When you upload bank or credit card statements into DocuClipper, the system automatically reads and extracts the transaction data, then calculates totals to help you verify that everything matches the original statement. This process is called reconciliation.

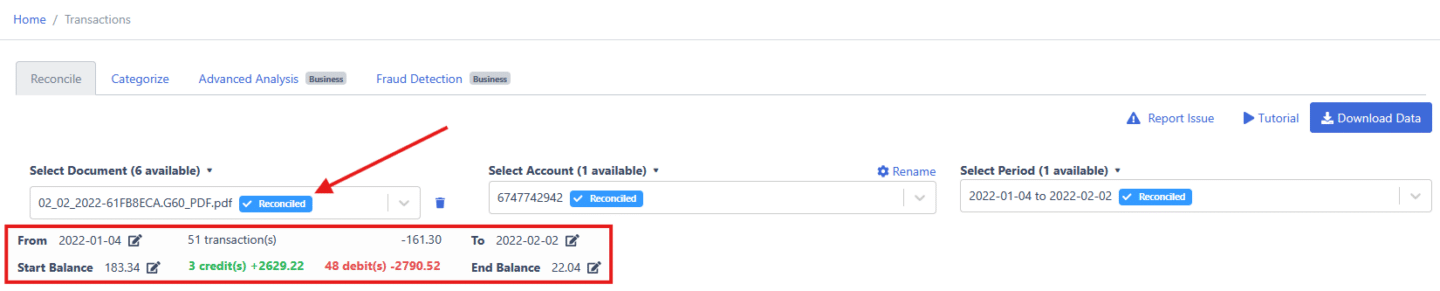

A Reconciled status means that DocuClipper’s extracted data matches the statement’s totals.

A Not Reconciled status means that something doesn’t add up — usually due to missing data, misclassified transactions, or unavailable totals in the uploaded statement.

Understanding Reconciliation #

When DocuClipper processes a statement, it captures the following key values from your uploaded file:

- Start Balance (if available)

- End Balance

- Total Credits (Deposits/Incomes)

- Total Debits (Withdrawals/Expenses)

- Number of Credits

- Number of Debits

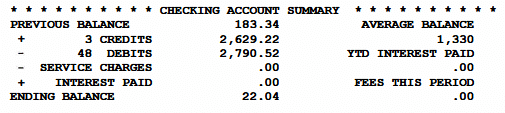

DocuClipper then compares these extracted values with the totals shown in your bank statement.

If all values match, your statement status will show Reconciled.

If one or more values don’t match, you’ll see a Not Reconciled message.

Note: Some bank statements do not display all required information — for example, they may omit the start or end balance, or exclude the number of debits/credits. In such cases, automatic reconciliation may not be possible even if the extracted data itself is correct.

Common Causes of “Not Reconciled” Status #

- Missing Transactions

One or more transactions were not extracted from the statement due to formatting inconsistencies or scanning issues. - Incorrect Transaction Type

A transaction may have been classified as a debit instead of a credit (or vice versa). - Incomplete Statement Data

Your uploaded PDF may not include totals for debits, credits, or balances, so DocuClipper has no reference values to reconcile against. - Corrupted or Partial Upload

Pages missing or cropped during upload can cause reconciliation errors.

How to Fix Reconciliation Issues (Step-by-Step) #

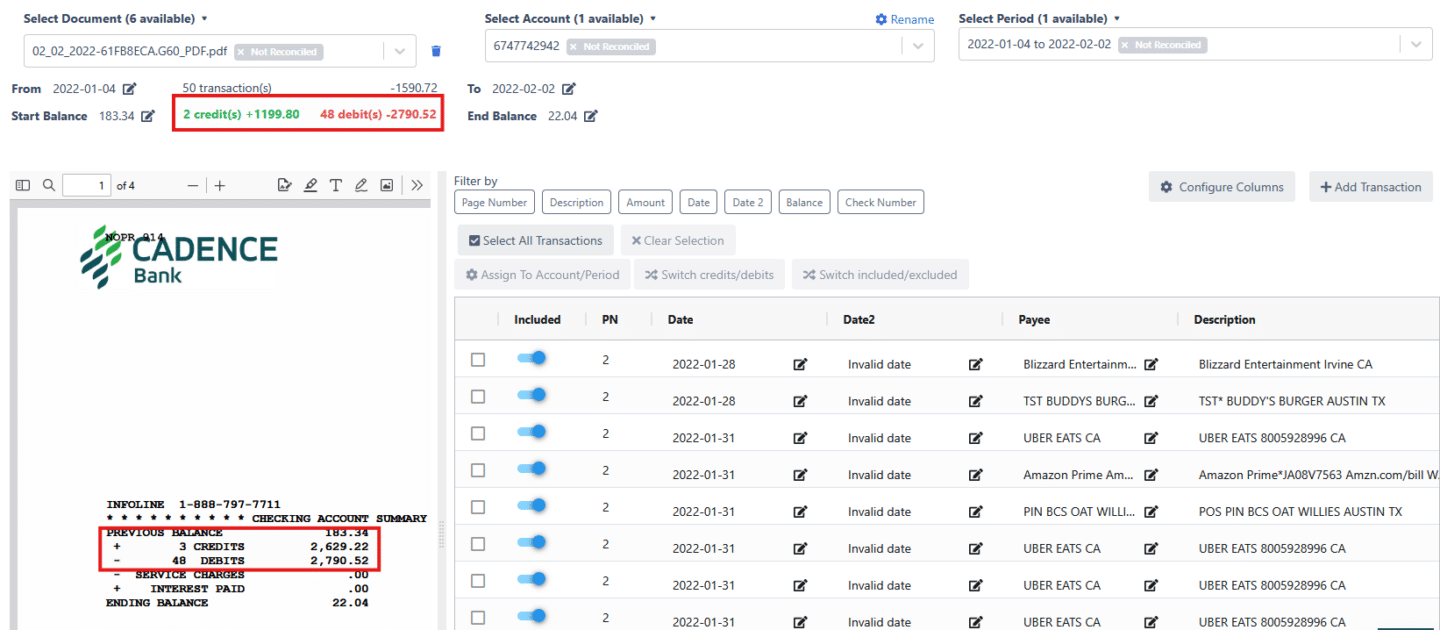

1. Review the Reconcile Pane #

At the top of your statement view, check the Reconcile pane to compare extracted totals with the statement’s printed totals.

Look for differences between the two sides — this will guide you to where the mismatch occurs.

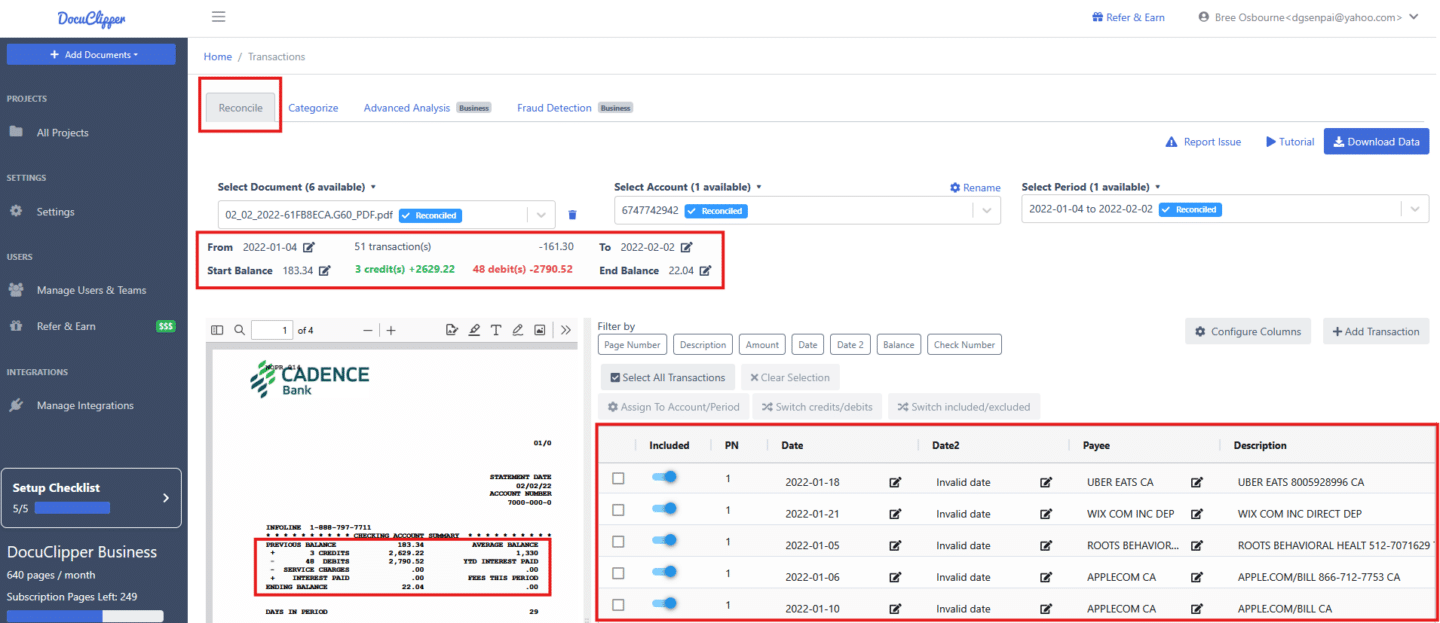

2. Identify Mismatched Credits or Debits #

If DocuClipper shows fewer credits or debits than your statement lists, scroll through the Transactions panel on the right-hand side to find discrepancies.

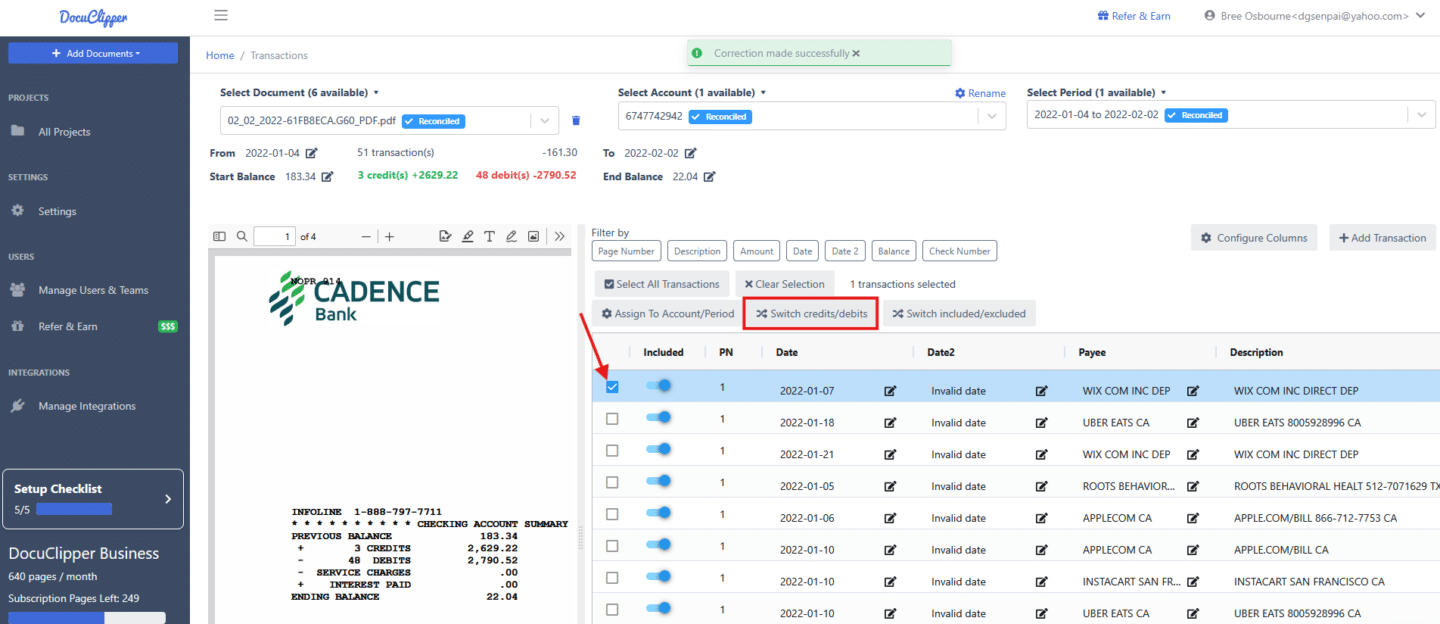

3. Correct Misclassified Transactions #

If you find a transaction listed as a debit when it should be a credit, simply tick the checkbox beside it and click Switch Credit/Debit.

Once corrected, the Reconciliation pane will automatically update.

If the totals now match, your statement should change to Reconciled.

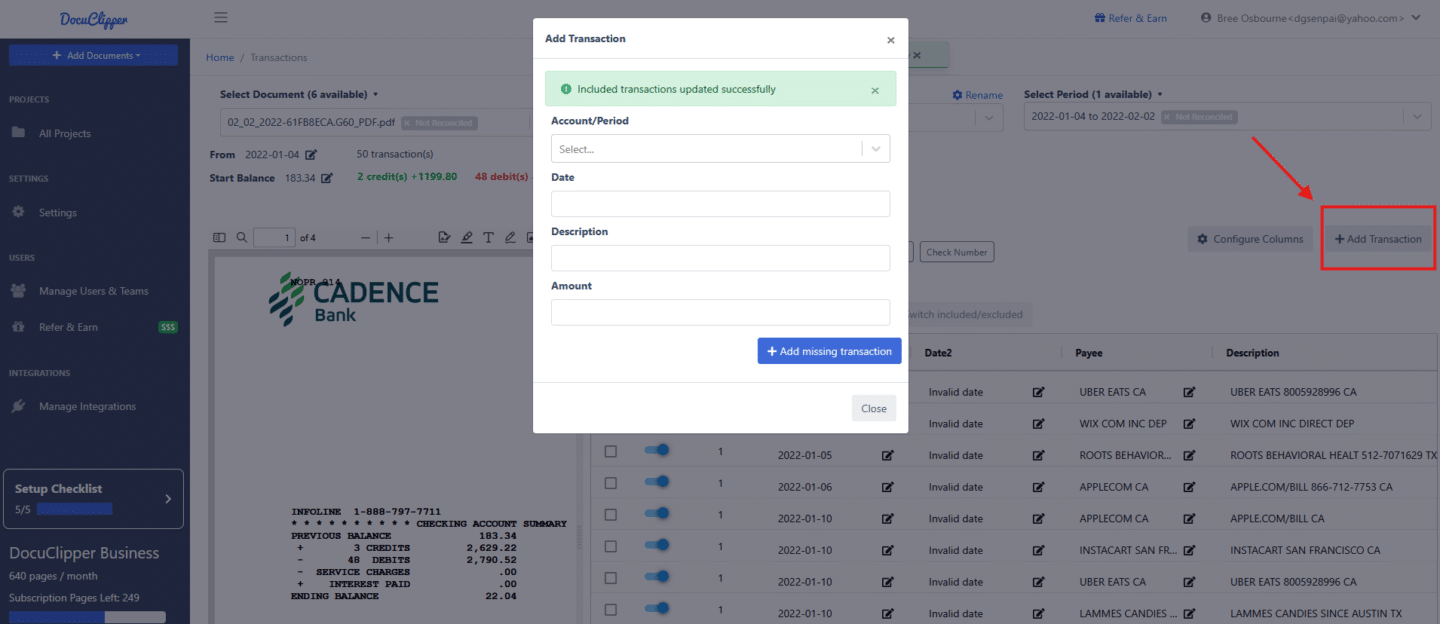

4. Add Missing Transactions #

If a transaction was not extracted at all:

- Click Add Transaction in the Transactions panel.

- Enter the correct date, description, and amount exactly as it appears on your bank statement.

- Assign the correct type (Credit or Debit).

- Click Save.

Once added, DocuClipper will re-total the statement and update the reconciliation status.

5. Recheck the Totals #

If your statement still shows as “Not Reconciled,” review:

- Whether the uploaded statement includes all pages

- Whether the statement contains beginning/ending balances

- That transaction amounts use consistent decimal formatting (no commas, symbols, or spacing issues)

Example (see video tutorial below) #

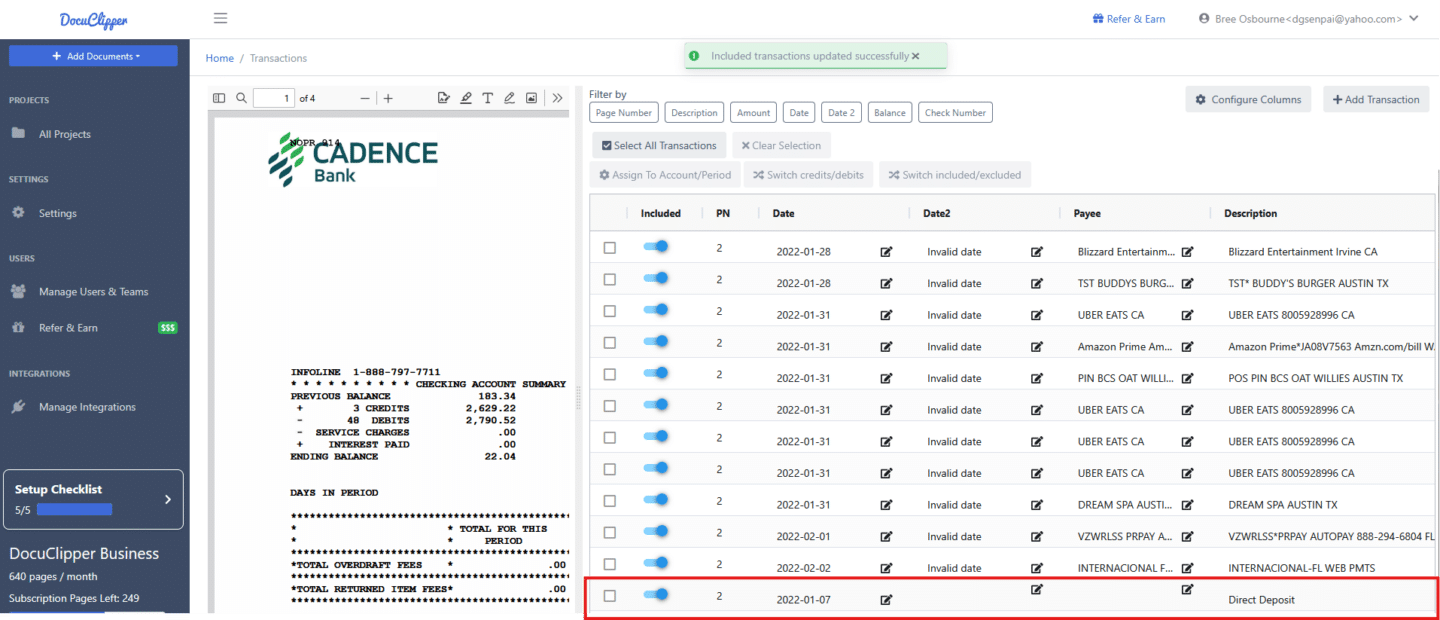

In the video demonstration:

- DocuClipper extracted 2 credits, but the bank statement listed 3 credits, showing a difference of $1,429.42.

- Reviewing the transactions revealed that one direct deposit for $1,429.42 was mistakenly labeled as a debit instead of a credit.

- After switching the type, the statement immediately became Reconciled.

In another case, a transaction was completely missing. Adding it manually (with the correct date and amount) brought the statement back into balance.

Video Tutorial: How to Resolve “Not Reconciled” Errors #

🎥 Watch the walkthrough:

In this video, you’ll learn how to identify mismatched transactions, correct debit/credit errors, and add missing entries so your statement reaches “Reconciled” status.

Additional Notes #

- Reconciliation calculations are based on extracted numeric values and metadata parsed from the PDF.

- When statement metadata (e.g., totals, balances) is missing or ambiguous, reconciliation relies on inferred data from transactions.

- In some cases, false negatives can occur if the PDF layout omits balance indicators — these cases are informational and not system errors.

Still Need Help? #

If you’ve reviewed your transactions and the statement remains Not Reconciled, please contact support@docuclipper.com with:

- The affected statement file(s)

- Screenshots of your reconciliation pane

- A brief description of what’s not matching

Our team will review the extraction and help identify the root cause.