Dive into our comprehensive guide on bank statements, a crucial yet often overlooked financial tool.

We’ll demystify what a bank statement is, its importance, and how to effectively use it for personal and business finances.

Learn how to read, obtain, and convert your bank statements, and understand their role in fraud detection, loan applications, and more.

Whether you’re a financial novice or a seasoned pro, this guide is a must-read to enhance your financial literacy.

Get ahead in accounting with AI innovations – our eBook explains all!

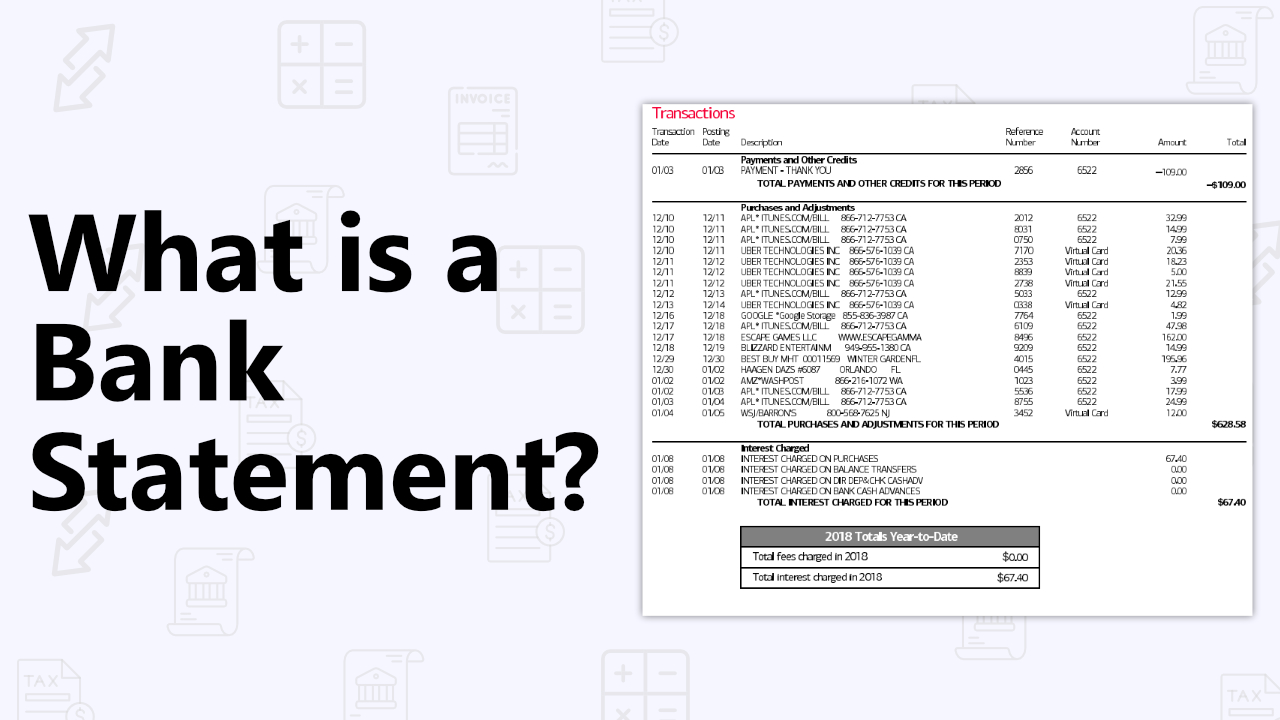

What Is a Bank Statement?

A bank statement, also known as an account statement, is an official document provided by your bank. It is typically issued on a monthly basis and encapsulates all the bank transactions in your account for that given period.

This comprehensive summary includes all your financial transactions, such as deposits, withdrawals, and accrued interest, along with the opening and closing balances for the period.

This document serves as a ledger of your monetary activities. Regular examination of your bank statements can assist in tracking expenses, spotting potential accounting discrepancies, and identifying fraudulent activities.

Bank statements also include vital account information, such as account numbers.

Why Bank Statement is Important?

Bank statements hold significant value, whether for personal financial management or business operations.

The reasons for their importance, however, can vary based on the context.

Let’s discover why bank statements are crucial for both personal and business finances.

Personal Bank Statements

Bank statements serve as a vital tool for account holders, offering a detailed record of all financial activities. This enables you to easily track your expenses, prevent any fraud or even mistakes, and even ensure that you got your refunds back.

Just think about the moments when you had to follow up with a company to get your refund back. Is there any time you could possibly forget about the refund?

By regularly analyzing your bank statements, above mentioned risks can be minimized.

With that, there are more reasons why bank statements are important, and here are some key reasons:

- Financial Tracking: Bank statements allow you to monitor your financial habits, identify potential errors, and understand your spending patterns. Regularly verifying your bank account can ensure your records align with the bank’s, reducing the risk of overdraft fees and errors.

- Fraud Detection: Regularly reviewing your bank statements can help you detect any unauthorized transactions on your account, enabling you to alert your bank immediately. In some cases, individuals might come across fake bank statements, and being vigilant can significantly reduce the risk of financial fraud and potential monetary loss.

- Dispute Resolution: Should any inconsistencies arise in your bank statement, they should be promptly reported to the bank. Typically, account holders have a 60-day window from their statement date to dispute any errors.

- Secure Personal Information: Bank statements contain sensitive personal information, including your name, account number, and address. It’s essential to store your bank statements securely and dispose of them appropriately to prevent potential fraudulent activities.

- Financial Management: Bank statements provide a comprehensive list of transactions, including account balances, penalties, charges, and settlements. This transparency helps account holders avoid surprise charges and spot unauthorized transactions, making account management easier and hassle-free.

Business Bank Statements

Bank statements hold significant importance not just for individuals, but they are absolutely vital for businesses.

Given the nature of businesses, where multiple individuals often have access to the business bank account for various expenditures, the need for meticulous tracking of bank statements becomes even more crucial.

Here’s why:

- Financial Analysis: Bank statements provide businesses with a detailed record of all bank transactions, which can be used for financial analysis. This can help businesses understand their cash flow, identify trends, and make informed financial decisions.

- Budgeting and Forecasting: Regular review of bank statements can help businesses track their income and expenses, which is essential for effective budgeting and financial forecasting.

- Tax Preparation: Bank statements are a valuable resource during tax season. They provide a record of all financial transactions, which can be used to verify income and expenses when preparing tax returns.

- Loan Applications: When applying for a business loan, banks often require copies of bank statements. These statements show the financial health of the business and help lenders determine the business’s ability to repay the loan.

- Fraud Detection: Regularly reviewing bank statements can help businesses spot any unauthorized transactions or irregularities, which could indicate fraudulent activity.

- Record Keeping: For businesses, keeping accurate records is not just good practice—it’s often a legal requirement. Bank statements provide an official record of all transactions, which can be crucial for audits or legal proceedings.

- Accounting Software: Bank statements are often used to import bank transactions into your accounting software. This integration can streamline the accounting process, reduce manual data entry, and improve the accuracy of your financial records.

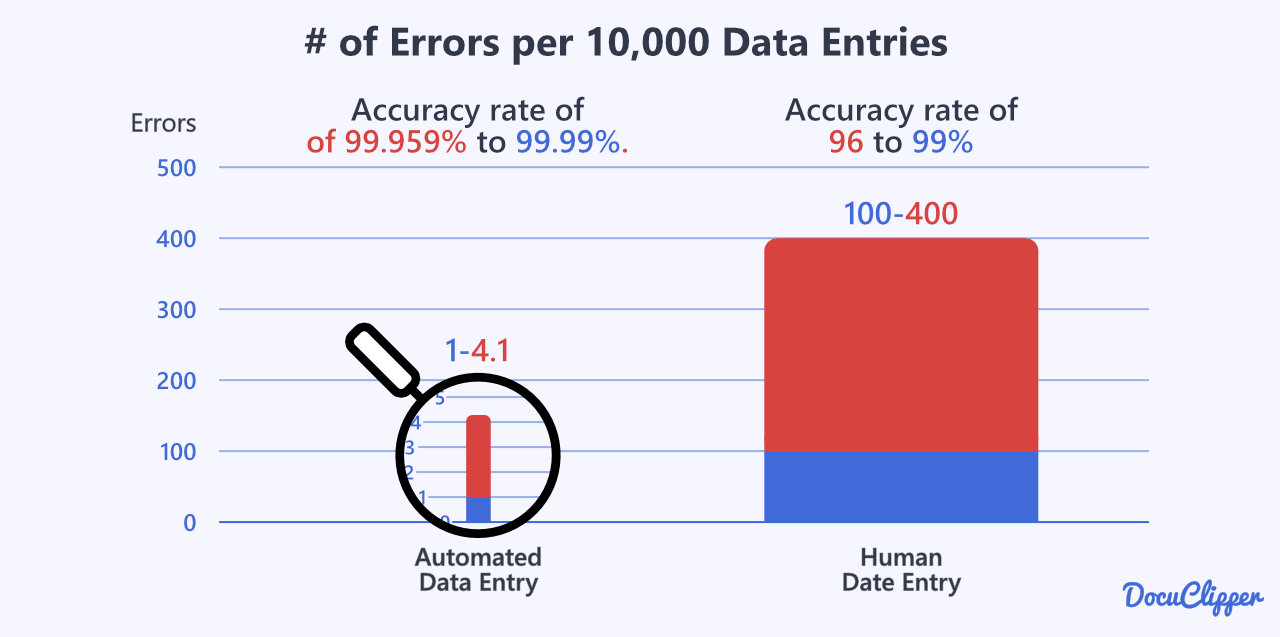

In fact, Humans make 100x more data entry errors compared to automated data entry systems. (data entry statistics)

Overall, bank statements are essential documents for both personal and business use as they help you to better track, analyze, and manage your financials.

Additionally because of around 70% of small businesses don’t have an accountant and 60% of small business owners feel they aren’t knowledgeable when it comes to accounting, it’s even more important to understand bank statements. (Accounting statistics)

That’s why you should make sure that you’re checking your financial records with bank statements on a regular basis to avoid any financial losses.

Electronic Bank Statements

Electronic Bank Statements, often referred to as EBS, are digital versions of traditional paper bank statements. They are typically sent to account holders via email or can be accessed and downloaded through the bank’s online banking platform.

EBS work by digitizing the information traditionally found on a paper bank statement. This includes account balances, descriptions, dates, transaction history, and any other notices or information from the bank.

The digital format allows for this information to be accessed and managed electronically, which can offer a range of benefits.

Benefits of Electronic Bank Statements

The importance and benefits of Electronic Bank Statements lie in their convenience, accessibility, environmental friendliness, and versatility:

- Convenience: EBS can be accessed anytime and anywhere, as long as you have internet access. This means you don’t have to wait for a paper statement to arrive in the mail.

- Accessibility: EBS are usually stored in your online banking account, allowing you to access past statements easily. This can be particularly useful when preparing for tax season or when you need to check historical transactions.

- Environmentally Friendly: By choosing EBS, you’re reducing the need for paper, which contributes to environmental conservation.

- Versatility: EBS can be easily integrated into various financial management software, making it easier to manage and analyze your finances.

Get ahead in accounting with AI innovations – our eBook explains all!

Types of Electronic Bank Statements

There are different types of EBS, and the availability may vary depending on the bank:

- PDF Bank Statements: These are the most common type of EBS and are a direct digital version of a paper statement. They can be downloaded and stored on your computer or printed if necessary.

- CSV or Excel Statements: Some banks offer statements in CSV or Excel format. These can be useful for those who want to analyze their transactions in more detail, as the data can be easily manipulated in a spreadsheet. However if not, then DocuClipper can convert PDF bank statements to Excel or CSV.

- OFX or QFX Statements: These formats are designed to be imported directly into financial software like Quicken. They can be a time-saver for businesses or individuals who use such software for their financial management.

- CAMT 053 and CAMT 054 Statements: CAMT 053 and CAMT 054 are specific types of XML-based bank statement formats. They’re standards used in many European countries and provide detailed information about each transaction. These formats can be particularly useful for businesses that need to automate their reconciliation process. (Learn more)

- MT940 Statements: MT940 is an international standard for electronic bank statement files. It’s widely used by banks across the world and provides a consistent, structured format for transaction data. (Learn more)

- BAI2 Statements: BAI2 is a file format used by many banks to deliver electronic bank statement data. It’s particularly popular in the United States and provides detailed, categorized transaction data. (Learn more)

Bank Fees and Bank Statements

Bank statements serve as more than just a record of transactions; they are a critical tool for understanding the various bank fees charged by your bank.

These fees can include everything from monthly maintenance charges and ATM fees to the widely debated overdraft fees.

Here are some key points to understand about bank fees and their representation in bank statements:

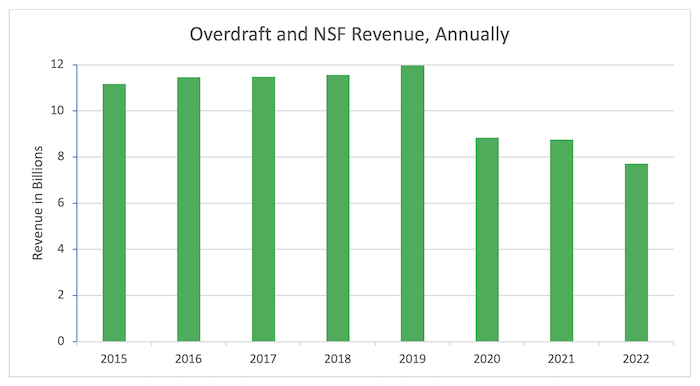

- Overdraft Fees: These fees are charged when a transaction exceeds the available balance in your account. Despite recent reductions, these fees can still pose a significant financial burden. In 2022, consumers paid over $7.7 billion in overdraft/NSF fees. Source.

- Monthly Maintenance Fees: These are fees charged by some banks for the upkeep of your account. They are usually waived if certain conditions are met, such as maintaining a minimum balance.

- ATM Fees: If you use an ATM that is not in your bank’s network, you may be charged a fee. These fees can add up over time and should be monitored closely.

- Other Fees: Banks may charge various other fees, such as for paper statements or cashier’s checks. It’s important to review your bank statement regularly to understand these charges.

What I am trying to say here is bank statements are an essential tool for understanding and managing bank fees.

Regular review of these statements can help you identify and avoid unnecessary charges, ultimately saving you money.

After all, nobody enjoys paying “junk fees”.

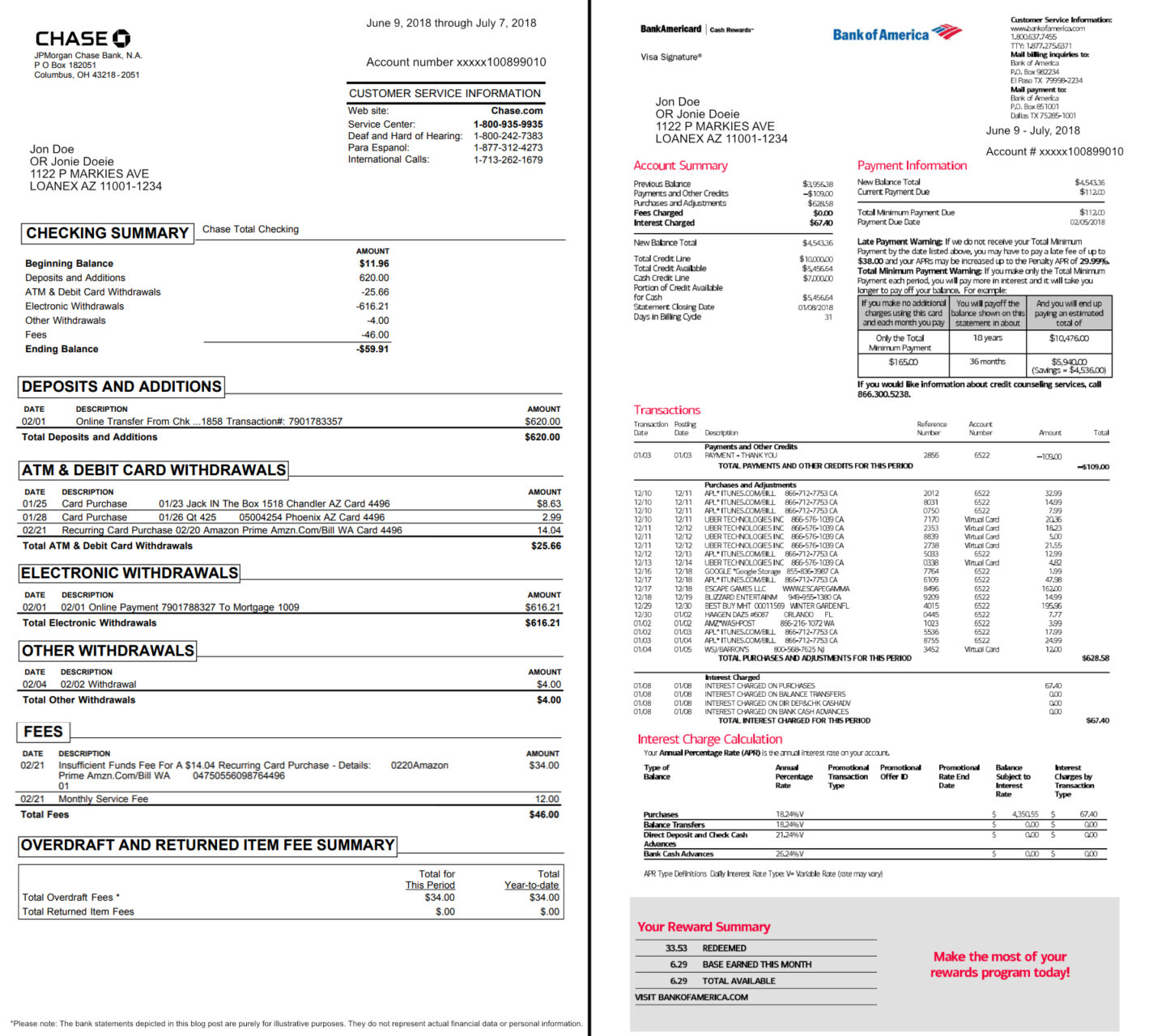

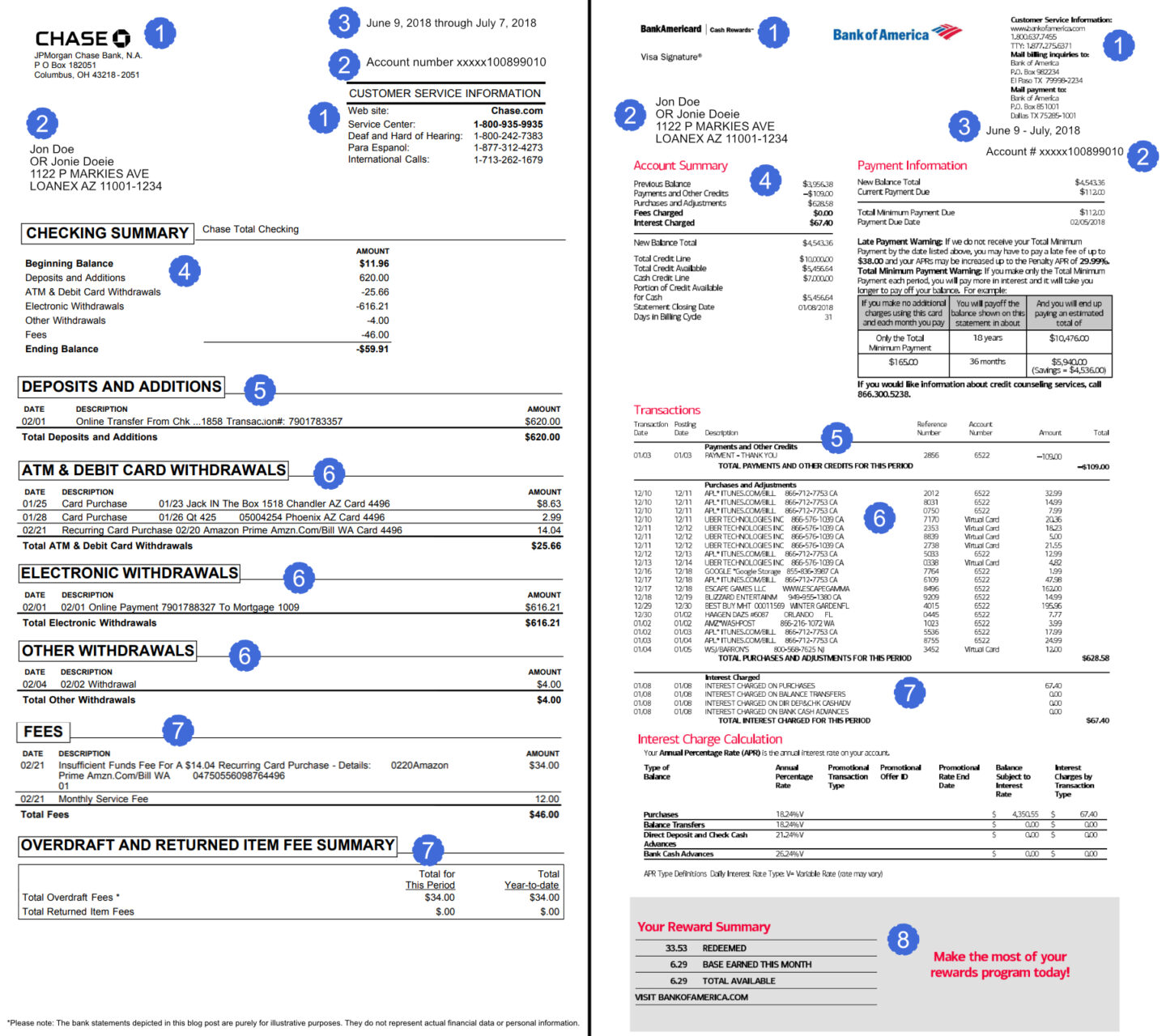

How to Read and Understand Bank Statement?

Knowing how to read and understand bank statements is an important skill for anybody who wants to better manage financials.

They are designed to provide a detailed overview of your financial activities, and each section serves a specific purpose.

Here’s a breakdown of the key components of a bank statement and how to effectively read and comprehend each section:

- Bank Information: This includes the bank’s name, address, and contact information.

- Account Information: This section contains your name, address, and account number.

- Statement Period: This indicates the start and end dates for the transactions listed on the statement.

- Opening/Closing Balance: The opening balance is the amount of money in the account at the beginning of the statement period, while the closing balance is the amount at the end of the period.

- Deposits: This section lists all the deposits made into the account during the statement period. Each entry typically includes the date of the transaction, a description, and the amount credited to the account.

- Withdrawals: This section lists all the withdrawals made from the account during the statement period. This can include ATM withdrawals, checks, and debit card purchases. Similar to the deposits section, each withdrawal entry will typically include the date, a description, and the amount debited from the account.

- Fees: Any fees charged by the bank, such as monthly service fees or overdraft fees, will be listed in this section.

- Interest Earned: If your account earns interest, the amount earned during the statement period will be listed here.

By understanding these components, you can effectively read and interpret your bank statement, allowing you to better manage your finances and spot any potential errors or fraudulent activities.

Remember, your bank statement is more than just a piece of paper or a digital document—it’s a powerful tool for financial management.

Furthermore, we recommend getting yourself familiar with some of the commonly used bank statement abbreviations.

How to Get a Bank Statement?

Getting your bank statements is becoming easier and easier.

The majority of banks now provide online banking services, enabling customers to view and download their bank statements with ease and convenience, right from their homes.

This not only saves time but also allows for immediate access to your financial information whenever you need it.

Here’s a general step-by-step guide on how to obtain your bank statement online:

- Log into your account: Access your online banking account by entering your login credentials.

- Select the appropriate account: Navigate to the “Accounts” menu or your home screen and select the account for which you need the statement.

- Go to the Statements & Documents section: Look for a section titled “Statements”, “Documents”, “Account Statements”, or something similar.

- Choose the desired statement period: Select the statement for the period you need.

- Download or print the statement: Look for an option to download or print your statement and proceed accordingly.

Please remember that these steps may slightly vary depending on your bank’s website or online banking system. Always ensure that you are on the official bank website and that your connection is secure when accessing your bank statements.

If you are not currently an Online Banking customer, you can typically enroll in Online Banking on your bank’s website.

Lastly, it’s important to note that the exact process may differ depending on the specific bank. Therefore, it is advisable to follow the instructions provided by your bank for accessing and downloading bank statements.

In case your bank account is already closed, then you can read our guide on how to get bank statements from a closed account.

Get ahead in accounting with AI innovations – our eBook explains all!

How to Convert Bank Statement to Excel, CSV?

One common task that individuals and businesses often need to perform is converting bank statements into a more manageable format, such as Excel or CSV using bank statement OCR technology.

This process can be time-consuming and complex, but with the right tools, it can be simplified.

Here, we’ll walk you through how to convert bank statements to Excel or CSV using DocuClipper, a tool designed to make this task straightforward and efficient.

-

Select the Bank Statement Converter

Log into DocuClipper and choose the “Bank & Credit Card Statements” option. Drag and drop your bank statements into the platform. DocuClipper can process both text and scanned bank statements using OCR technology.

-

Automatic Transaction Extraction

Once you click on ‘convert’, DocuClipper extracts all the transactions from your bank statements, including additional data like balances, dates, and account numbers.

-

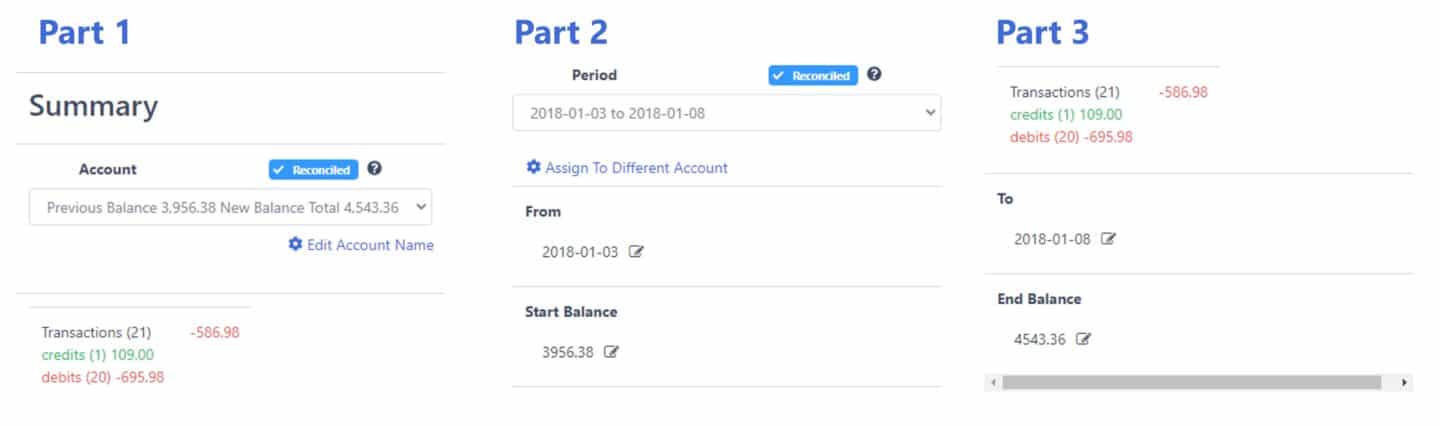

Reconcile the Bank Statements

DocuClipper automatically reconciles the bank statements by comparing transaction totals to summary information. You can check the reconciliation status on the summary table.

-

Convert Bank Statement to Excel or CSV

lick on “Download data” and select either “Excel” or “CSV” as the output format. The converted file will be downloaded to your computer with all bank extracts.

-

Configure the Output Format

With DocuClipper, you can customize the output by choosing which columns to include. Supported fields include “date”, “amount”, “debit”, “credit”, “balance”, “account number”, and more.

Converting PDF bank statements to Excel or CSV can save significant time and effort, and DocuClipper makes this process easy with its automatic bank statement recognition feature.

Learn more here:

- How to Convert Bank Statements to Excel or CSV

- How to Convert Credit Card Statements to Excel or CSV

- How to Import Bank Statements into QuickBooks Online

- How to Import Bank Statements into QuickBooks Desktop

How Long Do Banks Keep Bank Statements?

Banks are required by federal law to keep most records on file for at least five years. This includes bank statements, canceled checks, and other account-related documents. Banks may retain these records for longer periods if they choose to do so.

It’s important to note that while banks have these requirements, it’s also a good idea for you to keep your own records.

This can be especially useful in situations where you might need to provide financial details, such as:

- Tax purposes: You may need to keep your bank statements for tax purposes for up to seven years. This is because the IRS can audit your tax returns for up to three years after you file them.

- Dispute resolution: If you have a dispute with your bank, you may need to provide your bank statements as evidence. In some cases, you may need to keep your bank statements for up to ten years.

- Loan applications: If you apply for a loan, you may need to provide your bank statements to the lender. This is so that the lender can assess your financial history and determine whether you are a good credit risk.

With that being said, while banks do keep records of your bank statements, it’s always a good idea to keep your own copies for easy access and to ensure you have them when needed.

How to Reconcile a Bank Statement?

Reconciling bank statements is a crucial task for maintaining accurate financial records. It involves comparing your internal record of transactions and balances with your bank’s record.

Here’s a general guideline on how to do it manually:

- Collect Your Documents: Gather your bank statement and a record of your transactions for the corresponding period.

- Compare Balances: Start by verifying that the ending balance of your bank statement matches the current balance of your bank account according to your records.

- Match Transactions: Go through each transaction on your bank statement and match it with the transactions in your record. This includes deposits, withdrawals, and any fees or charges.

- Identify Discrepancies: If there are any transactions listed on your bank statement that doesn’t match your records, identify and investigate these discrepancies. They could be due to timing differences, errors, or unauthorized transactions.

- Update Your Records: Once you’ve identified and understood the discrepancies, update your records to reflect the correct information. This might involve adjusting for bank fees or charges that you hadn’t previously recorded, or adding transactions that were missing from your records.

- Repeat Regularly: Reconciliation should be done regularly to ensure that your financial records are accurate and up-to-date. The frequency will depend on the volume of transactions and the specific needs of your business.

While manual reconciliation is possible, it can be time-consuming and prone to errors.

This is where tools like DocuClipper can be incredibly useful. DocuClipper automates the reconciliation process, saving you time and reducing the risk of errors.

It compares transaction totals to summary information on the statement.

If everything checks out, the statement is identified as reconciled, saving you time and manual review. You can see the reconciliation status on the summary table.

By automating the reconciliation process, you can focus more on analyzing the data and less on the tedious task of matching transactions. It’s a win-win for efficiency and accuracy.

What is a Bank Statement Used For?

A bank statement serves multiple purposes for both individuals and businesses. Here are some of the key uses:

- Financial Management: Bank statements provide a detailed record of all transactions within a specific period. This allows account holders to track their income and expenses, identify spending habits, and manage their budgets effectively.

- Error Detection and Dispute Resolution: Regular review of bank statements can help identify any errors or discrepancies. If any are found, they can be reported to the bank for resolution. This is crucial in ensuring the accuracy of your financial records.

- Fraud Detection: By reviewing bank statements, account holders can spot any unauthorized transactions and report them to the bank. This can help in mitigating potential financial losses due to fraud.

- Loan Applications: When applying for a loan, lenders often require applicants to provide bank statements. These statements give lenders insight into the applicant’s financial behavior and ability to repay the loan.

- Tax Preparation: Bank statements can be used to verify income and expenses during tax preparation. They serve as a reliable source of financial information, which can be helpful when filling out tax forms.

- Record Keeping: For businesses, bank statements are an essential part of financial record keeping. They provide an official record of all transactions, which can be crucial for audits, financial analysis, and legal proceedings.

- Reconciliation: Bank statements are used in the reconciliation process, where they are compared with the business’s internal records to ensure accuracy.

In summary, bank statements are a versatile tool that plays a vital role in financial management, fraud detection, loan applications, tax preparation, and more.

Regular review and understanding of bank statements can contribute significantly to effective financial management.

Final Words

In summary, a bank statement is an essential document not used by many unless they’re accountants, bookkeepers or lenders.

However, bank statements contain important information and you should be regularly checking bank statements to prevent any loss of money due to any reasons mention above.

It serves as a comprehensive record of your financial activities, providing valuable insights into your spending habits, identifying potential errors, and helping to detect any fraudulent activities.

Regular review of your bank statements is a simple yet effective step towards sound financial management.

Don’t let this vital tool go underutilized – make it a habit to check your bank statements regularly to safeguard your financial health.

Convert PDF Bank Statements with DocuClipper

Ready to simplify your financial management? Try DocuClipper today! Our platform makes it easy to convert, reconcile, and analyze your bank statements, saving you time and effort.

With DocuClipper, you can focus on what truly matters – growing your wealth and securing your financial future. Start your free trial today and experience the difference!

Frequently Asked Questions Related to Bank Statements

In this section, we’re going to answer commonly asked questions regarding bank statements, their use, and purpose:

What happens if you don’t have a bank statement?

If you don’t have a bank statement, you may lack a comprehensive record of your financial transactions for a given period. This could make it harder to track your spending, identify fraudulent activity, or resolve disputes. It could also pose challenges when applying for loans or preparing taxes, as bank statements are often required for these processes. However, most banks allow you to access past statements online or request copies.

How often do you get bank statements?

Bank statements are typically issued on a monthly basis, providing a detailed record of all transactions within that period. However, the frequency can vary depending on the bank and the type of account. Some banks may offer quarterly statements or allow you to choose your preferred frequency. Online banking platforms often allow you to access your statement information at any time.

How do I print my bank statement?

To print your bank statement, log into your online banking account and navigate to the ‘Statements’ section. Select the statement you want to print, open it, and click the ‘Print’ button. Ensure your printer is connected and configured correctly. Remember, the exact steps may vary depending on your bank’s online interface.

How do I get a bank statement?

To get a bank statement, log into your online banking account, navigate to the ‘Statements’ or ‘Documents’ section, and select the statement period you need. You can then download or view the statement. If you prefer paper statements, you can request them from your bank. The exact process may vary depending on your bank’s policies and online banking system.

Why do you need a bank statement?

A bank statement is essential for tracking your financial activities, detecting any unauthorized transactions, and managing your budget effectively. It’s also used for loan applications, tax preparation, and dispute resolution. For businesses, bank statements are crucial for financial analysis, budgeting, record-keeping, and reconciliation. Regular review of bank statements ensures the accuracy of your financial records.

Can I print a bank statement from the bank?

Yes, you can print a bank statement at the bank. Most banks offer this service at their local branches. You may need to provide identification and account details. Some banks may charge a fee for this service, especially for older statements. It’s advisable to contact your bank for specific procedures and requirements.

How long does it take to get a bank statement?

Typically, banks generate statements at the end of each monthly cycle, so it can take approximately 30 days to receive a new statement. If you’re requesting an older statement, it might be available immediately online, or it could take a few days to a week if the bank needs to mail it to you. The exact timing can vary depending on the bank’s policies and procedures.

Can a bank refuse to give you a statement?

No, a bank cannot refuse to provide you with a statement for your account. Banks are legally required to provide periodic statements. However, they may charge a fee for providing additional or older statements. If you’re having trouble obtaining a statement, it’s recommended to contact your bank’s customer service for assistance.

Do you have to pay to get a bank statement?

While most banks provide regular bank statements for free, some may charge a fee for additional or older statements. The cost can vary depending on the bank and the specific request. However, many banks offer free online access to statements, allowing customers to view, download, and print their statements at no extra cost. Always check your bank’s policy to understand any potential charges.

Do banks still send paper statements?

Yes, many banks still send paper statements to their customers. However, with the rise of digital banking, most banks also offer the option of electronic statements. Customers can usually choose their preferred method of receiving statements through their bank’s online banking platform.

What does a bank statement include?

A bank statement includes the bank’s name, account holder’s information, statement period, opening and closing balances, deposits, withdrawals, fees, and any interest earned. It provides a detailed record of all transactions made during a specific period.