What is Invoice-to-Bank Transaction Matching?This feature allows you to link your extracted invoice data with corresponding bank transactions, providing a complete financial picture and helping with reconciliation, expense tracking, and audit trails.

Why Match Invoices to Bank Transactions? #

Financial Reconciliation #

Ensure your invoice records match your actual bank transactions for accurate bookkeeping.

Audit Trail #

Create a complete paper trail linking invoices to actual payments for compliance and auditing.

Expense Tracking #

Monitor cash flow by connecting invoices to actual payment dates and amounts.

Automation #

Streamline your accounting workflow by automating the matching process.

Supported Document Types #

- Invoices – Customer invoices for services or products sold

- Bills – Vendor bills for purchases and services

- Expenses – Business expense documents and receipts

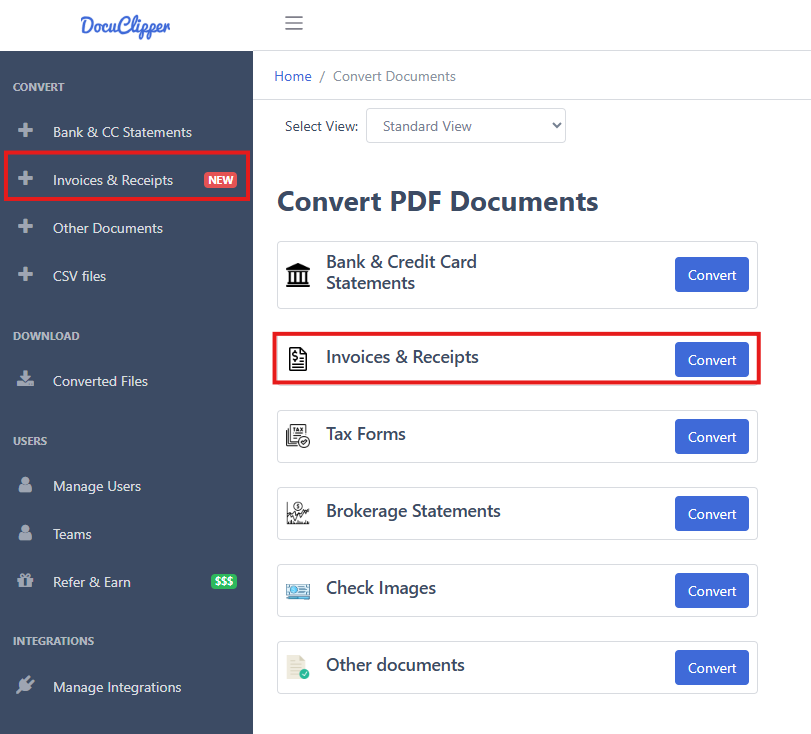

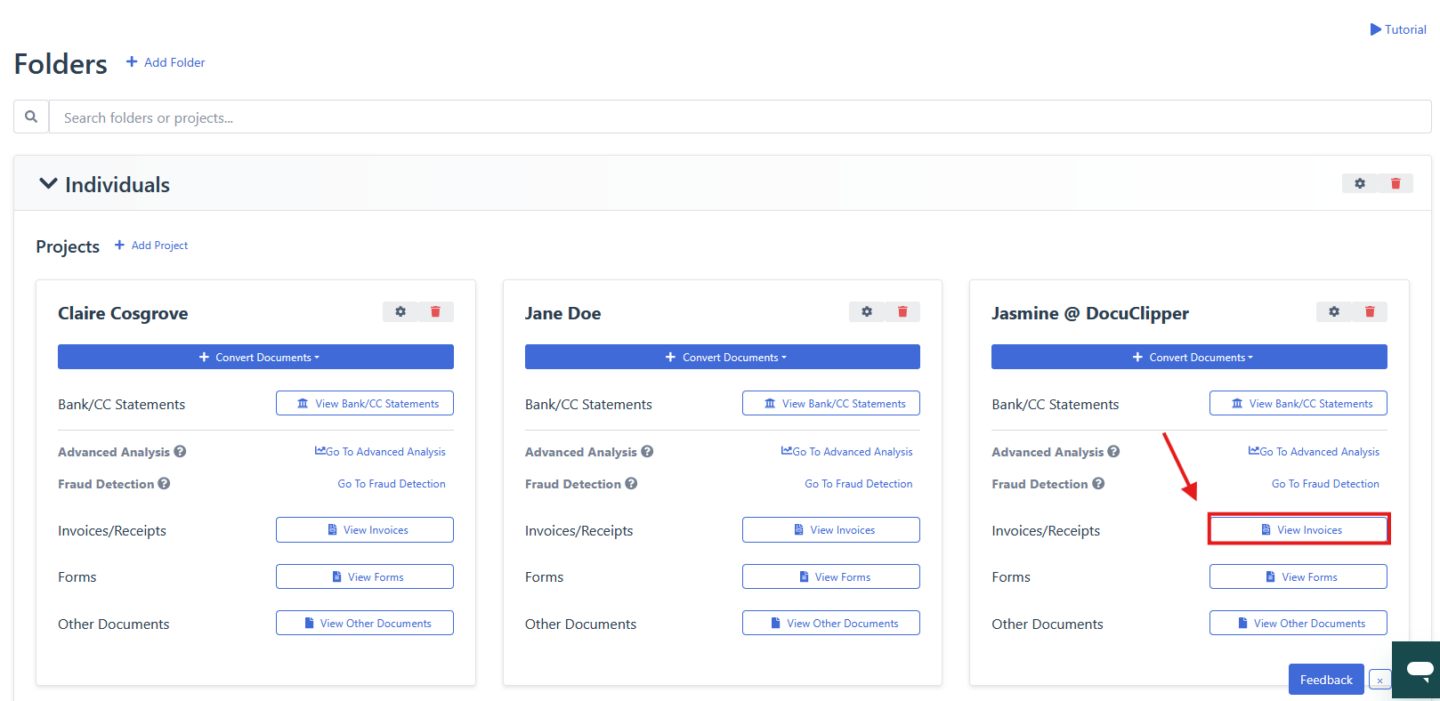

How to Access the Matching Feature #

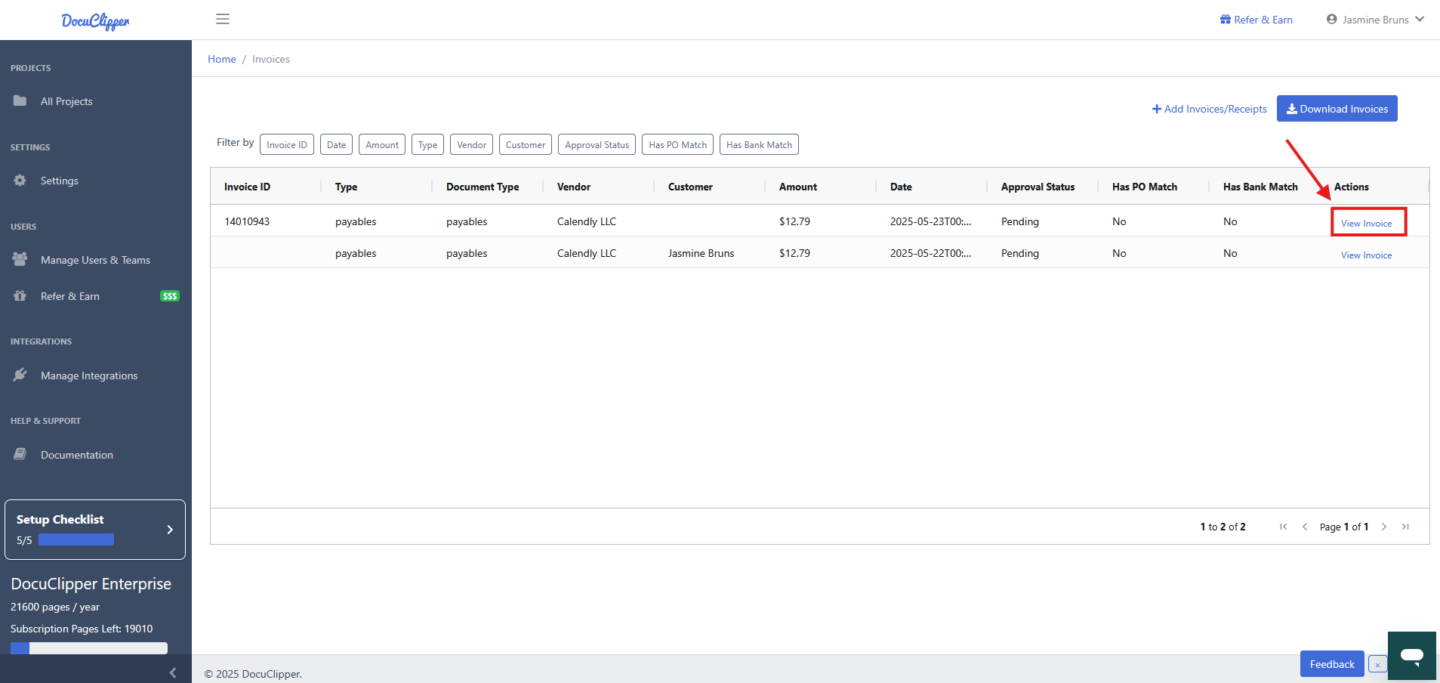

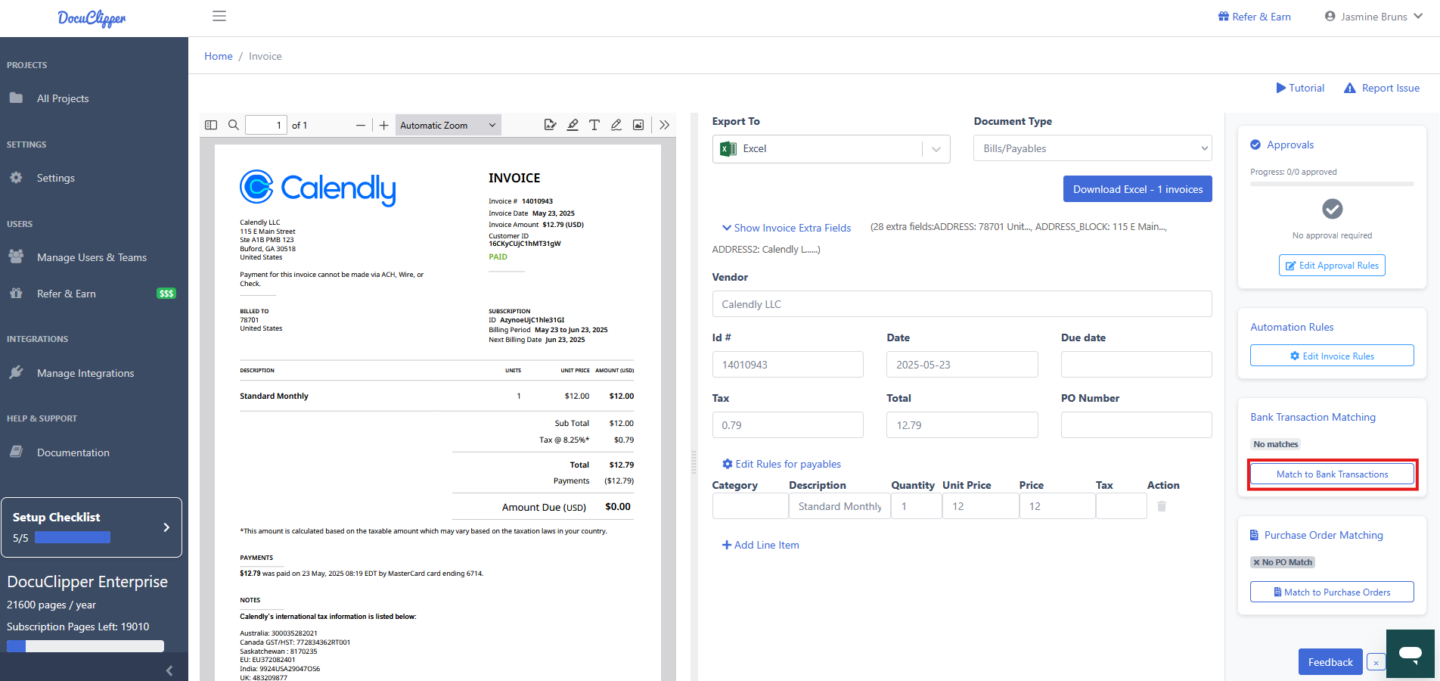

Step 1: Go to your invoice processing page where you can view and edit extracted invoice data.

Step 2: Look for the “Bank Transaction Matching” section in the right sidebar.

Step 3: Click the “Match to Bank Transactions” button to open the matching drawer.

Creating New Matches #

Step-by-Step Process #

Step 1: Review Invoice Information. The drawer will display the current invoice details including:

- Invoice number and date

- Total amount

- Customer or vendor information

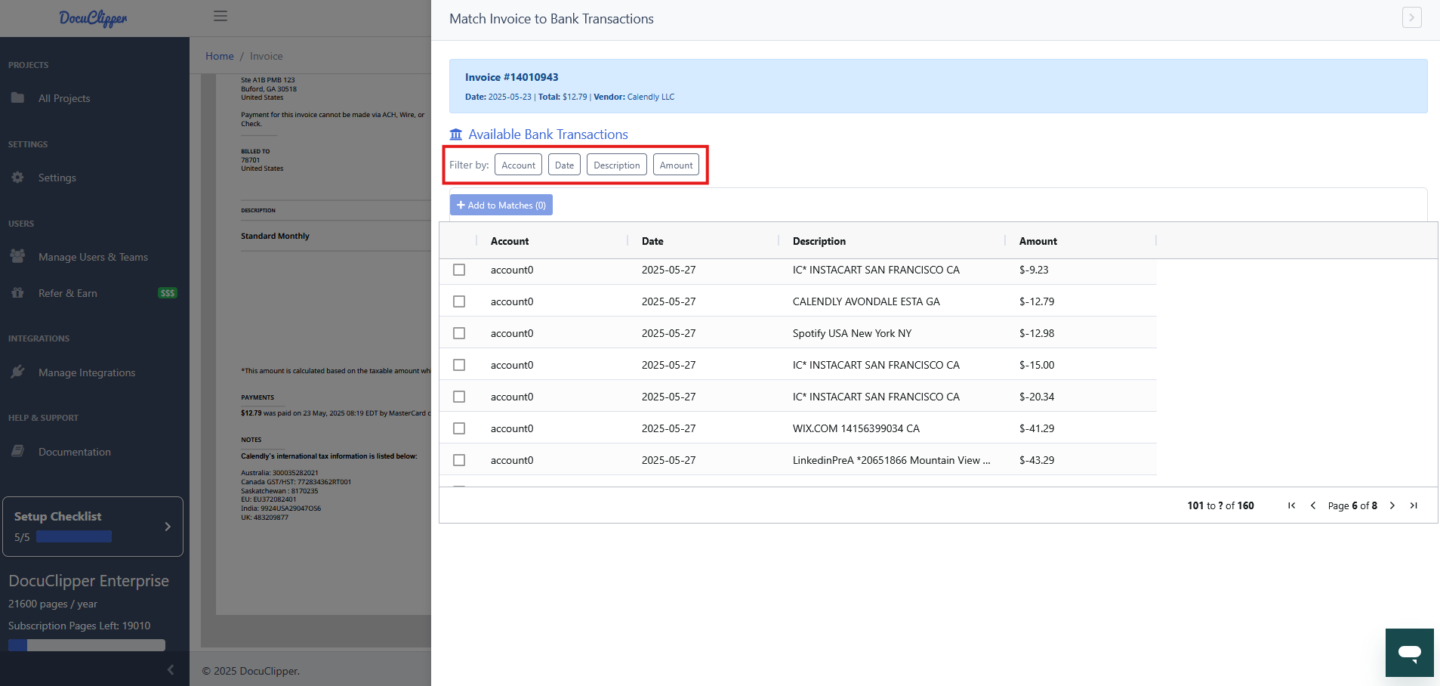

Step 2: Filter Bank Transactions. Use the filtering options to narrow down available bank transactions:

- Account: Filter by specific bank accounts

- Date: Filter by transaction date ranges

- Description: Search by transaction descriptions

- Amount: Filter by transaction amounts

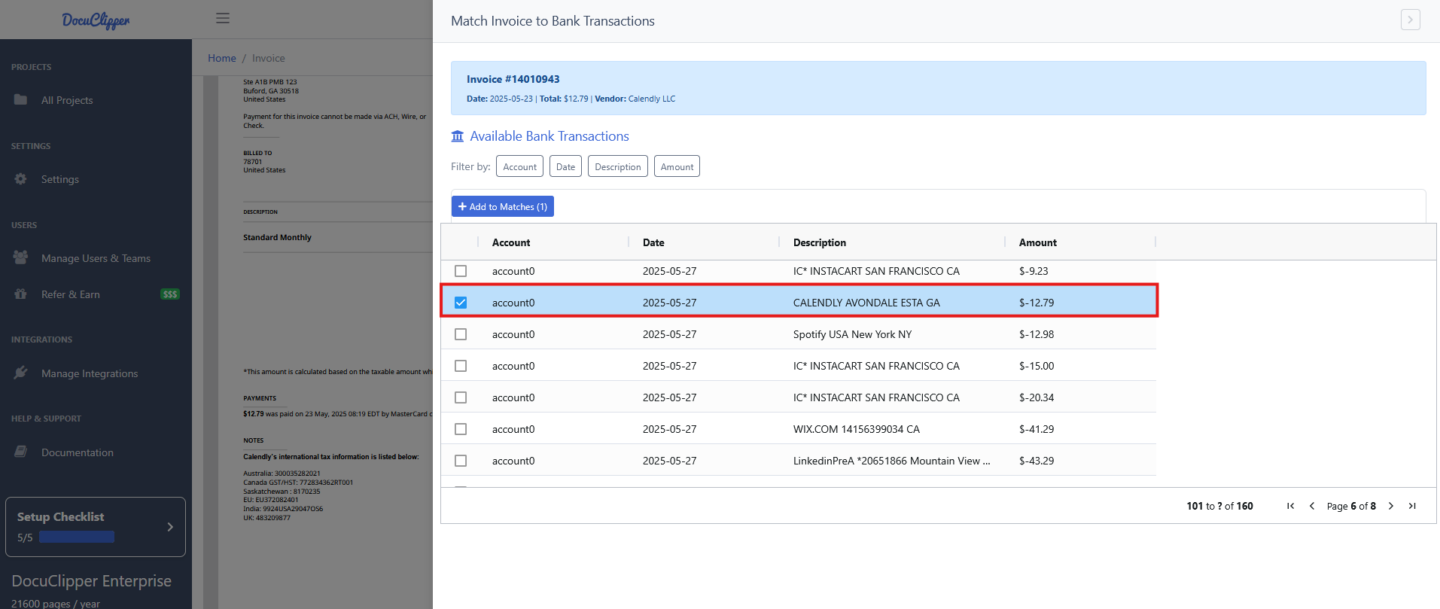

Step 3: Select Bank Transactions

- Browse the “Available Bank Transactions” table

- Select one or more transactions using the checkboxes

- Click “Add to Matches” to add selected transactions

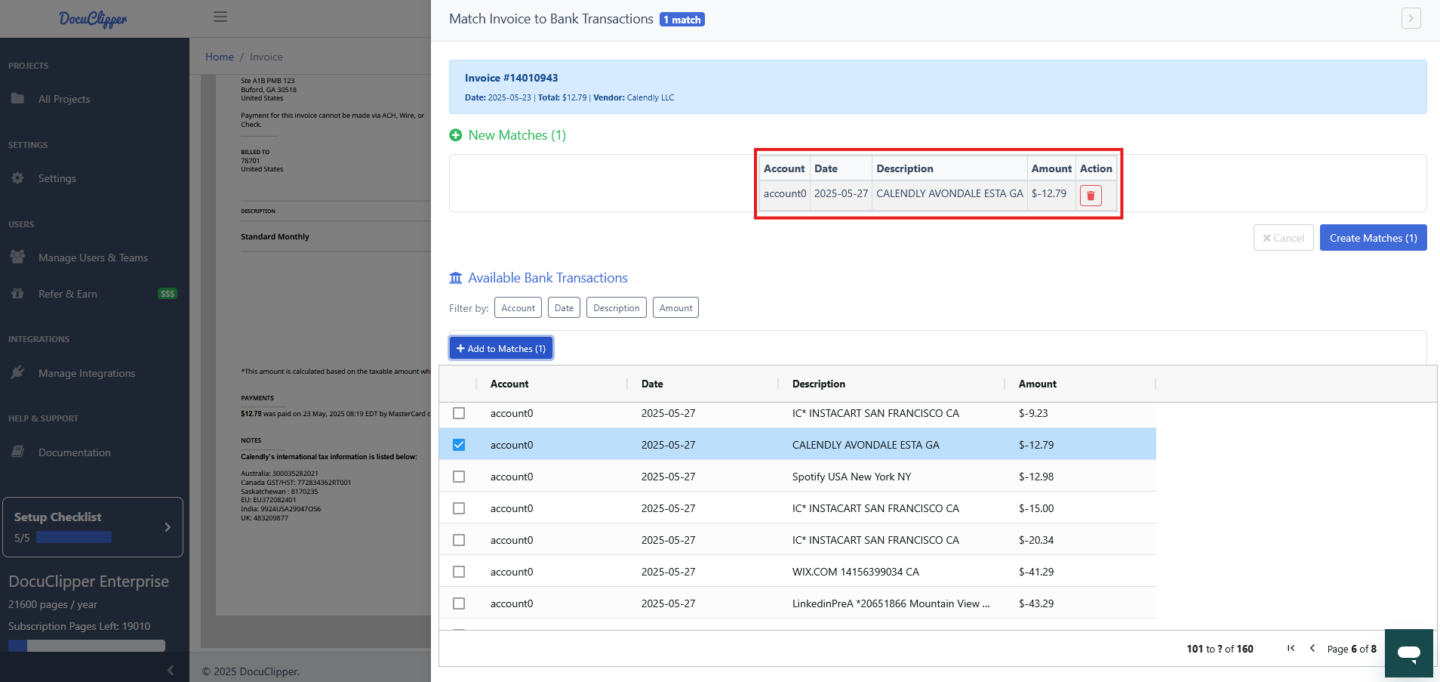

Step 4: Review New Matches. Selected transactions will appear in the “New Matches” section where you can:

- Review the transaction details

- Remove transactions if needed using the trash icon

Step 5: Create the Matches. Click “Create Matches” to finalize the linking process.

Managing Existing Matches #

Viewing Existing Matches #

If an invoice already has matched bank transactions, they will be displayed in the “Existing Matches” section showing:

- Bank account information

- Transaction date

- Transaction description

- Transaction amount

- Match status (pending, approved, rejected)

Deleting Matches #

Important: You can delete existing matches if they were created in error. Click the trash icon next to any existing match to remove it. This action cannot be undone.

Best Practices and Tips #

Pro Tips for Effective Matching: #

- Date Range Filtering: Start by filtering bank transactions to a reasonable date range around the invoice date

- Amount Matching: Look for bank transactions that match or are close to the invoice total

- Description Keywords: Use vendor names or invoice numbers in the description filter

- Multiple Transactions: Some invoices may be paid across multiple bank transactions

- Regular Review: Periodically review and update matches as new bank data becomes available

Common Scenarios to Watch For: #

- Partial Payments: An invoice might be paid in multiple installments

- Processing Fees: Bank transactions might include processing fees, making amounts slightly different

- Currency Conversion: International transactions may have different amounts due to exchange rates

- Payment Timing: Bank transactions might occur days after the invoice due date

Troubleshooting #

Common Issues and Solutions #

No Bank Transactions Appear

- Check that you have bank transaction data imported

- Verify your date range filters aren’t too restrictive

- Ensure the bank account filter includes the relevant accounts

Can’t Find the Right Transaction

- Try broader date ranges (payments often occur after invoice dates)

- Search by partial amounts if fees were included

- Check different bank accounts if multiple accounts are used

- Look for similar but not exact description matches

Match Creation Fails

- Ensure you have proper permissions for the selected bank accounts

- Verify the bank transactions haven’t already been matched to other invoices

- Check your internet connection and try again

Getting Help #

Need Additional Support? If you encounter issues or have questions about invoice-to-bank transaction matching, please contact our support team or consult the additional documentation in your knowledge base.