In the world of finance, efficiency is key. That’s where bank extracts come in. These structured, machine-readable files can transform the way you handle financial data.

In this post, we’ll explore what bank extracts are, how they’re used in various industries, and the top software for creating them.

What is a Bank Extract?

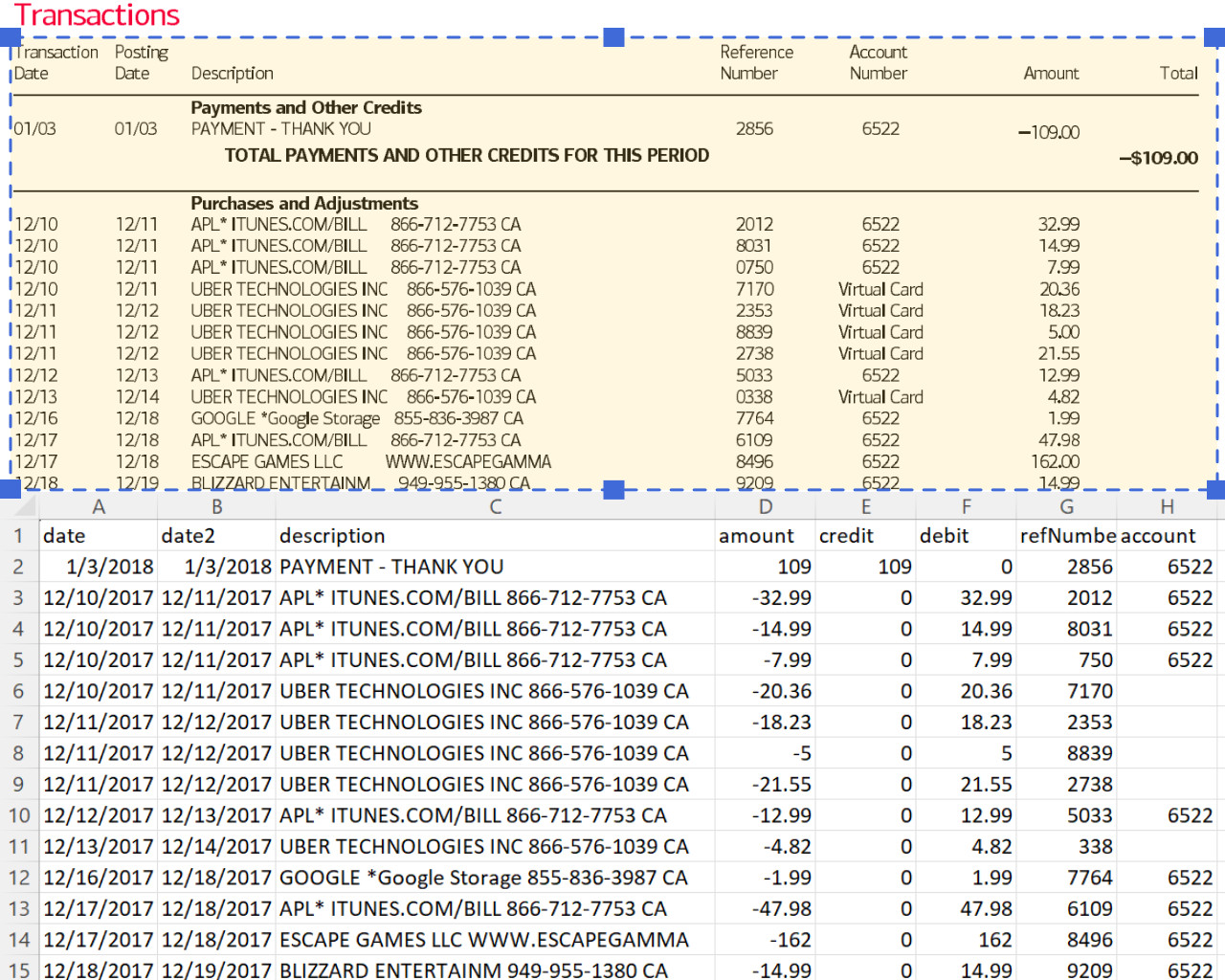

A bank extract refers to bank transaction data extracted from a bank statement. Usually provided in a structured, machine-readable format such as CSV or XLS. This process involves converting the transaction data from bank statements, which may be in paper or PDF format, into a structured data format be it manually or using software that can be easily analyzed, processed, and/or imported into accounting software.

Bank extracts contain all the transactional information from the bank statement, including the date, description, amount, account number, and whether the transaction was a debit or credit.

The key advantage of a bank extract over a traditional bank statement is that it allows for easier data manipulation and bank statement analysis, making it a valuable tool for businesses, accountants, lenders, and financial analysts.

Bank Extract vs Bank Statement

While both bank extracts and bank statements provide valuable information about banking transactions, they serve different purposes and are used in different contexts.

Understanding the differences between these two can help individuals and businesses make more informed decisions about their financial management.

Bank Statement

A bank statement is a comprehensive record provided by the bank that details all transactions in an account over a specific period, usually a month. It includes deposits, withdrawals, bank fees, and any other transactions that affect the account balance.

Bank statements are typically provided in a PDF format, although they can also be accessed online or received as paper statements.

Bank statements are essential for account holders to monitor their account activity, verify transactions, and track their spending.

They are also often required for various business financial processes, such as applying for business loans, preparing business tax returns, or conducting financial audits.

Bank Extract

A bank extract, on the other hand, is a structured, machine-readable extraction of all transactions contained within a bank statement. It is usually provided in a format such as CSV or XLS, which allows for easy data manipulation and analysis.

While a bank statement provides a static record of transactions, a bank extract allows businesses to interact with the data more dynamically.

Businesses can sort transactions, filter them based on certain criteria, integrate the data with other financial software for more in-depth analysis, and easily import the transactions into accounting software.

Bank extracts are particularly useful for businesses, accountants, and financial analysts who need to process large volumes of transaction data. Data extraction accounting software can automate the data extraction process, reducing manual data entry, minimizing errors, and saving time.

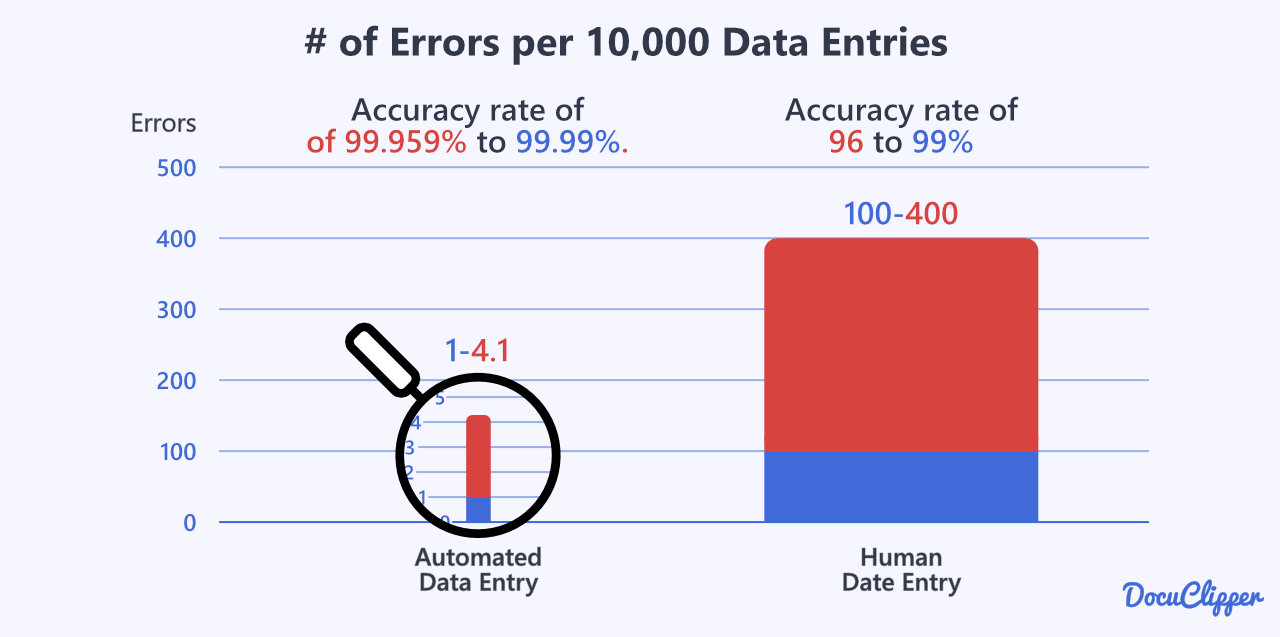

Learn more about the benefits of automated data entry vs manual data entry.

In fact, Humans make 100x more data entry errors compared to automated data entry systems. (data entry statistics)

How to Extract Data from Scanned or PDF Bank Statements

Extracting data from scanned or PDF bank statements can be done manually or automatically. However, the method you choose largely depends on the volume of data you need to process and the resources available to you.

Manual Extraction

The manual method involves copying the headers and transaction information from the bank statement and pasting it into a spreadsheet.

This process can be time-consuming and prone to errors, especially when dealing with a large number of bank statements.

Here are the steps:

- Open the scanned or PDF bank statement.

- Select the headers and copy them.

- Open a new spreadsheet in Excel or a similar program and paste the headers into the first row.

- Go back to the bank statement, select the transaction information, and copy one row and column at a time.

- Paste the transaction information into the spreadsheet under the corresponding headers.

As you can imagine, this is not really an option to manage multiple bank statements.

Automatic Extraction

For businesses that regularly work with bank statements, manual extraction is not an efficient option and 29% of the accounting companies have already implemented the automated accounts payable process to eradicate human labor and increase accuracy. (Accounting statistics)

This is where a bank statement converter or OCR Software for Accounts Payable such as DocuClipper, comes in handy.

This tool can automatically extract data from scanned or PDF bank statements and convert it into a structured format like Excel in seconds, saving you hours or even days of manual work.

Here’s how it works:

- Upload your scanned or PDF bank statement to DocuClipper.

- The software will automatically recognize and extract the transaction data.

- Download the Excel, CSV, or QBO file and integrate it with your financial software or use it for your analysis. Learn more on How to Convert PDF to QBO

To learn more read our detailed guides:

Industries That Often Need Bank Extracts

While every company uses bank statements and/or needs to extract transactions from bank statements, some industries work with bank extracts regularly and they are a big part of their business.

Here are the most common industries that use bank extraction software to improve their business processes:

Accounting & Bookkeeping Firms

Accounting and bookkeeping firms are one of the primary industries that frequently require bank extracts. These firms are responsible for maintaining accurate financial records for businesses, which involves recording and analyzing a large volume of financial transactions.

Bank extracts allow accounting and bookkeeping firms to efficiently manage and process their clients’ financial data. By converting bank statements into a structured format like CSV or XLS, these firms can easily sort, filter, and analyze transaction data.

This can help in tasks such as:

- Reconciling bank statements with the company’s internal financial records.

- Tracking income and expenses for financial reporting.

- Identifying unusual transactions that may indicate fraud.

- Preparing financial statements such as profit and loss accounts and balance sheets.

Given the large volume of bank statements that accounting and bookkeeping firms typically handle, manual data extraction can be time-consuming and prone to errors that’s why using a bank statement converter for accounting and bookkeeping firms is essential for these companies.

Financial Investigators

Financial investigators play a crucial role in uncovering financial crimes, such as fraud, money laundering, and embezzlement. They analyze financial data to detect irregularities, trace illicit funds, and gather evidence for legal proceedings.

Bank extracts are a valuable tool for financial investigators. They provide a structured, machine-readable format of all transactions contained within a bank statement, allowing investigators to easily sort, filter, and analyze transaction data. This can assist in tasks such as:

- Tracing suspicious transactions.

- Identifying patterns that may indicate fraudulent activity.

- Gathering evidence for legal proceedings.

Given the large volume of bank statements that financial investigators typically handle, manual data extraction can be time-consuming and prone to errors. That’s why a bank statement converter for financial investigators is essential for this industry.

Forensic Accounting

Forensic accounting is a specialized field of accounting that combines accounting, auditing, and investigative skills to examine financial statements for signs of potential fraud, misconduct, or financial irregularities.

Forensic accountants are often called upon in legal proceedings to provide expert testimony and to assist in the investigation and detection of financial crimes.

Bank extracts are a valuable tool for forensic accountants allowing forensic accountants to easily sort, filter, and analyze transaction data. This can assist in tasks such as:

- Identifying and tracing fraudulent transactions.

- Analyzing financial data for signs of misconduct.

- Gathering and presenting financial evidence in legal proceedings.

Given the complexity and volume of financial data that forensic accountants typically handle, specialized forensic accounting software is often used to assist in the analysis and investigation process.

Learn more about OCR for forensic accounting.

Business Owners

Business owners, regardless of the size or nature of their businesses, often have to deal with a significant amount of financial data. This includes managing income, expenses, payroll, taxes, and other financial transactions that occur within their business.

Bank extracts are an invaluable tool for business owners allowing business owners to easily sort, filter, and analyze transaction data.

This can assist in tasks such as:

- Tracking income and expenses for financial management and planning.

- Reconciling bank statements with the business’s internal financial records.

- Preparing financial statements and tax returns.

- Identifying patterns and trends in financial data to inform business decisions.

Therefore, for those businesses that often need to extract data from bank statements, using a bank statement converter for businesses can be very important.

Family Law

Family law is a legal practice area that focuses on issues involving family relationships, such as divorce, child custody, and spousal support, among others. Family lawyers often deal with financial matters related to these issues, such as the division of assets in a divorce or determining child support payments.

OCR for family lawyers, allowing lawyers to easily extract, sort, filter, and analyze transaction data.

This can assist in tasks such as:

- Identifying income and expenses for the calculation of child or spousal support payments.

- Tracing assets during the division of property in a divorce.

- Providing financial evidence in court proceedings.

Given the nature of their business, the requirements for detailed, error-free analysis are essential for their clients. That’s why using a bank statement converter for family law practitioners is essential to deliver the best possible outcome for their clients.

Best Bank Statement Extraction Software

After reading part of this article you may realize that you need bank statement extraction software that can efficiently convert bank statements into structured data formats.

Here are some of the best bank statement converters in the market:

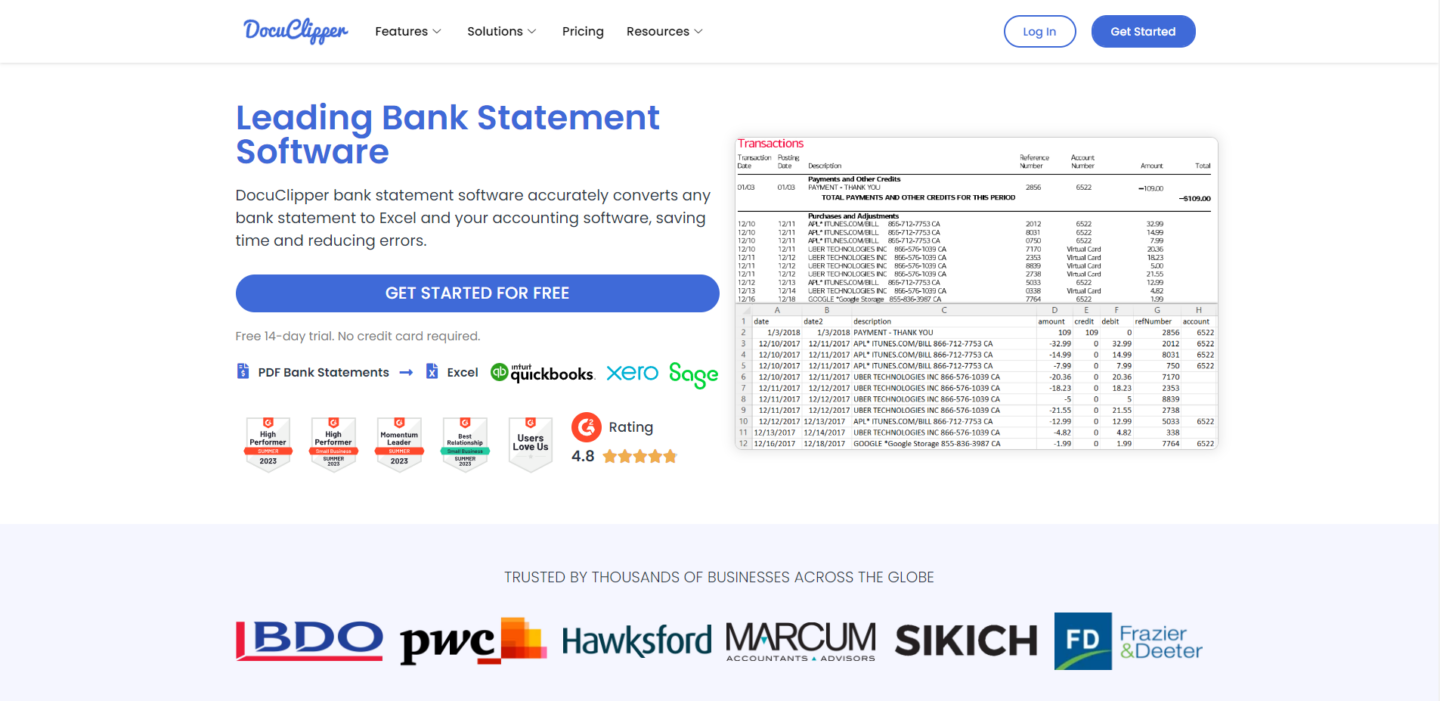

DocuClipper: DocuClipper is known for its robust OCR bank statement capabilities, top OCR accuracy, and speed, ease of use, and lovely customer support. It can automatically extract data from scanned or PDF bank statements and convert it into a structured format like Excel, CSV, or even QBO in seconds. This not only saves time but also ensures accuracy, making it a popular choice among businesses of all sizes.

Dext Prepare: Formerly known as Receipt Bank, Dext Prepare is a powerful tool that extracts data from bank statements and other financial documents. It’s designed to streamline bookkeeping tasks, making it easier to capture, process, and share financial data. (Check out Dext Prepare alternatives.)

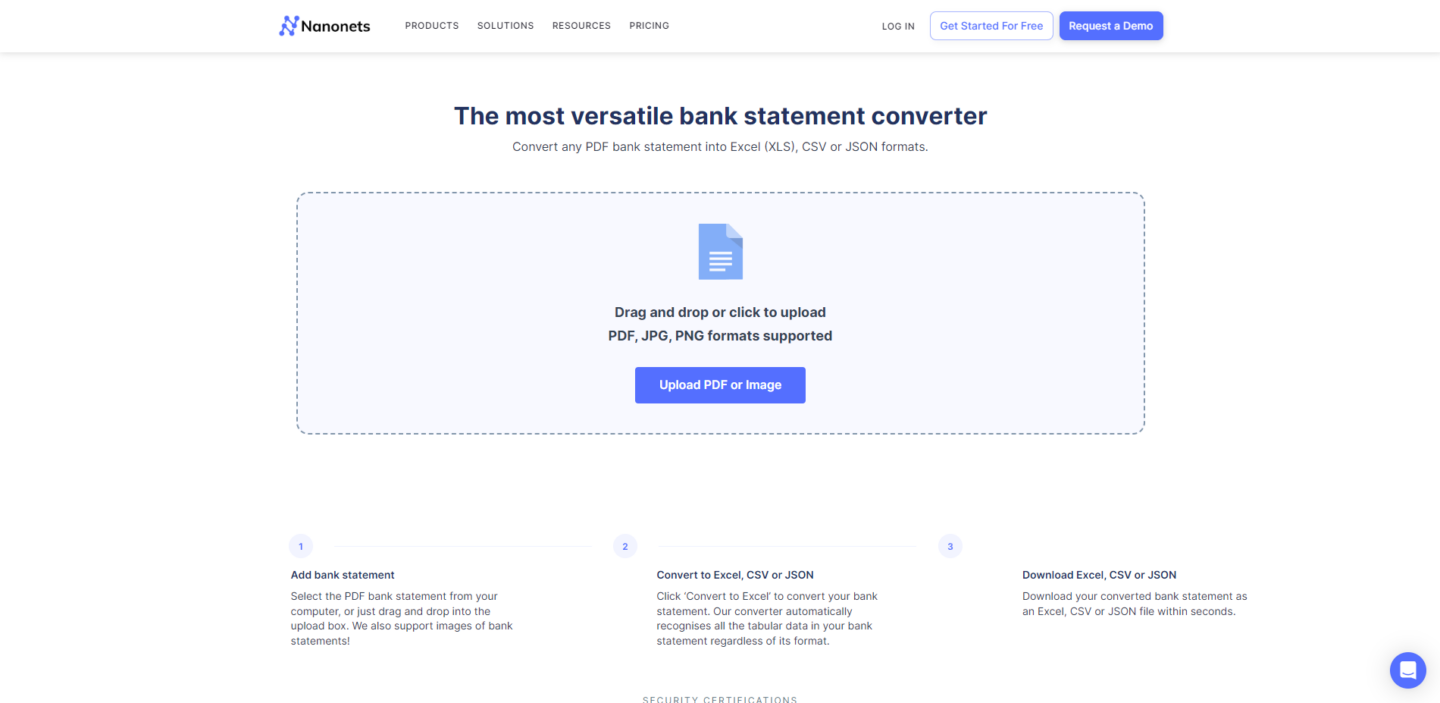

Nanonets: Nanonets use advanced OCR technology to extract data from various types of documents, including bank statements. It’s known for its high accuracy and the ability to handle complex documents. (To learn more visit also Nanonets alternatives or DocuClipper vs Nanonets.)

Docparser: Docparser is a cloud-based document OCR data extraction tool that converts PDF files into structured data. It’s particularly useful for extracting data from bank statements, invoices, and other financial documents. (Check out Docparser alternatives.)

MoneyThumb: MoneyThumb‘s 2qbo Convert Pro is a tool that converts PDF bank statements into QuickBooks-compatible files. It’s a great tool for accountants and bookkeepers who need to import bank transactions into QuickBooks. (Also check MoneyThumb alternatives)

Each of these software solutions has its unique features and benefits. The choice would depend on the specific needs of your business.

The Benefit of Using Bank Extract Software

Using bank extraction software such as DocuClipper has enormous benefits for productivity, reducing errors, all the way to getting to lowering your OPEX, and boosting your revenue.

A Bank statement converter is important for businesses that need to process a lot of bank statements regularly.

Here are the biggest benefits that our customers always mention when they implement DocuClipper.

Convert Scanned or PDF Bank Statements to Excel in Seconds

Bank extract software, such as DocuClipper, uses advanced OCR technology to quickly and accurately convert scanned or PDF bank statements into structured data formats like Excel. This process, which could take hours if done manually, can be completed in seconds, saving businesses valuable time and resources.

Easily Import Bank Extract to Accounting Software

Once bank statements have been converted into a structured data format, the data can be easily imported into accounting software for further analysis and reporting. This seamless integration simplifies the financial management process and ensures that all financial data is easily accessible and up-to-date.

Reduce Errors in Bank Statement Processing

Manual data entry is prone to errors, which can lead to inaccurate financial records and potentially costly mistakes. Bank statement processing software automates the data extraction process, significantly reducing the risk of errors and ensuring the accuracy of the extracted data.

Increase Efficiency and Productivity

By automating the data extraction process, bank extract software allows businesses to process a large volume of bank statements quickly and efficiently. This not only increases productivity but also allows staff to focus on more strategic tasks, such as data analysis and financial planning.

Improve Customer Outcomes

Accurate and timely financial data is crucial for making informed business decisions. By providing a quick and accurate way to extract data from bank statements, bank extract software can help businesses improve their financial management, leading to better customer outcomes.

Conclusion

Understanding and utilizing bank extracts can significantly streamline your financial processes, whether you’re an accounting firm, a business owner, or a financial investigator. The ability to convert bank statements into structured data formats like Excel or CSV not only saves time but also reduces errors and increases efficiency.

Remember, the right bank extract software can transform your financial management, leading to improved customer outcomes. So, consider your specific needs and choose a solution that best fits your business.

As we wrap up, we’d love to hear from you. How has using bank extract software transformed your financial processes? Share your experiences on social media and tag us!

Create Bank Extracts in Seconds

Ready to transform your financial management? Try DocuClipper today! Experience the ease of converting bank statements into structured data formats in seconds. Start your free trial now!

Frequently Asked Questions about Bank Extract

In this section, we’re going to answer commonly asked questions related to bank extracts:

How do I get a bank extract?

To get a bank extract, you can use a bank statement converter software like DocuClipper. It automatically extracts data from your scanned or PDF bank statements and converts it into a structured format like Excel or CSV. This process is quick, accurate, and can save you significant time and effort.

What is a bank statement or bank extract?

A bank statement is a record from a bank that shows all transactions for an account over a specific period. A bank extract, on the other hand, is a structured, machine-readable file that contains all transactions from a bank statement, typically in a format like CSV or Excel, making it easier to analyze and process the data.

How can I extract my bank statement online?

To extract your bank statement online, you can use a bank statement converter software like DocuClipper. Simply upload your scanned or PDF bank statement to the software. It will automatically extract the transaction data and convert it into a structured format like Excel or CSV, which you can then download for your use.

Related Articles:

- How to Convert PDF to CSV for Xero

- How to Import Bank Statements into QuickBooks Online: Easy Step-by-Step Guide

- How to Import bank statements into Sage in 7 Easy Steps

- How to Import Bank Statements into Xero in 5 Easy Steps

- How to Read a Bank Statement

- How to Get Old Bank Statements from a Closed Account

- Invoice Data Extraction: How to Extract Data from Invoices