Getting your business expenses sorted out is a great way to look at whether your business is making a profit or not. However, looking at it as a whole is overwhelming and can be confusing for the owners and even for some finance professionals.

One way to make it easier to process is by categorizing your business expenses. This allows your finance team or you as an owner can see through the expenses of your business across the different fields.

What is Business Expense?

A business expense refers to the costs incurred during the operation and maintenance of a business. These are the necessary expenditures that a business makes as part of its daily operations.

They can range from the rent for the business premises, salaries and wages paid to employees, costs of goods sold, utilities, marketing, and advertising costs, among others.

Essentially, any cost that is necessary for the creation of the product or service that the business sells can be considered a business expense.

Enhance Your Budgeting Skills – Secure Our Transaction Categorization Spreadsheet Right Away!

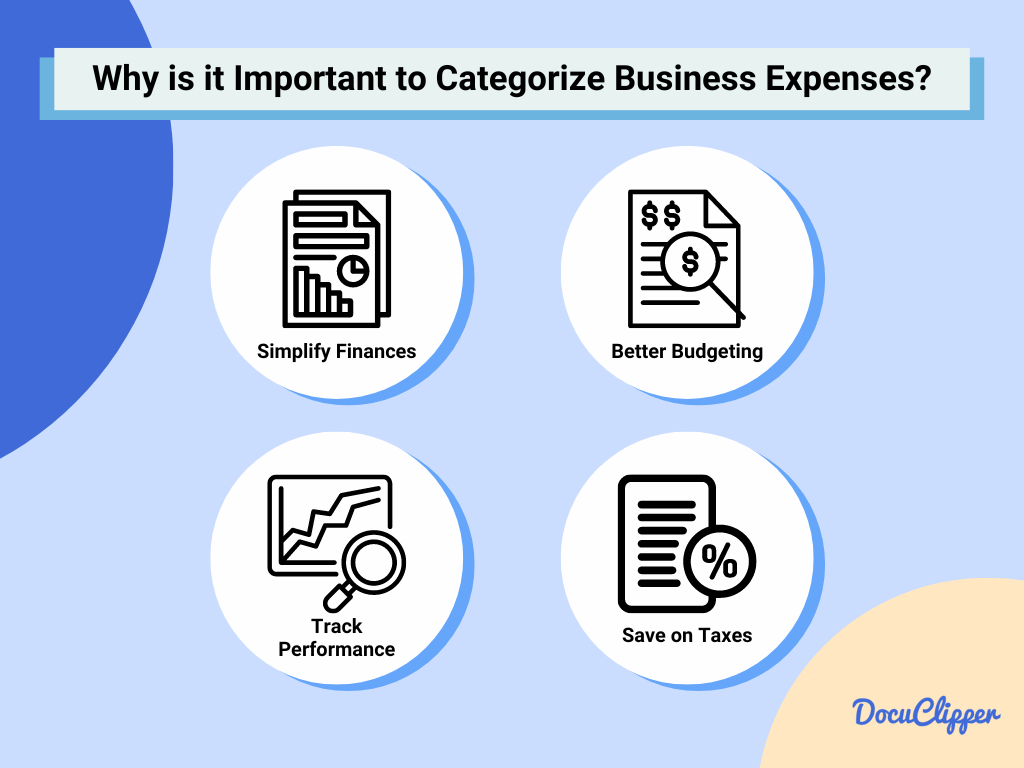

Why is it Important to Categorize Business Expenses?

Categorizing transactions like your business expenses is important for your business to see how much money is spent on the different aspects of the business. It may vary for different businesses, managers, accountants, and investors, but here are the major reasons why:

- Simplify Finances: It helps you keep track of where your money goes, making it easier to see where you can cut costs.

- Save on Taxes: Some expenses can lower your tax bill. Sorting them correctly ensures you don’t miss out on these savings.

- Better Budgeting: Knowing how you spend helps plan your future expenses, helping you use your money more wisely.

- Track Performance: Comparing expenses over time helps you see trends, manage money better, and make smart choices for your business.

The Most Common Business Expense Categories

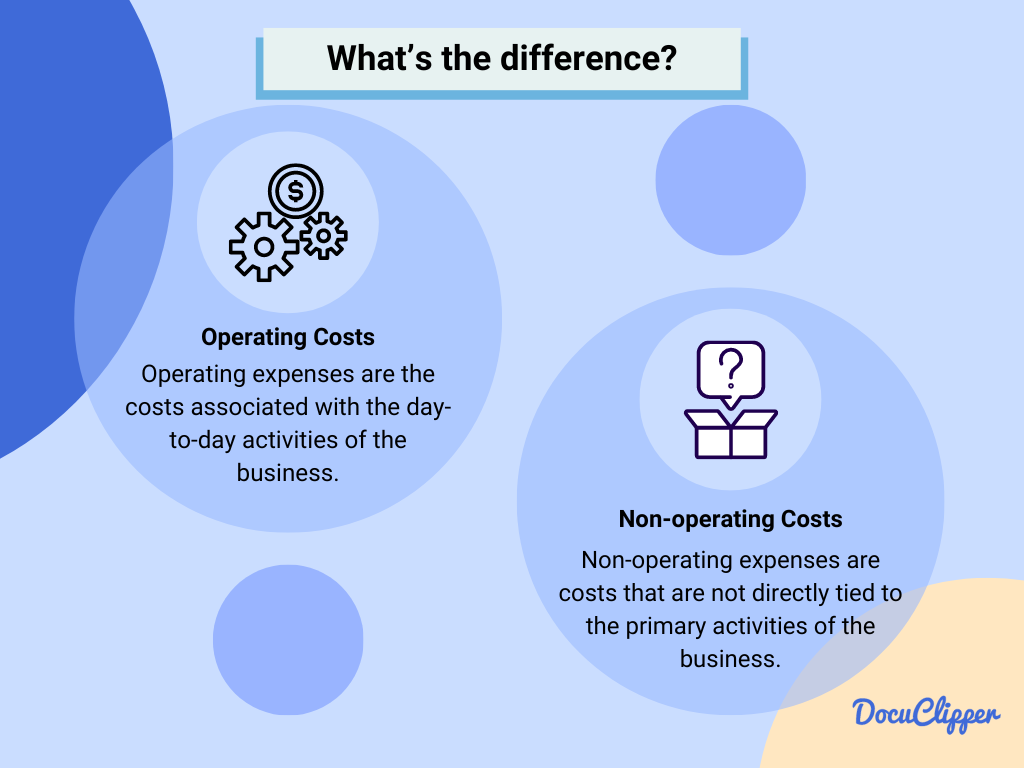

The types of expenses that you have in your business can be divided into two. They can be operating expenses and non-operating expenses.

Operating Expenses

Operating expenses (OPEX) are the costs associated with the day-to-day activities of the business. These expenses are necessary for the business to operate and generate revenue.

- Salaries and Wages: Payments made to employees for their work.

- Rent or Mortgage Payments: Costs for leasing or owning office space.

- Utilities: Electricity, water, internet, and other necessary services.

- Supplies and Materials: Items that are used in the daily operation of the business.

- Insurance: Various types of insurance to protect the business assets and operations.

- Marketing and Advertising: Costs associated with promoting the business and its products or services.

- Depreciation: The reduction in the value of the business assets over time.

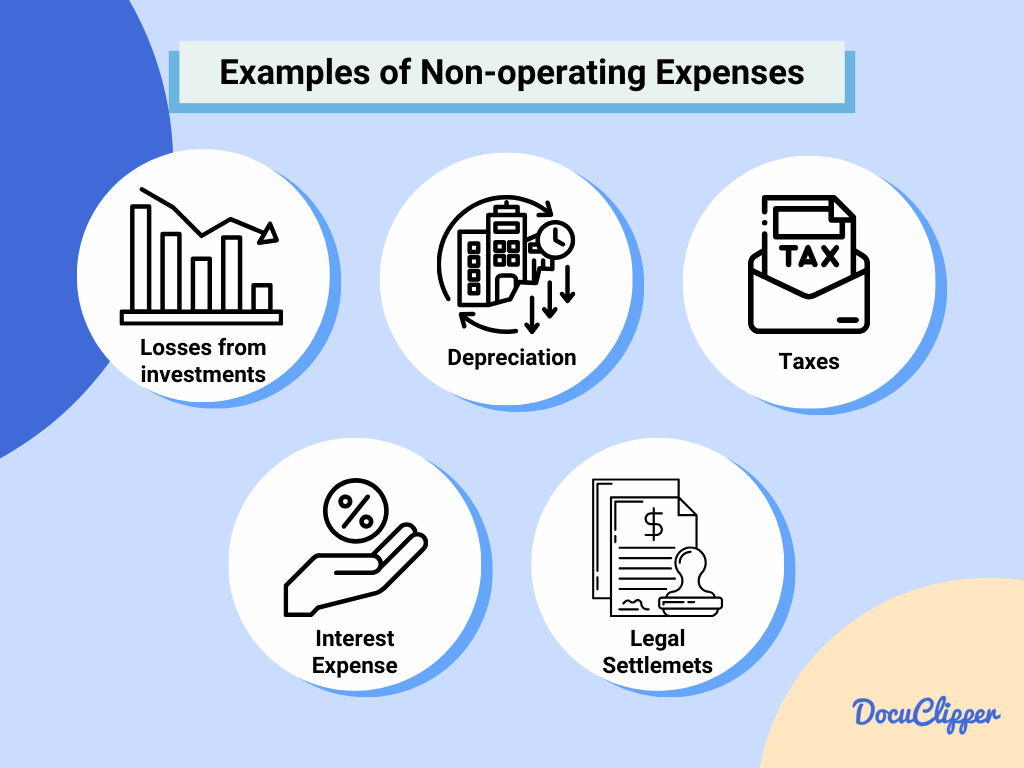

Non-operating Expenses

Non-operating expenses (NOPEX) are costs that are not directly tied to the primary activities of the business. These expenses are not incurred in the production of goods or services but may still be necessary for the business’s overall operations.

- Interest Expense: Costs related to borrowing money, such as interest on business loans or credit lines.

- Taxes: Various taxes that the business is required to pay, which are not directly related to the production of goods or services.

- One-time Expenses: Unusual or rare expenses not expected to recur regularly, such as legal fees from a lawsuit.

Business Expense Categories That Should Be Tracked by Almost Every Business

Here are some of the general categories that businesses keep track of:

- Insurance: Protects against risks like liability, property damage, and employee accidents. Essential for financial stability, it covers potential losses and legal claims, ensuring business continuity.

- Utilities: Includes electricity, water, gas, and internet services. Vital for daily operations, utilities ensure a functional work environment, supporting productivity and operational efficiency.

- Employee Benefits: Encompass health insurance, retirement plans, and perks. Attracts and retains talent, enhancing employee satisfaction and loyalty, while boosting productivity and morale.

- Advertising: Drives brand awareness and customer acquisition. It spans digital and traditional media, crucial for market positioning and generating sales, impacting overall business growth.

- Office Supplies: Covers stationery, printing, and small equipment needs. Essential for daily tasks and efficient operations, ensuring employees have the necessary resources for productivity.

- Rent: Monthly payment for business premises. A significant fixed expense, it secures a location for operations, customer access, and professional visibility.

- Taxes: Governmental levies on business activities. Ensuring compliance, and taxes impact financial planning and profitability, requiring accurate accounting and reporting.

- Legal Fees: Costs for legal advice, contracts, and disputes. Protects business interests, intellectual property, and compliance with laws, safeguarding against legal challenges.

- Payroll: Major operating expense for salaries and wages. Directly affects employee motivation and retention, reflecting the business’s investment in its workforce.

- Interest Expenses: Costs from loans and credit lines. Affects cash flow and financial planning, requiring strategic management to optimize financial health.

- Travel Expenses: For business development and networking. Includes transportation, lodging, and meals, essential for expanding business opportunities and professional relationships.

- Maintenance and Repairs: Ensures efficient operation and longevity of assets. Covers the upkeep of facilities and equipment, crucial for operational reliability and productivity.

- Office Expenses: Broad category for maintaining an office environment. Includes cleaning, security, and other services, supporting a productive and safe workplace.

- Bank Fees: Related to business banking and transactions. Efficient management can reduce operational costs, affecting overall financial performance and savings.

- Licenses or Permits: Required for legal operation. Ensures compliance with industry regulations, necessary for business legitimacy and operational authorization.

How to Categorize Business Expenses (Best Practices)

Here are some of the best practices when tracking business expenses to make it easier for transaction categorization:

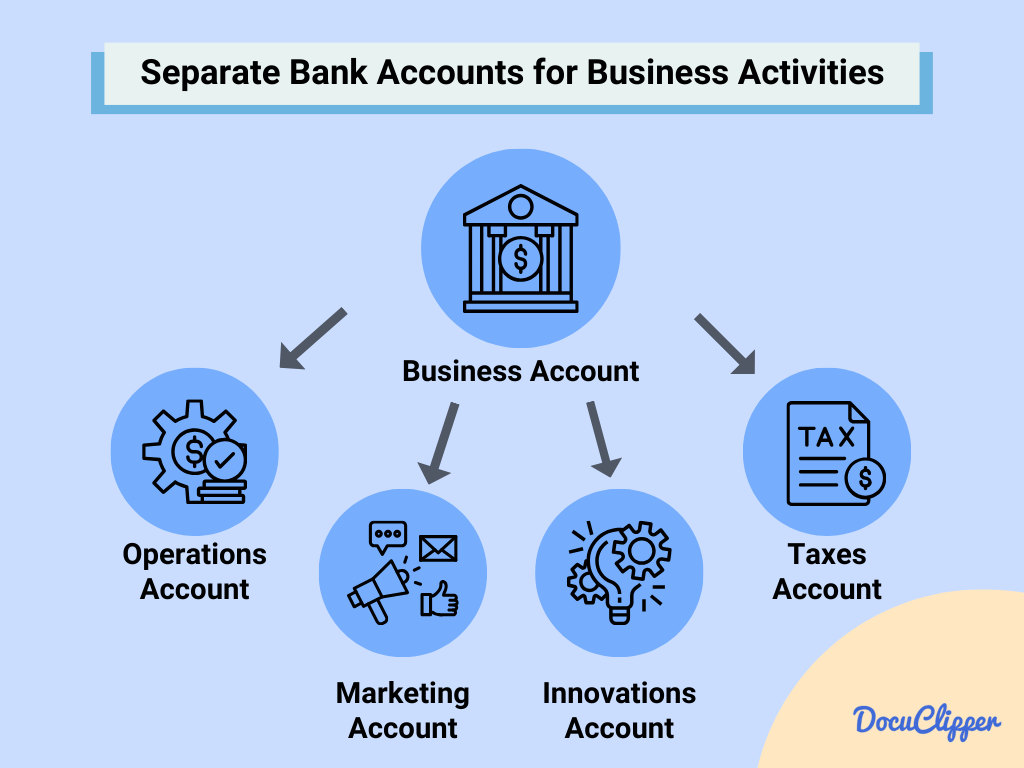

Practice #1: Have a Separate Business Bank Accounts from a Personal Bank Account

This separation ensures clear financial boundaries between personal and business finances, simplifying accounting and tax preparation. It helps avoid mixing funds, which can lead to tax and legal complications.

Practice #2: Use Only Business Debit & Credit Cards

Similar to having separate accounts, using dedicated business cards for all business-related bank transactions streamlines expense tracking and reinforces the separation of personal and business finances.

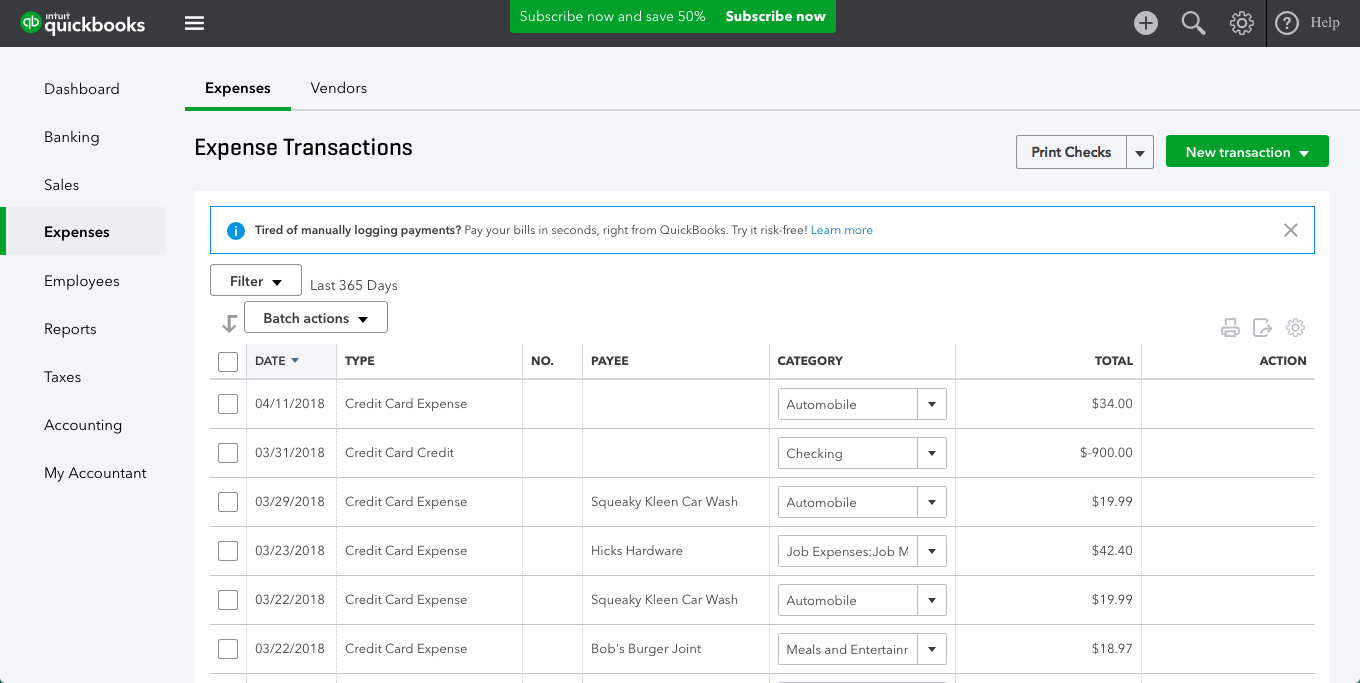

If you’re using QuickBooks learn more about how to categorize credit card transactions in QuickBooks.

Practice #3: Create Your Own Business Expense Categories

Customize your business expense categories to reflect the unique aspects of your business. Custom categories help in more accurately tracking and analyzing expenses, facilitating better financial decisions.

Practice #4: Correctly File Recips and Invoices Both Physical and Digitally

Proper documentation is important to financial management and tax compliance. Organize and store all bank statements, receipts and invoices systematically to ensure they are easily accessible for reporting and audits.

Practice #5: Use Accounting or Expense Tracking Software (Or Outsource Bookkeeping)

Modern software solutions automate much of the expense-tracking process essentially automating your bookkeeping, reducing errors and saving time.

However, despite that, you might still need to outsource your bookkeeping.

For businesses without the capacity to manage this in-house, outsourcing to a professional can be a cost-effective solution.

However, on the plus side, this reduces the need to outsource your data entry.

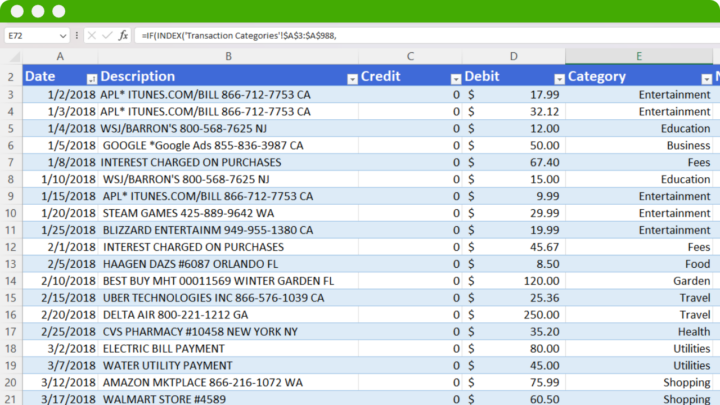

Or if you don’t want to use these tools, then you can categorize your expenses in Excel.

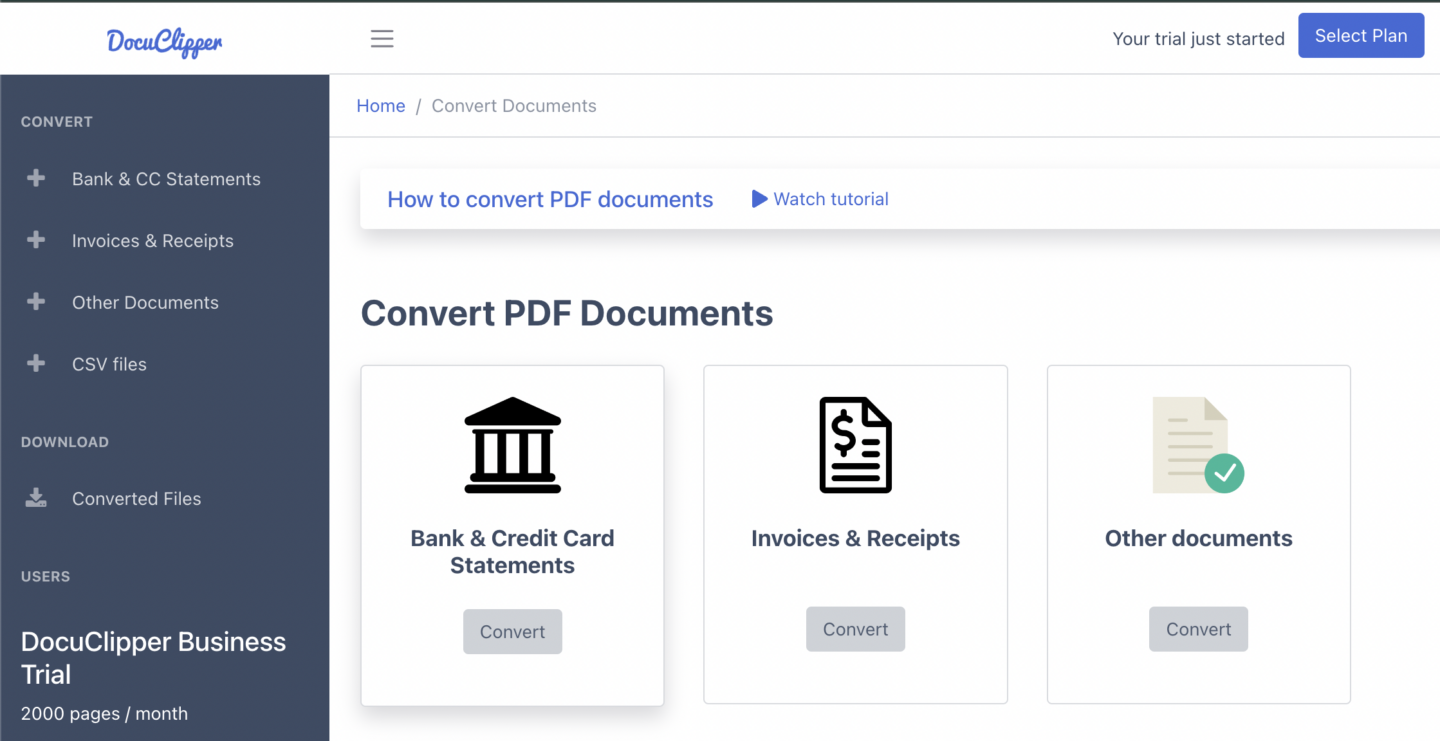

Practice #6: Convert PDF Statements for Ease of Tracking

Digitalizing credit card and bank statements into editable formats can simplify the reconciliation process. This practice makes it easier to categorize expenses and track financial data over time.

Some OCR software can go beyond converting bank transactions and can convert CSV to QBO and PDF to QBO. Here are more articles about keeping and managing bank statements:

- 101 Bank Statement Abbreviations & Other Bank Related Jargon

- How Long to Keep Bank Statements?

- How to Read a Bank Statement and Actually Understanding It

Practice #7: Hire a Bookkeeper or Accountant

Even with the best systems in place, the expertise of a professional accountant or bookkeeper is invaluable. They can provide strategic advice, ensure compliance with tax laws, and offer insights into financial health and planning.

Which Expenses Are Not Tax Deductible?

Deductible business expenses are those costs that can be subtracted from your company’s income before calculating how much tax you owe. This process lowers your overall taxable income, which can significantly reduce your tax bill.

Essentially, these are expenses considered necessary and ordinary for running your business, such as rent, salaries, and office supplies.

Non-deductible expenses are those that cannot be subtracted from your taxable income, according to the tax regulations of your country or local government. While specifics can vary, here are some commonly non-deductible expenses across various jurisdictions:

- Personal expenses: Costs that are purely personal and not related to your business operations cannot be deducted. This includes living expenses such as rent for a personal residence or personal vehicle costs unless part of the expense directly relates to business activities and can be separated.

- Political Contributions: Money given to political parties, candidates, or campaign funds usually cannot be deducted as these are considered personal choices and not business expenses.

- Commuting: The daily expenses of traveling from home to work and back are generally not deductible. These costs are considered personal commuting expenses, even though they are a necessity for getting to and from your place of business.

- Illegal expenses & penalties: Expenses incurred from illegal activities or fines and penalties paid to governmental entities for violations of laws are not deductible. This includes fines, penalties, and legal fees associated with such activities.

- Gifts over a certain amount: While business gifts can sometimes be deductible, there’s usually a limit to the amount that can be deducted. Expenses for gifts beyond this threshold are not deductible. The exact limit can vary by country but is put in place to prevent excessive deductions for high-value gifts.

Conclusion

Organizing your business spending into categories is useful. It helps you see clearly where your money goes, makes preparing for taxes easier, and can help you find ways to save. By keeping your money matters tidy, you’re setting your business up for better financial health and growth.

Simple steps like using different bank accounts for personal and business use, and sticking to business-only credit cards, can make a big difference in managing your finances more smoothly. This way, you’ll be better equipped to make smart decisions for your business’s future.

How DocuClipper Can Help?

DocuClipper offers a straightforward solution for managing your business finances without the complexity of traditional accounting software. It can convert PDF bank and credit card statements into editable formats.

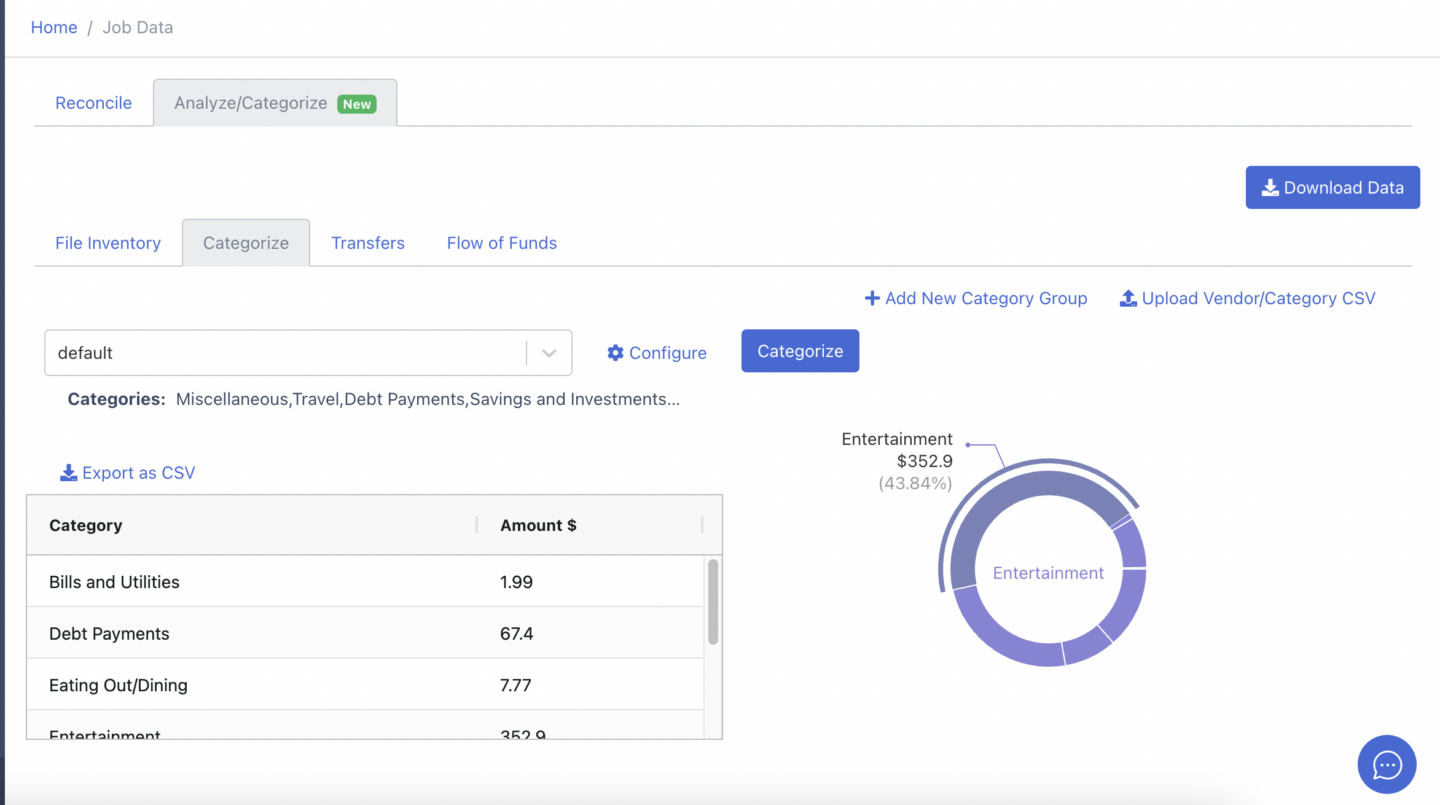

It also has a transaction categorization feature that allows you to customize the system to your specific needs by creating custom category groups for different aspects of your business or individual clients.

With DocuClipper, tracking and monitoring expenses and income becomes more accessible, providing a user-friendly alternative for businesses and professionals aiming to maintain financial oversight with minimal hassle.

FAQs about How to Categorize Business Expenses

Here are some frequently asked questions about categorizing business expenses:

How do I organize my business expenses?

Organize your business expenses by separating them into clear categories such as utilities, payroll, and rent. Use accounting software or spreadsheets to track them regularly and review monthly to adjust for any financial planning.

What is the best way to categorize expenses?

The best way to categorize expenses is by aligning them with your business operations and tax requirements. Common categories include operating expenses, payroll, marketing, and capital expenses.

How do I list my business expenses?

List your business expenses by creating a detailed record that includes the date, amount, category, and purpose of each expense. Utilize accounting software to help automate this process and ensure accuracy and completeness.

Do business expenses need to be categorized?

Yes, categorizing business expenses is crucial for financial reporting, budgeting, and tax purposes. It helps in understanding your business’s financial health and ensures compliance with tax regulations.

How do I organize my monthly expenses?

Organize your monthly expenses by recording them in a dedicated accounting system or spreadsheet as they occur. Group them into categories and review at the end of each month to monitor your spending patterns and adjust budgets accordingly.

What are the 4 types of expenses in accounting?

Expenses are categorized into four main types: Operating Expenses for daily business operations, Non-Operating Expenses not tied to core activities like interest payments, Capital Expenditures for long-term asset investments, and Cost of Goods Sold for direct production costs.

What Cannot be written as a business expense?

Personal expenses, fines or penalties, and illegal activities cannot be written off as business expenses. Additionally, capital expenses are not expensed but are capitalized and depreciated or amortized over time.

What is miscellaneous expenses?

Miscellaneous expenses refer to the small, infrequent costs that don’t fit neatly into standard expense categories. They should be kept to a minimum and monitored closely to ensure they don’t become a significant, untracked portion of your spending.