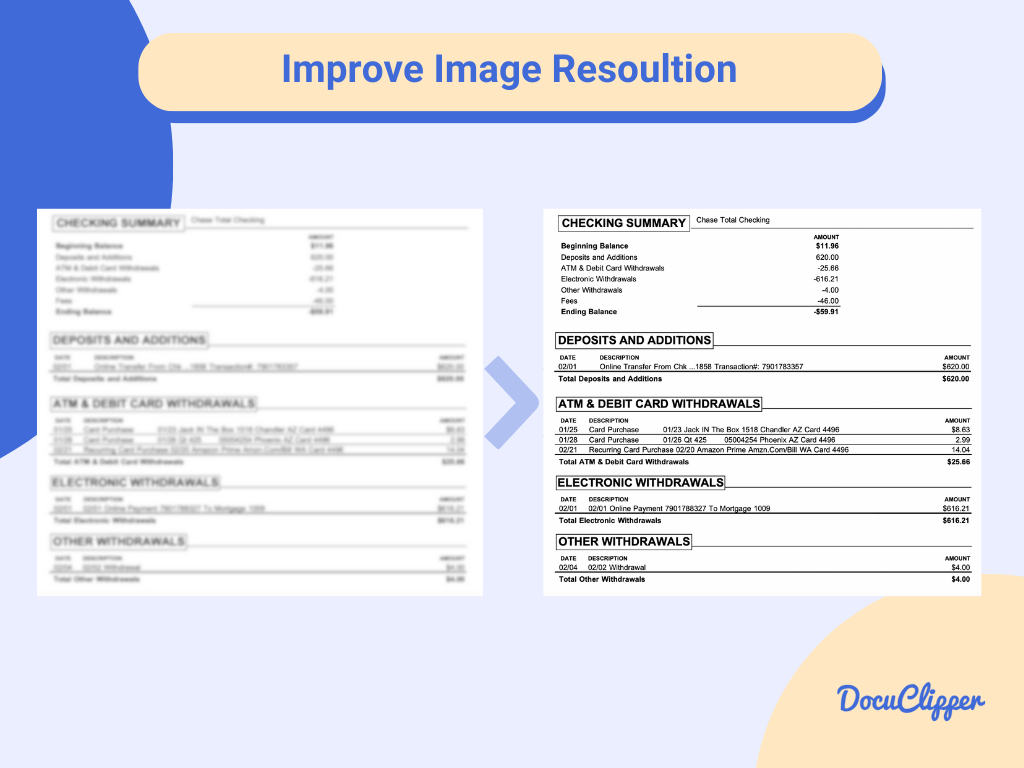

- Improve Accuracy & Data Quality: Most OCR bank statement converters and processing software boast an impressive 99.5% accuracy rate in data extraction. OCR accuracy varies on the format and software being used. A good bank statement analyzer can achieve similar accuracy rates. OCR accuracy varies on the format and software being used.

- Prevents Fraudulent Transactions: Automating the processing of bank statements can also enhance the detection of fraudulent transactions in fake bank statements, making it easier to spot any irregularities.

How to Process Bank Statements Automatically

Processing bank statements automatically requires OCR bank statement converters. These converters can go beyond extracting data but do reconciliation and categorization.

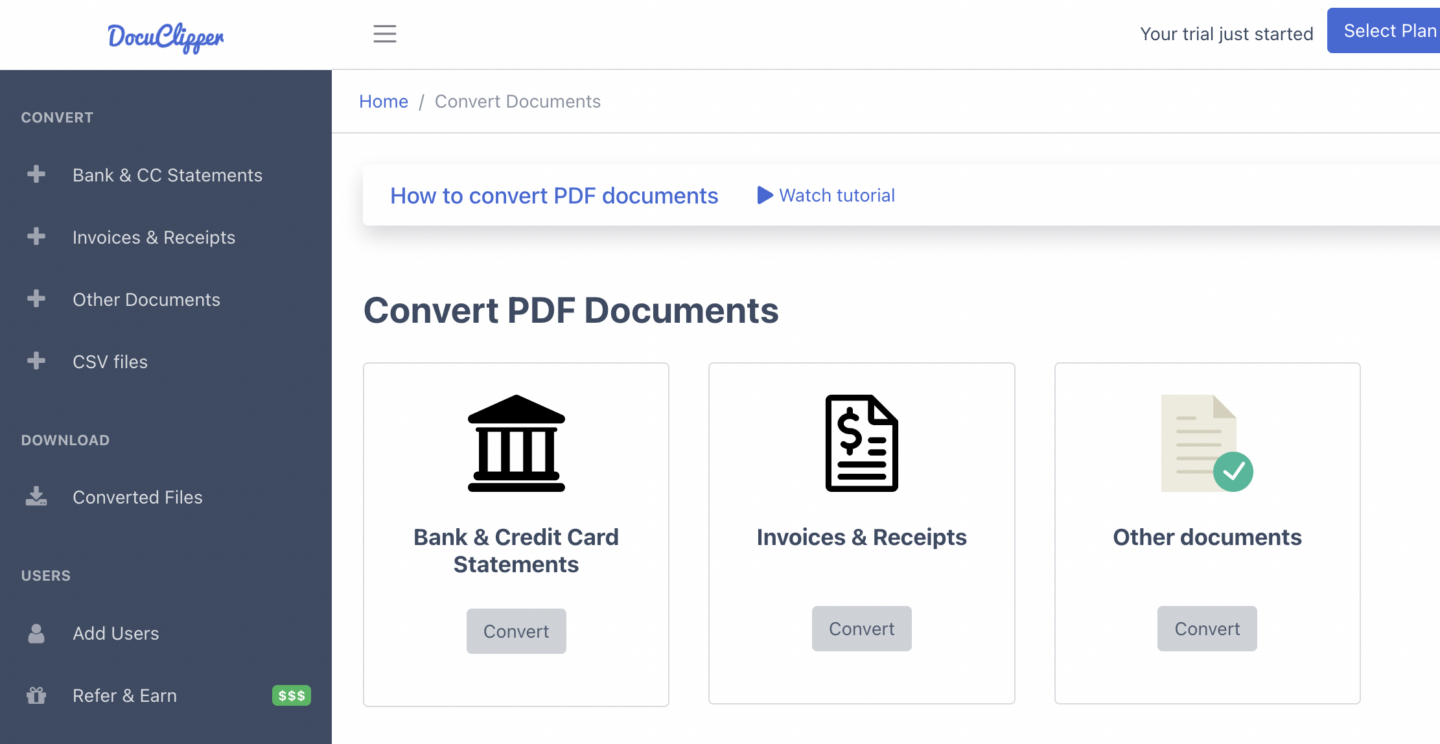

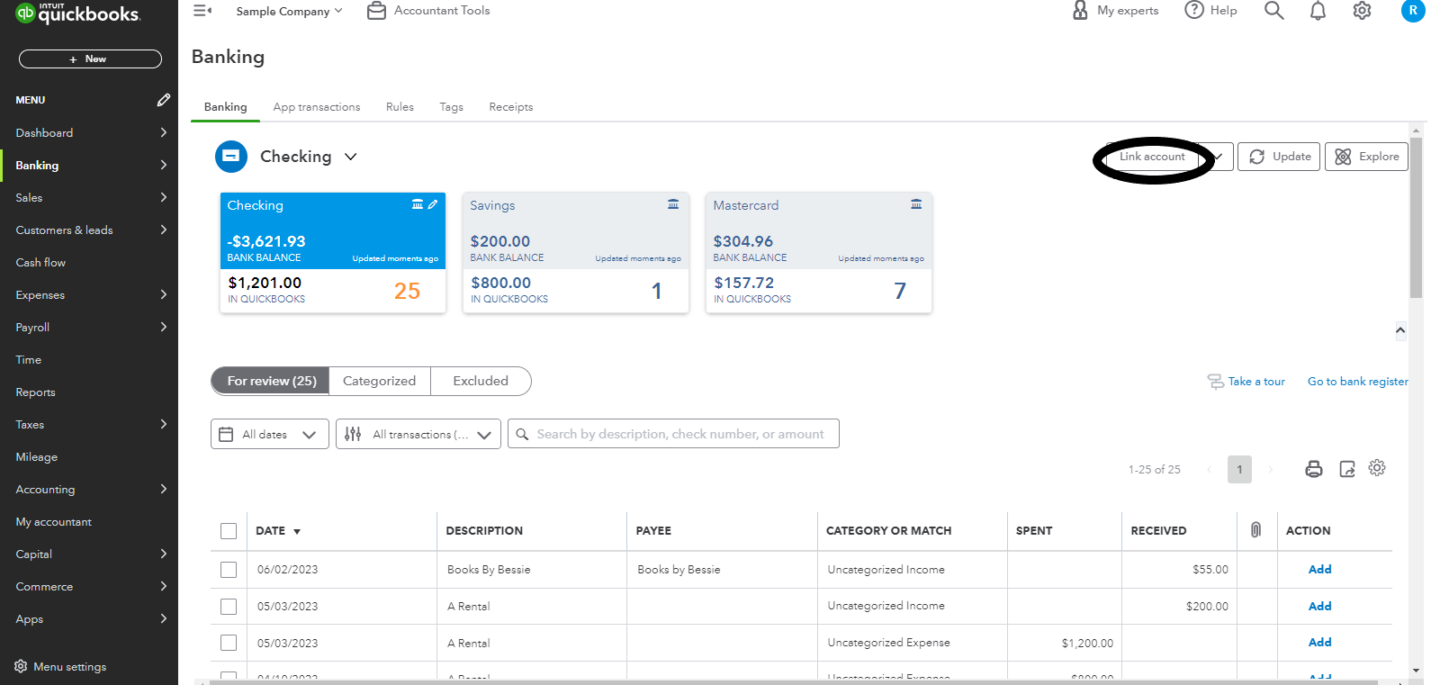

One of the most accurate convert bank statements is through DocuClipper with its features that use a cloud-based system that can easily be integrated with accounting software like Xero, Sage, and Quickbooks.

Here are some ways to process your bank statements in a snap with DocuClipper.

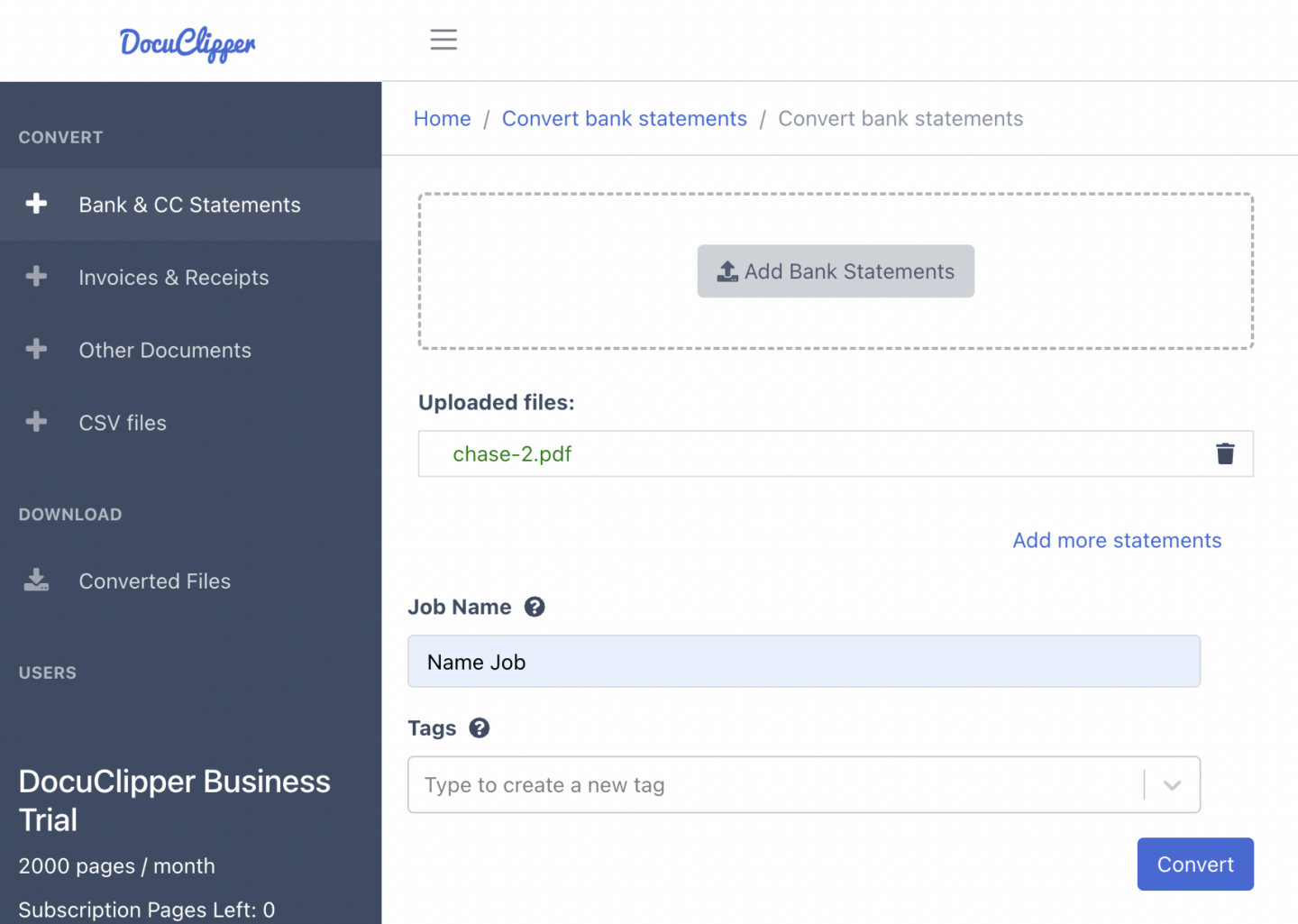

Upload Documents

Begin the process by choosing the bank statements you want to work with. Upload them to the platform, setting the stage for efficient processing.

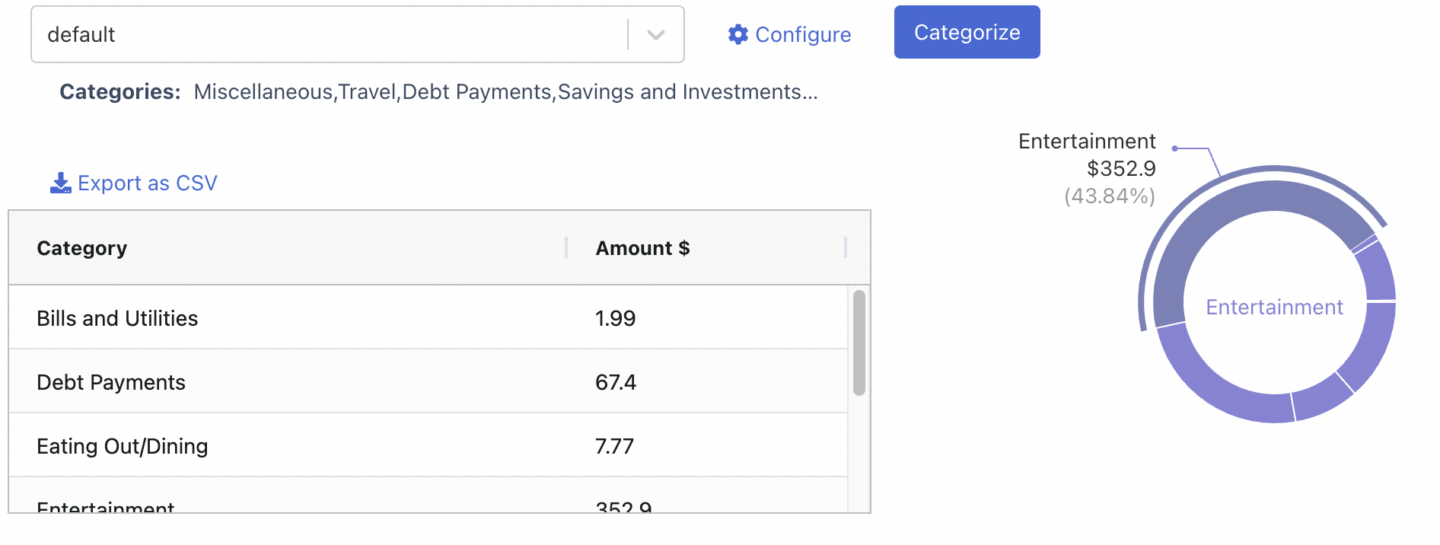

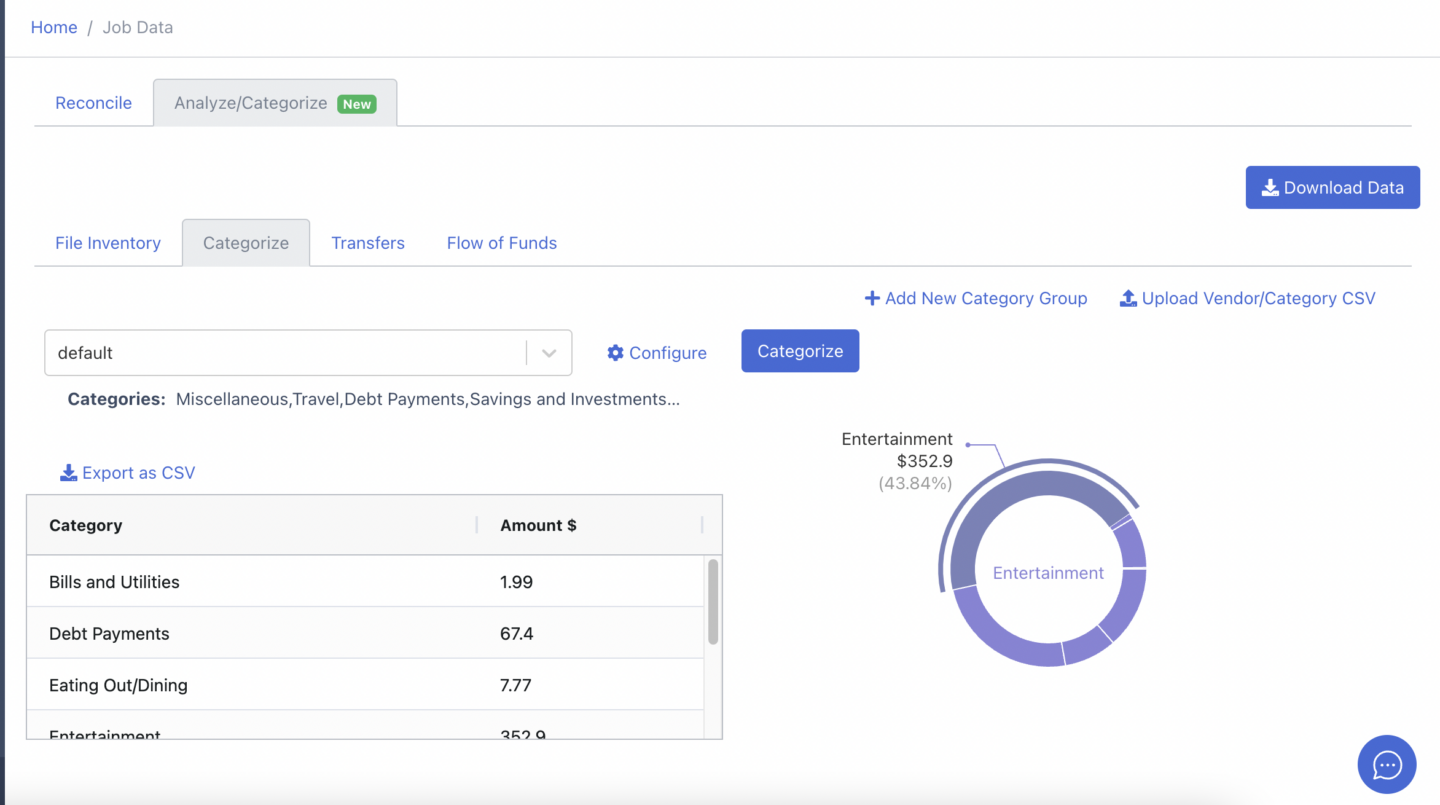

Categorize Transaction

Utilize DocuClipper for precise transaction tracing and categorization. You have the flexibility to select specific fields for a customized approach or employ the default feature for quick categorization.

Carefully review each transaction, adjusting keywords to ensure each transaction is accurately matched and categorized.

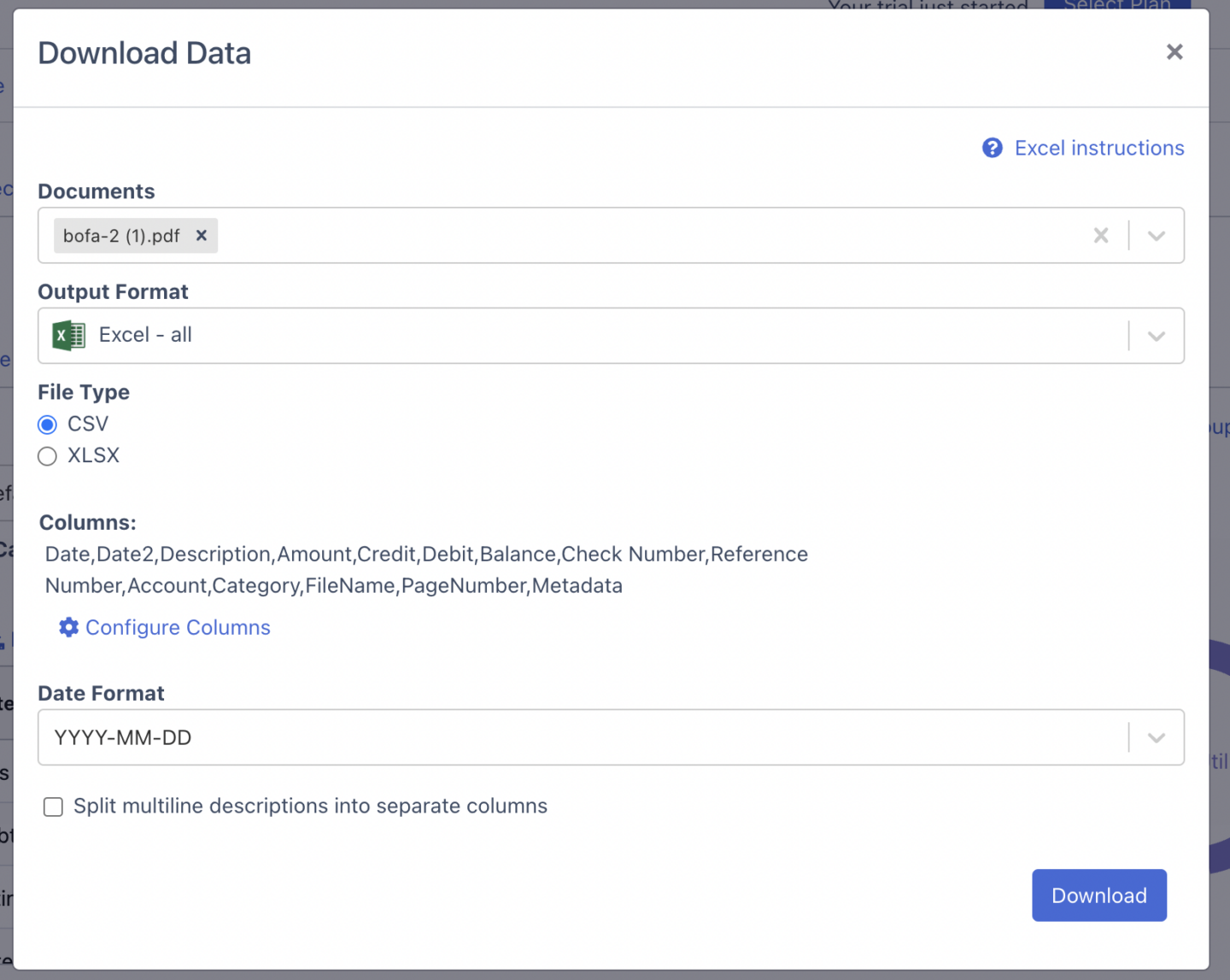

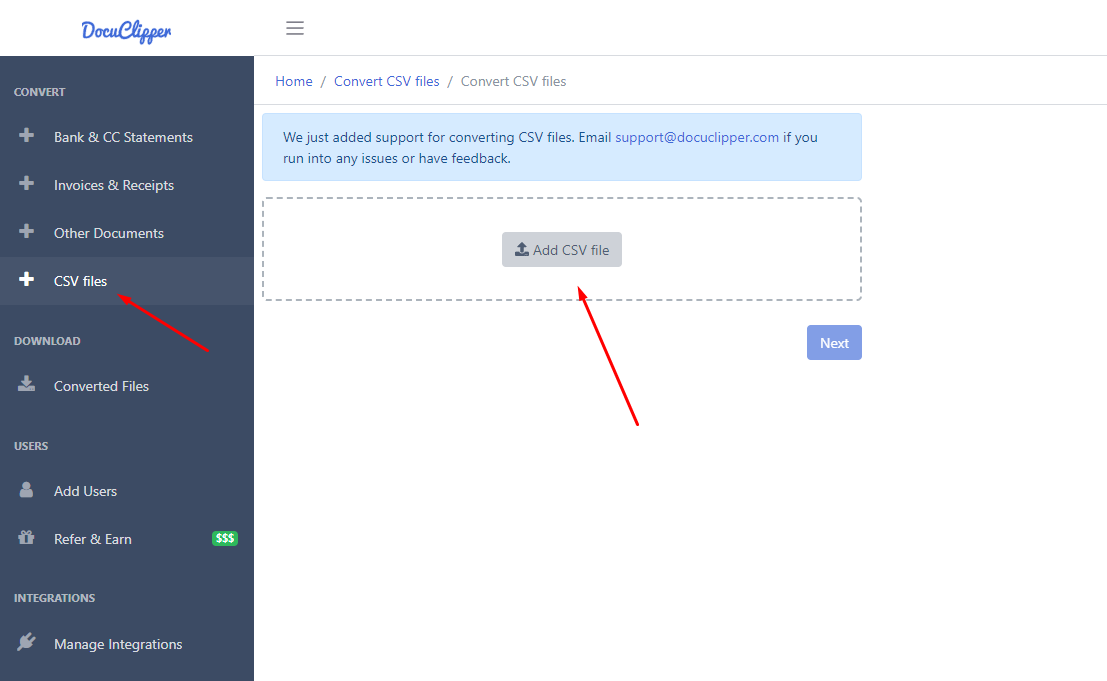

Convert into CSV

For converting your data into a CSV format:

- Navigate to the sidebar menu in DocuClipper and click on “CSV Files.”

- Upload your CSV file by either dragging and dropping it into the designated box or by clicking “Add CSV File” to select and upload your file.

Once uploaded, your CSV file can be processed and converted within the DocuClipper platform.

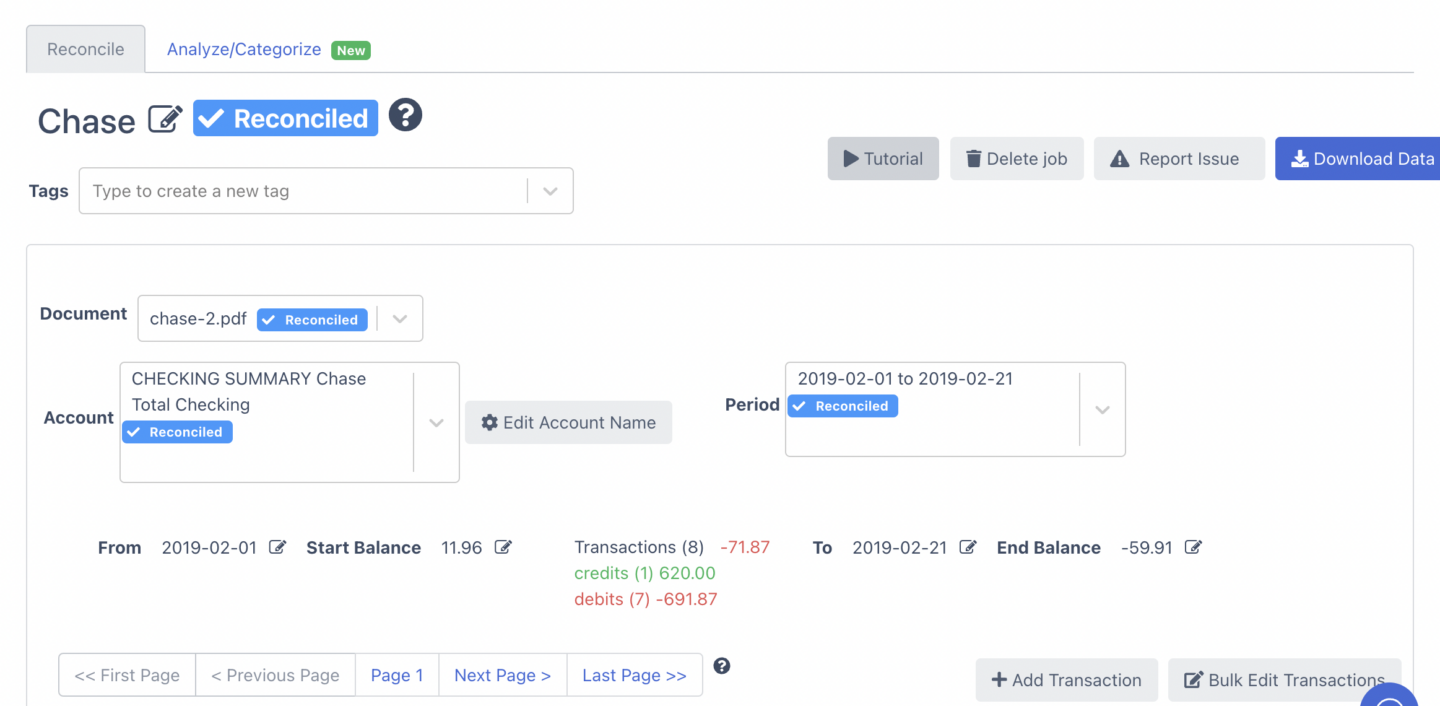

Review Fields

Carefully check for any missing fields which might impact the accuracy of your results. Pay special attention to unreconciled data, as this could indicate critical missing or incorrectly arranged information.

Map Columns to QBO Fields

When you’re confident that all transactions in DocuClipper are accurate and complete:

- Click on “Download Data” and opt for the QBO format.

- Select your bank, or if applicable, use Chase Web Connect.

- Determine the account type, choosing either Bank or Credit Card.

- Input the routing and account numbers.

- Choose the currency that applies to your transactions.

- Finally, click “Download QBO Web Connect.”

This action converts your optimized CSV data into a QBO file format, ready for efficient import into QuickBooks Online.

Use Cases of Bank Statement Processing

Automated bank statement processing has been used across many industries to make things easier and to put more control into managing finances.

In this section, we’re going to show you a couple of common use cases using bank statement processing:

Cash Flow Analysis

Processing bank statements is important for understanding cash flow when doing bank statement analysis. In a retail store, it helps identify revenue trends and manage expenses. It also aids in forecasting financial health by providing a clear picture of current financial status.

Tax Preparations & Reporting

Automated bank statement processing is invaluable during tax season. It helps individuals and businesses, like freelancers, accurately report income and expenses. This process ensures compliance with tax regulations and aids in maximizing potential deductions.

Bank Statement Reconciliation

Reconciliation using processed bank statements ensures financial records match bank records. Consider a small café reconciling its daily sales with bank deposits; this helps in identifying discrepancies and maintaining accurate financial records.

Transaction Categorization

Transaction categorization through automated processing simplifies financial management. It helps businesses categorize transactions, seeing their expenses and income, aiding in more effective budgeting and financial planning. This feature is especially useful for companies with diverse transaction types. Check out our guide on:

- How To Automatically Categorize Bank Transactions in Excel: Template Included

- How to Categorize Business Expenses

Assessment of Creditworthiness

Lenders use processed bank statements to assess a borrower’s financial health. For instance, a bank may review a small business’s statements to decide on a loan application, looking for red flags like inconsistent income or high spending. Learn more about OCR for underwriting.

Fraud Detection

Bank statement verifications are effective in detecting fraud. A company might use this technology to spot irregular transactions like altered dates or amounts, which could indicate fraudulent activity.

Alimony and Child Support Calculations

In legal scenarios, processed bank statements are used to assess alimony and child support. A law firm might analyze a client’s financial status to argue for a fair support amount, ensuring all income sources are considered.

Insurance Risk Assessment

Insurance companies utilize bank statement processing for risk assessment. Analyzing spending habits helps in determining lifestyle risks, which can influence policy rates and terms. This approach is essential for customizing insurance plans based on individual risk profiles.

Budget Planning

Effective budget planning is facilitated by automated bank statement processing. It allows organizations to track and manage their financial resources better, leading to more informed decisions in resource allocation and financial strategy development.

Best Practices in Bank Statement Processing

Here are some practices when you process bank statements:

Utilize Bank Feeds

Bank feeds offer a convenient shortcut for simplifying bank statement processing. They automatically link your bank statements to your database or accounting software, streamlining the entire process of managing financial transactions.

Use Accurate Bank Statement Converters

Select a top-quality bank statement converter that’s accurate, fast, and fits your budget. Make sure it supports various formats and connects with numerous banks nationwide for greater convenience.

Automate Categorization Rules

Automating transaction categorization can be tricky, but DocuClipper simplifies it. You can set specific rules for how transactions are categorized, making it easier to sort and analyze your data for different financial processes.

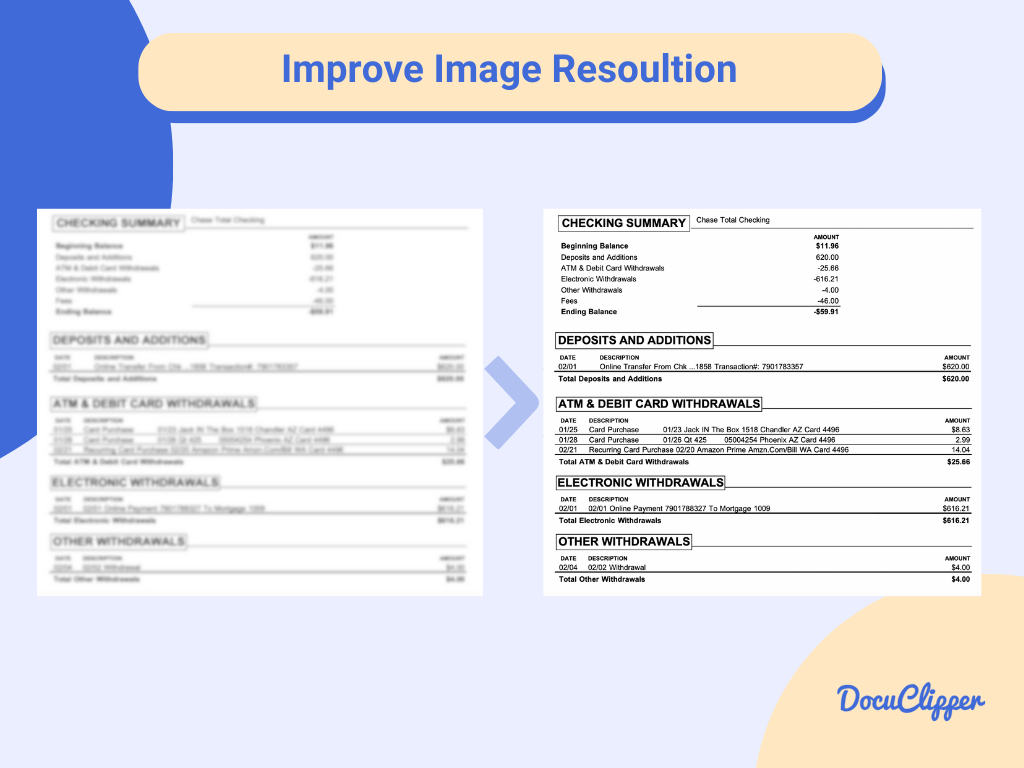

Ensure High-Quality Scans and Resolutions

Although OCR technology has advanced in enhancing image and scanning quality, it remains important to regularly inspect the quality of each image. This step helps to ensure that accuracy is maintained and not impacted by any unexpected variables.

Standardize the Processing Workflow

It’s efficient to follow a workflow that includes screening, sourcing, and checking when processing bank statements. This way, you avoid the time-consuming issue of categorizing bank transactions, only to discover later that the statement is fraudulent.

Conclusion

In conclusion, effective bank statement processing is crucial for financial management. Utilizing advanced OCR technology, modern software simplifies this task. These tools facilitate streamlined analysis, accurate reconciliation, and efficient transaction categorization. Their adoption significantly enhances operational efficiency, reduces costs, and improves data accuracy and fraud detection.

For businesses and individuals alike, using these technological advancements is a strategic step towards more effective and stress-free financial management, ensuring a clearer understanding and better control of their financial health.

Process Bank Statements with DocuClipper

DocuClipper is one of the best bank statement processing software in the market. It utilizes OCR technology to convert PDFs and images of bank statements into editable text. It also has features that can streamline and automate your bank statement analysis with its bank statement reconciliation and transaction categorization feature.

With its top-notch accuracy, your processing bank statements with DocuClipper goes without any worry.