Fake bank statements are on the rise and being used for unlawful financial gain.

But how can you identify if a statement is falsified?

This guide covers the common signs to inspect statements for fabrication clues.

Follow these tips to detect fake bank statements and stop fraud attempts.

What is a Bank Statement?

![How to Spot Fake Bank Statements [12 Ways to Identify] 1 how to read and understand bank statement](https://www.docuclipper.com/wp-content/uploads/what-is-a-bank-statement-1440x1280.jpg)

A bank statement is a summary of bank transactions and account balances over a specified period of time. Statements are issued by banks and credit unions to keep customers informed about activity in their accounts.

Typically bank statements detail transactions like deposits, withdrawals, checks, debit card purchases, ATM transactions, interest earned, or fees charged.

They include opening and closing balances for the statement period as well as contact information for the financial institution.

Bank statements may be issued monthly, quarterly, or on other cycles depending on the account type. In simple terms, they provide an official financial record of the money flowing in and out of an account.

Why Are Bank Statements Being Faked?

Unfortunately, fake bank statements are created for deceptive and illegal purposes.

Financial statement fraud, the category under which fake bank statements fall, accounts for 10% of corporate fraud cases according to statistics but results in a median loss of $954,000 per incident.

This is significantly higher than the median loss of $100,000 in more common corporate fraud cases. (Source)

The massive Enron scandal of 2001 stands out as a sobering example of how severe the impacts of financial statement manipulation can be.

With that here are common reasons why bank statements are being faked:

- To get approved for loans or credit cards by exaggerating income and assets.

- To qualify for rental leases by appearing financially stable.

- To get hired for jobs that require proof of steady income.

- To support fraudulent insurance claims about lost or stolen items.

- To launder money obtained through criminal or illegal means.

- To hide funds or assets from courts and authorities in cases like divorce proceedings.

- To qualify for government benefits based on low-income status.

- To get better rates or terms for financial products by inflating account balances.

- To delay foreclosure, wage garnishment, or judgment recovery by showing false balances.

- To mislead investors about company finances and assets.

- To hide spending and transactions from a spouse or partner.

Nearly one-third of all fraud cases result from insufficient internal controls. Strengthening these controls is crucial in preventing and detecting financial statement fraud, including fake bank statements.

Read More about How to Read Bank Statements.

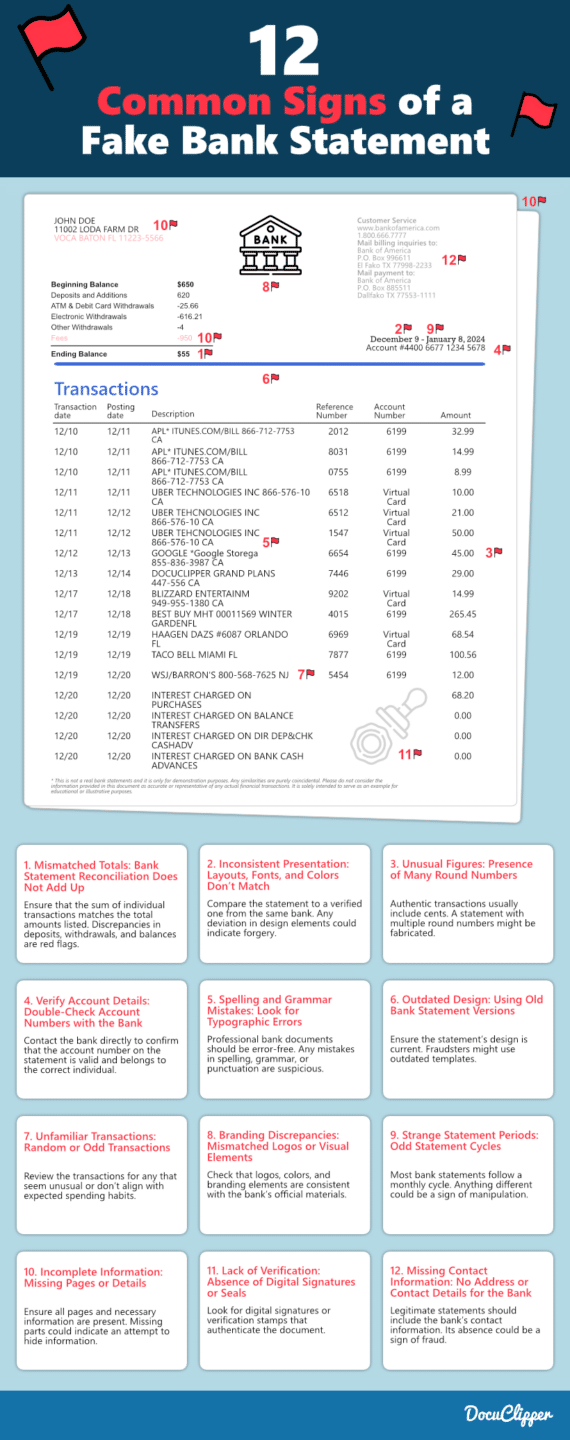

12 Common Signs of a Fake Bank Statement

Spotting signs of a fake bank statement can be relatively easy if you know where to look.

Therefore, here are the 12 common signs of a fake bank statement:

1. Bank Statement Reconciliation Does Not Match

A key technique is to verify that the transaction details on the statement add up to the totals listed by doing a bank statement reconciliation.

![How to Spot Fake Bank Statements [12 Ways to Identify] 3 credit card statement reconciliation for accuracy for importing credit card statements into quickbooks desktop](https://www.docuclipper.com/wp-content/uploads/credit-card-statement-reconciliation-for-accuracy-for-importing-credit-card-statements-into-quickbooks-desktop.png)

On authentic statements, the total of all deposits, withdrawals, fees, and interest earned should equal the ending balance after starting from the beginning balance.

However, on fake statements, these numbers often don’t align. The individual payments may sum to $5,000, but the total states $6,000. The starting balance is listed as $2,500, but adding up the transaction amounts yields a $3,000 opening balance.

Mismatched totals between itemized activity and the summary information provided on the statement indicate fabrication. The transactions were likely made up and not properly reconciled with the statement balances

2. Inconsistent Layouts or Fonts

Banks always use the exact same template, formatting, colors, and fonts across all real statements. This maintains their professional brand image.

Therefore, a statement that looks different in layout, style, or font choice compared to a legitimate sample from the same bank is highly suspicious.

Authentic statements keep tightly consistent designs that are always recognizable as that particular bank.

For example, Wells Fargo statements have their classic clean style.

![How to Spot Fake Bank Statements [12 Ways to Identify] 4 example of a wells fargo real bank statement](https://www.docuclipper.com/wp-content/uploads/example-of-a-wells-fargo-real-bank-statement-1113x1440.webp)

Or Bank of America utilizes bold red and blue colors. Any deviation in visual design likely means deception.

![How to Spot Fake Bank Statements [12 Ways to Identify] 5 example of a real bank statement from bank of america](https://www.docuclipper.com/wp-content/uploads/example-of-a-real-bank-statement-from-bank-of-america-1440x1238.jpg)

So it’s important for auditors who do bank statement audits to pay close attention to font inconsistencies as a red flag for potential fraud.

3. Many Round Numbers

Genuine bank transactions will have specific dollar amounts, often down to the penny. Fake bank statements tend to use round numbers or multiples of 100s or 1,000s instead. For example, a real statement would show a restaurant charge of $24.18 or an ATM withdrawal of $302.43.

However, a fraudulent statement may list charges like $100, $200, or $1,000 – unusually clean, round figures that real purchases rarely total up to. Lots of perfectly round numbers without specific cents indicate the transactions are likely fabricated. This occurs because the faker does not have the real payment amounts.

4. Double-check account Numbers with Banks

The account number listed on a questionable statement should be verified directly with the bank. Call the customer service number and confirm whether the account number belongs to the person and matches their records. If not, it is clearly a fake designed for fraudulent purposes.

Even slight alterations, like changing a digit or two in the real account number, can expose counterfeits. The bank will be able to identify discrepancies instantly. Don’t trust any statement with an account number that can’t be verified.

5. Grammar or Typographic Errors

Official bank statements and documents are always professionally written and checked for errors before release. However, fake statements generated by fraudsters often contain spelling, grammar, punctuation, or wording mistakes.

These may include things like misspellings, sentences without proper punctuation or capitalization, improper grammar structure, and more. Statements from banks avoid such errors, so if these issues are present, it indicates an amateur creator of false documents.

6. Old Bank Statement Version

Banks regularly update their statement templates and designs to keep things fresh and incorporate new security features. As a result, using an old, outdated statement format is a common mistake made by creators of false documents.

Comparing to a legitimate recent sample statement can identify if the statement in question is using an older design no longer in circulation. The fraudster likely pulled an old template that the bank is no longer using.

7. Random Transactions

Authentic bank activity reflects real and predictable spending habits, displaying logical and expected transactions like grocery, gas, retail, bills, etc. However, fake statements often contain unusual, random transactions that don’t align with regular spending.

Things like sporadic cash withdrawals for odd amounts, transferred sums to random individuals, purchases at unfamiliar merchants, and more can signal fabrication. Real bank statements should show familiar and expected transaction history.

8. Mismatched Logos or Branding

Banks meticulously maintain the same logos, colors, fonts, and visual branding across all official statements and materials. Therefore, any discrepancies or variations in logo design, styling, fonts, etc compared to a legitimate document should raise red flags.

Fraudsters typically access template statements but fail to match the branding perfectly. Look for minor differences in font, dated logos, incorrect colors, and other subtle mismatches that give away the deception. Always verify branding matches current materials.

9. Odd Statement Cycles

Most bank statements follow a standard monthly cycle issued at regular intervals. Anything that deviates from typical periods like weekly, bi-weekly, semi-monthly, quarterly, or arbitrary date ranges could indicate trickery.

Ask yourself why the statement would have an unusual cycle, unlike the industry standard. Most banks only use cycles other than monthly in special circumstances, so this warrants a deeper look to check for fakes.

10. Missing Pages

Multi-page official bank statements will always contain the complete set of pages, numbered sequentially and thoroughly. Statements that seem shortened, partial, or missing pages relative to a legitimate full statement are extremely suspicious.

For example, a single-page statement covering an entire month or year that would normally include many more pages should be verified. Incomplete statements demonstrate information is being withheld or that the creator couldn’t produce fully fabricated document sets.

11. No Digital Signatures

In this digital age, legitimate bank statements from most institutions will contain verifiable digital signatures or seals to prove authenticity.

If you’re unsure about the legitimacy of the bank statement request a bank statement with a seal and signature of the banker.

These demonstrate the document came directly from the bank and has not been tampered with.

The absence of a digital signature or verification stamp now sets off alarms that something is amiss. Fraudsters typically cannot replicate these digital measures. Always double-check statements for digital seals, especially if obtained from third parties.

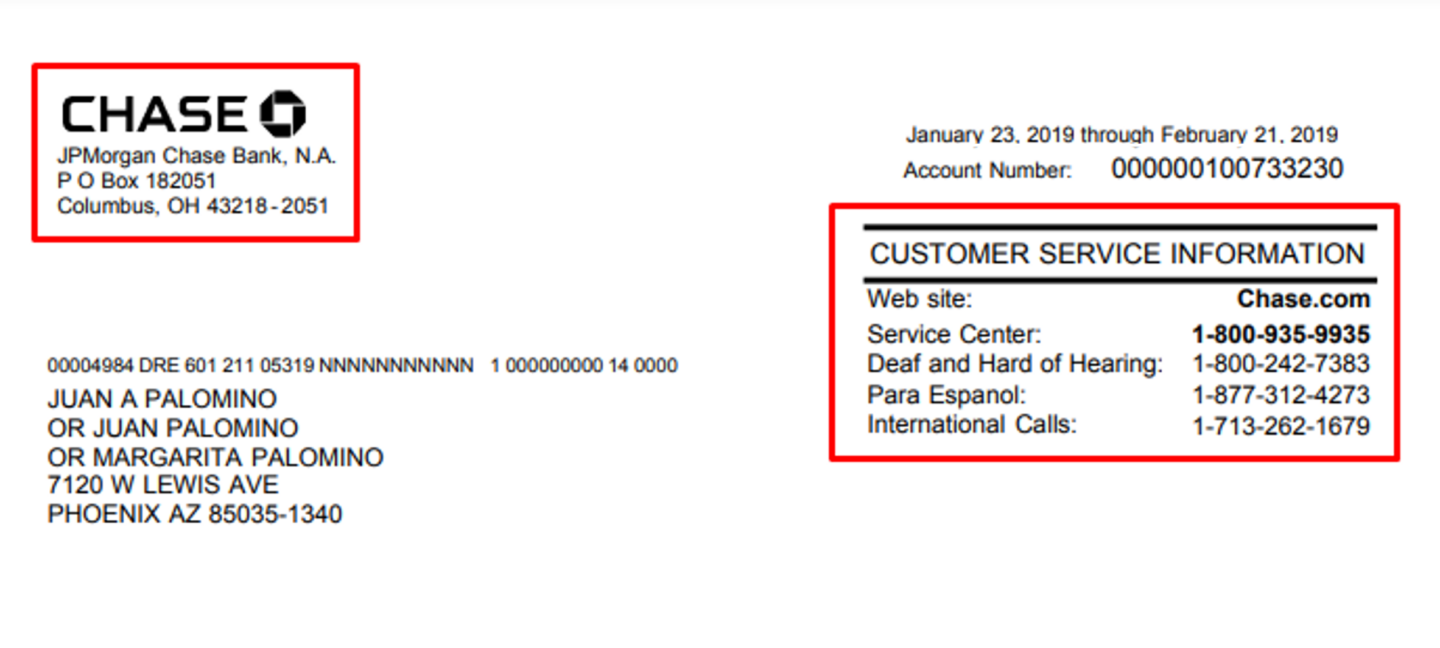

12. No Address for Bank

Genuine bank statements will unfailingly list the bank’s contact information on the document, including the mailing address, phone numbers, website, and other details. This provides customers access and the ability to verify.

Be suspicious of any statements lacking this key contact information. The creator clearly does not want you to call the bank to authenticate the document. Statements without addresses or contact info are almost assuredly fraudulent.

To learn more we recommend to read our article about bank statement verification.

Reconcile Bank Statements with DocuClipper

DocuClipper offers automated bank statement reconciliation using advanced OCR to convert PDF statements into editable Excel and CSV formats.

As a comprehensive bank statement analyzer, it validates against original opening and closing balances, allowing reconciled statement data to be seamlessly downloaded for import into accounting systems.

Once validated against original opening and closing balances, the reconciled statement data can be seamlessly downloaded for import into accounting systems. DocuClipper streamlines reconciliation to save time and reduce errors.

With DocuClipper it’s also easier to reconcile bank statements within your accounting software.

Conclusion

Fake bank statements are a serious issue that can enable financial fraud and wreak havoc on individuals and institutions if not identified. Being aware of common signs like inconsistent fonts, improper logos, transactions that don’t reconcile, and more can help protect against deception.

Always double-check questionable statements directly with banks before assuming validity.

And whenever you can, always ask for certified bank statements to ensure they’re real.

Advanced bank statement converters like DocuClipper also hold great promise for automating the reconciliation process to systematically flag fake or improperly manipulated bank statements.

Together, vigilance and technology can help restrict the impacts of falsified financial documents. Stay vigilant for any red flags and confirm legitimacy through multiple channels.

Frequently Asked Questions about Fake Bank Statements

In this section we’re going to answer the following questions about fake bank statements:

Can fake bank statements be detected?

Yes, fake bank statements can be detected through careful examination and by cross-checking details with banks. Comparing transactions, inspecting for formatting inconsistencies, and verifying key information can reveal falsified documents. Banks can also confirm validity.

Is it illegal to fake bank statements?

Yes, it is illegal to fabricate fake bank statements under various fraud laws. This includes falsifying financial documents, misrepresenting identity, forgery, identity theft, and providing false statements to banks, government entities, or third parties. Significant civil and criminal penalties can apply.

Can bank statements be falsified?

Unfortunately yes, modern editing software makes it possible for anyone to falsify bank statement details and appearance to create convincing fakes. Common falsification tactics include inflating balances and income, adding fake transactions, and altering personal/account details, especially where bank statement income verification is performed.

Can a bank statement be edited?

While physically possible with today’s technology, it is illegal to edit or alter original bank statements in any way. Statements are official bank documents that cannot be legitimately modified once issued and distributed in original form.

Do banks verify bank statements?

Yes, all banks have procedures to verify bank statement validity if contacted by a customer with concerns. They can cross-check account details and transactions against internal records to confirm legitimacy.

Is lying on financial statements illegal?

Intentionally providing false information on any financial statements or records is considered fraud. This includes falsifying details or omitting information on bank statements, tax returns, income reports, and any other financial documents.