Categorizing transactions is a critical step in personal and business finance to gain insights from your spending data. But with growing bank statements each month, categorizing manually is tedious and prone to errors.

In this article, we will show you how to categorize transactions using different methods to streamline the process, from built-in bank features to accounting software to third-party apps.

We compare the pros and cons of manual, automated, and hybrid categorization approaches.

The goal is to help identify the optimal transaction categorization workflow to fit your needs and resources.

With the right process, you can analyze finances through the precise customized lens that matters most to your goals.

Take control of your transactions – Download the best transaction categorization spreadsheet!

1. Using Banking Categorization

Most online banking platforms like Chase, Bank of America, and Wells Fargo now come with built-in features to help categorize your transactions called spending by category.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 1 spending by category banking categorizing transactions](https://www.docuclipper.com/wp-content/uploads/spending-by-categiry-banking-categorizing-transactions-1440x646.png)

When you log into your online banking account, you will see your transactions categorized into common spending groups like groceries, bills, restaurants, etc. The bank applies categorical tags to merchants and transactions automatically based on past data.

This automatic transaction categorization can help you track your spending and improve your financial management.

Some key benefits include:

- Real-time updates – Transactions are categorized as soon as they are posted, so you have an up-to-date view of spending. No need to wait until the end of the month.

- Integration – The categorized transactions integrate directly with your bank data. No need to export statements.

- User-friendly interfaces – The category tags are displayed clearly within the bank’s interface, making it easy to view spending analytics.

However, there are some limitations to be aware of:

- Limited customization – You may be stuck with the bank’s predefined categories and unable to customize or add your own.

- Data errors – If the bank algorithm miscategorizes a transaction, it can distort your spending analysis. Always verify accuracy.

- Can’t split transactions – Some purchases may need to be split across multiple categories, which banking platforms don’t allow.

Overall, banking categorization features provide a convenient starting point for tracking expenses and are good enough for basic personal financial management.

But it’s not good enough for more detailed financial analysis or even for business financial management.

2. Using Accounting Software

For more advanced categorization and reporting, small business owners often turn to accounting software like QuickBooks, Xero, or FreshBooks that helps them keep track of their business expenses.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 2 quickbooks online how to categorize transactions](https://www.docuclipper.com/wp-content/uploads/quickbooks-online-how-to-categorize-transactions-1440x812.png)

These programs allow you to set up a customized chart of accounts with granular categories like “Printing – Business Cards”, “Legal Fees”, or “Contract Labor – Design Work”. You can track income and expenses in the detail you need.

The key benefits of using accounting software include:

- Custom categories – Easily categorize your business expenses. Track the specifics you care about. (Learn more about business expense categories.)

- Integration – Seamlessly integrate bank/CC statements to auto-sync your latest transactions.

- Reporting – Generate financial reports filtered by your custom categories, like analyzing legal fee expenses over time.

- Multi-user access – Share categorized data with tax preparers or business partners through the cloud.

However, there are also some disadvantages of using accounting software for transaction categorization:

- Learning curve – The software may have a steep learning curve, especially for setting up the chart of accounts and categorization rules. Can take time to master.

- Data entry – Unless bank/CC accounts are integrated, transaction data must be entered manually. Can be time-consuming.

- Cost – Many of the robust accounting platforms have a monthly subscription fee. Can be a hit to the budget for very small businesses.

Overall, accounting software provides robust categorization and reporting capabilities but does require an investment of time and money to learn and implement effectively.

The power of customized categories and analytics reports makes it a worthwhile investment for many businesses seeking more control and visibility into their finances.

For more information read our other guides:

- How to Manually Import Bank Transactions Into QuickBooks Online

- How to Manually Import Bank Transactions into QuickBooks Desktop

- How to Manually Import Credit Card Transactions Into QuickBooks Desktop

- How to Manually Import Credit Card Transactions into QuickBooks Online

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 3 Horizontal Poster Transaction Categorization](https://www.docuclipper.com/wp-content/uploads/Horizontal-Poster-Lead-Magnet-TC.png)

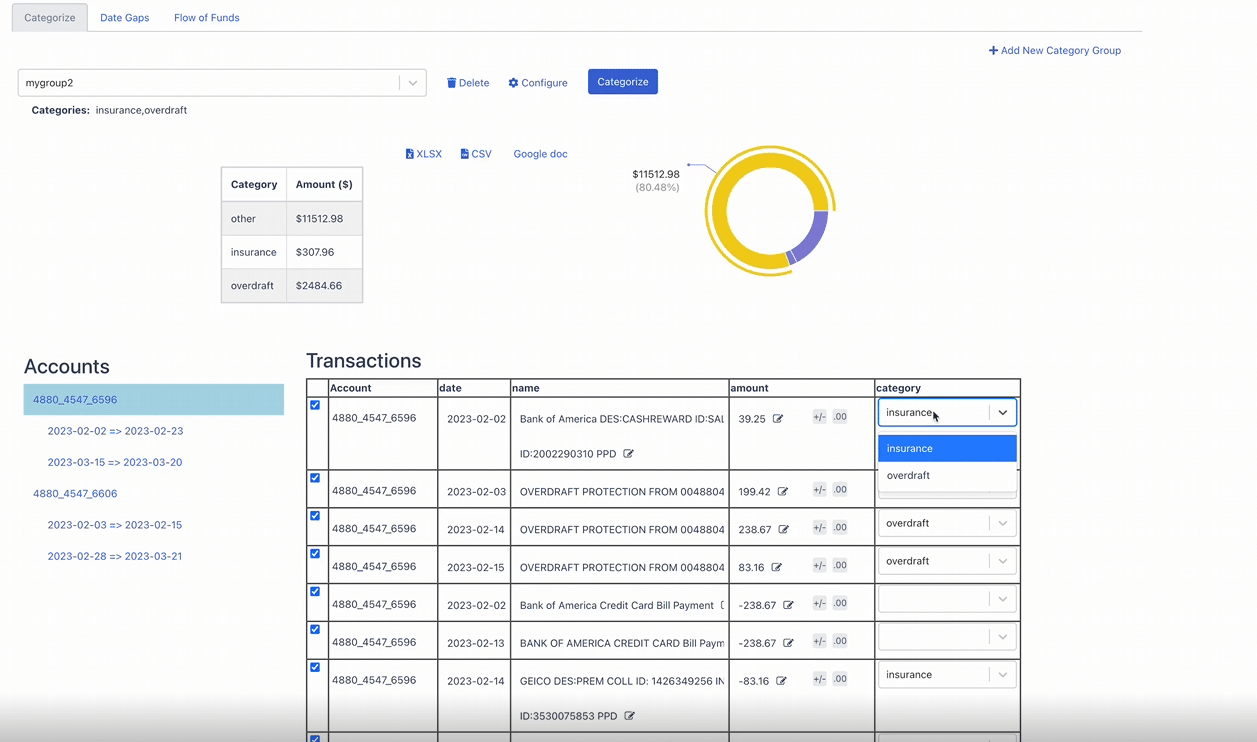

3. Using Bank Statement Converter

Manually entering and categorizing transactions from PDF bank and credit card statements can be tedious and time-consuming. That’s where bank statement converters can help. Learn the difference between credit card and bank statements.

A Bank statement converter is a tool that automatically converts PDF statements into editable, categorized formats like Excel. This eliminates the need for manual data entry.

This is especially useful for individuals who work with paper or PDF bank statements and conduct bank statement analysis, import bank transactions into accounting software, or for anything else.

Some key benefits of using a bank statement converter include:

- Bypass manual entry – The PDF is automatically converted into an Excel file with your transaction data.

- Accurate conversion – Advanced OCR technology accurately parses transaction details without human error.

- Saves time – Converting and categorizing statements takes minutes versus hours of manual work.

- Easy editing – The converted Excel file allows you to quickly review, edit, and recategorize transactions as needed.

- Export options – Easily export the converted data into accounting software or other formats.

For example, with DocuClipper you can easily categorize your bank transactions from PDF bank statements, giving you quick access to data without manual data entry.

Additionally, you can upload your vendor list into the DocuClipper Transaction Categorization feature to quickly categorize your bank transactions.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 5 upload vendor categorization csv file docuclipper](https://www.docuclipper.com/wp-content/uploads/upload-vendor-categorization-csv-file-docuclipper-1440x773.png)

Using a reliable bank statement converter eliminates the most tedious parts of transaction categorization – the manual entry and reconciliation. The exported Excel data is then easy to work with and categorize further.

4. Using Budget Apps

In addition to accounting software, there are many user-friendly budgeting apps that can help categorize transactions. Popular options include Mint, YNAB (You Need A Budget), PocketGuard, and EveryDollar.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 6 Mint App spend by category categorize transactions](https://www.docuclipper.com/wp-content/uploads/Mint-App-spend-by-category-categorize-transactions.png)

These apps can connect to your bank and credit card accounts to automatically import and categorize transactions. Some key benefits include:

- Automatic syncing – Transactions are automatically downloaded from accounts, eliminating manual entry.

- Spending insights – Advanced algorithms categorize transactions to provide insights on spending habits.

- User-friendly – Simple interfaces make viewing categorized transactions easy for beginners.

- Mobile access – Budget apps typically have iOS and Android apps for categorization on the go.

- Free options – Many basic budgeting apps are free or low-cost.

For example, an app like Mint will automatically sync all your transactions and place them in categories like groceries, mortgages, utilities, restaurants, etc.

You can view spending trends by category and monitor your budget making it an effective tool for managing your finances.

The key limitation is that budget apps generally use preset categories that can’t be customized. But if you just need a quick snapshot of spending by common categories, budget apps provide an easy solution.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 7 Lead Magnet AI eBook Horizontal](https://www.docuclipper.com/wp-content/uploads/Lead-Magnet-AI-eBook-Horizontal.png)

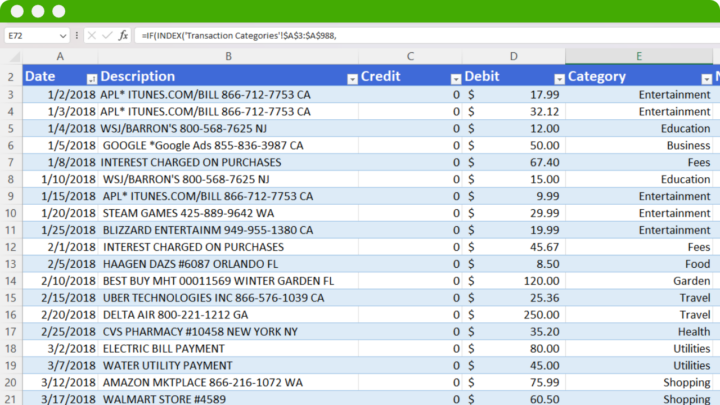

5. Using Excel

Another way is you can categorize your bank transactions in Excel.

Download our credit card and bank transaction Excel template.

For those who want maximum customization in categorizing transactions, Excel provides a versatile solution. By setting up a well-designed spreadsheet, you can categorize transactions with formulas, formatting, and more.

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 8 using excel to categorize transactions](https://www.docuclipper.com/wp-content/uploads/using-excel-to-categorize-transactions.png)

Some key benefits of using Excel include:

- Customization – Tailor categories and layout to your exact preferences. Add or remove columns as needed.

- Formulas – Use formulas like VLOOKUP to auto-categorize based on keywords, amounts, etc.

- Formatting – Highlight categories through conditional formatting for quick visual analysis.

- Charts – Plot categorized spending into charts and graphs for insights.

- Pivot tables – Rearrange summarized data by your categories of choice.

While Excel lacks a direct bank connection, there are several efficient ways to get your transaction data into a spreadsheet:

- Export transactions directly from your bank account.

- Convert PDF statements using a tool like DocuClipper.

- Export categorized transactions from accounting software.

Once the data is in Excel, here are some tips for categorizing:

- Set up columns for Transaction Date, Posting Date, Description, Original Category, Amount, and New Category.

- Use LOOKUPs or VLOOKUPs to auto-tag categories based on keywords or amounts.

- Add drop-down lists to limit categories and prevent errors.

- Use color formatting for quick visual analysis of categories.

- Rearrange with pivot tables.

With some formulas and formatting, Excel provides flexible DIY categorization and reporting solution enabling you to categorize your business expenses in Excel and income. The manual work pays off in customization.

6. Manually Categorizing Transactions

The most traditional approach to categorizing transactions is still printing out paper bank and credit card statements and highlighting or noting categories by hand.

However, manual data entry is time-consuming and prone to errors. In fact, humans on average make 100x more mistakes than automated data entry systems. (Data entry statistics)

![How to Categorize Transactions for Bank and Credit Card Statements [6 Ways] 9 error rate humans vs automation per 10000 data entries](https://www.docuclipper.com/wp-content/uploads/error-rate-humans-vs-automation-per-10000-data-entries.png)

Here is a brief overview of manually categorizing transactions:

- Print statements – Print out or download PDF copies of your monthly statements. Have paper copies to work with.

- Highlight categories – Go through each transaction and highlight with colored pens or markers to designate categories.

- Write notes – Jot down category names or codes next to any unclear transactions.

- Input to software – Manually enter the categorized transactions into accounting software or Excel.

Benefits:

- Complete control over the categorization process without relying on software or algorithms.

- Ability to create new one-off categories on the fly for unique transactions.

Drawbacks:

- Extremely time-consuming to print, highlight, and manually input transactions.

- Prone to human error in data entry or inconsistent categorization.

- Difficult to analyze data without re-entering into software.

While manual categorization works in a pinch, it lacks efficiency and consistency. For most businesses, automated or software-assisted categorization is worth implementing to save time and improve accuracy.

Conclusion

Categorizing transactions is essential for gaining insights from your financial data. As discussed, there are various methods from software tools to manual highlighting. Overall, the most efficient categorization leverages automation through bank integration, accounting software, or converters, combined with human oversight for accuracy.

While services like Mint provide hassle-free categorization, the lack of customization leaves gaps. On the other hand, manual methods are thorough but extremely time-consuming. The ideal approach export bank data into accounting software or Excel using an accurate converter tool. This balances automation with custom categorization for optimal efficiency and accuracy.

The key is finding the right process that fits a business’s needs and resources.

Try DocuClipper Bank Statement Converter

Tired of manual data entry from PDF bank statements? Experience the OCR efficiency and OCR accuracy of the DocuClipper Bank Statement Converter. Try it today and revolutionize your transaction categorization process!

Related Articles

- How to Convert PDF to QBO Format Easily & Automatically

- How to Do Bank Statement Reconciliation (Manually & Automatically)

- 9 Biggest OCR Limitations and How to Overcome Them

- How to Import Bank Statements into QuickBooks Online: Easy Step-by-Step Guide

A Step-by-Step Guide to Import Bank Statements into QuickBooks Desktop

- How OCR Data Entry Works and Helps Businesses

- Benefits of OCR for Family Law Industry