Managing invoices efficiently is a critical challenge for businesses and accounting professionals in today’s fast-paced financial landscape. The diversity of invoice formats across suppliers, vendors, and service providers creates significant data entry and processing hurdles.

In 2025, invoice automation has become essential for competitive businesses. Fortunately, advanced invoice scanning technologies offer powerful solutions to transform how organizations handle financial documentation.

In this comprehensive guide, we’ll analyze the 14 best invoice scanning software solutions available today, comparing their features, accuracy rates, integration capabilities, and pricing to help you find the perfect tool for your specific business requirements.

Key Takeaways

- Advanced OCR technology enables 97%+ accuracy in extracting data from various invoice formats

- Integration capabilities with accounting platforms like QuickBooks, Xero, and Sage are crucial for seamless workflow

- Pricing ranges from $0.08 per invoice to enterprise-level subscriptions exceeding $500/month

- Mobile accessibility enables on-the-go invoice processing for modern business environments

- Cloud-based solutions offer advantages in accessibility, updates, and maintenance

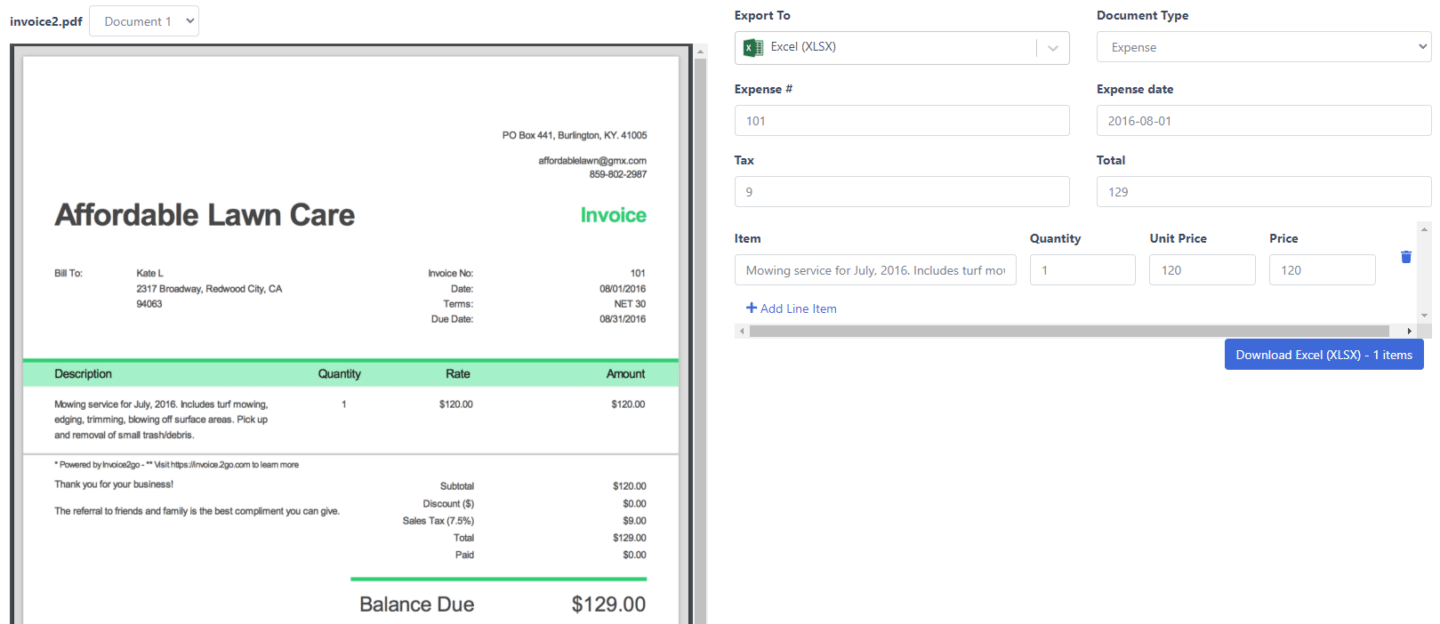

1. DocuClipper

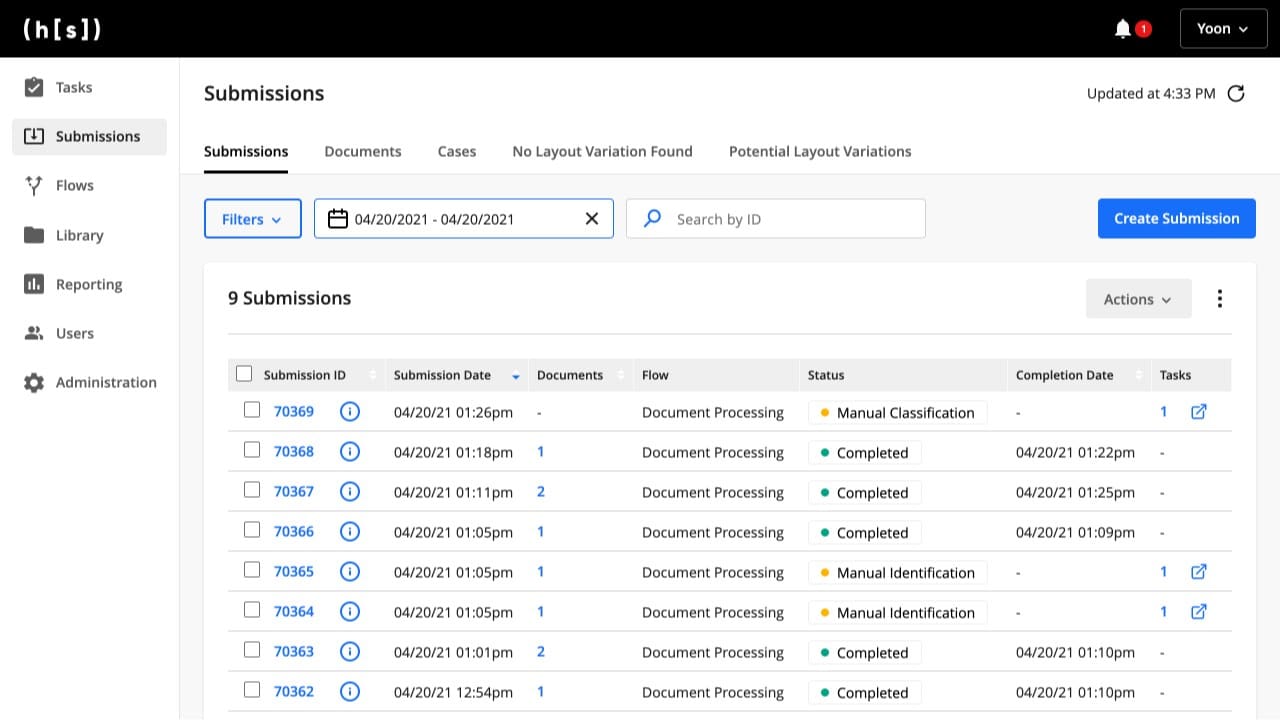

DocuClipper stands out as the best invoice parser for digitalizing invoices, delivering structured data outputs in Excel, CSV, and QBO formats with an impressive 97% accuracy rate.

Leveraging proprietary OCR data extraction technology with algorithms specifically engineered for invoice processing, this invoice data extraction software excels at streamlining the invoice scanning process.

DocuClipper supports batch processing to enhance file conversion efficiency and offers robust API functionality for seamless integration with leading accounting platforms including QuickBooks, Xero, Sage, and other accounting and ERP systems.

Pros

- Advanced Invoice OCR Software: DocuClipper’s Invoice OCR technology processes all invoice formats regardless of layout or source, ensuring consistent results.

- Superior Accuracy: Achieves 97% accuracy when converting PDF invoices to Excel and extracting invoice data from PDFs, minimizing manual corrections.

- Comprehensive Integrations: Seamlessly connects with QuickBooks, Excel, Google Sheets, and other financial platforms to create end-to-end automated workflows.

- Processing Speed: Capable of handling hundreds of invoices simultaneously, often completing processing within seconds.

- Enterprise-Grade Security: SOC 2 compliant with Amazon secure server infrastructure and AES 256-bit SSL encryption for comprehensive data protection.

Cons

- Financial Analysis Limitations: While excellent for data extraction, the software provides only basic financial analysis tools, which may not satisfy businesses requiring in-depth financial insights.

Pricing

- DocuClipper Starter: $39.00 monthly/$27 monthly (annual billing) – Includes 120 pages/month, unlimited users, bank reconciliation, batch processing, accounting integrations, 30-day data retention, and basic support.

- DocuClipper Professional: $74.00 monthly/$52 monthly (annual billing) – Expands to 500 pages/month, 1-year data retention, and transaction categorization.

- DocuClipper Business: $159.00 monthly/$111.00 monthly (annual billing) – Provides 2,000 pages/month, 2-year data retention, dedicated support, inventory management, transfer detection, funds flow analysis, dedicated queues, and API access.

- DocuClipper Enterprise: Custom pricing – Delivers customized page volumes, 5-year data retention, SSO, API keys, and dedicated processing queues.

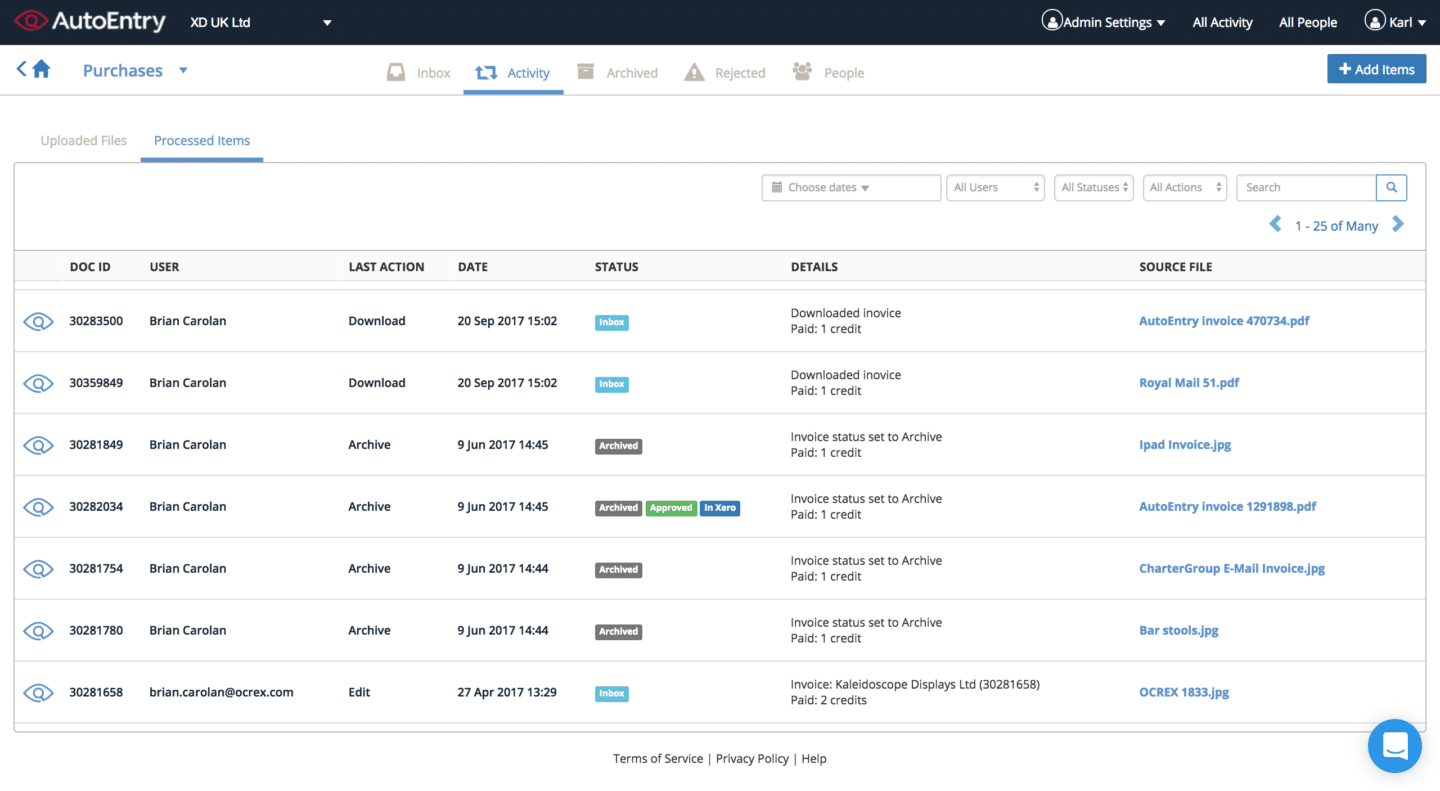

2. AutoEntry

AutoEntry specializes in data automation for accounting processes, extracting and publishing financial data directly to major accounting platforms. It excels at invoice scanning for accounting purposes and offers flexible access without long-term contracts, making it accessible to businesses globally.

Pros

- User-Friendly Operation: AutoEntry allows for document submission through scanning, email, or its dedicated mobile app for quick image capture.

- Mobile Functionality: The mobile application enhances flexibility, enabling users to capture invoices remotely and streamline invoice data entry workflows.

- Scalability: AutoEntry supports unlimited companies and users from implementation, with all features available immediately.

Cons

- Integration Challenges: Some users report difficulties integrating with accounting platforms like Xero, particularly during invoice publication.

- Support Limitations: Customer service has received criticism for response times and unresolved billing issues, even after service cancellation.

- Technical Reliability: Users occasionally encounter glitches and system disruptions that impact performance and user experience.

Pricing

- Bronze: $15/month – 50 credits

- Silver: $26/month – 100 credits

- Gold: $48/month – 200 credits

- Platinum: $112/month – 500 credits

- Diamond: $315/month – 1500 credits

- Sapphire: $494/month – 2500 credits

All plans include unlimited cloud storage, unlimited users, and a dedicated partner portal for accounting professionals. Subscriptions can be canceled up to 24 hours before monthly renewal, and a free trial is available for evaluation.

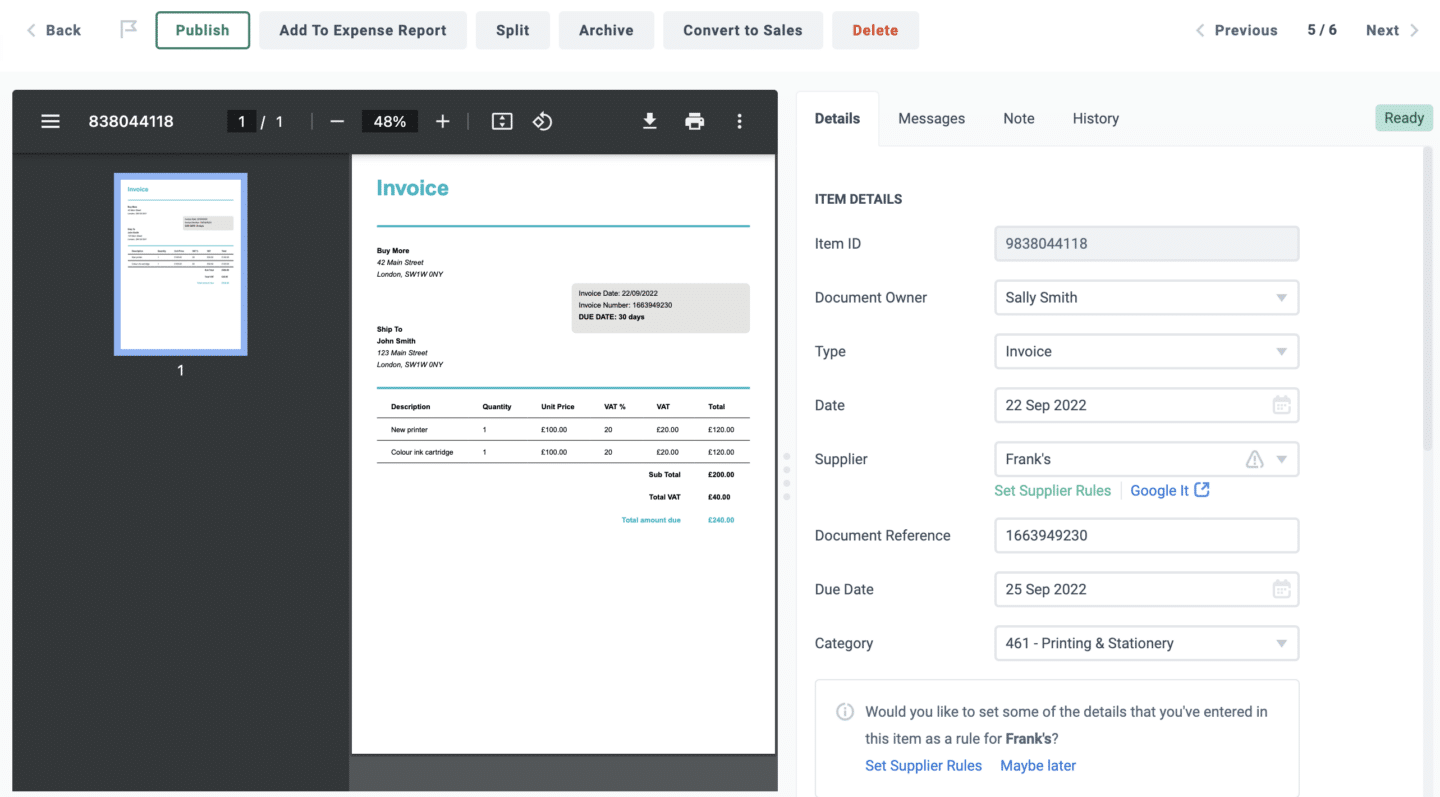

3. Dext Prepare

Dext Prepare is designed to enhance accountant and business productivity through advanced data management and insights. It provides robust tools for preparing, organizing, and automatically publishing invoices and receipts to accounting systems.

Pros

- Intuitive User Experience: Both web platform and mobile applications feature user-friendly designs, complemented by comprehensive training resources.

- Processing Efficiency: The platform’s accurate data recognition and predefined supplier rules significantly streamline bulk expense review and posting.

- Accessibility: Dext Prepare simplifies financial processes to minimize errors, making it accessible to team members without specialized accounting knowledge.

Cons

- Enterprise Scalability: May not support multi-level approval workflows for expense reports, potentially limiting usefulness for larger organizations.

- Processing Inconsistencies: Some users experience occasional delays in document processing for invoices and receipts.

- Customer Experience Issues: Reports indicate challenges with sales practices, billing discrepancies, and customer service responsiveness.

Pricing

Monthly or annual subscription options are available, with 13% savings on annual commitments. Plans can be customized to specific business requirements.

Typical pricing includes:

- $199.99/month (annual billing) – 10 clients, unlimited users

- $214.99/month (annual billing) – Advanced features and enhanced support

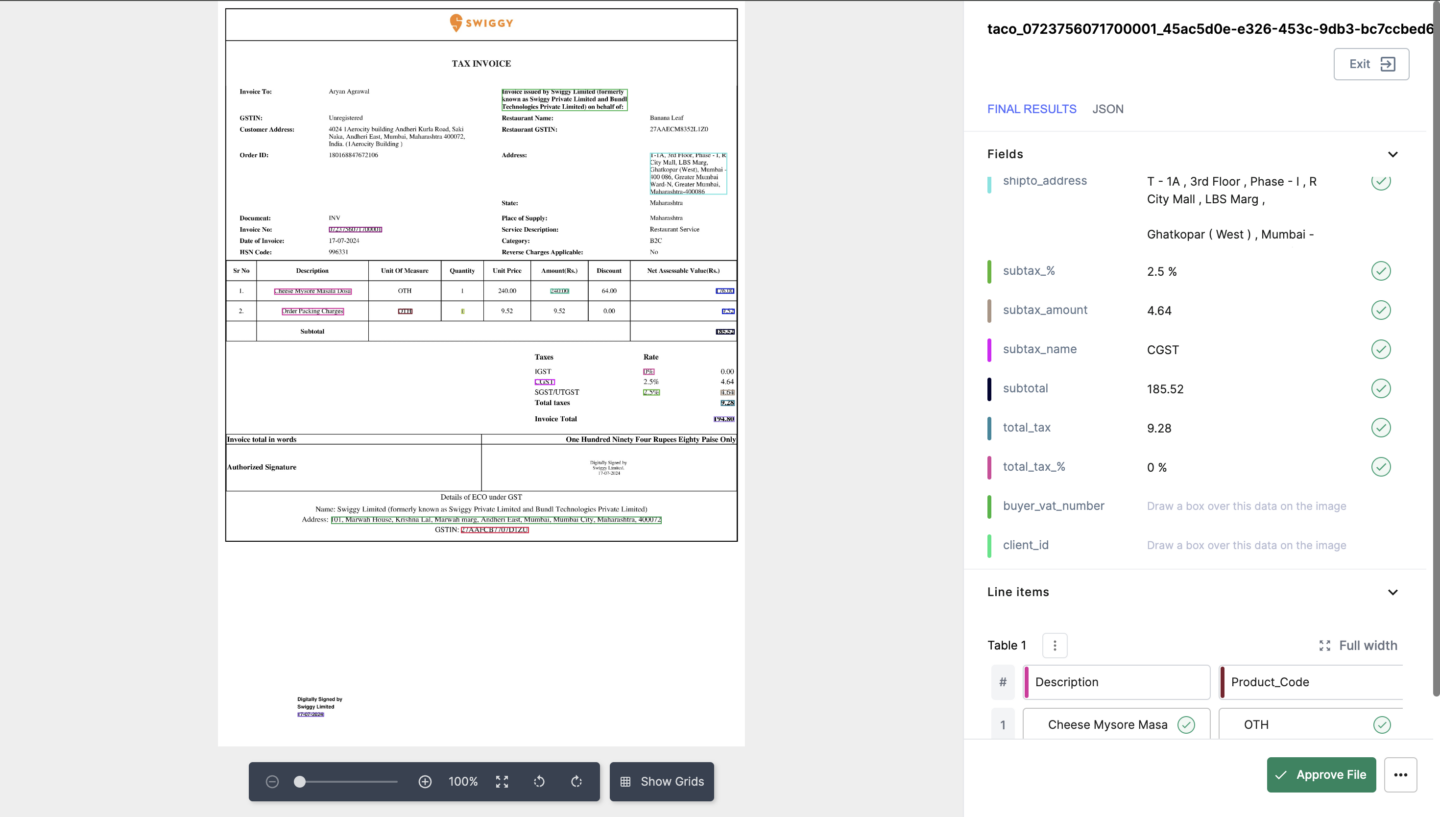

4. Nanonets

Nanonets delivers AI-driven automation for streamlining complex business processes across finance, accounting, supply chain, operations, sales, and HR departments.

The platform employs a no-code approach that transforms invoices and receipts from diverse sources—including documents, emails, tickets, and databases—into actionable business intelligence, enhancing decision-making and operational efficiency.

Pros

- Superior User Interface: Features a customizable, user-friendly interface supported by responsive customer service to enhance overall user experience.

- Versatile Processing Capabilities: Nanonets handles diverse document types and data formats with advanced zero-shot models and flexible data conversion options.

- Self-Improving Technology: The AI’s continuous learning functionality enables progressive system enhancement, increasing efficiency over time.

Cons

- Implementation Complexity: Initial account setup for invoice and receipt processing can be challenging for new users.

- Technical Issues: Users occasionally encounter minor bugs and interface inconsistencies during operation.

- Learning Investment: Training custom models and mastering the system requires dedicated effort and may initially seem non-intuitive to new users.

Pricing

- Starter: Free sign-up with pay-as-you-go options – First 500 pages free, then $0.30 per page, includes 3 starter workflows, limited fields, and auto-capture for tables.

- Pro: $999 per month per workflow – Includes 10,000 pages monthly (then $0.10 per page), auto-capture line items, up to 20 fields, team management, custom OCR data capture AI, annotation services, and integration with MS Dynamics, Salesforce, and SAP.

- Enterprise: Custom pricing – Contact sales for tailored enterprise solutions.

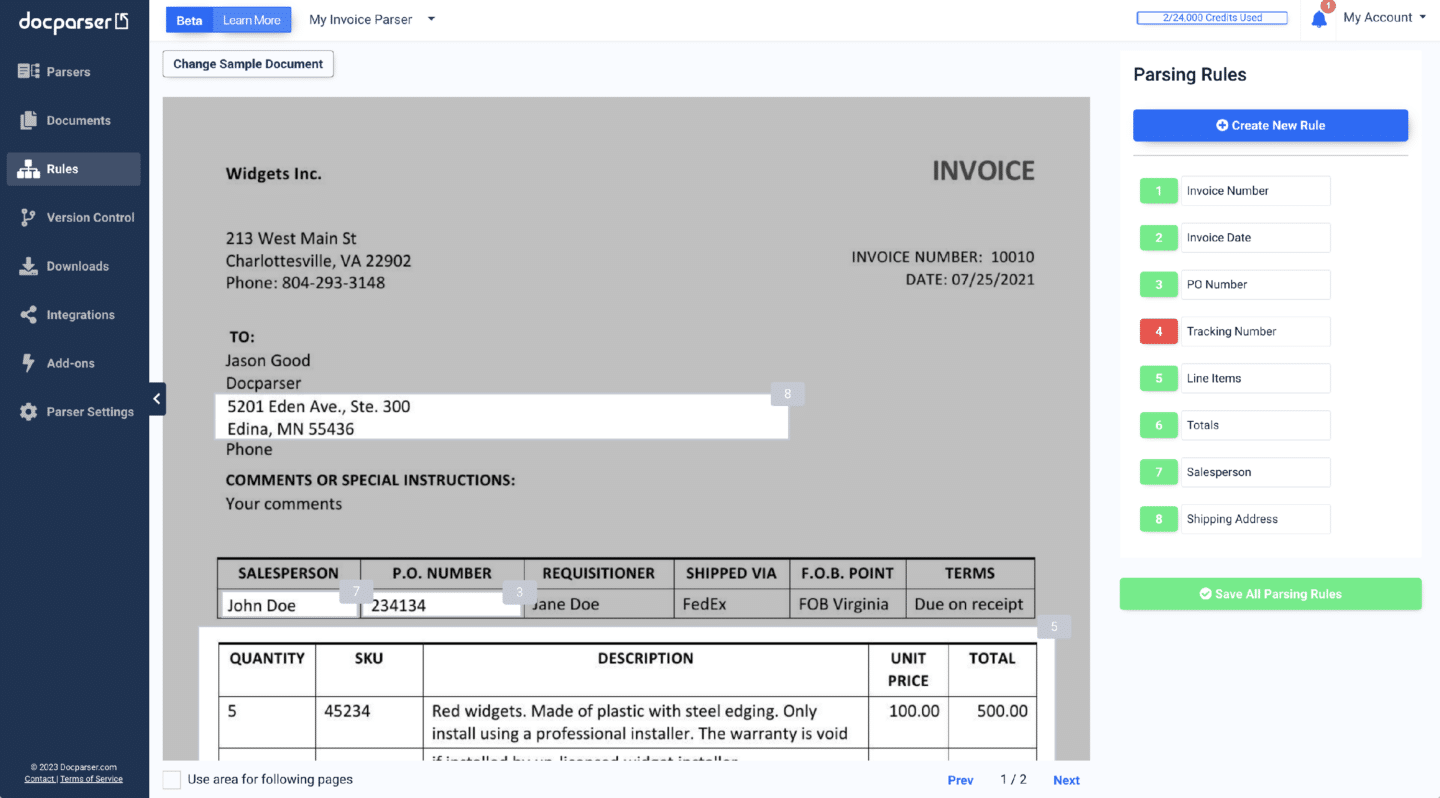

5. DocParser

Docparser is a robust invoice parser designed to automate data extraction from diverse document formats including PDFs, MS Word, DOCX, JPGs, TIFFs, and PNGs.

This platform streamlines document processing workflows for invoices and receipts, enabling rapid and precise extraction of customer information from sales invoices and shipping details from delivery receipts. Docparser’s intuitive interface and cloud-based architecture make it highly accessible and scalable for businesses of all sizes.

Pros

- Customizable Parsing Rules: Users can create tailored rules to optimize data extraction for specific invoice formats and requirements.

- Seamless Integration: Offers straightforward connectivity with popular third-party tools including Zapier, Google Sheets, and Microsoft Power Automate.

- Intelligent Document Routing: Automatically directs incoming receipts to appropriate rule sets for efficient processing.

Cons

- Interface Complexity: Some users find the workflow configuration for parsing rules confusing and the user interface less intuitive than desired.

- Value Perception: The per-form cost may be considered high by some organizations, particularly those with high-volume needs.

- Technical Barrier: Users without JSON experience may struggle with data structuring requirements.

Pricing

- Starter: $39.00 monthly – 100 credits, designed for individuals managing manual data extraction.

- Professional: $74.00 monthly – 250 credits, adds multifactor authentication and team collaboration features.

- Business: $159.00 monthly – 1,000 credits, tailored for automating complete business processes.

- Enterprise: Custom pricing – Available for large-scale and unlimited parsing requirements, with extended document retention and white-labeling options.

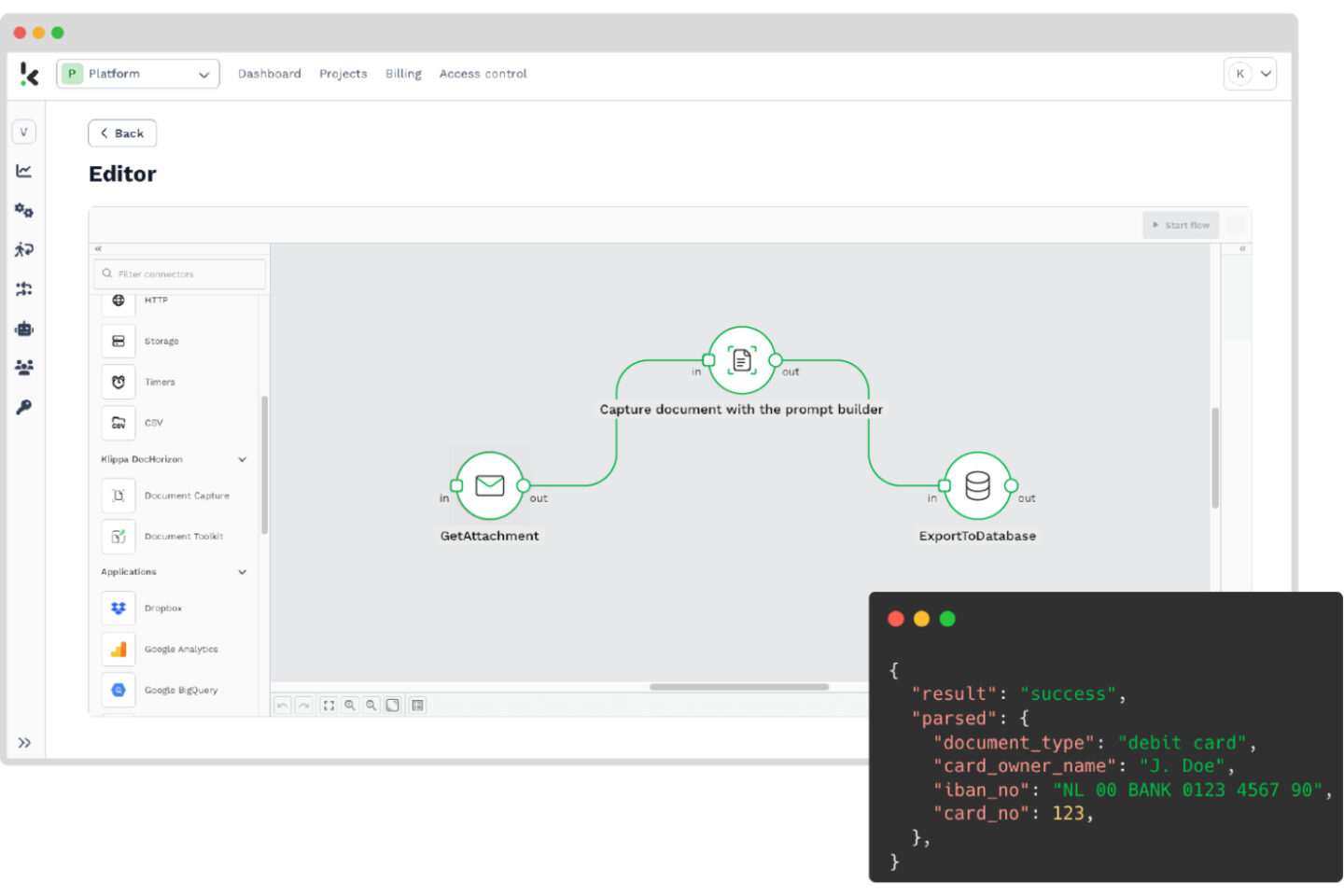

6. Klippa

Klippa provides a comprehensive expense management solution that optimizes business expense handling. The platform automates submission and processing of business expenses, including invoices and receipts, streamlining financial operations.

Pros

- Flexible Submission Options: Enables expense submission through web interface, mobile application, or email, simplifying the expense management process.

- Mobile Capabilities: The dedicated mobile app supports on-the-go expense management, enhancing flexibility for distributed teams.

- Multilingual Support: Available in English, German, Dutch, French, Spanish, and Portuguese, making it suitable for international operations.

Cons

- Initial Learning Period: New users typically require time to become proficient with setup and model training procedures.

- Customization Restrictions: White-label options provide limited customization, such as color scheme modifications.

- Technical Stability: Minor bugs and occasional processing delays can impact user experience, though issues are typically resolved quickly.

Pricing

- Effective: €5.00 monthly per active user – Ideal for organizations new to digital expense management, featuring basic OCR technology, multiple submission methods, and accounting system integration.

- Premium (Most Popular): €6.00 monthly per active user – Enhances the Effective plan with fraud detection, dedicated account management, and additional compliance tools.

- Custom: Tailored pricing – Provides fully customized solutions for organizations with specialized requirements, including advanced API access and custom service agreements.

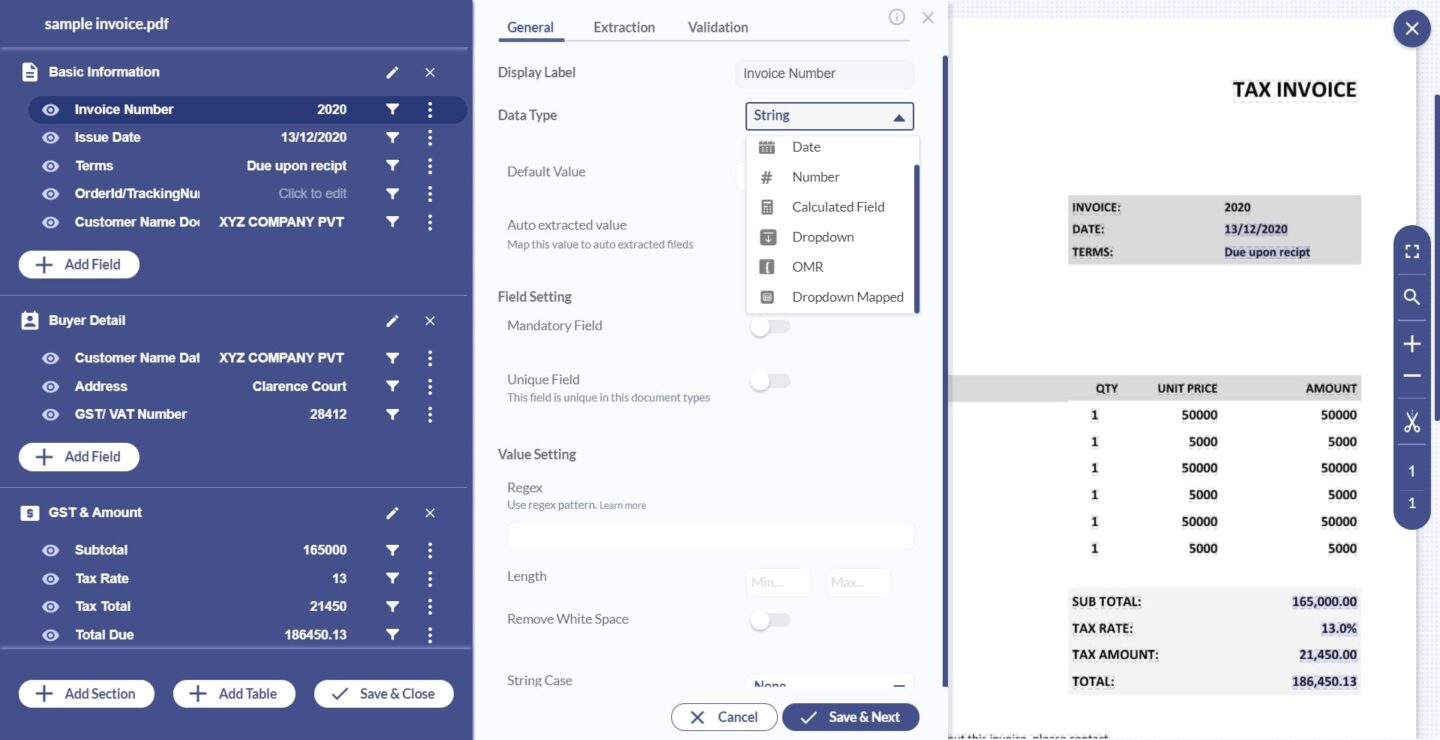

7. Docsumo

Docsumo is a leading Intelligent Document Processing (IDP) solution for financial documentation. Initially developed for automated invoice processing, Docsumo has expanded to provide comprehensive data extraction solutions for the financial sector throughout the United States.

Pros

- Exceptional Support: Renowned for its responsive, solution-focused team and efficient onboarding process with adaptable support staff.

- Processing Performance: Significantly enhances invoice and receipt extraction with measurable improvements in accuracy and processing speed, directly benefiting customer outcomes.

Cons

- Model Maintenance: Minor process changes necessitate model retraining, which can be time-consuming.

- Global Coordination: Cross-timezone collaboration can complicate meeting scheduling, despite team flexibility.

- System Limitations: Users occasionally encounter formatting inconsistencies and system timeouts when processing large document batches or exhausting credit allocations.

- Processing Constraints: Challenges arise when converting invoices with multiple accounts or when credit limits are reached.

Pricing

- Start-ups and Businesses: Starting at $500+ monthly – Includes APIs for invoices, purchase orders, ID cards, supports 3 users, machine learning, and Table Vision. Does not include email parsing, invoice validation, custom ML training, table categorization, or document classification.

- Business: Custom pricing – Supports specific data capture from documents like bank statements and insurance forms, accommodates 10 users, and includes email parsing, basic validation, and custom ML model training. Excludes table categorization and document classification.

- Enterprise: Custom pricing – Designed for comprehensive needs spanning multiple document types and custom workflows, supports unlimited users, and includes advanced validation, analytics, table categorization, and document classification.

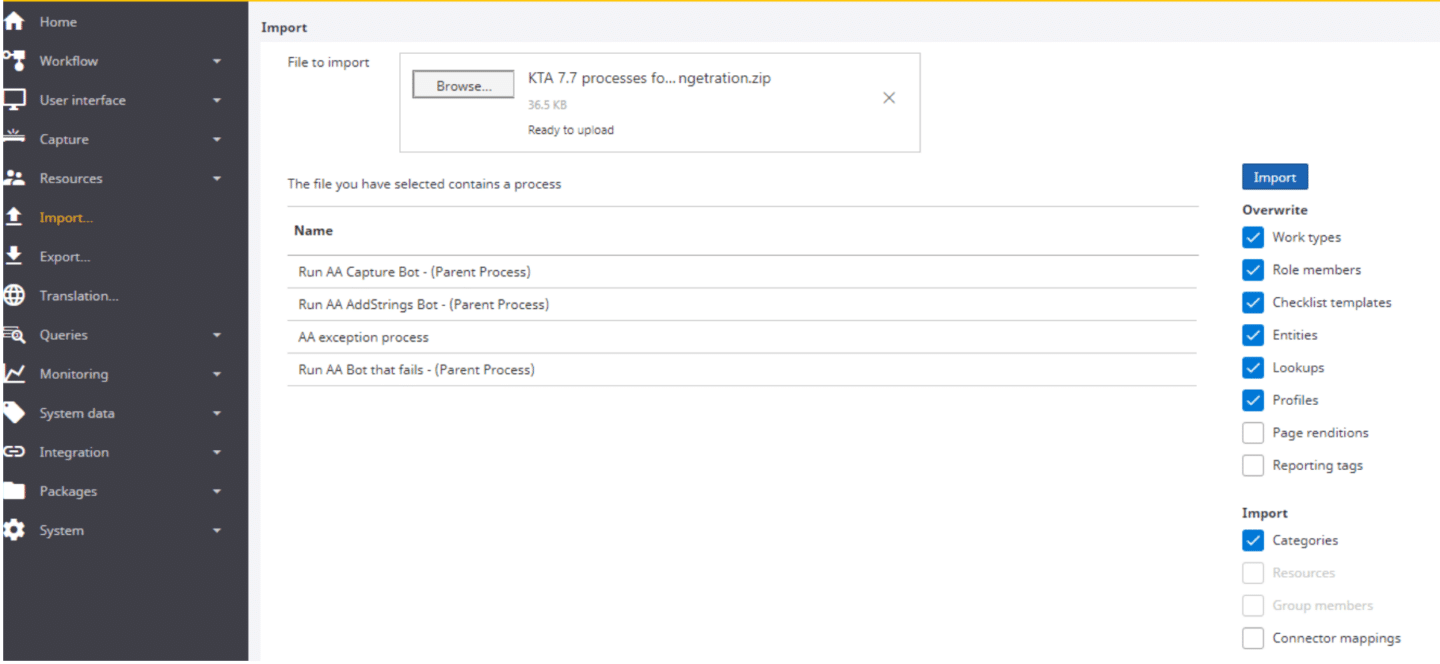

8. Tungsten Automation

Tungsten Network provides a global e-invoicing platform that streamlines procure-to-pay processes, helping organizations process invoices efficiently, reduce operational costs, optimize cash flow, and minimize fraud risks. The platform can effectively extract invoice data from PDFs and other formats.

Pros

- Automated Invoice Workflows: Users can automatically generate and distribute invoices in multiple formats, simplifying invoice management processes.

- Cloud Architecture: The cloud-based platform enables remote access and management of invoicing processes from any location.

Cons

- Connectivity Dependence: Platform performance relies heavily on stable internet connectivity.

- User Experience Challenges: Some users report the platform as maintenance-intensive and occasionally problematic. The interface has been described as coding-intensive and not particularly user-friendly, with limitations in automating complex processes beyond basic file transfers.

Pricing

- Power PDF Standard for Windows and Mac: $129

- Power PDF Advanced for Windows: $179

9. HyperScience

HyperScience leads in AI-powered back-office automation and intelligent document processing technology. The platform delivers turnkey solutions focused on hyper-automation, achieving 99.5% accuracy and 98% automation rates through proprietary machine learning models that efficiently process various content types from structured invoices to receipts.

Pros

- Superior Data Extraction: Recognized for exceptional structured data extraction capabilities with high automation and accuracy rates, particularly with optimized production models.

- Rapid Document Implementation: New structured document formats can be quickly incorporated using only blank templates, facilitating easy document library expansion.

- Advanced Text Recognition: Highly effective at interpreting handwritten invoice and receipt content, especially valuable for insurance sector applications.

Cons

- Document Format Limitations: Not optimized for processing invoices and financial documentation.

- Semi-Structured Content Challenges: Semi-structured extraction workflows can be unwieldy, often requiring human intervention for field classification and data verification, interrupting automated processes.

- Training Data Requirements: Semi-structured extraction training requires minimum 400 sample documents, creating implementation barriers and extending deployment timelines.

- Infrastructure Demands: Platform deployment necessitates substantial infrastructure resources and complex configuration.

Pricing

HyperScience Platform – Intelligent Document Processing (IDP) – SaaS

Platform Fee:

- 12 Months: $210,000

- 24 Months: $390,000

- 36 Months: $570,000

10. Hyland (OnBase)

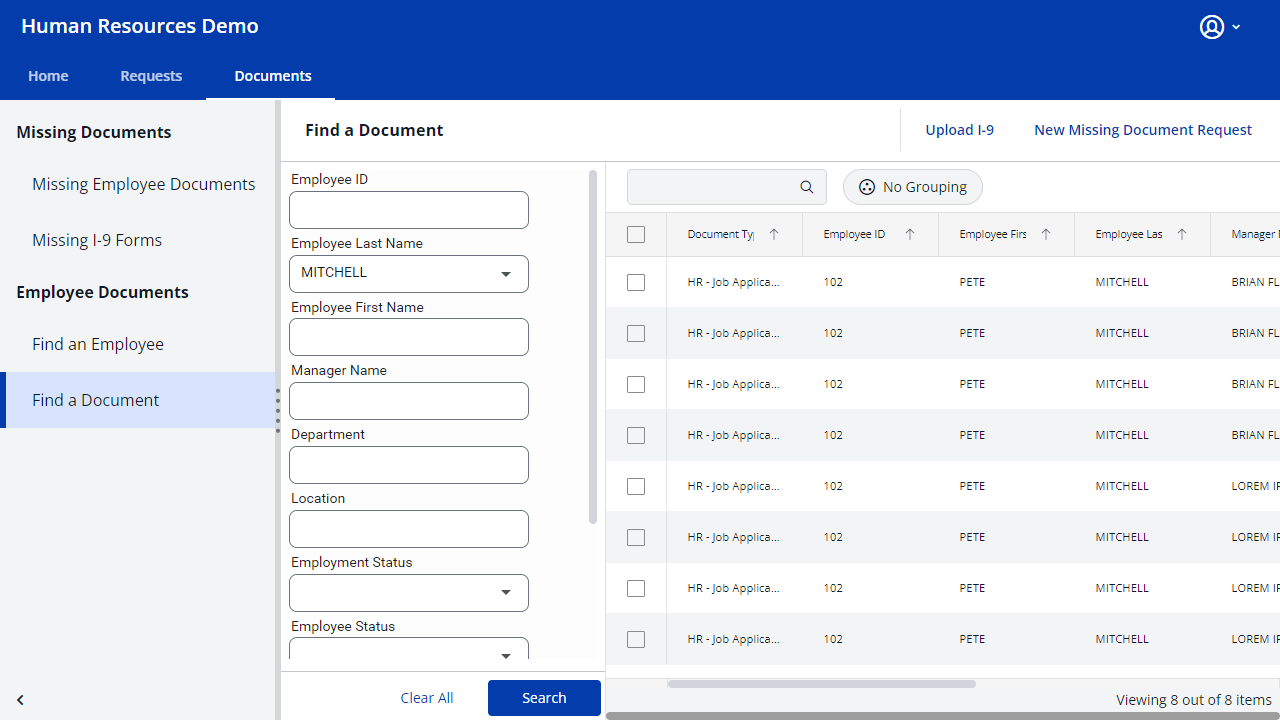

Hyland’s OnBase platform provides comprehensive enterprise content management with purpose-built industry and departmental solutions addressing specific business challenges.

The Hyland AP automation solution efficiently captures invoices at their source—whether scanned or received electronically. Through intelligent capture technology, it automates data extraction from invoices, accelerating processing and eliminating manual invoice processing requirements.

Pros

- Accessible Administration: Appreciated for its “clicks not code” approach, making it user-friendly for accounting professionals when processing invoices.

- Configuration Flexibility: Highly adaptable platform supporting diverse use cases, enabling automation of previously manual invoice processes.

Cons

- Legacy Interface: The configuration environment utilizes an outdated thick client requiring modernization, and certain configuration limitations increase manual workload.

- Operational Complexity: System upgrades can be challenging, often requiring extensive planning and troubleshooting.

- Stability Concerns: Users may experience disruptions, particularly during connectivity fluctuations, resulting in unexpected application closures during document uploads or imports.

Pricing

Hyland OnBase does not publicly disclose pricing information. Interested organizations should contact Hyland directly for customized pricing based on specific requirements and configurations.

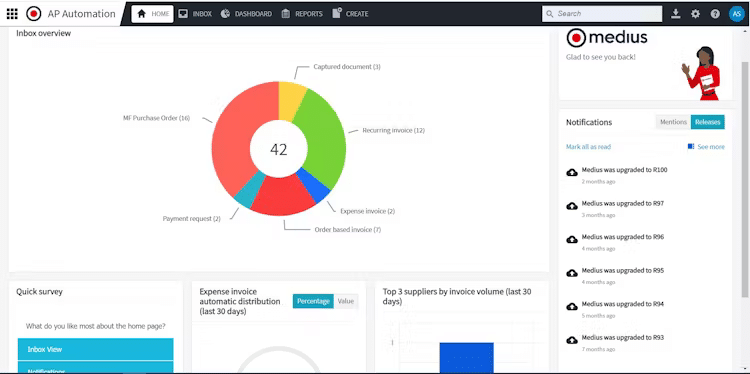

11. Medius

Medius specializes in end-to-end spend management automation, from sourcing to payment, significantly reducing manual tasks and accelerating invoice processing workflows. The platform supports scanning receipts into various formats and offers rapid implementation, intuitive interfaces, and insightful analytics that drive continuous improvement with exceptional speed-to-value.

Pros

- Financial Control: Enhances spending visibility across categories, cost centers, and projects, improving financial record management, forecasting, and budgeting while reducing common errors like duplicate POs, pricing discrepancies, and budget overruns.

- Intuitive Operation: Recognized for operational simplicity, particularly in invoice processing and management, streamlining workflows for both processing staff and approval managers.

Cons

- Prepayment Limitations: Currently lacks comprehensive support for prepayment invoices, though feature enhancements are anticipated.

- Configuration Complexity: The extensive administrative categories can overwhelm users attempting to customize business rules.

- Technical Reliability: Occasional issues include goods receipts not automatically updating, requiring manual intervention or support assistance.

- User Experience Challenges: Some system configurations lack intuitive design and require support guidance. Performance degradation occurs with larger documents, and mobile support for invoice approval workflows is limited.

- System Organization: Dashboard and document management interfaces can appear cluttered with multiple document versions, and audit trails for deleted invoices are difficult to trace.

Pricing

Pricing details are not publicly available. Interested organizations should contact Medius directly for custom quotations based on specific requirements.

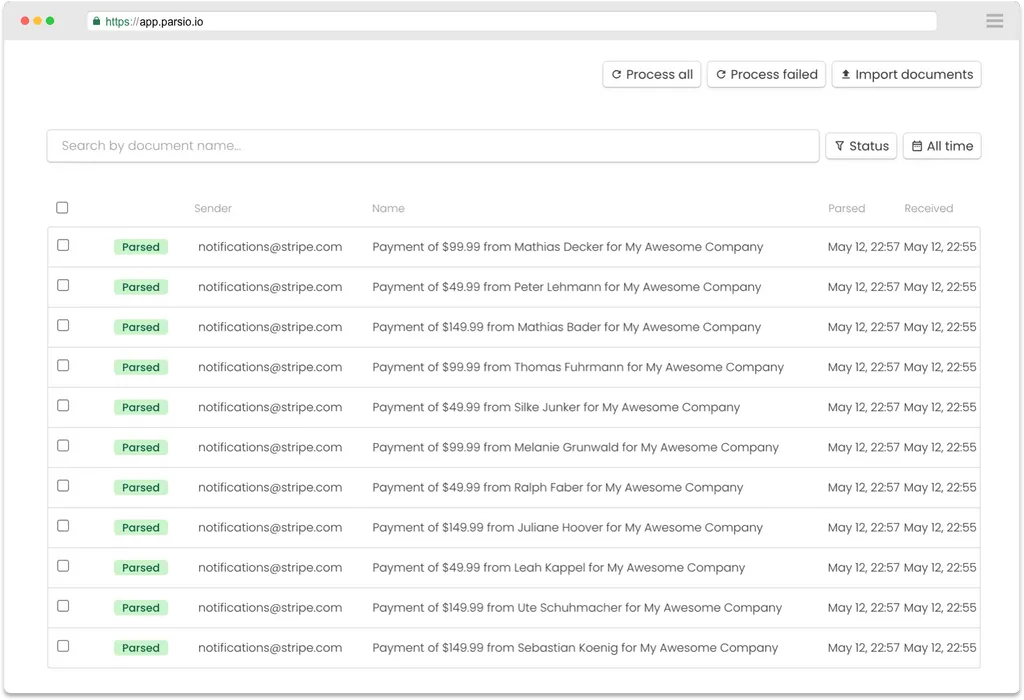

12. Parsio

Parsio is a powerful data extraction solution designed to automate information capture from emails and attachments, including PDFs, HTML, XML, and XLSX files. Users simply highlight target data fields, and Parsio automatically processes similar incoming documents and communications.

Key Features

- AI-Powered Technology: Leverages machine learning for OCR processing and automated data extraction from scanned PDFs, images, and handwritten documents.

- GPT Integration: Utilizes natural language processing to extract information from unstructured communications and documents.

- Template-Based Processing: Supports no-code parsing templates for emails, PDFs, and files with standardized layouts.

- Signature Analysis: Automatically extracts contact information from email signatures using AI technology.

- Accessible Interface: Highlight-to-extract functionality provides quick, simple setup without coding requirements.

- Table Processing: Efficiently extracts line items from invoices, order confirmations, and similar structured data.

Pros

- Automation Excellence: Ideal for processing emails and PDF attachments in automation workflows with Zapier, Integromat, Integrately, Konnectzit, or Pabbly Connect.

- User-Friendly Design: Intuitive interface ensures rapid implementation and adoption.

- Customer Support: Exceptional assistance helps users optimize implementation for specific requirements.

- Implementation Simplicity: Streamlines previously cumbersome manual processes.

- Integration Capabilities: Works seamlessly with webhooks, Zapier, and Google Sheets.

Cons

- Interface Refinement: Some users report the interface could benefit from usability improvements.

- Template Complexity: Creating advanced templates can be challenging, though support resources are available.

- Investment Level: May present cost considerations for smaller organizations.

Pricing

- Starter: 1,000 credits/month for $49/month – Includes OCR, AI, and GPT-powered parsers, 90-day data retention, unlimited integrations via Zapier and Make, webhooks, API access, and all Sandbox features.

- Growth (Most Popular): 5,000 credits/month for $149/month – Expands Starter features with increased processing capacity.

- Business: 12,000 credits/month for $299/month – Delivers premium experience with extended 180-day data retention and dedicated support.

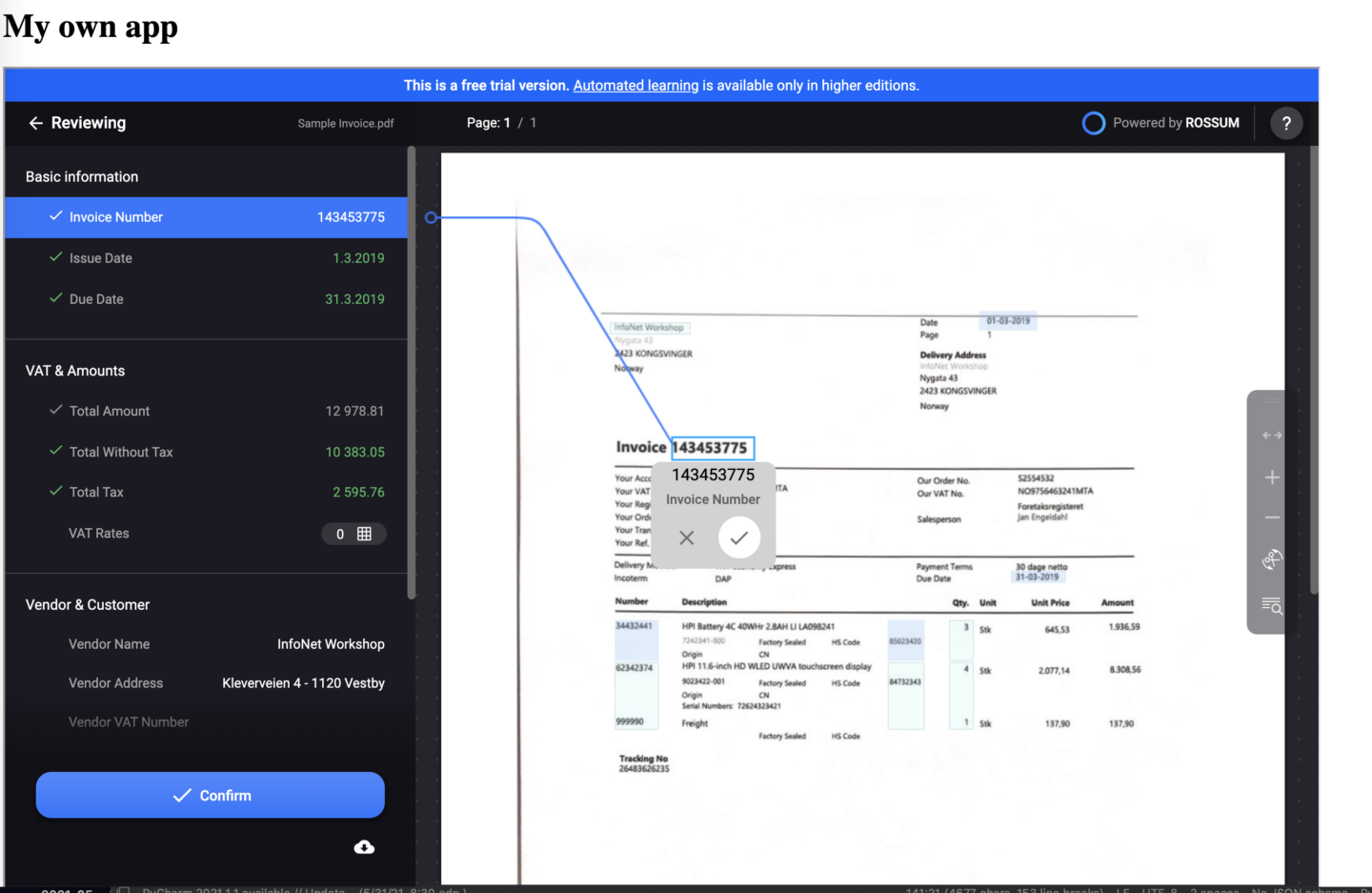

13. Rossum

Rossum is an AI-powered document processing platform specializing in automated data capture from invoices and related business documents. What distinguishes Rossum is its cognitive data capture methodology that operates without templates, allowing it to adapt dynamically to diverse invoice formats without extensive configuration requirements.

Pros

- Template-Free Processing: Rossum’s AI engine interprets invoice layouts without predefined templates, making it exceptionally adaptable to new supplier formats.

- Intuitive Validation Interface: Features a user-friendly verification environment that simplifies review and correction of extracted data for AP teams.

- Adaptive Learning: The platform continuously improves through usage, becoming progressively more accurate with each document processed.

- Multilingual Capabilities: Processes invoices in multiple languages, supporting international business operations.

Cons

- Accuracy Development: May require an initial period to reach optimal accuracy levels as the system learns document patterns.

- Integration Complexity: Some organizations report that comprehensive ERP integration requires specialized technical expertise.

- Cost Structure: Pricing may present barriers for smaller businesses with lower invoice volumes.

Pricing

- Starter: $0.30 per document (minimum 250 documents monthly/$75 minimum) – Includes essential data extraction features, single-user access, and standard support.

- Business: $0.20 per document (minimum 1,000 documents monthly/$200 minimum) – Adds multi-user capabilities, priority support, and API access.

- Enterprise: Custom pricing – Features advanced functionality including dedicated account management, custom field extraction, and comprehensive integration support.

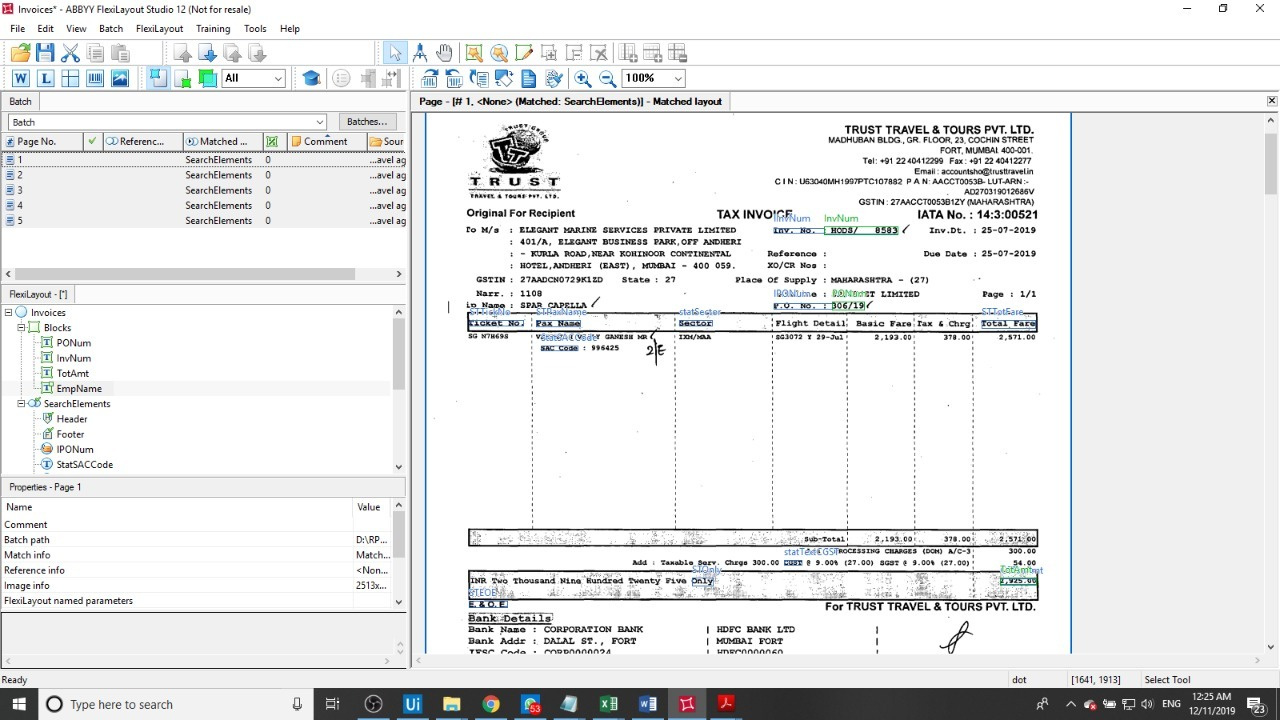

14. ABBYY FlexiCapture

ABBYY FlexiCapture delivers comprehensive document processing capabilities that transform various document types—including invoices and receipts—into actionable business data. The platform offers both on-premises and cloud deployment options, providing flexibility for diverse organizational requirements.

Pros

- Industry-Leading OCR: Renowned for superior OCR technology delivering exceptional text recognition accuracy from invoice documents.

- Multi-Document Support: Processes various document types beyond invoices, including purchase orders, receipts, and contracts within unified workflows.

- Workflow Customization: Enables organizations to design tailored document processing sequences aligned with specific AP requirements.

- Security Framework: Provides robust protection including data encryption, role-based access controls, and comprehensive audit tracking.

Cons

- Adoption Complexity: The platform’s extensive functionality requires significant training and configuration time.

- System Requirements: On-premises deployments demand substantial computing resources for optimal performance.

- Investment Consideration: Higher acquisition cost compared to alternatives, particularly for comprehensive enterprise implementations.

Pricing

- Cloud Subscription: Starting at approximately $500 monthly for fundamental functionality, with volume-based pricing.

- On-Premises License: Custom pricing based on processing volume and required features, typically starting at several thousand dollars for implementation.

- Enterprise Package: Custom pricing including advanced capture capabilities, multiple workflows, and dedicated support services.

What is Invoice Scanning Software?

Invoice scanning software utilizes optical character recognition (OCR) and artificial intelligence to extract, organize, and process data from diverse invoice formats, streamlining accounts payable operations.

The primary advantage is automated information capture with high accuracy and efficiency, significantly reducing errors and processing time. These platforms handle multiple invoice formats and integrate with accounting systems to create end-to-end financial workflows.

Why is Invoice Scanning Software Important?

Modern invoice scanning solutions deliver substantial benefits for organizations seeking to optimize financial operations:

- Productivity Enhancement: Automates data entry tasks, allowing finance teams to focus on strategic activities instead of manual document processing.

- Operational Savings: Reduces labor expenses while minimizing costly data entry errors and duplicate payments.

- Data Accuracy: Ensures consistent, precise data extraction, significantly reducing financial record discrepancies.

- Workflow Simplification: Eliminates error-prone manual data entry processes, streamlining accounts payable procedures.

- System Integration: Advanced API capabilities enable seamless connectivity with accounting platforms, facilitating real-time financial management across organizational systems.

How to Choose Invoice Scanning Software

Selecting the appropriate invoice scanning solution involves several structured evaluation steps:

- Needs Assessment: Begin by determining specific organizational requirements for invoice processing automation. Consult with finance teams to identify pain points and improvement opportunities.

- Cost-Benefit Analysis: Evaluate current inefficiencies against solution investments, considering both direct and indirect costs of manual processing versus automation benefits.

- Feature Evaluation: Analyze each platform’s capabilities against your requirements, focusing on essential functionality while avoiding unnecessary features that increase costs.

- Technical Assessment: Consider OCR accuracy rates, integration capabilities, deployment options (cloud vs. on-premises), security compliance, and mobile accessibility.

- User Experience: Evaluate interface design, workflow customization options, and implementation requirements for your team.

- Trial Implementation: Conduct a practical evaluation with representative invoice samples while engaging with vendor support to assess responsiveness and expertise.

- Integration Planning: For successful candidates, develop a comprehensive implementation strategy to integrate with existing financial systems.

Why Choose DocuClipper As Your Invoice Scanning Software?

DocuClipper distinguishes itself as the optimal invoice scanning solution through superior accuracy and processing speed. It offers exceptional cost-effectiveness with rates as low as $0.08 per invoice.

The platform seamlessly converts PDF invoices to Excel, CSV, and QBO formats for streamlined analysis, and features comprehensive API systems for direct integration with accounting solutions including Xero, Sage, and QuickBooks. (Learn more about importing invoices into QuickBooks)

With capacity to process hundreds of invoices within seconds, DocuClipper transforms financial operations through both efficiency and precision. This performance enhancement represents a strategic investment for organizations seeking to optimize financial workflows without significant expenditure.

Conclusion

Selecting the optimal invoice scanning software represents a strategic decision for financial efficiency in 2025. This comprehensive comparison has examined 14 leading solutions, each designed to address specific business requirements across various scales and industries.

From DocuClipper’s exceptional accuracy and integration capabilities to specialized offerings from established providers like ABBYY FlexiCapture and Rossum, today’s market offers diverse options for automating invoice processing workflows.

By evaluating factors including extraction accuracy, processing speed, integration options, and total cost of ownership, organizations can identify the solution that best aligns with their specific operational needs.

The right invoice scanning technology investment delivers substantial returns through reduced processing costs, minimized errors, accelerated approval cycles, and enhanced financial visibility.

As businesses continue digital transformation initiatives, automated invoice processing remains a cornerstone of modern financial operations.

Frequently Asked Questions

What is the difference between OCR and invoice scanning software?

OCR (Optical Character Recognition) is the underlying technology that converts images of text into machine-readable text. Invoice scanning software builds upon OCR by adding specialized algorithms designed specifically for extracting structured data from invoice formats, often incorporating machine learning to improve accuracy for financial documents.

Can invoice scanning software work with handwritten invoices?

Advanced invoice scanning solutions incorporate handwriting recognition capabilities, though accuracy varies depending on legibility. Solutions like HyperScience and ABBYY FlexiCapture offer superior handwritten text recognition but may require human verification for optimal results.

How secure is cloud-based invoice scanning software?

Leading cloud-based invoice scanning platforms implement enterprise-grade security including SOC 2 compliance, AES 256-bit encryption, secure data centers, role-based access controls, and regular security audits. Always verify specific security certifications and compliance standards based on your industry requirements.

What accuracy rates should I expect from invoice scanning software?

Modern invoice scanning solutions typically achieve 85-97% accuracy, with variations based on document quality, format consistency, and system training. Top performers like DocuClipper consistently deliver 97% accuracy through specialized algorithms designed for financial document processing.

Can invoice scanning software integrate with my ERP system?

Yes, most professional invoice scanning solutions offer integration capabilities with popular ERP systems through APIs, pre-built connectors, or middleware solutions. Verify specific compatibility with your ERP platform before implementation.