In today’s financial landscape, understanding the intricacies of bank statements is more crucial than ever.

Whether you’re an accountant, bookkeeper, financial investigator, law practionaire, business owner, or someone keen on personal finance, bank statement analysis offers invaluable insights into financial health and habits.

Here is our comprehensive guide to this essential practice, discover its significance and equip yourself with actionable steps to master it.

What is a Bank Statement Analysis?

Bank statement analysis is a systematic process used by individuals, bookkeepers, businesses, and financial institutions to review and interpret transactions recorded in a bank statement.

This analysis provides a comprehensive view of an account’s activity over a specific period, offering insights into spending habits, income sources, and overall financial health.

At its core, bank statement analysis aims to:

- Understand Financial Patterns: By examining the inflows and outflows, one can identify recurring expenses, periodic income, and any anomalies that might indicate errors or fraud.

- Reconcile Discrepancies: Comparing the bank statement with personal or business accounting records ensures that there are no unaccounted transactions or mismatches.

- Assess Liquidity: It helps in evaluating the availability of funds, ensuring that there are sufficient resources to meet upcoming liabilities.

Why is Bank Statement Analysis Important?

Bank statement analysis serves as a foundation to better understand bank statement the financial health of an individual or a business. It enables you to better understand the financial history, and spending habits, and evaluate the person or business’s financial health.

Analyzing bank statements offers several benefits:

- Detecting Financial Discrepancies: One of the primary reasons for bank statement analysis is to detect anomalies, including the potential presence of fake bank statements. Examine the statements for any transactions that seem out of place, unusually large amounts, regular small-amount transfers, or entries that don’t align with your records. Identifying these issues promptly can protect you from potential financial fraud and ensure the accuracy of your financial records.

- Monitoring Cash Flow and Liquidity: Cash flow is the lifeblood of any business. Through bank statement analysis, companies can track their cash inflows and outflows, understanding their operational efficiency and financial flexibility.

- Evaluating Client’s Financial Credibility: For businesses that offer credit terms, extend loans, rent, or engage in partnerships, assessing a potential client’s bank statement is invaluable. Regular analysis of a client’s bank statements can reveal their payment habits, outstanding debts, and overall financial behavior, and mitigate potential risks.

- Enhancing Business Financial Health: A regular review of bank statements provides businesses with a clear picture of their financial health. It allows them to make informed decisions, whether it’s about cutting unnecessary expenses, optimizing operations, or seeking external funding. It can act as a diagnostic tool, highlighting areas of strength and pinpointing potential weaknesses.

- Optimizing Cash Flow Management: Effective cash flow management is about more than just monitoring; it’s about optimization. By understanding the nuances of their cash flow, businesses can strategize on how to improve their working capital, negotiate better terms with suppliers, or identify lucrative investment opportunities.

In conclusion, bank statement analysis is not just a routine financial task—it’s essential to practice that helps companies to better understand the financial health of a business or individual, be it yours or somebody else.

This is even more important as around Around 70% of small businesses don’t have an accountant and they do their own accounting alone.

While 21% of SMBs owners admit to not knowing enough about bookkeeping. (Bookkeeping statistics)

How to Do Bank Statement Analysis

Bank statement analysis is a very tedious process that requires attention to detail and a systematic approach. Whether you’re a business owner, an accountant, or someone looking to understand their financial standing better, here is our guide on how you can effectively analyze any bank statements:

Step 1: Gathering Necessary Documents

Before diving into the analysis, ensure you have all the relevant bank statements at hand. This might include monthly statements, electronic records, or any related financial documents that provide context to the transactions.

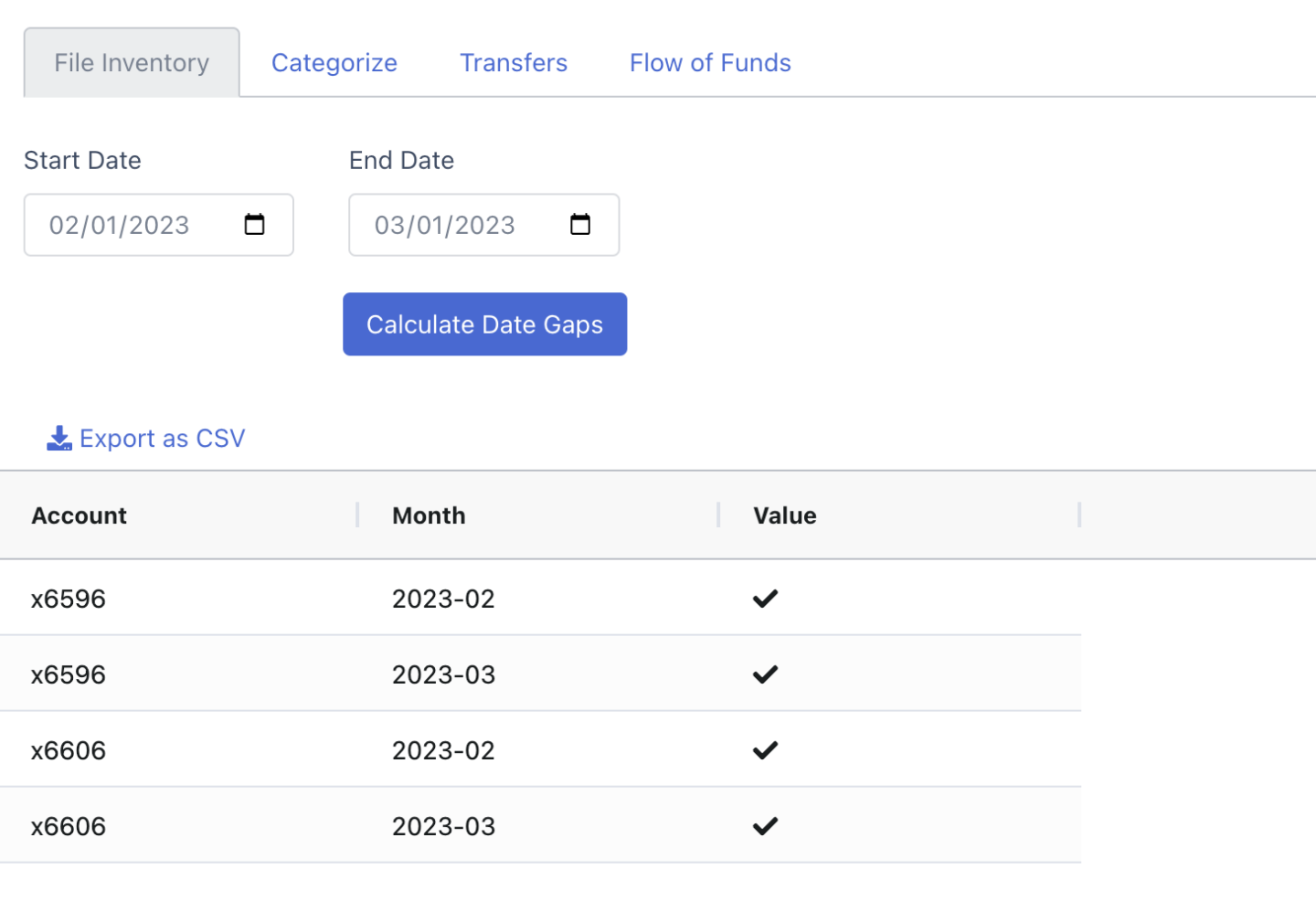

DocuClipper File Inventory feature can help you gather all bank statements in one place to ensure all necessary statements are present for your analysis.

Step 2: Convert Bank Statements into Editable Files

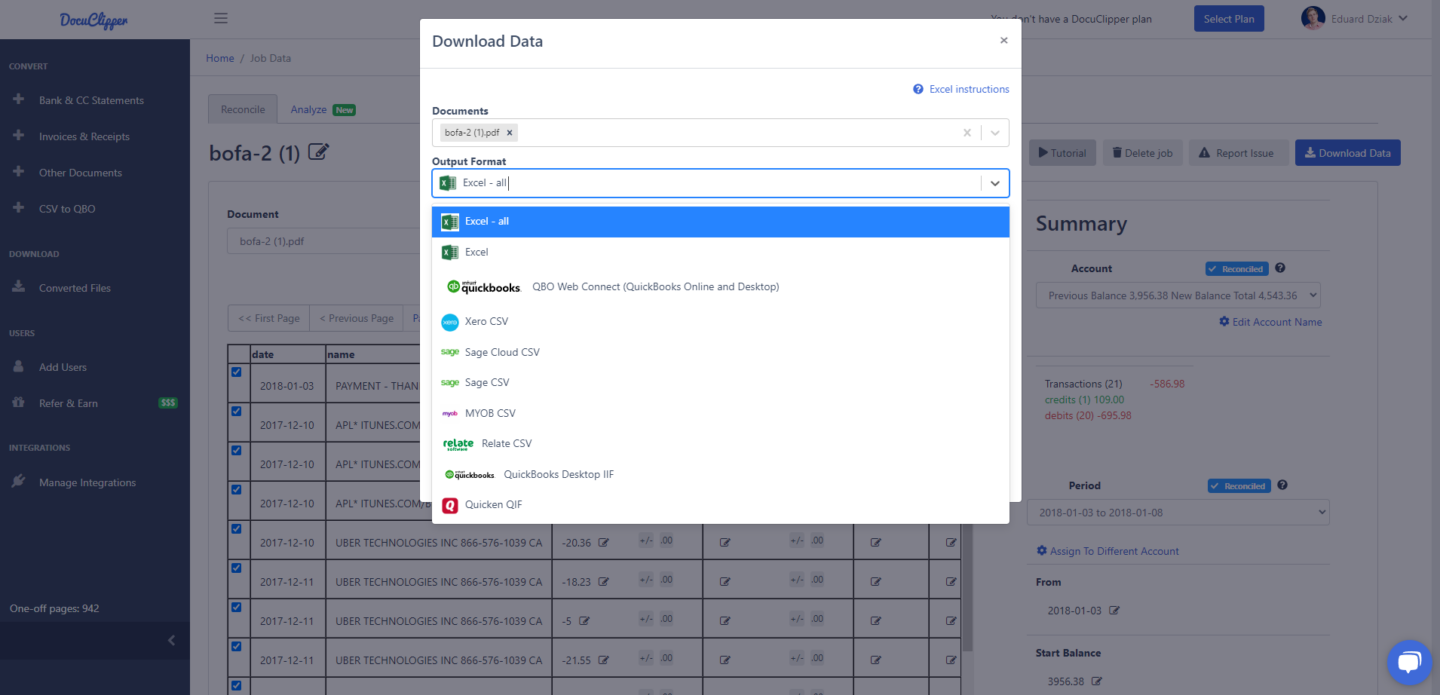

Converting bank statements from PDF or scanned formats into editable files like CSV, Excel, or QBO is critical for efficient bank statement analysis.

This conversion facilitates easy data manipulation, sorting, and integration with various analysis platforms, enhancing accuracy and efficiency.

DocuClipper simplifies this conversion process with their bank statement OCR, effortlessly converting bank statements into formats like Excel, CSV, or even PDF to QBO and creating a bank extract for you. It can even convert CSV files directly to QBO, streamlining data input for QuickBooks users. (Learn more about how to convert PDF to QBO)

With DocuClipper, you ensure data integrity during conversion, save time by eliminating manual data entry, and seamlessly integrate with your preferred analysis platform, optimizing the entire analysis process.

In fact, Humans make 100x more data entry errors compared to automated data entry systems. (data entry statistics)

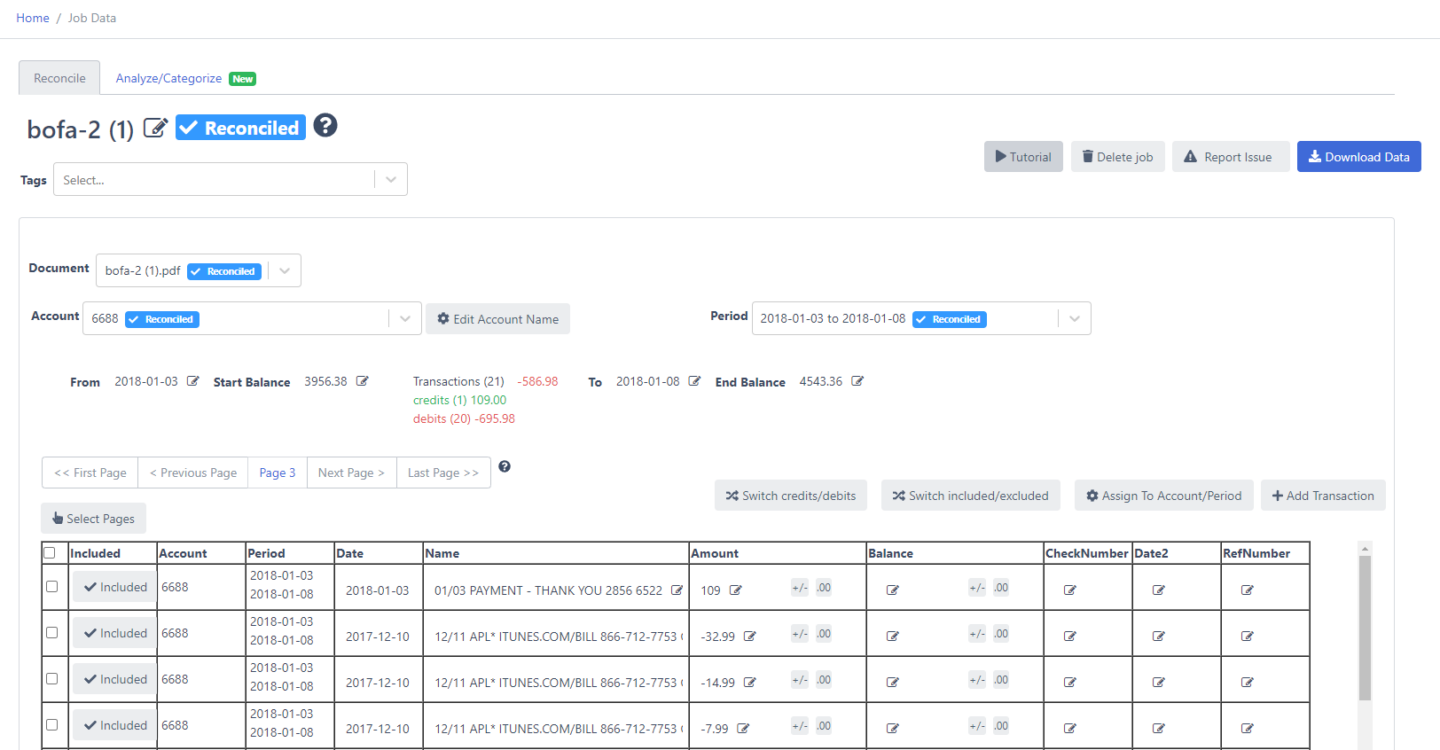

Additionally, DocuClipper automatically reconciles bank statements to ensure the accuracy of conversion and help you spot potential fraudulent bank statements.

For more information, DocuClipper can also convert CSV to QBO. Read more on how to convert CSV to QBO.

Also, learn about:

Step 3: Identifying and Categorizing Transactions

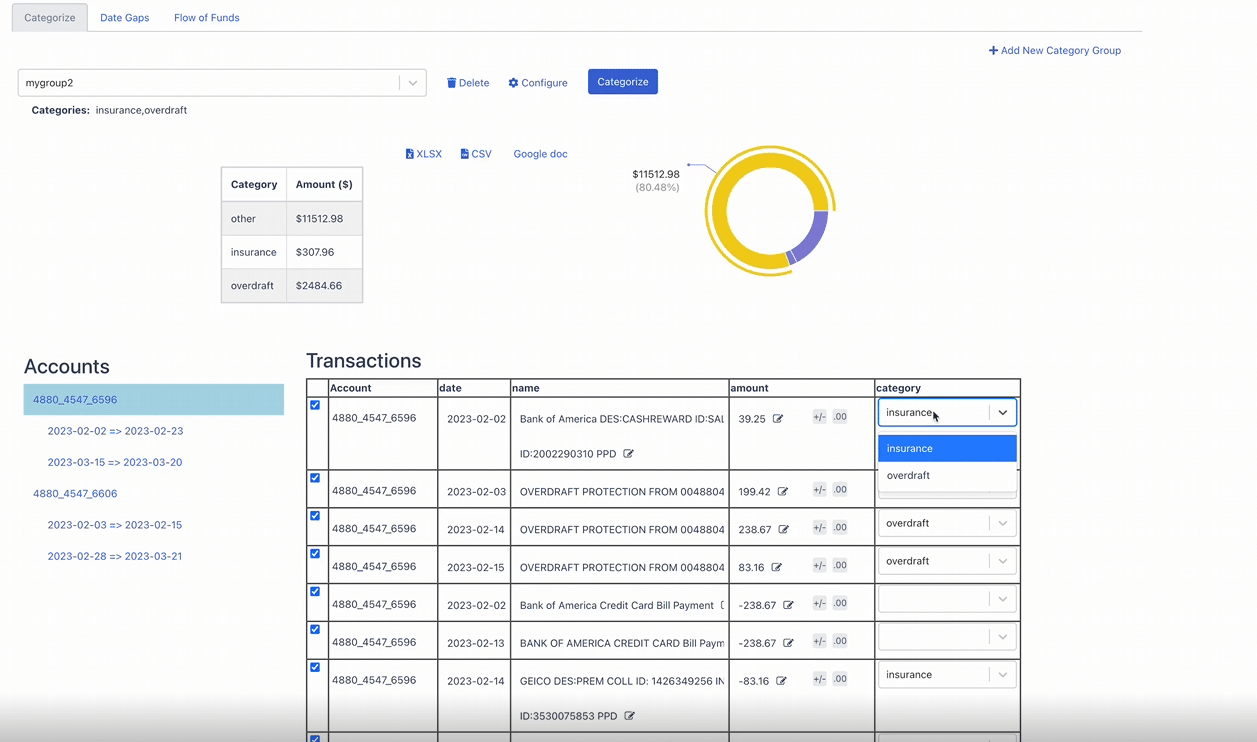

With the bank statements ready, start by listing all the transactions. Categorize them based on their nature, such as income, expenses, transfers, and others. Proper transaction categorization not only helps in understanding the financial flow but also aids in budgeting and financial planning.

DocuClipper Transaction Categorization can help you simplify the categorization process. This feature allows for the automatic categorization of transactions using keywords, streamlining data analysis and interpretation

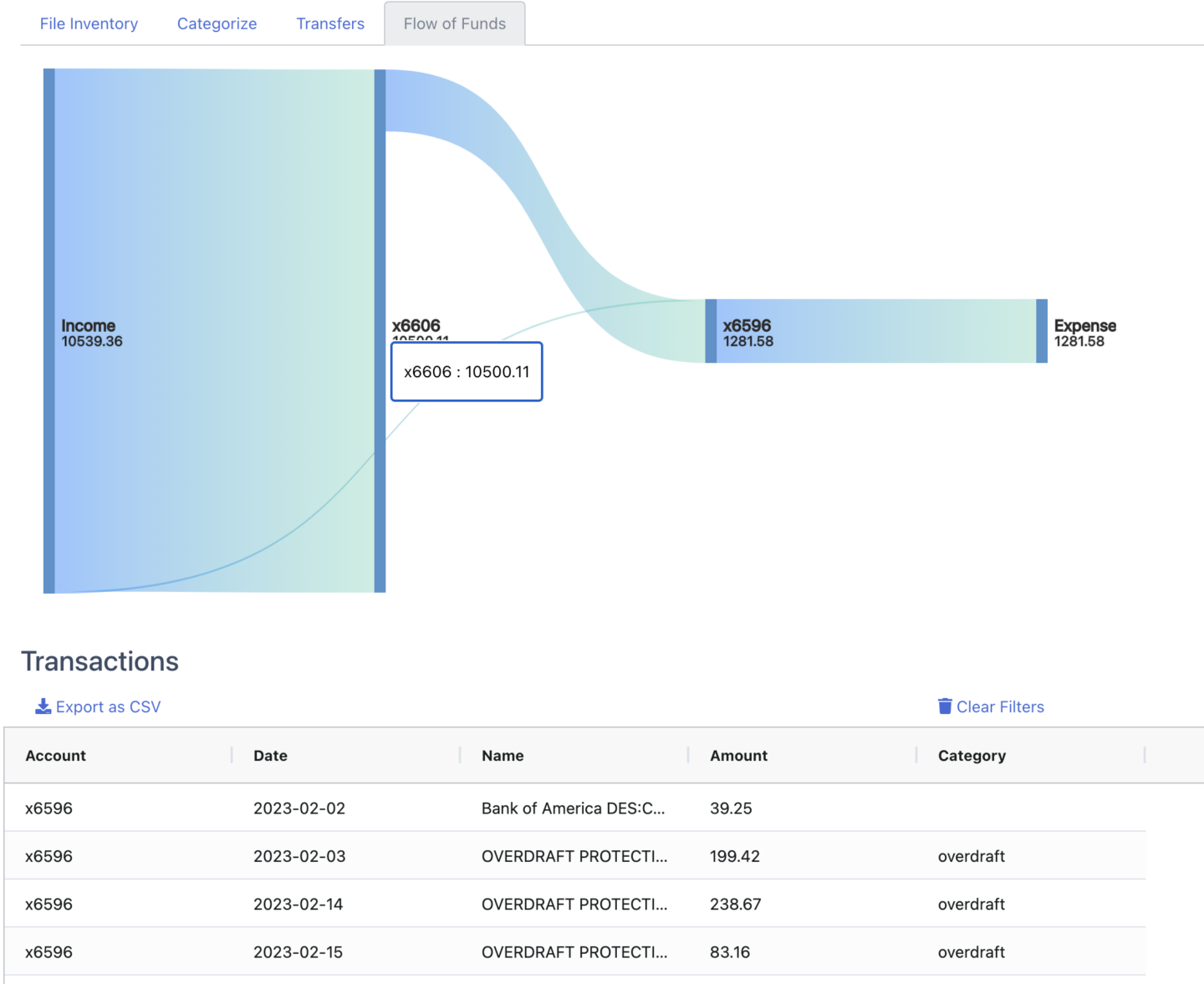

Additionally, you can use DocuClipper Flow of Funds to clearly illustrate the flow of money across accounts.

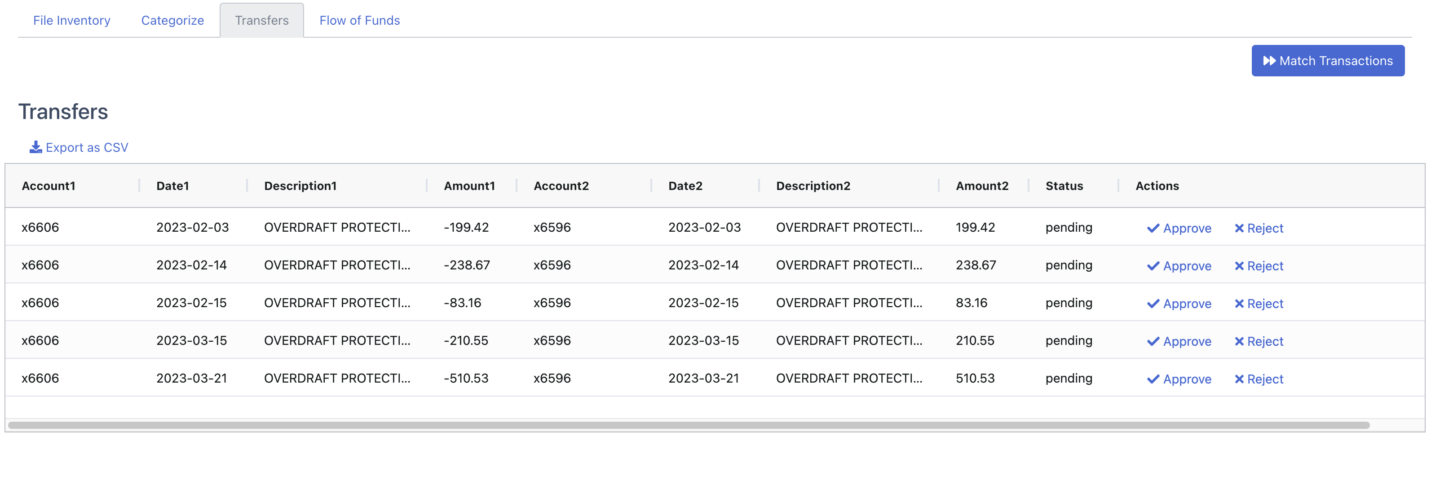

And DocuClipper system identifies transfers between accounts, providing a clear and concise view of financial behaviors.

Additionally, we also recommend getting yourself familiar with common bank statement abbreviations as it will help you to better categorize your transactions.

Or for more basic needs, you can use Excel to categorize your bank transactions.

We have a transaction categorization and expense spreadsheet here that you can download.

Step 4: Spotting Unusual or Unauthorized Transactions

One of the primary reasons for bank statement analysis is to detect anomalies.

Examine the statements for any transactions that seem out of place, unusually large amounts, regular small-amount transfers, or entries that don’t align with your records. These could be indicators of errors, fraud, or unauthorized access to the account.

Step 5: Reconciling with Accounting Records

And lastly, once you’ve reviewed the bank statement, it’s time to compare it with your internal accounting records. This process, known as bank reconciliation, ensures that your books align with the bank’s records.

Any discrepancies should be investigated and resolved promptly. This step is crucial for businesses to maintain accurate financial statements and for individuals to ensure they have a clear picture of their financial health.

Learn about the differences between bank statement vs bank reconciliation.

Common Challenges in Bank Statement Analysis and How to Overcome Them

Bank statement analysis, while invaluable, is not without its challenges.

Here are some common hurdles faced during the process and strategies to navigate them:

- Volume of Transactions: Especially for businesses with high transactional activity, sifting through pages of bank statements can be daunting.

- Solution: Solution: Use a bank statement analyzer or automated tools to sort and categorize transactions. This not only speeds up the process but also reduces the chances of human error. DocuClipper can help with this.

- Inconsistent Transaction Descriptions: Different vendors might use varying descriptions for similar transactions, making categorization challenging.

- Solution: Implement a standardized naming convention or use software that can recognize and group similar transaction types based on predefined rules such as DocuClipper.

- Missing or Duplicate Entries: Occasionally, transactions might be missed or recorded multiple times, leading to inaccuracies.

- Solution: Regularly reconcile bank statements with internal accounting records. Automated reconciliation tools can also highlight potential discrepancies for review.

- Deciphering Complex Transactions: Some transactions, especially those related to financial instruments or foreign exchange, can be complex to interpret.

- Solution: Invest in training or workshops to understand these transactions better. Alternatively, consult with financial experts or use specialized software designed to handle such transactions.

- Potential Fraudulent Activity: Unauthorized or suspicious transactions can sometimes go unnoticed, especially if they are small or infrequent.

- Solution: Set up alerts for unusual transaction patterns or amounts. Regularly review and verify transactions, especially those that deviate from the norm.

- Time-Consuming Manual Processes: Manual entry or categorization can be time-intensive and prone to errors.

- Solution: Embrace automation. Tools that can convert, categorize, and analyze transactions can significantly reduce the time spent on manual tasks and enhance accuracy. Try DocuClipper for free.

- Integration with Other Financial Systems: Sometimes, data from bank statements needs to be integrated with other financial systems or software, which can be challenging.

- Solution: Opt for software solutions that offer integration capabilities or APIs. This ensures seamless data flow between systems, simplifying analysis and reporting.

Best Practices for Effective Bank Statement Analysis

As shown in this blog post, bank statement analysis is a cornerstone of sound financial management.

To maximize its benefits and ensure accuracy, here are some of the best practices recommended by accounting and bookkeeping experts:

- Regularly Scheduled Reviews: Just like any other financial review routine, it’s essential to analyze bank statements at regular intervals. Whether monthly, quarterly, or annually, consistent reviews help in the timely detection of discrepancies and understanding of financial trends.

- Using Standardized Categorization Methods: Adopting consistent and standardized categorization methods aligns with global accounting standards. This ensures that transactions are grouped logically, making analysis more straightforward and comparable across different periods.

- Use Automation to Reduce Errors: Manual processes are prone to errors. Leveraging automation tools can significantly reduce mistakes, ensuring that the data being analyzed is accurate and reliable.

- Collaborating with Financial Experts: While automation and tools can aid the process, collaborating with financial experts provides an added layer of security. Their expertise can help in interpreting complex transactions and offering strategic financial insights as well as spot common errors/issues with bank statement analysis.

- Educate Yourself in Finance and Fraud Prevention: A basic understanding of finance and fraud prevention techniques can go a long way. It empowers individuals and businesses to spot red flags, understand financial implications, and make informed decisions.

- Stay Updated with Accounting Standards: As the financial industry evolves, so do accounting standards. Staying updated ensures that your analysis aligns with current best practices and regulatory requirements.

By integrating these best practices into your bank statement analysis process, you enhance its effectiveness, ensuring that the insights derived are accurate, timely, and actionable.

Conclusion

Bank statement analysis is a common practice we see our customers perform for their clients or themselves.

And while it can be tedious, it’s also an essential part of the overall financial analysis process to ensure sound financial health.

We do regular bank statement analysis to prevent any fraud, errors, or other financial issues that can happen. (Luckily it did not happen so far *knock* *knock*.)

So we understand how important it is to do so.

And of course if you’re doing this for client or potential client, ensure you ask for certified bank statement to avoid any fake bank statements.

Of course, we at DocuClipper aim to simplify some of the accounting, bookkeeping, and financial analysis processes so you can spend more time on valuable tasks and less on things that can be automated.

Analyze Your Bank Statements with DocuClipper

Dive into the future with DocuClipper! Streamline your financial reviews, effortlessly convert and categorize transactions, and unlock unparalleled insights with our cutting-edge tools. Don’t let manual processes hold you back.

🌟 Join the revolution and experience seamless bank statement analysis with DocuClipper today! 🌟

FAQs of Bank Statement Analysis

In this section, we are going to answer the following questions related to bank statement analysis:

What is the meaning of bank statement analysis?

Bank statement analysis refers to the systematic review of bank transactions recorded in a bank statement. It provides insights into an account’s activity over a set period, helping individuals and businesses understand spending habits, income sources, and overall financial health. This analysis aids in detecting discrepancies, fraud, reconciling records, and assessing liquidity.

Why is bank statement analysis important?

Bank statement analysis is vital as it offers a clear snapshot of financial health, revealing spending habits and income sources. It aids in detecting financial discrepancies, understanding cash flow patterns, and ensuring records align with bank details. Regular analysis can also highlight potential fraud, assist in budgeting, and inform strategic financial decisions, safeguarding an individual’s or business’s financial well-being.

What are the 4 pieces of information a bank statement tells you?

A bank statement provides:

· Transaction History: Details of all deposits, withdrawals, fees, and purchases.

· Account Balance: The opening and closing balances for the period.

· Account Details: Information like account number and the bank’s customer service contacts.

· Overdraft Protection: Status and limits, if applicable, indicating any buffer against overspending.

These elements offer a comprehensive view of an account’s activity and financial status.

Related Articles:

- How to Import Bank Statements and Transactions into QuickBooks Online & Desktop

- 10 Best Bank Statement Converter Software

- How to Import bank statements into Sage in 7 Easy Steps

- How to Get Old Bank Statements from a Closed Account

- How to Read a Brokerage Statement

- How Long to Keep a Brokerage Statement